NTAA Supplement - Paisley Robertson Accountants

advertisement

July Supplement 2015

The

'

Tax Advisers'

Voice

July 2015

Year End Supplement

The NTAA

2014/15

Year End

Supplement

Voice

Page 1

Voice

2014/15 Supplement

Index

Capital Gains Tax – Improvement Thresholds, Indexation Factors.......................... 17-18

Cars – Per Kilometre Claims for Car Deductions/Depreciation Cost Limit............... 16

Client Details – 2015 Individual Income Tax Return Checklist................................. 23-28

Depreciation – Prime Cost and Diminishing Value Rates (150% and 200%)........... 20-21

Fringe Benefits Tax – 2016 & 2015......................................................................... 22

Genuine Redundancy Payments – Tax-free Amounts.............................................. 4

Higher Education Loan Programme (HELP) Repayment Thresholds – 2014/15...... 8

Income-producing Building Write-off Rates............................................................. 19

Medicare Levy – 2014/15........................................................................................ 5-6

Medicare Levy Surcharge – 2014/15....................................................................... 7

Rates of Tax 2014/15 – Companies ...................................................................... 8

– Non-resident Individuals................................................... 3

– Non-resident Minors – Unearned (Division 6AA) Income.. 4

– Resident Individuals......................................................... 3

– Resident Minors – Unearned (Division 6AA) Income........ 3

– S.99 Assessment – Resident Deceased Estate................ 4

– S.99A Assessment – No Beneficiary Presently Entitled.... 5

– Superannuation Funds..................................................... 9

Superannuation Guarantee Rate............................................................................. 11

Superannuation Thresholds – 2014/15.................................................................... 10-11

Tax-free Threshold – Pro-Rated Tax-Free Threshold for Non-residents................... 4

Tax Offsets 2014/15 – Dependant Tax Offsets...................................................... 12

– Low Income Tax Offset...................................................... 14

– Net Medical Expenses Tax Offset...................................... 13

– Private Health Insurance Tax Offset.................................. 15

– Senior and Pensioner Tax Offset....................................... 14

– Zone Tax Offset................................................................. 16

Trading Stock – Valuation of Natural Increase/Goods Taken for Private Use........... 18

DISCLAIMER

This publication has been prepared for the members of the National Tax & Accountants' Association Ltd. Many of the comments

contained in Voice are general in nature and anyone intending to apply the information to practical circumstances should independently

verify their interpretation and the information's applicability to their particular circumstances.

Page 2

July Supplement 2015

July Supplement 2015

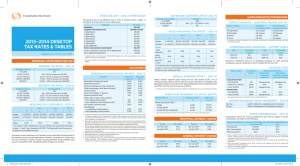

Rates of Tax – 2014/15

Resident Individuals

The following rates apply to individuals who are residents of Australia for tax purposes for the entire income

year.

Taxable Income1

$

0 – 18,200

18,201 – 37,000

37,001 – 80,000

80,001 – 180,000

180,001+

Tax Payable2,3

Nil

19% of excess over $18,200

$3,572 + 32.5% of excess over $37,000

$17,547 + 37% of excess over $80,000

$54,547 + 47%4 of excess over $180,000

1 The tax-free threshold may effectively be higher for taxpayers eligible for the low-income tax offset, the Seniors and

Pensioners Tax Offset and/or certain other tax offsets.

2 The above rates do not include the Medicare Levy (2% from 1 July 2014, previously 1.5%).

3 As part of the 2015/16 Federal Budget, the government announced that, with effect from 1 July 2015, individual taxpayers

with business income from an unincorporated business that has an aggregate annual turnover of less than $2 million will

be eligible for a small business tax discount. The discount will be 5% of the income tax payable on the business income

received from an unincorporated small business entity. The discount will be capped at $1,000 per individual for each

income year and will be delivered as a tax offset.

4 This rate includes the 2% 'Temporary Budget Repair Levy' which applies from 1 July 2014 until 30 June 2017 on that part

of a person's taxable income that exceeds $180,000.

Non-resident Individuals

The following rates apply to individuals who are not residents of Australia for tax purposes for the entire

income year:

Taxable Income

$

0 – 80,000

80,001 – 180,000

180,001+

1

2

3

Tax Payable1,2

32.5% of the entire amount

$26,000 + 37% of excess over $80,000

$63,000 + 47%3 of excess over $180,000

Medicare Levy is not payable by non-residents.

As part of the 2015/16 Federal Budget, the government announced that, with effect from 1 July 2015, individual taxpayers

with business income from an unincorporated business that has an aggregate annual turnover of less than $2 million will

be eligible for a small business tax discount. The discount will be 5% of the income tax payable on the business income

received from an unincorporated small business entity. The discount will be capped at $1,000 per individual for each

income year and will be delivered as a tax offset. At the time of writing, no information was available regarding if and how

this proposal applies to non-resident individuals.

This rate includes the 2% 'Temporary Budget Repair Levy' which applies from 1 July 2014 until 30 June 2017 on that part

of a person's taxable income that exceeds $180,000.

Resident Minors – Unearned (Division 6AA) Income

The following rates apply to the income of certain minors (e.g., persons under 18 years of age on the last

day of the income year who are not classed as being in a full-time occupation) that is not excepted income

(e.g., employment income):

Division 6AA Income

$

0 – 416

417 – 1,307

1,308+

1

2

3

Tax Payable1,2,3

Nil

68% of excess over $416

47% of the entire amount

The 2% Medicare levy is not included but may apply.

Resident minors are not entitled to the low-income tax offset in respect of 'unearned' income.

The effect of the 2% 'Temporary Budget Repair Levy' which applies from 1 July 2014 until 30 June 2017 has been included

in the above table.

Voice

Page 3

Voice

Non-resident Minors – Unearned (Division 6AA) Income

The following rates apply to the income of certain non-resident minors (e.g., non-resident persons under 18

years of age on the last day of the income year who are not classed as being in a full-time occupation) that

is not excepted income (e.g., employment income):

Division 6AA Income

$

0 – 416

417 – 663

664+

1

2

Tax Payable1,2

34.5% of the entire amount

$143.52 + 68% of excess over $416

47% of the entire amount

The Medicare Levy is not payable by non-residents.

The effect of the 2% 'Temporary Budget Repair Levy' which applies from 1 July 2014 until 30 June 2017 has been included

in the above table.

Pro-Rated Tax-Free Threshold – Non-residents

The tax-free threshold that applies to residents ($18,200 per annum in 2013/14 and 2014/15) is effectively

pro-rated in an income year in which a taxpayer either ceased to be, or became, a resident for tax purposes.

For the 2014/15 income years the pro-rated threshold will be calculated using the following formula:

$13,464 + ($4,736 x number of months taxpayer was resident for the year ÷ 12)

Genuine Redundancy Payments

The tax-free amount of a genuine redundancy payment in 2014/15 is $9,514 plus $4,758 for each

completed year of service.

S.99 Assessment – Resident Deceased Estate

The following rates apply where a trustee is assessed under S.99 of the ITAA 1936 in respect of a resident

deceased estate. Where the date of death is less than 3 years before the end of the income year, the trustee

is assessed as a resident individual.

