Perspectives on Liquidity

Adding A-2/P-2 Commercial Paper to

Separate Accounts

Securities From the Second Credit Tier May Boost Yields on Separate Accounts

Without Adding Undue Risk

About the authors

Robert A. Piepenburg, CFA

Robert Piepenburg is a managing director

and director of credit research at BofA

Global Capital Management.

Susan M. Chevalier

Susan Chevalier is a director and senior client

relationship manager in BofA Global Capital

Management’s institutional client service group.

With their strong focus on principal protection, many cash investors

limit themselves to securities with gold-plated credit ratings on the

assumption that investing in only the highest-rated issues will

reduce portfolio risk and thus help insulate their portfolios from

market volatility. While it is true that restricting one’s investment

universe to the highest-quality names typically reduces credit risk,

it also makes it more difficult to achieve attractive yields, particularly

when interest rates are near historic lows.

Fortunately, protecting principal and pursuing attractive risk-adjusted yields

are not incompatible. Investors with separately managed accounts — managed

portfolios customized to the needs of each investor — may be able to achieve

both objectives by tapping securities rated A-2/P-2 by Standard & Poor’s and

Moody’s Investors Service, respectively. Rated just one notch lower than shortterm securities with top-tier credit ratings (A-1/P-1), credits from the second

credit tier may deliver 33 to 46 basis points more yield than A-1/P-1 issues with

the same maturities, according to the Federal Reserve. That incremental

yield comes at the cost of marginally higher credit risk, but by enhancing

portfolio diversification, the addition of A-2/P-2 credits actually may decrease

1

overall portfolio risk, potentially reducing portfolio volatility.

The potential yield enhancement offered by A-2/P-2 paper stems from the higher

risk premium it commands relative to that of A-1/P-1 debt as well as technical

factors, such as lower demand by investors. As they try to capture that

incremental yield without jeopardizing portfolio stability, separate-account

managers must identify securities that offer attractive values and are imperfectly

correlated. Indeed, it is the heightened diversification presented by A-2/P-2

credits that helps offset their additional credit risk, thus making them a viable

option for inclusion in both individuals’ and corporations’ investment policies.

1

Diversification does not guarantee a profit or ensure against loss.

Understanding short-term debt ratings

While it is true that the A-2/P-2

rating signals somewhat higher

A credit rating reflects the risk — as perceived by the major rating agencies —

of an issuer failing to make principal and interest payments on a timely basis,

i.e., default risk. An additional risk for investors — the risk of ratings downgrade —

often is reflected in the ratings outlook that accompanies an issuer’s credit

rating. Both a default and a credit downgrade can translate into losses for

fixed income investors, because they typically result in price declines for the

affected issue. Issuers with the top rating — A-1/P-1 for short-term securities —

are judged by the rating agencies to be among those that are the least likely

to default, which is why some risk-averse investors eschew all but the highestrated credits.

operating weakness on the part

While it is true that the A-2/P-2 rating signals somewhat higher credit risk

relative to the top-tier rating, it does not signify operating weakness on the

part of A-2/P-2 issuers. In fact, the debt issued by companies in this group is

considered “investment grade” by the rating agencies, and A-2/P-2 issuers

include many Fortune 500 businesses from diverse industries.

of A-2/P-2 issuers.

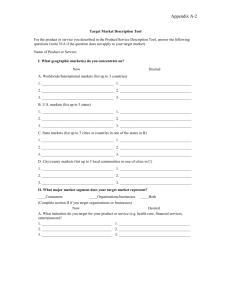

Figure 1

credit risk relative to the

top-tier rating, it does not signify

Heavyweights with A-2/P-2 credit ratings2

Issuers of A-2/P-2 commercial paper include blue-chip companies across a range of industries.

Many investment policies allow the purchase of two- or three-year bonds issued by Fortune 500

companies, but prohibit the inclusion of the same issuers’ A-2/P-2 commercial paper in separateaccount portfolios.

