MYOBTaxSeminars2013

advertisement

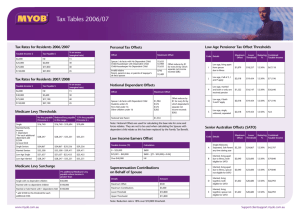

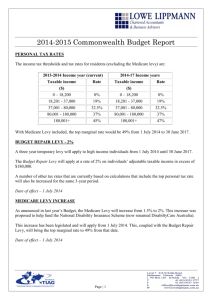

MYOBTaxSeminars2013 Stay one step ahead Resident Tax Rates 2012-13 and 2013-14 PRIVATE HEALTH INSURANCE REBATE 2012-13 TAXABLE INCOME TAX ON TAXABLE INCOME % ON EXCESS (MARGINAL RATE) $18,200 $37,000 $80,000 $180,000 Nil $3,572 $17,547 $54,547 19% 32.5% 37% 45% GDP Uplift Factor 3% Non-Resident Tax Rates 2012-13 and 2013-14 TAXABLE INCOME TAX ON TAXABLE INCOME % ON EXCESS (MARGINAL RATE) Nil $80,000 $180,000 Nil $26,000 $63,000 32.5% 37% 45% REDUCED LEVY PAYABLE IN THE RANGE... INCOME RANGE UP TO 65 $84,000 or less 30% $84,001 - $97,000 p.a. 20% $97,001 - $130,000 p.a. 10% $130,001 and over p.a. Nil Couple/Family $168,000 or less 30% $168,001 - $194,000 p.a.* 20% $194,001 - $260,000 p.a.* 10% $260,001 and over p.a.* Nil * Add $1,500 for each additional child after the first Ordinary rate of levy payable where taxable income (or family income) exceeds… Single $20,542 $20,543 - $24,166 $24,167 Married (without child) $33,693 $33,694-$39,637 $39,638 dependency Offsets 2012-13 Medicare Levy Surcharge 2012-13 A three tiered Medicare levy surcharge came into effect on 1 July 2012. MLS INCOME RANGE SINGLE COUPLES/FAMILIES (NO DEPENDENTS) Tier 1 $84,001 - $97,000 p.a. $168,001 - $194,000 p.a.* Tier 2 $97,001 - $130,000 p.a. $194,001 - $260,000 p.a.* Tier 3 $130,001 and over p.a. $260,001 and over p.a.* * Add $1,500 for each additional child after the first LEVY PAYABLE 1% 1.25% 1.5% accountants@myob.com.au 1300 555 666 myob.com.au 70 AND OVER 40% 30% 20% Nil 40% 30% 20% Nil CODE DETAILS MAXIMUM OFFSET LOWER THRESHOLD UPPER THRESHOLD A Single, Widowed, Separated COMBINED TAXABLE INCOME $2,230 $32,279 $50,119 N/A $2,040 $31,279 $47,599 $95,198 $2,040 $31,279 $47,599 $95,198 $1,602 $28,974 $41,790 $83,580 $1,602 $28,974 $41,790 $83,580 B C D CALCULATION OF OFFSET $445 $445 – [(TI – 37,000) x 1.5%] NIL Zone and Overseas Forces Rebate 2012-13 ZONE Special Zone A Ordinary Zone A Special Zone B Ordinary Zone B Overseas Forces Single SAPTO $32,279 $32,280-$37,974 $37,975 Married SAPTO $46,000 $46,001 - $54,116 $54,117 *Note The Married rates have not been passed at the time of going to print. > For each additional dependant add $3,094 to lower limit. >The figures applicable to married taxpayers also apply to taxpayers who would be entitled to a sole parent, child-housekeeper or housekeeper rebate if entitlements to such rebates had not been restricted from 1 July 2000. >Where there are more than six dependent children or students, add $3,640 for each extra child or student to the upper limit. SENIOR AND PENSIONER OFFSETS AND SELF-FUNDED RETIREES 2012-13 65-69 35% 25% 15% Nil 35% 25% 15% Nil Low Income earners tax Offset 2012-13 INCOME THRESHOLD 0 - $37,000 $37,001 - $66,667 Over $66,667 Medicare Levy Thresholds 2012-13 NO LEVY PAYABLE IF INCOME IS < STATUS Single E Married, living apart due to illness - both eligible Married, living apart due to illness - spouse not eligible Married, living together - both eligible Married, living together - spouse not eligible Medical expenses offset 2012-13 From 1 July 2012, the medical expenses offset will be means tested on a two-tier income basis and given on assessment. AMOUNT $1,173 + 50% of the relevant offset amount $338 + 50% of the relevant offset amount $1,173 + 50% of the relevant offset amount $57 + 20% of the relevant offset amount $338 + 50% of the relevant offset amount INCOME RANGE SINGLE Tier 1 $84,000 Tier 2 $84,001 Additional child increment $1,500 class of dependant Rebate Maximum ATI Dependent Spouse (without child) It is proposed that the following 8 Other dependant rebates be replaced with a single non-refundable rebate for a dependant who is genuinely unable to work Child-housekeeper (without child) Child-housekeeper (with child) Housekeeper (without child) Housekeeper (with child) Invalid relatives of both taxpayer and spouse Invalid spouse Carer spouse Parents/Parents-in law of both taxpayer and spouse Notional offsets Dependent Spouse (with child) Sole Parent Student First child under 21 years – not a student Each other child under 21 years not a student * Limited to dependent spouse born before 1 July 1952 $2,423 $9,974 $1,975 $2,366 $1,975 $2,366 $889 $2,423 $2,423 $1,776 $8,182 $9,746 N/A N/A $3,838 $9,974 $9,974 $7,386 $2,815 $1,607 $376 $376 $282 $11,541 N/A $1,786 $1,786 $1,410 FAMILY CLAIM THRESHOLD LEVY PAYABLE $168,000 $168,001 $2,120 $5,000 