Taxable Income

$

Less than 3 years since death

0 – 18,200

18,201 – 37,000

37,001 – 80,000

80,001 – 180,000

180,001+

3 years or more since death

0 – 416

417 – 670

671 – 37,000

37,001 – 80,000

80,001 – 180,000

180,001+

1

2

Rate1

%

Nil

19% of excess over $18,200

$3,572 + 32.5% of excess over $37,000

$17,547 + 37% of excess over $80,000

$54,547 + 47%2 of excess over $180,000

Nil

50% of excess over $416

$127.30 + 19% of excess over $670

$7,030 + 32.5% of excess over $37,000

$21,005 + 37% of excess over $80,000

$58,005 + 47%2 of excess over $180,000

Medicare Levy does not apply to S.99 assessments of deceased estate trustees.

This rate includes the 2% 'Temporary Budget Repair Levy' which applies from 1 July 2014 until 30 June 2017 to the extent

taxable income exceeds $180,000.

Page 4

July Supplement 2015

July Supplement 2015

S.99A Assessment – No Beneficiary Presently Entitled

The following rate applies where there is no beneficiary entitled to the income of a resident trust.

Taxable Income

Rate1,2

%

$

1+

1

2

47% of the entire amount

Medicare Levy is not included but does apply (except in relation to deceased estates).

Note that from 1 July 2014 until 30 June 2017, the rate includes the 2% 'Temporary Budget Repair Levy'.

General Rate

Medicare Levy – 2014/15

Taxpayer

Rate

%

2015

2% of taxable income

Low-income Thresholds – Individuals

The 2014/15 Medicare Levy low-income thresholds for individuals are as follows:

Threshold

Amount1

$

Phase-in Limit2

$

2% at or

Above3

$

Not eligible for Seniors and Pensioners Tax Offset

20,896

20,897 – 26,120

26,121

Eligible for Seniors and Pensioners Tax Offset

33,044

33,045 – 41,305

41,306

Single Taxpayer

1

2

3

No Medicare Levy is payable on taxable income levels at or below the Threshold Amount.

Where taxable income falls within the Phase-in Limit, the Medicare Levy is payable at 10% of the excess over the Threshold

Amount.

The Medicare Levy of 2% (increased from 1.5%) applies to the entire amount of taxable income.

Voice

Page 5

Voice

Family Thresholds – 2014/15

A taxpayer may be eligible to pay no (or a reduced) Medicare Levy if their family income is within the

thresholds set out below, and the taxpayer:

♦ has a spouse (including de facto and same-sex) on the last day of the income year;

♦ has not remarried after their spouse died during the income year; or

♦ is eligible for the notionally retained sole parent rebate, the housekeeper or the child-housekeeper

rebates (or would be entitled if they did not qualify for the Family Tax Benefit Part B).

The 2014/15 Medicare Levy thresholds for families are as follows:

No. of Dependent

Children/Students

$

Family Income

1

Threshold

$

Reduced Levy2

$

2%

at or above3

$

Taxpayer Not eligible for Seniors and Pensioners Tax Offset

0

35,261

35,262 – 44,076

44,077

1

38,499

38,500 – 48,123

48,124

2

41,737

41,738 – 52,171

52,172

3

44,975

44,976 – 56,218

56,219

4

48,213

48,214 – 60,266

60,267

5

51,451

51,452 – 64,313

64,314

6

54,689

54,690 – 68,361

68,362

Extra child

3,238

4,048

Taxpayer Eligible for Seniors and Pensioners Tax Offset

1

2

3

0

46,000

46,001 – 57,500

57,501

1

49,238

49,239 – 61,547

61,548

2

52,476

52,477 – 65,595

65,596

3

55,714

55,715 – 69,642

69,643

4

58,952

58,953 – 73,690

73,691

5

62,190

62,191 – 77,737

77,738

6

65,428

65,429 – 81,785

81,786

Extra child

3,238

4,048

Family Income is the combined taxable income of a taxpayer and their spouse. If the taxpayer does not have a spouse,

Family Income is the taxpayer’s taxable income only. No Medicare Levy is payable on taxable income levels at or below

the Family Income Threshold.

There is no ‘phase-in limit’ stated for families as there is with individuals since the figures change with the number of

dependants. However, where family income exceeds the threshold, the levy payable is shaded-in, with the general

effect that the levy payable cannot exceed 10% of the excess of the family income over the family income threshold. The

‘reduction formula’ used varies depending on the circumstances of the family in question.

Further note that, if a taxpayer’s family income is above the threshold but the taxpayer’s taxable income is below the

individual threshold, special rules apply so that they are entitled to a reduction.

The levy payable by the relevant taxpayer is 2% (increased from 1.5%) of their entire taxable income.

Page 6

July Supplement 2015

July Supplement 2015

Medicare Levy Surcharge – 2014/15

The Medicare levy surcharge (‘MLS’) may apply in respect of a resident taxpayer where the taxpayer, their

spouse and/or dependent children (if any) did not have the appropriate level of private patient hospital cover

(subject to certain exceptions for ‘prescribed persons’) and the applicable ‘income test’ threshold is exceeded.

From 1 July 2012, the rate at which the MLS is applied is determined under a tiered income system whereby a

taxpayer’s level of ‘income for surcharge purposes’ (on a spouse inclusive basis, where relevant) is classified

as either ‘Base Tier’, ‘Tier 1’, ‘Tier 2’ or ‘Tier 3’.

Income tier thresholds

The following table sets out the income thresholds and MLS rates that apply in respect of:

• Taxpayers who were single for the whole income year; and

• Taxpayers who were ‘married’ (including de facto, same, or opposite sex partners) and/or had at least

one ‘dependent child’ (children) for the whole income year.

The MLS only applies in respect of periods in which private patient hospital cover was not held for the

taxpayer, their spouse and dependants (if relevant).

Medicare Levy Surcharge Thresholds – 2014/15

Singles1

Base Tier

$

Tier 1

$

Tier 2

$

Tier 3

$

90,000 or less

90,001 – 105,000

105,001 – 140,000

140,001+

Families and Couples

1,2,3

0 dependants

180,000 or less

180,001 – 210,000

210,001 – 280,000

280,001+

1 dependant

180,000 or less

180,001 – 210,000

210,001 – 280,000

280,001+

2 dependants

181,500 or less

181,501 – 211,500

211,501 – 281,500

281,501+

3 dependants

183,000 or less

183,001 – 213,000

213,001 – 283,000

283,001+

4 dependants

184,500 or less

184,501 – 214,500

214,501 – 284,500

284,501+

5 dependants

186,000 or less

186,001 – 216,000

216,001 – 286,000

286,001+

1,500

1,500

1,500

1,500

1.0%

1.25%

1.5%

Each extra child

Medicare levy surcharge rate

Rate

0.0%

4

1

Based on the law applying at the time of writing, the MLS income thresholds will remain at 2015 rates for the next three

years.

2 For a couple, their combined income for surcharge purposes is generally applied against the family surcharge threshold

(but levied against each of the taxpayer’s own taxable income, reportable fringe benefits and on any amounts on which

family trust distribution tax has been paid). However, if the income for surcharge purposes of one of the couple does not

exceed the applicable Medicare levy low income threshold that member is not liable for the MLS.

3 A taxpayer’s child is a ‘dependant’ child for these purposes where the child is a resident, aged less than 21 years (or

between 21 years and less than 25 years and receiving full-time education at a school, college or university) and the

taxpayer contributed to the maintenance of the child.

4 If the MLS applies, it is levied on the taxpayer’s taxable income, reportable fringe benefits and on any amounts on which

family trust distribution tax has been paid.