Short-term rating Long-term rating

Consumer

Energy and

utilities

Industrials

Tech/media/

telecom

2

Diageo

A-2/P-2

A3/A-

Lowe’s

A-2/P-2

A3/A-

SABMiller

A-2/P-2

A3/A-

Consolidated Edison of NY

A-2/P-2

A3/A-

Duke Energy

A-2/P-2

A3/A-

Wisconsin Energy

A-2/P-2

A3/A-

Daimler

A-2/P-2

A3/A-

Nissan Motor

A-2/P-2

A3/A-

Corning

A-2/P-2

A3/A-

Comcast

A-2/P-2

A3/A-

Source: BofA Global Capital Management. Ratings as of June 30, 2015. This information is for illustrative purposes only and is not intended to be representative of

holdings of a specific portfolio. It should not be used or construed as a recommendation of any security or sector.

2

One of the more important drivers of a company’s debt rating — either shortor long-term — is the strength of its balance sheet. Typically, companies with

A-1/P-1 ratings maintain low net debt-to-capital ratios and thus are deemed

less likely to default because of lower debt service costs vis-à-vis companies

with higher leverage and because they have deep pools of capital to withstand

financial challenges. Conversely, companies with strong management, healthy

operating performance and excellent growth prospects may still receive an A-2/P-2

rating because they have less capital and higher debt levels than A-1/P-1 issuers.

The vast majority of banks and

other financial firms typically

carry A-1/P-1 ratings because

they are required to maintain

large capital reserves relative

to their debt levels.

An overconcentration of A-1/P-1 issuers within the financial sector

An important consequence of the rating agencies' focus on balance sheet

strength is an overconcentration of A-1/P-1 issuers within the financial

sector. The vast majority of banks and other financial firms typically carry

A-1/P-1 ratings because they are required to maintain large capital reserves

relative to their debt levels — both to comply with increasingly stringent

government regulations and because they require investor confidence to

maintain access to the capital markets. Nonfinancial companies, which hail

from sectors ranging from auto makers to utilities, have considerably more

capital structure flexibility. For a heavy equipment maker, for example,

it may make more sense to expend capital on a new production line than

to husband that capital simply to obtain a higher credit rating.

Consider the business imperatives of a cable company. To attract or retain

customers, it might need to build out or upgrade its network. Whether achieved

by increasing leverage or expanding cash flow, meeting that goal likely would be

more valuable to that cable company than the benefits a top-tier credit rating

might confer. Put simply, it often doesn’t make sense for nonfinancial companies

to structure their balance sheets to achieve a top credit rating. As such,

companies in capital-intensive industries as diverse as energy, telecommunications

and automobile manufacturing, often carry similar credit ratings not because

their business prospects are significantly less creditworthy than firms with

A-1/P-1 ratings, but because their need for capital results in a more aggressive

use of their balance sheets.

Taking a closer look at credit risk

Of course, some risk-averse investors might avoid the additional credit risk

embedded in A-2/P-2 issues relative to A-1/P-1 debt no matter the reason for

the risk differential. However, these investors should know that while A-2/P-2

issuers may exhibit higher credit risk than those with A-1/P-1 ratings, the

heightened risk has rarely resulted in an increase in “credit events.”

3

A potential issue with limiting

cash portfolios to A-1/P-1 debt

is that it may pressure portfolio

According to Moody’s Investors Service, the default rate for nonfinancial

commercial paper initially rated P-2 is 0.01% 120 days after issuance (the

maturity limit for A-2/P-2 paper issued in the market today). That rate is

roughly equal to the default rate for similar paper with a P-1 rating. Moreover,

the recovery rate — the rate of recovered principal and interest — for defaulted

nonfinancial paper since 1972, regardless of its initial commercial paper rating,

is 100%. Similarly, the risk of ratings downgrade for A-2/P-2 issuers also is

roughly comparable to that of higher-rated issuance. According to Moody’s,

95.58% of P-2 commercial paper issued by nonfinancial corporations continued

to be rated P-2 or higher 120 days after it was issued, while 96.66% of P-1

paper continued to be rated P-1 or higher 120 days after issuance.

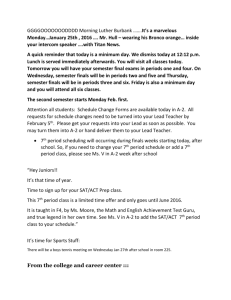

Figure 2

Historic credit migrations for nonfinancial corporations

yield and increase portfolio

volatility by increasing exposure

to the financial sector...

