2013–2014 desktop tax rates & tables

advertisement

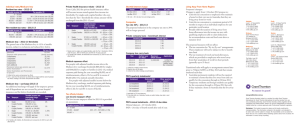

MEDICARE LEVY – 2012–13 THRESHOLDS LOW INCOME TAXPAYERS OFFSET 2012–13 Taxable income (TI) $ 0–37,000 37,001–66,666 66,667+ The general rate of the Medicare levy is 1.5% of taxable income, subject to exclusions and reduced levy as per table below. Taxpayer 2013–2014 DESKTOP TAX RATES & TABLES Updated as at 25 July 2013 Individual Taxpayer with spouse and: 0 dependants 1 dependant 2 dependants 3 dependants 4 dependants 5 dependants Each additional Senior and pensioner Australians1 Senior Australian w/spouse and 0 dependants Each additional dependant No levy $ 20,542 (family income) 33,693 36,787 39,881 42,975 46,069 49,163 +3,094 32,279 46,000 +3,094 1. Entitled to Senior and Pensioner Tax Offset (SAPTO). Eligible seniors will not pay Medicare levy until they begin to incur an income tax liability. INDIVIDUAL RATES/MEDICARE LEVY Note: the thresholds for 2013-14 are unlikely to be known until May 2014 (usually announced as a part of the Budget) Tax payable $ Nil Nil + 19% of excess over 18,200 3,572 + 32.5% of excess over 37,000 17,547 + 37% of excess over 80,000 54,547 + 45% of excess over 180,000 RESIDENT TAX RATES – 2013–14 Taxable income $ 0–18,200 18,201–37,000 37,001–80,000 80,001–180,000 180,001+ Tax payable $ Nil Nil + 19% of excess over 18,200 3,572 + 32.5% of excess over 37,000 17,547 + 37% of excess over 80,000 54,547 + 45% of excess over 180,000 MEDICARE LEVY SURCHARGE – 2013–141 Tier 1 Tier 2 Tier 3 $ $ $ $ Singles 0–88,000 88,001–102,000 102,001–136,000 136,001+ Families1 0–176,000 176,001–204,000 204,001–272,000 272,001+ Medicare levy surcharge Rates 0.0% 1.0% 1.25% 1.5% 1 For families with 2 dependants who are children, the surcharge thresholds to tiers 1, 2 and 3 are increased by $1,500. The thresholds then increase by $1,500 for each additional child. Surcharge amount depends on the taxable income/reportable fringe benefits of the taxpayer, spouse and all dependants. However, a member of a couple does not pay surcharge if his/her taxable income/reportable fringe benefits total does not exceed (for 2012–13) $20,542 (2013-14 figure not known). DTRT_2013-14 Oct_2013.indd 1 SUPERANNUATION/TERMINATION SUPER GUARANTEE – QUARTERLY REGIME 2013–141+ Quarter ending HEALTH INSURANCE TAX OFFSET – 2013–14 Tier 3 Tier 1 Tier 2 $ $ $ $ Singles 0–88,000 88,001–102,000 102,001–136,000 136,001+ Families1 0–176,000 176,001–204,000 204,001–272,000 272,001+ Employer1 contribution due 28 October 28 January 28 April 28 July 30 September 31 December 31 March 30 June SGC statement and payment due 28 November 28 February 28 May 28 August 1. An employer can offset SGC against a "late" contribution made by the 28th day after the second month after the end of the quarter. SUPERANNUATION GUARANTEE – SUPPORT LEVELS Rebate Aged under 65 30% 20% 10% 0% Year Aged 65–69 35% 25% 15% 0% 2003–12 2013–14 Aged 70 or over 40% 30% 20% 0% Prescribed support 9% 9.25% Year Prescribed support 9.5% 10% 2014–15 2015–16 Maximum contribution base for an individual employee for each quarterly contribution period is $48,040 for 2013–14 ($45,750 for 2012–13). 