Note that, where a taxpayer’s circumstances change during the income year, for example, if the taxpayer

marries, or ceases to be married, during the income year, the MLS is calculated separately for each of these

periods (based broadly on the rules set out above).

Voice

Page 7

Voice

HELP Repayment Thresholds – 2014/15

The Higher Education Loan Programme ('HELP') offers Commonwealth loans to eligible students to assist

them with paying their higher education fees and to study overseas. A HELP debt is repaid through the

taxation system, based on a taxpayer's HELP 'repayment income'. HELP repayment income is the sum of

the taxpayer's:

–

taxable income;

–

total net investment loss;

–

reportable fringe benefits;

–

exempt foreign employment income; and

–

reportable superannuation contributions.

HELP Repayment Income Thresholds and Rates

Rate of Repayment

%

Nil

4

4.5

5

5.5

6

6.5

7

7.5

8

HELP Repayment Income

$

0 – $53,344

$53,345 – $59,421

$59,422 – $65,497

$65,498 – $68,939

$68,940 – $74,105

$74,106 – $80,257

$80,258 – $84,481

$84,482 – $92,970

$92,971 – $99,069

$99,070+

Note that, as part of the 2015/16 Federal Budget, the government announced that it will extend the HELP

repayment framework to debtors residing overseas for six months or more if their worldwide income exceeds

the minimum repayment threshold. This measure is proposed to apply from 1 July 2017.

Company Rates of Tax – 2014/15

General Company Tax Rate1

Rate

%

Description of Taxpayer

Private companies (except life insurance companies, RSA Providers & PDFs)

30

Public companies (except life insurance companies, RSA Providers & PDFs)

Corporate Unit Trusts

Corporate Limited Partnerships

Public Trading Trusts

Strata Title Bodies Corporate

30

30

30

30

30

1 As part of the 2015/16 Federal Budget, the government announced that, with effect from the 2016 income year, it will

deliver a tax cut to small businesses by reducing the company tax rate to 28.5% (i.e., a reduction of 1.5%) for companies

with aggregated annual turnover of less than $2 million.

Non-profit Company Tax Rates

Taxable Income

$

0 – 416

417 – 915

916+

Page 8

Rate

%

Nil

55% of excess over $416

30% of the entire amount

July Supplement 2015

July Supplement 2015

Superannuation Funds – 2014/15

Complying Superannuation Fund

Type of Receipt

Earnings (other than non-arm's length income)

Income received including realised capital gains

Discount capital gains (asset held for 12 months or more)1

Employer Contributions2,3

Portion covered by S.295-180 choice4

SGC shortfall component

All other employer contributions (no S.295-180 choice)

Employee and Self-employed Contributions2

Portion covered by S.290-170 notice (of intention to claim a deduction)3

All other employee and self-employed contributions (no S.290-170 notice)

Contributions – other person (excluding trustee of exempt life assurance fund or of complying

superannuation fund, ADF or PST)

Portion covered by S.295-180 choice4

Spouse contributions

Contributions for minor (not by an employer)

Government Co-contributions

First Home Saver Account

All other contributions (no S.295-180 choice)

Roll-overs5

Originating from taxable source (e.g., another complying fund)

– tax-free component

– taxable component (taxed element)

– taxable component (untaxed element)5

Non-arm's Length Component

Non-arm's length income (less attributable deductions) – S.295-550

Transfer from Foreign Superannuation Funds

– amount specified in a choice under S.305-80

Transfer from Superannuation Holding Accounts (SHA) special account6

All

Change of Status

Foreign fund to complying fund

– market value of assets less member contributions

1

2

3

4

5

6

Rate of Tax

%

15

10

0

15

15

15

0

0

0

0

0

0

15

0

0

15

47

15

15

15

Effective tax rate when the 15% complying superannuation fund rate is applied to two-thirds of the discount capital gain.

Where a superannuation contribution has been made in respect of an individual who has not provided their TFN to the

superannuation fund by the end of the year then these contributions will be subject to additional tax of 34% (calculated as

49% less the ordinary rate of the tax paid by the fund (i.e., 15 %) for the period 1 July 2014 to 30 June 2017). However,

a tax offset is generally available if the TFN is provided to the fund in any of the three years after the year of contribution.

From 1 July 2012, subject to certain exceptions, the tax rate on concessional contributions made by, or on behalf of an individual

with 'income' (as defined) plus 'low tax contributions' greater than $300,000 increased from 15% to 30%. The additional 15%

(known as Division 293 tax) is assessed to the individual, who has the option of having the fund pay. If an individual's 'income'

(excluding their concessional contributions) is less than $300,000 but the inclusion of their contributions pushes them over this

threshold, then the 30% tax rate will only apply to the amount of the contributions that are in excess of $300,000.

The choice applies to contributions made to a public sector superannuation scheme (other than one that came into existence

after 5 September 2006) and the contributor must consent to the choice.

The rollover benefit will be taxed in the receiving fund to the extent it is not an 'excess untaxed rollover amount'. If the

rollover amount exceeds the untaxed plan cap amount, the excess is taxed to the member (and not the fund) at 49% for

the 2015 income year (which is the top marginal rate of 45% plus the 2% 'Temporary Budget Repair Levy' and the 2%

Medicare levy), with the tax withheld by the fund that makes the rollover payment. Refer to 9.06.02 for the 'untaxed plan

cap amounts'.

The 'superannuation holding accounts (SHA) special account' (previously known as the superannuation holding accounts

reserve) was closed to employer deposits after 30 June 2006.

Voice

Page 9

Voice

Non-complying Superannuation Fund

Rate of Tax1

%

Type of Receipt

Earnings

Income received including realised capital gains

Discount capital gains (asset held for 12 months or more)2

Contributions (Australian fund)3

Employee and self employed

Employer (excluding trustee of exempt life assurance fund, complying superannuation

fund, complying ADF or PST)

Change of Status

Complying to non-complying

– market value of assets less undeducted contributions and

contributions segment

Foreign fund to Australian fund

– market value of assets less member contributions

1

2

3

47

23.5

0

47

47

47

Before 1 July 2014, the tax rate that generally applied to non-complying superannuation funds was 45%. For the period

1 July 2014 to 30 June 2017, the rate includes the 2% 'Temporary Budget Repair Levy'.

Effective tax rate when the 47% superannuation fund rate is applied to one-half of the discount capital gain.

Where a superannuation contribution has been made in respect of an individual who has not provided their TFN by the

end of the year, then these contributions will be subject to additional tax of 2% (calculated as 49% less the ordinary rate

of tax paid by the fund (i.e., 47%) for the period 1 July 2014 to 30 June 2017). However, a tax offset is generally available

if the TFN is provided to the fund in any of the three years after the year of contribution.

Superannuation Thresholds – 2014/15

Concessional Contributions Caps

Concessional contributions include employer contributions (including contributions made under a salary

sacrifice arrangement) and personal contributions claimed as a tax deduction by a self-employed person.

Year

Age at year-end

Amount of Cap

2015

50+

<50

$35,000

$30,000

Non-concessional Contributions Caps

Non-concessional contributions include personal contributions for which taxpayers do not claim an

income tax deduction. A person is liable to pay excess contributions tax if their non-concessional

contributions exceed the cap1.

1

Income Year

Amount of Cap

2014/15

$180,000 or $540,0001 over 3 years

There is a ‘bring-forward’ option under which taxpayers can contribute greater than $150,000 ($180,000 from 1 July 2014)

in an income year as long as the total contributions for that year and the next 2 years do not exceed $450,000 ($540,000

from 1 July 2014). This option only applies to taxpayers who are under 65 at any time in the year that they want to 'bringforward' their contributions.