Rating at maturity

Maturity

(days)

30

60

90

120

Beginning

rating

P-1

P-2

P-3

Default

P-1

99.16%

0.44%

0.00%

0.00%

P-2

0.29%

98.58%

0.43%

0.00%

P-3

0.02%

1.14%

95.45%

0.02%

P-1

98.33%

0.88%

0.01%

0.00%

P-2

0.58%

97.18%

0.82%

0.01%

P-3

0.03%

2.26%

91.23%

0.04%

P-1

97.50%

1.30%

0.02%

0.00%

P-2

0.87%

95.79%

1.17%

0.01%

P-3

0.05%

3.38%

87.30%

0.05%

P-1

96.66%

1.72%

0.03%

0.01%

P-2

1.15%

94.43%

1.49%

0.01%

P-3

0.06%

4.50%

83.62%

0.07%

Source: Moody's Special Comment, "Default and Recovery Rates of Corporate Commercial

Paper Issuers, 1972-H1 2013," October 8, 2013 (most current report).

Note: Neither rows nor columns will sum to 100%, as data includes only selected cohorts.

The value of A-2/P-2 debt

A potential issue with limiting cash portfolios to A-1/P-1 debt is that it may

pressure portfolio yield and increase portfolio volatility by increasing exposure

to the financial sector, which is the primary issuer of such paper. Separateaccount investors can address both the yield and diversification challenges

inherent in large allocations to A-1/P-1 debt by incorporating A-2/P-2 paper

4

in their portfolios. The inclusion of A-2/P-2 debt in a separate account

may enhance portfolio yield for several reasons. First, investors typically

are compensated for assuming the higher credit risk embedded in A-2/P-2

credits with potentially higher yields. Second, supply-demand dynamics

translate into a yield premium for A-2/P-2 commercial paper. Because money

market funds — the primary purchasers of commercial paper — can invest no

more than 3% of their assets in A-2/P-2 credits, there is far less demand for

securities rated A-2/P-2 than for the A-1/P-1 paper that dominates money

market fund portfolios. The smaller pool of buyers for A-2/P-2 credits requires

issuers of that paper to pay higher yields to attract buyers.

Broadening a portfolio’s

investment universe also gives

a manager greater flexibility to

invest the account’s assets during

periods when supply of top-tier

paper becomes tight, as during

a flight to quality brought on by

a financial or geopolitical crisis.

Another major benefit that may accrue from the inclusion of A-2/P-2 issues

in separate accounts — and an important one for investors focused on principal

protection — is enhanced portfolio diversification. As previously noted, the

majority of commercial paper issued by cable companies, telecoms and

certain subsectors of other capital-intensive industries is rated A-2/P-2.

Investors who accept only A-1/P-1 paper thus would find it difficult to diversify

across these industry segments and further away from the financial sector,

3

which accounts for more than 87% of outstanding A-1/P-1 paper.

Investors currently can achieve sector diversification by investing in nonfinancial

commercial paper rated A-1/P-1. However, the supply of that debt has dwindled

markedly since the 2008 financial crisis because many companies “termed out”

much of their short-term issuance, choosing instead to issue debt with longer

maturities to lock in attractive long-term funding rates. As a result, investor

demand for remaining nonfinancial A-1/P-1 issuance has significantly compressed

yields on that paper, raising the cost of maintaining proper diversification

across industry sectors. Put simply, then, investing only in A-1/P-1 paper may

constrain portfolio diversification.

That diversification challenge can be addressed by adding A-2/P-2 debt because

of the addition of diverse sectors in which many A-2/P-2 issuers reside. Just as

a mix of asset classes — equities, fixed income and cash — may help insulate an

investment portfolio from market turbulence, a blend of short-term debt issues

from diverse industries may help optimize the risk profile of a cash portfolio.

Integrating A-2/P-2 debt in separate accounts

Including A-2/P-2 paper in a separate-account portfolio presents investment

managers with opportunities to enhance yield. Broadening a portfolio’s

investment universe also gives a manager greater flexibility to invest the

account’s assets during periods when supply of top-tier paper becomes tight,

as during a flight to quality brought on by a financial or geopolitical crisis. To

capture these opportunities without adding undue risk, the manager must

incorporate A-2/P-2 issues in a strategic way.