1 RESIDENT TAX RATES – 2012–13 Taxable income $ 0–18,200 18,201–37,000 37,001–80,000 80,001–180,000 180,001+ Rebate $ 445 445 – [(TI – $37,000) x 1.5%] Nil TAX OFFSETS For families with 2 dependants who are children, the surcharge thresholds to tiers 1, 2 and 3 are increased by $1,500. The thresholds then increase by $1,500 for each additional child. ACCRUED LEAVE Payment type DEPENDANT/CONCESSIONAL OFFSETS – 2012–13 Taxpayer Dependent (invalid and carer)1 Dependent spouse2,3 Child-housekeeper (no dep chd/stud)2 Child-housekeeper (with dep chd/stud)2 Invalid relative Parent (of taxpayer or spouse) Student (notional only)5 Child under 21 years (non-student) – first child (notional only)5 – each additional child (notional only)5 Sole parent (notional only)5 Housekeeper – no dependent child/student2 – with dependent child/student2 Maximum rebate7 $ 2,423 2,4234 1,9754 2,3664 8894 1,7764 376 Maximum ATI6 $ 9,973 9,973 8,181 9,745 3,837 7,385 1,785 376 282 1,607 1,785 1,409 N/A 1,975 2,366 N/A N/A MEDICAL EXPENSES OFFSET – 2013–141 Where medical expenses paid during the tax year exceed $2,162, net of reimbursements, offset is 20¢ for each $1 in excess of $2,162. For taxpayers with adjustable taxable income above the relevant Medicare levy surcharge threshold the offset is 10c for each $1 in excess of $5,100. 1. The figure has been calculated according to indexation, the official figure has not been released by the ATO. SENIOR AND PENSIONER TAX OFFSET (SAPTO) Maximum offset1 $ Status 2012–13 1. Dependant (invalid and carer) offset replaced dependant offsets (but not spouse offset) from 2012-13, except for taxpayers eligible for zone, overseas forces or civilian offset. Taxpayers can only receive the offset if they contribute to the maintenance of their spouse, relative or spouse's relative who is genuinely unable to work due to invalidity or carer obligations. 2. Dependant (invalid and carer), spouse (including invalid spouse and carer spouse) and housekeeper offsets generally not available for any part of the year during which taxpayer (or spouse) is eligible for Family Tax Benefit Part B, although they are notionally retained for calculating zone offsets/Medicare levy. 3. Spouse offset not available where spouse born on or after 1 July 1952. Invalid spouse and carer spouse offsets may be available instead. Spouse offsets are the same irrespective of whether the taxpayer has dependent children under 21 or students under 25. For calculating zone offsets/Medicare levy, the higher spouse (with dep) offset is notionally retained. 4. Reduced by $1 for every $4 by which adjusted taxable income (ATI) of dependant exceeds $282. 5. Notionally retained for calculating zone offset/Medicare levy. 6. ATI of dependant at which offset is reduced to zero. 7. Spouse, invalid spouse and carer spouse offsets not available if taxpayer's ATI exceeds $150,000; dependant (invalid and carer), child housekeeper, parent, parent-in-law and housekeeper offsets not available if combined ATI of taxpayer and spouse exceeds $150,000. Assessable portion Below age pension age1 – Single – Couple (each) – Couple (illness separated) 2,230 1,602 2,040 Offset cuts out at $ 50,119 41,790 47,599 1. Offset entitlement reduces by 12.5% for each dollar of income until it reaches the cut out point. SHORTFALL INTEREST CHARGE Period Oct-Dec 2012 Jan-Mar 2013 SIC rate% 6.62 6.24 Period Apr-Jun 2013 Jul-Sep 2013 SIC rate% 5.95 5.82 GENERAL INTEREST CHARGE Period Oct-Dec 2012 Jan-Mar 2013 GIC rate% 10.62 10.24 Period Apr-Jun 2013 Jul-Sep 2013 GIC rate% 9.95 9.82 Long service leave – Pre-16/8/78 – 16/8/78 to 17/8/93 – Post-17/8/93 Annual leave – Pre-18/8/93 – Post-17/8/93 Maximum rate of tax1 Redundancy Resignation invalidity and early retirement retirement scheme payments 5% 100% 100% Marginal rate 