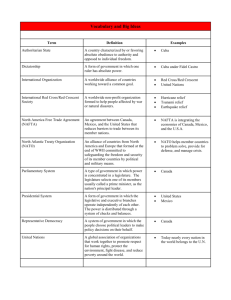

Trade Impact Review: Mexico Case Study NAFTA

advertisement