3

Monthly average outstanding tier I financial sector commercial paper from January 30, 2001 to June 30, 2015. Source: U.S. Federal Reserve.

5

A strong focus on diversification is central to this task. As previously noted,

the issuers of A-2/P-2 paper tend to fall across a variety of nonfinancial

industries. This creates opportunities for separate account managers to

further diversify cash portfolios across industries. The imperfect correlations

between securities issued by companies in different industry segments help

separate-account managers create more efficient portfolios. Put another way,

the enhanced portfolio diversification the addition of A-2/P-2 debt may achieve

creates the potential to increase yield without commensurately increasing

portfolio risk.

The imperfect correlations

between securities issued by

companies in different industry

segments help separate-account

managers create more efficient

portfolios.

Of course, investing in securities with slightly lower credit ratings does mean

accepting modestly higher credit risk. However, separate-account managers

can mitigate that additional risk through thorough credit research and

duration positioning.

Rigorous credit analysis is central to the effective integration of A-2/P-2 paper

into cash portfolios because it can provide a clearer view of a security’s credit

risk than a credit rating alone. Indeed, while credit ratings provide a useful

starting point for investors, they do not substitute for in-depth credit research.

Separate-account managers’ investment universe is far smaller than the list of

securities credit agencies must rate, freeing managers to perform more thorough

due diligence on issuers than rating agencies can. Managers probe financial

projections, analyze business and industry trends, perform stress tests and

otherwise evaluate each issuer’s true creditworthiness.

When considering the addition of A-2/P-2 paper to a cash portfolio, it is

important to recognize that credit risk is only one component of a security’s

risk profile. Interest-rate risk — the risk that spiking interest rates will decrease

security prices — is just as important a contributor to the total risk a security

represents. For example, consider an A-1/P-1 security that matures in

13 months (the statutory limit for commercial paper in money market funds)

versus an A-2/P-2 security maturing in four months (the practical maturity limit

given current market conditions). The first issue would have lower credit risk

than the second, but higher interest-rate risk — potentially making its total risk

greater than that of the lower-rated security.

Interest-rate risk is very low for A-2/P-2 paper, in aggregate. In fact, it is usually

lower than the interest rate risk in the A-1/P-1 market because the vast majority

of A-2/P-2 securities are issued with maturities of 120 days or less because

investors use tight maturity limits to manage their exposure to credit risk. By

contrast, investors typically are willing to invest out to 13 months for A-1/P-1

issuers because they view the credit risk of most top-tier issuers as de minimis.

The shorter average maturities in the A-2/P-2 market keep interest-rate risk

very low for these securities as a whole.

6

Maximizing the value of A-2/P-2 debt

The investment policies that define allowable securities in organizations’ cash

portfolios traditionally have excluded A-2/P-2 debt due to concerns about

credit risk. However, companies may want to amend their investment policies

to allow the inclusion of A-2/P-2 paper with maturities of 120 days or less,

because it may offer meaningful yield enhancement without substantially

increasing portfolio risk.

Companies may want to amend

their investment policies to allow

the inclusion of A-2/P-2 paper

with maturities of 120 days

or less, because it may offer

meaningful yield enhancement

without substantially increasing

portfolio risk.

The primary reason is the opportunity to enhance diversification. The ability to

invest across a wider range of industries and to further diversify away from the

financial sector enables managers to create more-efficient portfolios, while

also seeking the potential yield pickup from higher credit spreads and supplydemand dynamics in the A-2/P-2 market. Furthermore, A-2/P-2 paper presents

other characteristics, including strong business fundamentals and low interestrate risk, that can help mitigate the impact of the greater credit risk embedded

in A-2/P-2 debt.

