Expanding Your Church's Sources of Income Worksheet 1

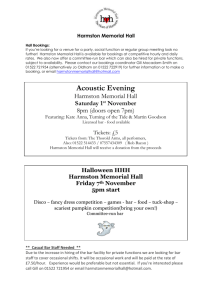

advertisement

Expanding Your Church’s Sources of Income Worksheet 1 — Current Sources of Income Assessment Step 1 — Identify Your Current Sources of Income Examine the sources of income listed on the “Current Sources of Income Worksheet” on page 3. Look over all the potential income sources listed. If you are unfamiliar with any of the potential sources, consult the “Descriptions of Sources of Income” on page 4. When you are clear about their meaning, put a check mark in the first column next to all the sources listed from which your church currently receives income. For the rest of this exercise, you will work only with those you have checked and ignore the others. Step 2 — Rate the Current Performance of Your Current Income Sources For each of the sources you checked in the first column, evaluate how well your church is performing with that source of income. Use the second column marked “Current Performance” to give each source checked a score of 1, 2, 3, or 4 based not just on how much money comes in, but how you think your church is doing relative to comparable churches. For example, if your church receives three or four memorial gifts each year amounting to about $200 dollars and you know that some other comparable churches received memorial gifts very regularly amounting to several thousand dollars a year, you would probably rate your church as a 1 or 2. However, if your church is more like the second church, you would rate your church as a 3 or 4. Here is another example. Regarding bequests, if your church gets modest bequests once every ten years or so, that would be a 1 or 2. If your church has a long-running emphasis on bequests and usually receives at least one each year, that would be a 3 or 4. Remember, this is relative performance given the type of giving. Step 3 — Rate the Potential for Future Growth of Current Income Sources Turning your attention to the far right column marked “Future Growth Potential,” give each of your checked sources a score of 1, 2, 3, or 4 based on how much future growth potential there is for this source. Using the previous illustrations, if you receive only a few memorial gifts during the year and you know that other church receive many more for much larger amounts of money, then that may be a 3 or 4 in terms of potential. On the other hand, the church with a well-established memorial giving tradition may realize that additional future growth potential may be modest and thus rate it a 1 or 2 for growth potential. Now each of your checked income sources should have two numbers, one in each of the two columns. Next Lewis Center for Church Leadership of Wesley Theological Seminary • www.churchleadership.com Step 4 — Identify Highs and Lows Go back over the columns where numbers are listed and by every “1” and “2” put an “L” for Low. And by every “3” and “4” you have listed, put an “H” for High. Looking across from left to right, identify items that have an “H” for High in both columns, meaning that the performance column has either a 3 or 4 and the growth potential column has a 3 or 4. Next, look for any items for which the two columns read: “L” – “H”, meaning that the performance column has either a 1 or 2 and the growth potential column has a 3 or 4. List any H – H sources below: _________________________ _________________________ _________________________ _________________________ List any L – H sources below: _________________________ _________________________ _________________________ _________________________ Step 5 – Discussion of Implications and Actions Steps The current revenue sources listed in Step 4 have the most potential for growth. The “H – H” items are things you already know how to do, but could generate more income. The “L – H” items are things that you do not do well now, but have great potential benefits with improved effort. If you are working with others, discuss the items you and others have most identified in the two lists above: • • • • • Out of all of these, which one or two should be your focus first? What would be the logical next steps? Who will be responsible for those next steps? By when can they be done? How will we hold ourselves accountable? __________________________________________________________________________________ Subscribe to Leading Ideas Online Newsletter For information, resources, and strategies for forward-thinking church leaders like you, subscribe to Leading Ideas, the Lewis Center’s free online newsletter at www.churchleadership.com/leadingideas or text LEAD to 22828. Connect with the Lewis Center Like us on Facebook at www.facebook.com/lewisleadership. Follow us on Twitter at www.twitter.com/lewisleadership. Lewis Center for Church Leadership of Wesley Theological Seminary • www.churchleadership.com 2 Current Sources of Income Worksheet Check those you do now 1. Christmas/Christmas Eve __________ Current Performance (1 to 4) __________ Future Growth Potential (1 to 4) __________ 2. Automatic Bank Withdrawal __________ __________ __________ 3. Online giving __________ __________ __________ 4. Debit/credit