Page 10

July Supplement 2015

July Supplement 2015

Government Co-contribution Table for Low Income Employees

The superannuation co-contribution was initially introduced by the Government from 1 July 2003 as an

incentive to encourage low income earners to save for their own retirement.

If an individual's satisfies the income test for the co-contribution, and they make personal (non-concessional)

superannuation contributions, the Government will match their contribution with a 'co-contribution'.

For the 2013 and later income years, the government will contribute $0.50 for every $1 an eligible individual

contributes into superannuation, up to the maximum co-contribution outlined in the following table for these

years.

Income Year

2014/15

1

Total Income1,2

$

Calculation of Maximum Co-contribution

$

0 – 34,488

$500

34,489 – 49,488

$500 – [3.333% x (Total income – $34,488)]

49,489+

Nil

Total Income is calculated as the sum of assessable income, the reportable fringe benefits total and reportable employer

superannuation contributions.

2 For the 2015 income year, the maximum entitlement remains at $500, whilst the lower income threshold increases to

$34,488 and the higher income threshold increases to $49,488.

Superannuation Spouse Contribution Tax Offset

The tax offset applies to contributions made by a taxpayer to a Complying Superannuation Fund or Retirement

Savings Account in respect of their low-income earning, or non-working, spouse (married or de facto). The

amount of the offset is as follows:

Spouse's Assessable

Income (AI)1

$

0 – 10,800

Maximum Rebatable

Contributions (MRC)

$

$3,000

10,801 – 13,799

$3,000 – [AI – $10,800]

MRC x 18%

13,800+

Nil

Nil

Maximum Offset

Amount2

$

$540

1 Including reportable fringe benefits and reportable employer superannuation contributions.

2 The offset is calculated as 18% of the actual contributions if this results in a lower amount.

Lump Sum Superannuation Benefits – Low Rate Cap Amount

The application of the low rate threshold for superannuation lump sum payments is capped. The low

rate cap amount is reduced by any amount previously applied to the low rate threshold.

Income Year

2014/15

Cap Amount

$185,000

Superannuation Guarantee Rate

Employers who provide less than a prescribed level of superannuation support (the 'charge percentage',

generally applied to the employee's ordinary time earnings) for their employees are liable to pay a superannuation

guarantee charge based on the shortfall (calculated with reference to 'salary and wages') plus an interest

component and an administration charge.

Income Year

2014/15

2013/141

1

Charge Percentage (%)

9.5

9.25

From 1 July 2013, the SG age limit no longer applies.

Voice

Page 11

Voice

Tax Offsets – 2014/15

Dependant Tax Offsets

From 1 July 2012 (i.e., for the 2013 and later income years), the Dependant (Invalid and Carer) Tax Offset

(DICTO) replaced eight dependent rebates (namely, the invalid spouse, carer spouse, housekeeper, child

housekeeper, child housekeeper (with child), invalid relative and parent/parent-in-law tax offsets). However,

for the 2014 income year, these offsets remain relevant for taxpayers who are eligible for the zone or overseas

forces tax offsets.

The DICTO is a non-refundable tax offset and is only available where the dependant who is being maintained

by the taxpayer is genuinely unable to work due to invalidity or carer obligations during an income year. Note

that, for the 2014 income year, the DICTO did not replace the dependent spouse tax offset ('DSTO'), which

continued to be available, but only in respect of a spouse that was born before 1 July 1952.

However, as part of the 2014/15 Federal Budget, the government announced that the DSTO will be abolished

for all taxpayers from 1 July 2014 (i.e., from the 2015 income year). At the time of writing, this measure is

awaiting Royal Assent. The ATO has recommended that taxpayers should not claim this offset for the 2015

income year and has removed the DSTO label from the 2015 individual tax return accordingly.

2014/15

Max

Offset

$

Description

DICTO1

Max

ATI1

$

2,535 10,422

N/A

N/A

Spouse/de facto (no dependent child/student) or invalid spouse/carer spouse

(whichever is applicable)

N/A

N/A

Child-housekeeper (no dependent child/student)

N/A

N/A

Child-housekeeper (with dependent child/student)

N/A

N/A

Invalid relative

N/A

N/A

Parent or parent-in-law

N/A

N/A

Housekeeper (no dependent child/student)

N/A

N/A

Housekeeper (with dependent child/student)

N/A

N/A

Spouse/de facto (with dependent child/student) – higher tax offset

N/A

N/A

First child under 21 (not being a student)

376

1,785

282

1,409

376

1,785

1,607

N/A

Spouse/de facto (no dependent child/student)

2

Tax offset/rebate available where taxpayer entitled to claim ZTO, OFTO or

OCTO3:

Tax offset/rebate ‘notionally’ used for other purposes:

4

Each other child under 21 (not being a student)

Student

4

Sole parent

1

4

4

If the taxpayer is claiming an offset in respect of a dependant other than a spouse, the combined Adjusted Taxable Income

(‘ATI’) of the taxpayer and their spouse must not exceed $150,000. If claiming for a spouse, the taxpayer’s ATI must not

exceed $150,000. In addition, the amount of the dependant offset reduces by $1 for every $4 by which the dependant's

ATI exceeds $282.

A taxpayer's ATI includes their

– taxable income;

– adjusted fringe benefits total;

– tax-free pensions or benefits;

– target foreign income;

– reportable superannuation contributions;

– total net investment losses;

Less Deductible child maintenance expenditure (i.e., child support paid).

Page 12

July Supplement 2015

July Supplement 2015

2

3

4

For the 2014 income year, this offset could be claimed by taxpayers who have a spouse born before 1 July 1952 where

certain conditions were met. If a DSTO claim was made, a claim could not be made for the same spouse under the DICTO.

For the 2014 income year, taxpayers eligible for the Zone Tax Offset (‘ZTO’), the Overseas Forces Tax Offset (‘OFTO’) or

the Overseas Civilian Tax Offset (‘OCTO’) continued to be entitled to claim (where eligible) the other eight dependent tax

offsets (e.g., the housekeeper tax offset) set out in the table above rather than the DICTO.

However, in its 2014/15 Federal Budget announcement, the government indicated that, from 1 July 2014 (i.e., from the 2015

income year), any retained entitlement to any of these eight other dependent tax offsets, as part of the ZTO, OFTO and

OCTO will be removed (the DICTO is available, where eligible). Note that at the time of writing, legislation to implement

this measure is awaiting Royal Assent.

These dependant tax offsets have been abolished or replaced, however they have been notionally retained for various

purposes (e.g., calculating the ZTO, OFTO, OCTO and entitlement to other tax offsets).

Medical Expenses Tax Offset

As part of the May 2013 Federal Budget, the former federal government announced that it would phase out

the Net Medical Expenses Tax Offset ('NMETO') by the end of the 2019 income year.

Legislative amendments to give effect to this measure were enacted by the Tax and Superannuation Laws

Amendment (2014 Measures No. 1) Act 2014. However, transitional arrangements apply whereby claims

for the NMETO can only be made as follows, subject to satisfying the income test set out below:

u For the 2014 income year, the NMETO can be claimed in respect of the full range of eligible out-ofpocket medical expenses if the offset was claimed in the 2013 year;

u For the 2015 income year, the NMETO can be claimed in respect of the full range of eligible out-ofpocket medical expenses if the offset was claimed in both the 2013 and 2014 income years;

u In all other cases, the NMETO can only be claimed in respect of out-of-pocket medical expenses

relating to disability aids, attendant care or aged care, up to and including the 2019 income year; and

u From 1 July 2019 (i.e., from the 2020 income year), the NMETO is abolished for all taxpayers.