The degree to which investors realize these benefits depends on the size

of their allocation to A-2/P-2 credits, which, of course, should reflect their risk

tolerance and liquidity requirements. Investors who opt to allocate a portion

of their assets to A-2/P-2 paper might need to update their investment policies,

so that the maximum size of the allocation, the industry mix, and its duration

(BofA Global Capital Management recommends maturities of 120 days or less)

are codified. Once a separate-account manager understands the investor’s

goals and sensitivities, he or she can strategically incorporate A-2/P-2 paper

into the portfolio using rigorous credit research and careful duration

positioning. Assuming sound portfolio construction, the inclusion of specific

second-tier issues may help managers capture greater yield in today’s challenging

interest-rate environment, while maintaining risk levels that are appropriate

for investors whose top priority is capital preservation.

7

About the authors

Robert A. Piepenburg, CFA

Managing Director

Director of Credit Research

Robert Piepenburg is a managing director and director of credit research at BofA Global Capital Management. In addition to leading a team of

ten taxable and tax-exempt research analysts, Mr. Piepenburg analyzes corporate bonds in the industrial (nonfinancial) sector for BofA Global

Capital Management’s taxable money market funds. Mr. Piepenburg joined a former Bank of America affiliate in 2009 and has been a member

of the investment community since 1986.

Prior to joining Bank of America, Mr. Piepenburg worked 11 years at Putnam Investments in various investment-grade and high-yield credit

research and bank loan trading roles. Before Putnam, Mr. Piepenburg worked five years on the bank loan syndication desk at BancBoston

Securities. He also worked in commercial real estate lending at both Bank of Boston and Wells Fargo Realty Advisors. Mr. Piepenburg began

his finance career as a corporate lender at The Sumitomo Bank, Ltd.

Mr. Piepenburg earned B.A. degrees in economics and communicative disorders and an M.B.A. in finance from the University of Wisconsin

at Madison. He is a member of the CFA Institute and the Boston Security Analysts Society. In addition, he is a CFA charter holder.

Susan M. Chevalier

Director

Senior Client Relationship Manager

Susan Chevalier is a director and senior client relationship manager in BofA Global Capital Management’s institutional client service group.

Ms. Chevalier’s responsibilities include advising corporations, foundations, endowments and municipalities on appropriate asset allocation,

benchmark selection, guideline enhancements, performance measurement and product selection. Previously, she served as a portfolio

strategist for a former affiliate of Bank of America and has been a part of the investment community since 1995.

Ms. Chevalier earned a bachelor's degree from California State Polytechnic University, Pomona School of Business. She is an affiliate member

of the CFA Institute, Los Angeles Society, as well as the chair of the Professional Development Committee of the Greater Los Angeles Chapter of

Bank of America’s LEAD for Women initiative. LEAD (Leadership, Education, Advocacy and Development) for Women is dedicated to promoting

professional women's development to help attract and retain successful women throughout Bank of America.

Chartered Financial Analyst® and CFA® are trademarks owned by the CFA Institute.

Past performance is no guarantee of future results.

This report is provided for informational purposes only and was not issued in connection with any proposed offering of securities. It was issued without regard to the specific

investment objectives, financial situation or particular needs of any specific recipient and does not contain investment recommendations. Bank of America and its affiliates do

not accept any liability for any direct, indirect or consequential damages or losses arising from any use of this report or its contents. The information in this report was obtained

from sources believed to be accurate, but we do not guarantee that it is accurate or complete. The opinions herein are those of BofA® Global Capital Management, are made as

of the date of this material, and are subject to change without notice. There is no guarantee the views and opinions expressed in this communication will come to pass. Other

affiliates may have opinions that are different from and/or inconsistent with the opinions expressed herein and may have banking, lending and/or other commercial

relationships with Bank of America and its affiliates. All charts are based on historical data for the time period indicated and are intended for illustrative purposes only.

Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible

prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates.

When interest rates go up, bond prices typically drop, and vice versa.

BofA Advisors, LLC operates as an investment advisor registered with the Securities and Exchange Commission, providing investment management services and

advising institutional and mutual fund portfolios. BofA Advisors, LLC is an indirect and wholly owned subsidiary of Bank of America Corporation and part of

BofA Global Capital Management.

©2015 Bank of America Corporation. All rights reserved.

BofA Advisors, LLC

100 Federal Street, Boston, MA 02110

www.bofacapital.com

AR7L5KB3 | WP-07-15-0744 | 08/2015