card giving __________ __________ __________ 5. Annual pledging __________ __________ __________ 6. New member pledges __________ __________ __________ 7. Budget “catch up” offering __________ __________ __________ 8. Short term challenge __________ __________ __________ 9. Year-end appeals __________ __________ __________ 10. End of tax year opportunities __________ __________ __________ 11. Memorial gifts __________ __________ __________ 12. Approved Memorial List __________ __________ __________ 13. All Saints Sunday __________ __________ __________ 14. Communion offerings __________ __________ __________ 15. Special holiday offerings __________ __________ __________ 16. Donations for special projects __________ __________ __________ 17. Mission Trip Sponsors/Fees __________ __________ __________ 18. Special need/opportunity offering __________ __________ __________ 19. Underwriters of items __________ __________ __________ 20. Gifts-in-kind __________ __________ __________ 21. Preschool/Day Care income __________ __________ __________ 22. Rental income __________ __________ __________ 23. User fees __________ __________ __________ 24. Fund raisers __________ __________ __________ 25. Special events (net income) __________ __________ __________ 26. Money saving changes __________ __________ __________ 27. Interest on idle funds __________ __________ __________ 28. Grants __________ __________ __________ 29. Capital campaign __________ __________ __________ 30. Bequests __________ __________ __________ Lewis Center for Church Leadership of Wesley Theological Seminary • www.churchleadership.com 3 Descriptions of Sources of Income Christmas/Christmas Eve offering for mission 1. Christmas/Christmas Eve offering for mission – receive the offering for mission causes and all will appreciate it Offering more options for giving 2. Automatic Bank Withdrawal giving – any type of electronic funds transfer from an account 3. Online giving – gifts made through church website or other online “bill pay” systems 4. Debit/credit/debit card giving – permitting donations using these cards Stewardship enhancements 5. Encourage annual pledges or estimates – providing a once a year opportunity for people to make a financial commitment 6. New member pledges – as part of the new member orientation, ask for a pledge 7. Budget “catch up” offering – occasional special pushes such at the end of the summer or other times as needed 8. Short term challenge – asking members to tithe or increase giving by 10 percent for one to three months 9. Year-end appeals – a special push at the end of the budget year 10. End of tax year opportunities – remind members of tax benefits from year end giving (e.g. appreciated assets) Special giving opportunities 11. Memorial gifts – donations made in memory of the deceased 12. Approved Memorials List/Wish List - a list of things needed by the church for which there are not yet budgeted funds 13. All Saints Sunday – as you celebrate those who died in the past year, use the occasion to list those making memorial gifts in the past year and present a new edition of an Approved Memorials List with things needed by the church and approved as memorial gifts 14. Communion offerings - the tradition of communion offerings permits gifts to numerous causes over the year 15. Special holiday offerings – Thanksgiving, Easter, etc. 16. Donations for special projects – asking for persons to underwrite certain projects outside the budget 17. Mission Trip Sponsors/Fees – sponsors help underwrite expenses; fees can cover some costs 18. Special need/opportunity offering – giving for an unanticipated need or opportunity arising during the year 19. Underwriters of previously budgeted items – an example is having people sign up to provide flowers rather than budgeting for flowers 20. Gifts-in-kind – a member or business provides work, supplies, or services without charging Earned income 21. Preschool/Day Care income – income generated by these programs beyond program costs 22. Rental income – for space, parking, telephone towers in steeples 23. User fees – anything from wedding fees to asking people in a study group to buy their books 24. Fund raisers – efforts through the year to generate extra money through dinners, selling items, etc. 25. Special events (net income) – concerts, plays, etc. Management increases 26. Money saving changes – money saved by eliminating unessential expenses has the same effect as new income 27. Interest on idle funds – cash flow interest on excess funds or funds being held for a future purpose 28. Grants – occasionally there are conference or foundation grants available; some churches even set up separate entities to receive grants not available to churches Capital needs 29. Capital campaign for major needs – usually a multi-year effort to raise significant funds for capital needs 30. Bequests – gifts received from persons remembering the church in the wills and estate plans Lewis Center for Church Leadership of Wesley Theological Seminary • www.churchleadership.com 20110922INCOME1 — Copyright © 2004-2011 by the Lewis Center for Church Leadership® of Wesley Theological Seminary 4