The NMETO has been income tested since 1 July 2012.

For the 2015 income year, the NMETO is claimed as follows:

Status

Adjustable taxable income

for rebates1,2

$90,000 or less

Single

Greater than $90,000

$180,000 or less

Family3,4

Greater than $180,000

1

2

3

4

Medical expenses

$2,218 or less

Greater than $2,218

$5,233 or less

Greater than $5,233

$2,218 or less

Greater than $2,218

$5,233 or less

Greater than $5,233

Rate of Offset

0

20

0

10

0

20

0

10

'Adjusted taxable income for rebates’ is calculated as the taxpayer's taxable income + adjusted fringe benefits total +

reportable super contributions + target foreign income + total net investment loss + any tax free pension or benefit –

deductible child maintenance expenditure.

A taxpayer will be eligible for the family threshold if they are married on the last day of the income year or have a dependant

on any day of the income year.

The threshold is increased by $1,500 for each dependant child after the first.

Where the taxpayer is married it is the combined total of the taxpayer's and their spouse's ‘adjusted taxable income for

rebates’ that is compared to the threshold.

Voice

Page 13

Voice

Low Income Tax Offset

Resident individuals (including trustees assessed under S.98 ITAA 1936 in respect of presently entitled

resident beneficiaries) are entitled to the low-income tax offset1.

In the 2014/15 and 2013/14 income years, the maximum offset of $445 is reduced by 1.5 cents for every

dollar of taxable income over $37,000. The offset is not automatically indexed.

1

Taxable Income

$

Tax Offset

0 – 37,000

37,001 – 66,666

66,667+

$445

$445 – [(Taxable Income – $37,000) x 1.5%]

Nil

Minors who are not classified as an 'excepted person' are not eligible to apply the low-income tax offset to reduce tax

payable on their unearned (i.e., Division 6AA) income.

Seniors and Pensioners Tax Offset

Maximum

Offset

$

Shade-out

Threshold2

$

Cut-out

Threshold2

$

Single, separated or widowed

$2,230

$32,279

$50,119

Each member of a couple (married or de facto, whether

of the same or opposite sex)3

$1,602

Each member of a couple (married or de facto, whether

of the same or opposite sex) separated due to illness or

because one was in a nursing home3

$2,040

Family Situation1

$57,948

($28,974 each)

$62,558

($31,279 each)

$83,580

($41,790

each)

$95,198

($47,599

each)

1 For a taxpayer who is a member of a couple, eligibility is established by halving the combined 'rebate' income of the

taxpayer and their spouse and comparing this amount against the relevant Cut-out Threshold – if this figure reaches the

Cut-out Threshold (meaning the combined rebate income of the taxpayer and their spouse is equal to or greater than

double the relevant Cut-out Threshold in the above table), then neither person is eligible for SAPTO. If this figure is below

the Cut-out Threshold, then the amount of each person’s SAPTO entitlement depends on their own rebate income and

their eligibility for any unused portion of their spouse’s SAPTO.

An individual's 'rebate' income for a year of income is the sum of the individual's:

(a)

taxable income for the year;

(b)

reportable superannuation contributions for the year;

(c)

total net investment loss for the year; and

(d)

the individual's adjusted fringe benefits total for the income year.

2 The maximum offset reduces by 12.5 cents for every dollar of rebate income over the Shade-out Threshold and reduces

to nil for rebate income levels at or above the Cut-out Threshold.

3 The transfer of any unused portion of a spouse’s SAPTO may occur if both the taxpayer and their spouse are eligible for

SAPTO, the spouse’s tax offset entitlement exceeds their tax payable, and tax payable by the taxpayer exceeds their tax

offset entitlement.

3 The transfer of any unused portion of a spouse’s SAPTO may occur if both the taxpayer and their spouse are eligible for

SAPTO, the spouse’s tax offset entitlement exceeds their tax payable, and tax payable by the taxpayer exceeds their tax

offset entitlement.

Page 14

July Supplement 2015

July Supplement 2015

Private Health Insurance Rebate

The private health insurance (PHI) rebate is an amount that the government contributes towards the cost of

PHI premiums. The rebate is only available in relation to a 'complying PHI policy' (basically, a policy offered

by a registered health insurer that provides hospital cover, general treatment cover or both), excluding 'lifetime

health cover loading' applied to the cost of a policy from 1 July 2013.

From 1 July 2012, the PHI rebate is income tested. As a result, higher income earners now receive less

PHI rebate or, if they do not have the appropriate level of private patient hospital cover, the Medicare levy

surcharge may increase (as set out in table 3.03.04).

The income tier thresholds

The PHI rebate is income tested against the income tier thresholds, as set out below.

Furthermore, from 1 April 2014, PHI rebate percentages are adjusted downwards by a single rebate adjustment

factor. This means that in each year, two separate PHI rebate percentages will be applied in calculating a

taxpayer's PHI rebate - one for the period 1 July to 31 March, and a separate percentage for the period 1

April to 30 June (as outlined in the following table for the 2015 income year).

Base Tier

$

Tier 1

$

Tier 2

$

Tier 3

$

90,000 or less

90,001 – 105,000

105,001 – 140,000

140,001+

0 dependants

180,000 or less 180,001 – 210,000 210,001 – 280,000

280,001+

1 dependant

180,000 or less 180,001 – 210,000 210,001 – 280,000

280,001+

2 dependants

181,500 or less 181,501 – 211,500 211,501 – 281,500

281,501+

3 dependants

183,000 or less 183,001 – 213,000 213,001 – 283,000

283,001+

4 dependants

184,500 or less 184,501 – 214,500 214,501 – 284,500

284,501+

5 dependants

186,000 or less 186,001 – 216,000 216,001 – 286,000

286,001+

Singles1,2

Singles

Families/Couples

1,3

Each extra child

1,500

Aged under 654

29.040%

1,500

1,500

1,500

Rebate 1 July 2014 to 31 March 2015

Aged 65 - 69

4

Aged 70 or over4

19.360%

9.680%

0%

33.88%

24.20%

14.52%

0%

38.720%

29.040%

19.360%

0%

Rebate 1 April 2015 to 30 June 2015

Aged under 65

27.820%

18.547%

9.273%

0%

Aged 65 - 694

32.457%

23.184%

13.910%

0%

Aged 70 or over4

37.094%

27.820%

18.547%

0%

4

1 Based on law applying at the time of writing, from 1 July 2015 to 30 June 2018, the PHI income thresholds will not be

indexed (i.e., they will remain at 2014/15 rates for the next three years).

2 A 'single' taxpayer is someone who is not married and does not have any dependent children.

3 A person will generally be assessed under the 'families/couples' tier thresholds if the person:

– is married on the last day of the income year (including a de facto couple) – in this case, it is the combined income

for surcharge purposes (i.e., the Base Tier) of the taxpayer and their spouse which is included; or

– at any time during the year, contributes in a substantial way to the maintenance of at least one dependent child who

is either the person's 'child' (as defined in S.995-1 of the ITAA 1997) or their 'sibling' who is dependent on them for

economic support.