30% Marginal rate Marginal rate 30% 30% 100% 100% 30% Marginal rate 30% 30% 1. Only applies to payments on termination. Table excludes Medicare levy. GENUINE REDUNDANCY/EARLY RETIREMENT – 2013–14 Tax-free Excess 9,246 + ($4,624 x completed years of service) Taxed as Employment Termination Payment SUPER CONTRIBUTIONS – 2013–14 Contributions above the annual contributions caps will be subject to excess contributions tax levied on the individual. Type of contribution Annual contribution cap Excess contributions tax – per person ($) (%) Concessional 25,0004 31.53 Non-concessional 150,0002 46.5 TFN not quoted1 N/A 46.5 1. Where a member's TFN has not been quoted to a super fund by 30 June each year, this "no-TFN contributions income" is taxed at 46.5% in the hands of the receiving fund. A super fund must return non-concessional contributions within 30 days where the member has not quoted a TFN. 2. Individuals under 65 may bring forward the non-concessional cap for the next two years (ie $450,000 over three years). 3. Excess concessional contributions tax of 31.5% is levied on the individual (on top of the original 15% contributions tax paid by the fund). 4. Note the concessional contributions cap increased to $35,000 for 2013-14 financial year for individuals 59 years or over on 30 June 2013. 14/11/2013 3:26:11 PM SUPERANNUATION LUMP SUMS – 2013–14 Lump sum paid from taxed fund1 Tax-free component2 Taxable component3 Tax-free5 Tax-free5,6 Tax-free5 0% – $0–$180,000 15% – $180,001+ Tax-free5 20% Age of recipient 60+ 554–59 0–544 1. Separate tax treatment applies for lump sums paid from an untaxed source (ie an element untaxed in fund) depending on the lump sum amount and recipient's age. 2. Includes the crystallised pre-July 1983 segment, undeducted contributions, CGT-exempt component and contributions not included in fund’s assessable income. 3. Determined by subtracting tax-free component from total value of lump sum. 4. Preservation age of 55 phasing to age 60 for those born after 1 July 1960. 5. Non-assessable, non-exempt income (ie not counted in working out tax payable on taxpayer’s other assessable income). 6. Table excludes Medicare levy. DEPRECIATION/CARS SMALL BUSINESS ENTITIES – 2013–14 • Immediate deduction for depreciating assets costing less than $6,500. • Other depreciating assets allocated to general small business pool. • Deduction (on diminishing value basis) is generally opening pool balance x 30% for general pool. Half pool rate (ie 15%) for new acquisitions. • Immediate deduction is also available for the first $5,000 of the cost of any motor vehicle. • Certain depreciating assets are excluded, eg buildings. UNIFORM CAPITAL ALLOWANCE SYSTEM – 2013–14 Decline in value of assets worked out using Prime Cost (PC) method or Diminishing Value (DV) method: EMPLOYMENT TERMINATION PAYMENTS – 2013–14 Age of recipient 55+ 0–54 Employment termination payment1 Tax-free component2 Taxable component3 15% – $0–$180,0003 Tax-free 45% – $180,001+3 30% – $0–$180,000 Tax-free 45% – $180,001+3 1. Payment must be received within 12 months of taxpayer’s termination of employment. Cannot be rolled over to a superannuation fund. Separate transitional rules apply where entitlement to termination payment established as at 9 May 2006 and payment made before 30 June 2012. 2. Includes the pre-July 1983 segment and invalidity segment. 