4 This is a reference to the age of the oldest person covered by the policy.

Voice

Page 15

Voice

Zone Tax Offset

Taxpayers who live in remote areas of Australia may be entitled to a Zone Tax Offset depending on the

amount of time spent in the relevant zones. Generally speaking, taxpayers qualify as residents of a zone

where they reside in the zone (not necessarily continuously) for 183 days or more. Remote areas do not

include offshore rigs.

To find out whether a location is currently in a zone or special area, refer to the 'Australian Zone List', which

can be found on the ATO website.

The 2014/15 zone rebate levels remain unchanged from 2013/14 and are set out below:

Maximum Offset2

$

Description1

Special Area in Zone A

$1,173 + 50% of the relevant rebate amount3

Special Area in Zone B

$1,173 + 50% of the relevant rebate amount3

Zone A

$338 + 50% of the relevant rebate amount3

Zone B

$57 + 20% of the relevant rebate amount3

1 The Zone A offset applies to a taxpayer who is a resident of Zone A during the year of income but has not resided or

actually been in the special area of either zone (these areas are particularly isolated) during any part of the year. The

Zone B offset applies to a taxpayer who is a resident of Zone B during the year of income but has not resided or actually

been in Zone A, or the special area of either zone during any part of the year. Where a taxpayer does not fall into any of

the previous categories but resided in a zone area for some of the year, the Commissioner can determine a reasonable

amount of tax offset to allow in the circumstances.

2 The zone offset amount noted in the table is increased by the full amount of the dependant spouse tax offset to which the

taxpayer would be entitled assuming the relevant age restriction for that rebate did not apply (and provided also that the

taxpayer is not otherwise already eligible to claim the offset).

Note that in the 2014/15 Federal Budget, the government announced that it would abolish the dependant spouse tax

offset from 1 July 2014, for all taxpayers. The government also announced that it would abolish the claiming of other

dependant-related tax offsets (e.g., the parent/parent-in-law tax offset) as part of the zone or overseas forces tax offsets

from 1 July 2014. However, eligible taxpayers may claim both the DICTO and the zone or overseas forces tax offset. At

the time of writing, legislation to enact this is awaiting Royal Assent.

3 The 'relevant rebate amount' is the total of certain rebates or notional rebates to which the taxpayer is entitled or deemed

to be entitled.

Note that as part of the 2015/16 Federal Budget, the government announced that from 1 July 2015 (i.e., from

the 2016 income year), it will exclude 'fly-in fly-out' and 'drive-in drive-out' workers ('FIFO/DIDO workers')

from being able to claim the Zone Tax Offset where their normal residence is not within a particular zone.

Furthermore, for those FIFO/DIDO workers whose normal residence is in one zone, but who work in another

zone, they will retain the Zone Tax Offset entitlement associated with their normal place of residence. At

the time of writing no legislation has been introduced to implement these changes.

Per Kilometre Claims for Car Deductions

The 2014/15 cents per kilometre (km) rates for car deductions (up to a maximum of 5,000 business kms per

car), based on engine capacity, are as follows:

Engine Capacity (cc)

1

Rate per Km1

Ordinary Car

Rotary Engine Car

2014/15

$

0 – 1,600

1,601 – 2,600

2,601+

0 – 800

801 – 1,300

1,301+

0.65

0.76

0.77

Note that, as part of the 2015/16 Federal Budget, the government announced that from the 2016 income year, the three

current 'cents per km' rates will be replaced with one rate set (initially) at 66 cents per km for all cars. The Commissioner

will be responsible for updating the rate in following years.

Page 16

July Supplement 2015

July Supplement 2015

Car Depreciation Cost Limit1

The depreciation cost limit applies to the income year in which the car is acquired or first held.

1

Income Year

Cost Limit

$

2014/15

57,466

A hearse is not subject to the depreciation car limit.

CGT Improvement Thresholds

Certain improvements to pre-CGT assets will be deemed to be separate post-CGT assets where the cost

base of the improvement exceeds both the improvement threshold for the year and 5% of the consideration

for the sale of the asset.

Income Year

Improvement Threshold

$

2014/15

140,443

2013/14

136,884

CGT Indexation Factors

Indexation (based on movements in the Consumer Price Index or CPI) is only relevant in working out the

cost base of an asset acquired on or before 11.45am 21 September 1999. Changes to the tax law mean

that indexation is frozen to the September 1999 quarter.

However, the CPI rates are reported in the table below because they are relevant to some provisions in

tax and superannuation law including, among other things, calculating the taxable value of a fringe benefit

relating to the repurchase of remote area residential property.1

Year

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

Voice

Quarter Ending

31 March

106.8

105.4

102.4

99.9

98.3

95.2

92.5

90.3

86.6

84.5

82.1

80.2

78.6

76.1

73.9

69.7

67.8

67.0

67.1

66.2

Quarter Ending

30 June

Not available

105.9

102.8

100.4

99.2

95.8

92.9

91.6

87.7

85.9

82.6

80.6

78.6

76.6

74.5

70.2

68.1

67.4

66.9

66.7

Quarter Ending

30 September

Not available

106.4

104.0

101.8

99.8

96.5

93.8

92.7

88.3

86.7

83.4

80.9

79.1

77.1

74.7

72.9

68.7

67.5

66.6

66.9

Quarter Ending

31 December

Not available

106.6

104.8

102.0

99.8

96.9

94.3

92.4

89.1

86.6

83.8

81.5

79.5

77.6

75.4

73.1

69.1

67.8

66.8

67.0

Page 17

Voice

Year

1995

1994

1993

1992

1991

1990

1989

1988

1987

1986

1985

1

Quarter Ending

31 March

63.8

61.5

60.6

59.9

58.9

56.2

51.7

48.4

45.3

41.4

37.9

Quarter Ending

30 June

64.7

61.9

60.8

59.7

59.0

57.1

53.0

49.3

46.0

42.1

38.8

Quarter Ending

30 September

65.5

62.3

61.1

59.8

59.3

57.5

54.2

50.2

46.8

43.2

39.7

Quarter Ending

31 December

66.0

62.8

61.2

60.1

59.9

59.0

55.2

51.2

47.6

44.4

40.5

Note that the Australian Bureau of Statistics changed the index reference base in September 2012 from 1989/90 to 2011/12.

As a result all CPI rates have been reset and the previous rates no longer apply. The rates reported in the above table

are the reset rates.

Valuation of Natural Increase – Prescribed Cost Rates – 2014/15

1

Description

Rate per Head

$

Description

Rate per Head

$

Cattle

Deer

Emus

Goats

20.00

20.00

8.00

4.00

Horses1

Pigs

Poultry

Sheep

20.00

12.00

0.35

4.00

Where a service fee is incurred for insemination and a horse is acquired as a result, its cost is the greater of the cost (i.e.,

actual or as prescribed by the regulations) and the amount of the service fee attributable to the acquisition.

Goods Taken from Stock for Private Use

2014/15

Type of Business

Bakery

Butcher

Restaurant/cafe (licensed)

Restaurant/cafe (unlicensed)

Caterer

Delicatessen

Fruiterer/greengrocer

Take-away food shop

Mixed business (e.g., milk bar, convenience store)

1

2

Adult/Child

Over 16 years

$

Child2

4-16 years

$

1,330

790

4,490

3,460

3,740

3,460

780

3,350

4,170

665

395

1,730

1,730

1,870

1,730

390

1,675

2,085

2

These amounts are taken from TD 2015/9 which is the current determination and which applies for the 2014/15 income

year.

Amounts are GST-exclusive.

Page 18

July Supplement 2015

July Supplement 2015

Income-producing Building Write-off Rates

Use of Building

Non-residential buildings

Industrial

Non-industrial buildings

Research & Development buildings

Residential buildings

Short-term traveller accommodation

Residential income-producing buildings

Structural improvements

Environment protection earthworks

1

Capital Works Commenced

Write-off

Rate

%

27/2/1992+1

20/7/1982 – 21/8/1984

22/8/1984 – 15/9/1987

16/9/1987+

21/11/1987+

4

2.5

4.0

2.5

2.5

22/8/1979 – 21/8/1984

22/8/1984 – 15/9/1987

16/9/1987 – 26/2/1992

27/2/1992+

18/7/1985 – 15/9/1987

16/9/1987+

27/2/1992+

19/8/1992+

2.5

4.0

2.5

4.0

4.0

2.5

2.5

2.5

For an industrial building constructed before 27 February 1992, the rates for non-industrial non-residential buildings are

applied.

Voice

Page 19

Voice

Prime Cost and Diminishing Value Rates (150% and 200%)

For most items of plant and equipment acquired* on or after 10 May 2006, the diminishing value method

(DVM) rate was increased from 150% to 200%. This means that the DVM depreciation rate is twice the

prime cost (PC) rate of depreciation for such assets.

Note(*): For these purposes, a taxpayer acquires an asset when they commence to hold it (e.g., on settlement

of a contract). Therefore, a taxpayer may acquire an asset on or after 10 May 2006 under a contract entered

into before 10 May 2006, and still use the 200% DVM rate.

The 200% DVM depreciation rates apply to new and second-hand assets, including those with statutory

caps (e.g., trucks). The rates also apply to both business assets and investment assets (e.g., assets used

in a rental property).

However, the 200% DVM depreciation rates do not apply to taxpayers using the SBE rules and assets classes

for which there are special arrangements (e.g., new horticultural plants).

For the purposes of the 200% DVM depreciation rates, specific assets are also excluded. The types of

assets excluded from the 200% DVM depreciation rates are:

u

In-house software

u

Intellectual property assets (except copyrights in a film)

u

Spectrum licences

u

Datacasting transmitter licences

u

Telecommunications site access rights

The following table sets out the effective PC and DVM rates of depreciation that apply to an asset based

on its effective life.

For example, a taxpayer may choose to use the Commissioner’s effective life of 10 years for a particular

asset. In that case, the PC rate of depreciation would be 10% (i.e., 100% divided by 10 (years)).

The equivalent DVM rate of depreciation would be either 15% (at 150% DVM rates) or 20% (at 200% DVM

rates) depending on whether the depreciating asset was acquired before 10 May 2006 or on or after 10

May 2006.

Effective Life

(years)

0.5

1

1.5

2

3

3.33

3.5

4

4.5

5

5.5

6

6.67

7

7.5

Page 20

Prime cost rate

%

Diminishing value rate

(150%)

%

Diminishing value rate

(200%)

%

*

100

66.67

50

33.33

30

28.57

25

22.22

20

18.18

16.67

15

14.29

13.33

*

*

100

75

50

45

42.86

37.5

33.33

30

27.27

25

22.5

21.43

20

*

*

*

100

66.67

60

57.14

50

44.44

40

36.36

33.33

30

28.57

26.67

July Supplement 2015

July Supplement 2015

Effective Life

(years)

8

8.33

9

10

11

12

12.5

13

13.33

15

16

16.67

17

17.5

18

20

23

25

30

33

33.33

35

40

45

47.5

50

80

100

Prime cost rate

%

Diminishing value rate

(150%)

%

Diminishing value rate

(200%)

%

12.5

12

11.11

10

9.09

8.33

8

7.69

7.5

6.67

6.25

6

5.88

5.71

5.56

5

4.35

4

3.33

3.03

3

2.86

2.5

2.22

2.11

2

1.25

1

18.75

18

16.67

15

13.64

12.5

12

11.54

11.25

10

9.375

9

8.82

8.57

8.33

7.5

6.52

6

5

4.55

4.5

4.29

3.75

3.33

3.16

3

1.88

1.5

25

24

22.22

20

18.18

16.67

16

15.38

15

13.33

12.5

12

11.76

11.43

11.11

10

8.70

8

6.67

6.06

6

5.71

5

4.44

4.21

4

2.5

2

Note: Where assets are acquired during the year, depreciation must be calculated on a per day basis. Therefore a 100% or

higher depreciation rate does not equate to an immediate write-off unless the asset is held for (up to) a full year.

* In the first year, the depreciation claim cannot be greater than the original cost and, over the life of the asset, total depreciation

claimed cannot exceed the asset's original cost.

Voice

Page 21

Voice

FBT Rate

Fringe Benefits Tax – 2016 & 2015

FBT is imposed on the grossed-up taxable value of the benefits provided. The FBT rate is as follows:

FBT Year Ended

Rate of Tax1

31 March 2016

49%

31 March 2015

47%

1 As a consequence of the introduction of the 2% 'Temporary Budget Repair Levy', the FBT rate has been temporarily

increased to 49% for the 2016 and 2017 FBT years. This change has also affected the gross-up rates and the FBT rebate

rate (which has also temporarily increased to 49% from 1 April 2015).

Gross-up Rates

Gross-up Rate1

1

FBT Year Ended

Type 1

Type 2

31 March 2016

2.1463

1.9608

31 March 2015

2.0802

1.8868

The FBT gross-up rates have been temporarily increased for the 2016 and 2017 FBT years as a result of the introduction of

the 2% 'Temporary Budget Repair Levy'.

Car Fringe Benefits – Statutory Formula Method – Statutory Fraction

Statutory Fraction

Annualised kilometres

Agreements in existence before

7.30pm 10 May 2011

Agreements entered into

from 7.30pm 10 May 2011

0 – 14,999

0.26

0.20

15,000 – 24,999

0.20

0.20

25,000 – 40,000

0.11

0.20

0.07

0.20

Engine Capacity

Cents per Km

2016 FBT Year

$

Cents per Km

2015 FBT Year

$

0 – 2,500cc

0.51

0.50

2,501cc+

0.61

0.60

Motorcycles

0.15

0.15

40,001+

Rates for Vehicles other than Cars1

1 These are residual fringe benefits.

Benchmark Interest Rate for Loan Fringe Benefits

FBT Year Ended 31 March

Rate

2016

5.65%

2015

5.95%

Car Parking Threshold

Page 22

FBT Year Ended 31 March

Threshold

2016

$8.37

2015

$8.26

July Supplement 2015

July Supplement 2015

2015 Individual income tax return checklist

Full Name

Tax File Number (TFN)

Has name changed

since last return?

Yes / No

If Yes, previous name :

Date of birth

Are you an Australian

resident?

Yes / No / Unsure

ABN (if applicable)

Address

Address (postal)

(Put ‘as above’ if the same)

Mobile:

Telephone contacts

Business Hours (work) :

After Hours (home):

Email

Electronic banking

details

BSB:

Account Number:

Account Name:

(for refund if applicable)

Main occupation

Spouse name and TFN

Voice

Page 23

Voice

Please circle YES or NO for each of the items listed below:

INCOME – Please provide evidence

1. Salary or wages ............................................................................................................................. YES/NO

2. Allowances, earnings, tips, director’s fees etc. ............................................................................... YES/NO

3. Employer lump sum payments ....................................................................................................... YES/NO

4. Employment termination payments ................................................................................................ YES/NO

5. Australian Government allowances and payments like Newstart, youth allowance and

Austudy payments ......................................................................................................................... YES/NO

6. Australian Government pensions and allowances .......................................................................... YES/NO

7. Australian annuities and superannuation income streams ............................................................. YES/NO

8.