3. Table excludes Medicare levy. SUPER CONTRIBUTIONS – SPOUSE REBATES Spouse assessable income and reportable fringe benefits (SAI)3 $ 0–10,800 10,801–13,799 13,800 + Maximum rebatable contributions (MRC) $ Maximum rebate $1 3,000 3,000 – [SAI – 10,800] Nil 5402 MRC x 18%2 Nil 4% 5% 6% 7% 9% 11% 1. Base value is either the cost of the asset (in the first income year) or the opening adjustable value for that year (in later income years). • Apportionment is required in the year of acquisition or disposal and where the asset is also used for non-taxable purposes. • Pooling for low cost/low value depreciating assets (ie cost/value <$1,000) is 18.75% in the year of allocation and 37.5% pa thereafter. • Pooling is also allowed for "in-house software" expenditure but it is depreciated at a different rate to the low cost/low value pool. • Immediate deduction for non-business taxpayers for assets costing $300 or less. • Certain assets are excluded from uniform capital allowance system, eg buildings, certain primary production assets, and some vehicles. CAR DEPRECIATION COST LIMIT – 2013–14 PENSIONS AND ANNUITIES – % FACTORS 2013–14 0–64 65–74 75–79 80–84 85–89 90–94 95+ CAR EXPENSES – PER KILOMETRE RATES – 2012–13 Rotary engines Conventional engines Cents per km 0–800 cc 801–1,300 cc 1,301 cc + 0–1,600 cc 1,601–2,600 cc 2,601 cc + 63 74 75 14% 1. Pensions commenced under a transition to retirement income stream (age 55+) cannot withdraw more than 10% of the account balance in any one year. The tax-free segment is tax-free regardless of age of pensioner. Taxable component is tax-free from age 60, if paid from a taxed source (a 15% rebate applies for those aged 55–59). SUPER – GOVERNMENT CO-CONTRIBUTION – 2013–143 1 Adjusted taxable income (AI) $ 0–33,516 33,517 – 48,516 48,517+ 2 Maximum Govt co-contribution $ 500 500 – ([AI-33,516] x 0.03333) NIL 1. Assessable income, reportable fringe benefits and reportable employer super contributions. 2. If amount payable < $20, minimum payment = $20. 3. Note the Government has reduced the maximum co-contributions to $500 from 2012-13 and later income years. Assuming no further legislative changes, this will also apply to the 2013-14 and later income years. Government co-contribution (up to max $500) is 50% of eligible personal superannuation contribution made to a complying super fund or RSA during income year. Must be under age 71 and lodge a tax return. DTRT_2013-14 Oct_2013.indd 2 DV method Base value1 x (days held/365) x (200%/Assets effective life) The 2013–14 motor vehicle depreciation cost limit is $57,466 (same as the 2012–2013 income year). 1. The rebate is not available if an employer deduction is allowed. 2. The actual amount of the contribution x 18% will be the maximum rebate where it is less than these figures. 3. Assessable income, reportable fringe benefits and reportable employer super contributions. Age of beneficiary Standard percentage factor1 PC method Asset's cost x (days held/365) x (100%/Asset's effective life) BUILDING WRITE-OFF Type Residential Non-residential Construction commenced 18/7/85–15/9/87 16/9/87–26/2/92 27/2/92 onwards Rate % 4 2.5 2.5 or 41 20/7/82–21/8/84 22/8/84–15/9/87 16/9/87–26/2/92 27/2/92 onwards 2.5 4 2.5 2.5 or 41 1. A 4% rate applies to short-term traveller accommodation and industrial buildings commenced to be constructed after 26 February 1992. Structural improvements commenced to be constructed after 26 February 1992 also eligible for write-off (at 2.5% rate). CPI NUMBERS Year Quarter ending 31 March 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 30 June 