Australian superannuation lump sum payments ............................................................................ YES/NO

9. Attributed personal services income .............................................................................................. YES/NO

10. Gross Interest ................................................................................................................................ YES/NO

11. Dividends ....................................................................................................................................... YES/NO

12. Employee share schemes .............................................................................................................. YES/NO

13. Distributions from partnerships and/or trusts .................................................................................. YES/NO

14. Personal services income (PSI) ..................................................................................................... YES/NO

15. Net income or loss from business (as a sole trader) ...................................................................... YES/NO

16. Deferred non-commercial business losses ..................................................................................... YES/NO

17. Net farm management deposits or repayments .............................................................................. YES/NO

18. Capital gains .................................................................................................................................. YES/NO

19. Foreign entities:

•

Direct or indirect interests in controlled foreign company.......................................................... YES/NO

• Transfer of property or services to a non-resident trust............................................................. YES/NO

20. Foreign source income (including foreign pensions) and foreign assets or property ...................... YES/NO

21. Rent ............................................................................................................................................ YES/NO

22. Bonuses from life insurance companies or friendly societies ......................................................... YES/NO

23. Forestry managed investment scheme income .............................................................................. YES/NO

24. Other income (please specify below).............................................................................................. YES/NO

..........................................................................................................................................................

..........................................................................................................................................................

..........................................................................................................................................................

Page 24

July Supplement 2015

July Supplement 2015

..........................................................................................................................................................

DEDUCTIONS – Please provide evidence

D1. Work related car expenses

− Cents per kilometre method (up to a maximum of 5,000 kms) .................................................. YES/NO

− Log book method ...................................................................................................................... YES/NO

− One-third of actual expenses method ....................................................................................... YES/NO

− 12% of actual cost method ....................................................................................................... YES/NO

D2. Work related travel expenses

Employee domestic travel with reasonable allowance .................................................................... YES/NO

− If the claim is more than the reasonable allowance rate, do you have receipts for

your expenses?......................................................................................................................... YES/NO

Overseas travel with reasonable allowance ................................................................................... YES/NO

− Do you have receipts for accommodation expenses? ............................................................... YES/NO

− If travel is for 6 or more nights in a row, do you have travel records? (e.g. a travel diary).......... YES/NO

Employee without a reasonable travel allowance ........................................................................... YES/NO

− Did you incur and have receipts for airfares?............................................................................ YES/NO

− Did you incur and have receipts for accommodation?............................................................... YES/NO

− Do you have receipts for hire cars (if applicable)? .................................................................... YES/NO

− Did you incur and have receipts for meals and incidental expenses? ....................................... YES/NO

− Do you have any other travel expenses? .................................................................................. YES/NO

Other work-related travel expenses (e.g., a borrowed car) (please specify).................................... YES/NO

..........................................................................................................................................................

D3. Work related uniform and other clothing expenses

Protective clothing ......................................................................................................................... YES/NO

Occupation specific clothing ........................................................................................................... YES/NO

Non-compulsory uniform ................................................................................................................ YES/NO

Compulsory uniform ....................................................................................................................... YES/NO

Conventional clothing ..................................................................................................................... YES/NO

Laundry expenses (up to $150 without receipts) ............................................................................ YES/NO

Dry cleaning expenses ................................................................................................................... YES/NO

Other claims such as mending/repairs, etc (please specify) ........................................................... YES/NO

..........................................................................................................................................................

D4. Work related self-education expenses

Course taken at educational institution:

− union fees ................................................................................................................................ YES/NO

− course fees .............................................................................................................................. YES/NO

− books, stationery ...................................................................................................................... YES/NO

− depreciation ............................................................................................................................. YES/NO

− travel ........................................................................................................................................ YES/NO

− other (please specify) ............................................................................................................... YES/NO

Voice

Page 25

Voice

..........................................................................................................................................................

D5. Other work related expenses

Home office expenses ................................................................................................................... YES/NO

Computer and software .................................................................................................................. YES/NO

Telephone/mobile phone ................................................................................................................ YES/NO

Tools and equipment ...................................................................................................................... YES/NO

Subscriptions and union fees ......................................................................................................... YES/NO

Journals/periodicals ....................................................................................................................... YES/NO

Depreciation .................................................................................................................................. YES/NO

Sun protection products (i.e., sunscreen and sunglasses) ............................................................ YES/NO

Seminars and courses not at an educational institution:

− Course fees .............................................................................................................................. YES/NO

− Travel ....................................................................................................................................... YES/NO

− Other (please specify) .............................................................................................................. YES/NO

Any other work related deductions (please specify) ....................................................................... YES/NO

..........................................................................................................................................................

..........................................................................................................................................................

Other types of deductions

D6. Low value pool deduction............................................................................................................... YES/NO

D7. Interest deductions ........................................................................................................................ YES/NO

D8. Dividend deductions ....................................................................................................................... YES/NO

D9. Gifts or donations ........................................................................................................................... YES/NO

D10.Cost of managing tax affairs .......................................................................................................... YES/NO

D11.Deductible amount of undeducted purchase price of a foreign pension or annuity ......................... YES/NO

D12.Personal superannuation contributions .......................................................................................... YES/NO

Full name of fund: ........................................................................................................................................

Account no: ..................................................................................................................................................

Fund ABN: ...................................................................................................................................................

Fund TFN: ....................................................................................................................................................

Do you pass the 10% test? ………………………………………………………………..…...YES/NO

Have you provided the fund a notice of intention to deduct the contribution?.................................. YES/NO

Has this notice been acknowledged by the fund?........................................................................... YES/NO

D13.Deduction for project pool .............................................................................................................. YES/NO

D14.Forestry managed investment scheme deduction .......................................................................... YES/NO

D15.Other deductions (please specify) ................................................................................................. YES/NO

Page 26

July Supplement 2015

July Supplement 2015

L1. Tax losses of earlier income years .................................................................................................. YES/NO

Tax offsets/rebates – Please provide evidence

T1. Are you a senior Australian or a pensioner?.................................................................................... YES/NO

T2. Did you receive an Australian superannuation income stream? ..................................................... YES/NO

T3. Did you make superannuation contributions on behalf of your spouse? ......................................... YES/NO

T4. Did you live in a remote area of Australia or serve overseas with the Australian defence

force or the UN armed forces in 2015?........................................................................................... YES/NO

T5. Did you have net medical expenses in 2015?................................................................................. YES/NO

If so, do these medical expenses include expenses relating to disability aids, attendant

care or aged care expenses?.......................................................................................................... YES/NO

Did you claim for NMETO in 2013 and 2014?................................................................................. YES/NO

T6. Did you maintain a dependant who is unable to work due to invalidity or carer obligations?........... YES/NO

T7. Are you entitled to claim the landcare and water facility tax offset? ............................................... YES/NO

T8. Other non-refundable tax offsets (please specify)........................................................................... YES/NO

T9. Other refundable tax offsets (please specify).................................................................................. YES/NO

Other relevant information