102.4 99.9 98.3 95.2 92.5 90.3 86.6 84.5 82.1 80.2 78.6 76.1 73.9 69.7 67.8 67.0 67.1 66.2 63.8 61.5 60.6 59.9 58.9 56.2 51.7 48.4 45.3 41.4 37.9 102.8 100.4 99.2 95.8 92.9 91.6 87.7 85.9 82.6 80.6 78.6 76.6 74.5 70.2 68.1 67.4 66.9 66.7 64.7 61.9 60.8 59.7 59.0 57.1 53.0 49.3 46.0 42.1 38.8 FBT – BENCHMARK INTEREST RATE The statutory benchmark interest rate for the 2013–14 FBT year is 6.45% FBT – CAR STATUTORY PERCENTAGES 30 September 31 December 101.8 99.8 96.5 93.8 92.7 88.3 86.7 83.4 80.9 79.1 77.1 74.7 72.9 68.7 67.5 66.6 66.9 65.5 62.3 61.1 59.8 59.3 57.5 54.2 50.2 46.8 43.2 39.7 102.0 99.8 96.9 94.3 92.4 89.1 86.6 83.8 81.5 79.5 77.6 75.4 73.1 69.1 67.8 66.8 67.0 66.0 62.8 61.2 60.1 59.9 59.0 55.2 51.2 47.6 44.4 40.5 Note: Indexation is not relevant for CGT assets acquired after 11.45am AEST on 21 September 1999. Where a CGT event happens to an asset acquired before that date the taxpayer has a choice of paying tax on the net gain worked out using indexation frozen at 30 September 1999 or paying tax on 50% of the net capital gain without indexation. Companies are not eligible for the 50% CGT discount. From the September 2012 quarter, the index numbers have been calculated on a new index reference period of 2011-12. This has resulted in the index numbers for each index series being reset to 100.0 for the 2011-12 financial year. According to the ABS, the differences do not constitute a revision. The figures shown in the above table are the reset index numbers. FRINGE BENEFITS TAX Contracts existing at 7.30pm (AEST) on 10 May 2011 Total kilometres 0–14,999 15,000–24,999 25,000–40,000 40,001 + Taxable value as % of original cost 26 20 11 7 New contracts entered into after 7.30pm (AEST) on 10 May 2011 Distance travelled From From From From (km) 10 May 2011 1 April 2012 1 April 2013 1 April 2014 0–14,999 20% 20% 20% 20% 15,000–24,999 20% 20% 20% 20% 25,000–40,000 14% 17% 20% 20% 40,001 + 10% 13% 17% 20% COMPANIES TAX RATE 30% – 2001–14+ PRIVATE COMPANY LOANS – BENCHMARK INTEREST Income year 2013-14 2012-13 2011-12 Interest rate % 6.20 7.05 7.80 PAYG QUARTERLY INSTALMENTS 1 Instalment 1st instalment 2nd instalment 3rd instalment 4th instalment Due dates2,3,4 28/10/2013 28/2/2014 28/4/2014 28/7/2014 1. Applicable to 30 June balancers. 2. Entities that report and pay GST on a quarterly basis or who are not registered for GST but are required to report another BAS obligation quarterly. 3. Certain individuals pay only two instalments (due at end of 3rd and 4th instalment quarters). 4. If due date falls on a Saturday, Sunday or public holiday, due date is next business day. PAYG ANNUAL INSTALMENTS – 2013–14 DUE DATES 30 June balancers – 21 October 2014. SAPs – 21st day of fourth month after end of year. FBT RATE AND GROSS-UP FORMULA Rate of fringe benefits tax for the year commencing 1 April 2013 is 46.5%. Fringe benefit type Type 1 – input tax credit available Type 2 – all other cases FBT gross-up rate 2.0647 1.8692 Phone: 1300 304 195 Email: LTA.Service@thomsonreuters.com Website: www.thomsonreuters.com.au © 2013 Thomson Reuters (Professional) Australia Limited ABN 64 058 914 668. The 2013-2014 Desktop Tax Rates & Tables is compiled from legislation and is intended as a guide only. Information given is current at time of going to press. These tables are not a substitute for professional advice and the Publisher and Brentnalls expressly exclude, in so far as legislation permits, liability for any errors or omissions. 14/11/2013 3:26:30 PM