20% 10% MATURE AGE WORKER TAX OFFSET 2012-13 INCOME THRESHOLD $1 - $9,999 $10,000 - $53,000 $53,001 - $62,999 Over $63,000 TAX OFFSET AMOUNT Calculated at 5 cents in the dollar $500 Reduced by 5 cents in the dollar NIL supervisory levy - self-managed super funds On lodgment of the 2012-13 Self-managed superannuation fund annual return (SAR), the SMSF will be required to pay 100% of the 2012-13 supervisory levy ($191) and 50% of 2013-14 supervisory levy ($130 rounded up). YEAR BASIC LEVY LEVY ADJUSTMENT LEVY PAYABLE RETURN LABEL L LEVY PAYABLE RETURN LABEL M 2012 - 2013 $191 $130 $321 $130 2013 - 2014 $129 $259 $388 $259 2014 - 2015 $259 N/A On lodgment of the 2013-14 SAR the SMSF will be required to pay 50% of the 2013-14 supervisory levy ($129 rounded down) and 100% of the 2014-15 supervisory levy ($259). On lodgment of the 2014-15 SAR the SMSF will be required to pay 100% of the 2015-16 supervisory levy ($259). MYOBTaxSeminars2013 Stay one step ahead Motor Vehicle per Km Rates 2012-13 ETP caps 2012-13 (indexed annually) ORDINARY CAR – ENGINE CAPACITY ROTARY ENGINE CAR – ENGINE CAPACITY CENTS PER KM 1600cc (1.6 litre) or less 1601-2600cc (1.601-2.6 litre) 2601cc (2.601 litre) and over 800cc (0.8 litre) or less 801-1300cc (0.801-1.3 litre) 1301cc (1.301 litre) and over 63 cents 74 cents 75 cents Income Test Thresholds 2012-13 OFFSET INCOME TEST INCOME THRESHOLD Spouse without child 1. Spouse ATI < $9,974 $9,974 2. Taxpayer Adjusted Taxable Income $150,000 Other dependants (Invalid and Carer) Combined Adjusted Taxable Income $150,000 Employee Share Schemes Adjusted Income $180,000 Non-commercial Business Losses Adjusted Income $250,000 HECS Repayments 2012-13 INCOME THRESHOLD TAX RATE % INCOME THRESHOLD TAX RATE % 0 - $49,095 $49,096 - $54,688 $54,689 - $60,279 $60,280 - $63,448 $63,449 - $68,202 0% 4% 4.5% 5% 5.5% $68,203 - $73,864 $73,865 - $77,751 $77,752 - $85,564 $85,565 - $91,177 $91,178 and above 6% 6.5% 7% 7.5% 8% SFSS Repayments 2012-13 INCOME THRESHOLD 0 - $49,095 $49,096 - $60,279 $60,280 - $85,564 $85,565 and above TAX RATE % 0% 2% 3% 4% ETP and Superannuation Lump Sums – Preservation Age FOR A PERSON BORN… PRESERVATION AGE Before 1 July 1960 1 July 1960-30 June 1961 1 July 1961-30 June 1962 1 July 1962-30 June 1963 1 July 1963-30 June 1964 After 30 June 1964 55 56 57 58 59 60 Government super Co-Contribution Rates 2012-13 TYPE OF CAP CAP Employment termination payment ($175,000 applies for each termination of different employment). $175,000 THRESHOLDS Whole of income (not indexed) $180,000 Death Benefit ETP. The cap is reduced for any death benefit termination payment previously received as a result of the same termination, $175,000 whether in an earlier income year or the year of receipt. Superannuation Lump Sum Caps 2012-13 (indexed annually) TYPE OF CAP CAP Superannuation lump sum (life-time cap) Superannuation Untaxed plan cap $175,000 $1.255 million AMOUNT Lower Threshold $31,920 Upper Threshold $46,920 Maximum Contribution $500 Note 1 To be eligible the taxpayer must earn 10% or more of their total income from employment, carrying on a business or a combination of both. Note 2 The offset decreases by 3.333 cents in the dollar for each dollar of income over the lower threshold. Note 3 The Government proposes to reduce the maximum payment amount and the matching rate. Low Income Superannuation Contributions (LISC) 2012-13 There is no tapering of the ATI threshold of $37,000 Superannuation Contributions on Behalf of Spouse 2012-13 THRESHOLDS AMOUNT INCOME THRESHOLD AMOUNT Maximum Offset $540 Maximum Contributions $3,000 Adjusted taxable income Maximum Contribution Payable Minimum Contribution Payable Payment Rate $37,000 $500 $20 15% Lower Threshold $10,800 Interest Rates - Early Payments and Overpayments Upper Threshold $13,800 PERIOD Note Reduction rate is 18% over the Lower Threshold. Superannuation Contributions 2012-13 TYPE CAPPED AT Concessional contributions cap* Non-concessional contributions cap** Non-concessional contributions - CGT cap amount Bring-forward cap for individuals aged under 65** $25,000 $150,000 $1.255m $450,000 * From 1 July 2014 it is proposed that the concessional contributions cap will be increased to $50,000 for individuals aged 50 years and over who have total superannuation balances less than $500,000 (this is not yet Law). ** A bring forward rule allows individuals under 65 years of age to make non-concessional contributions of up to three times their non-concessional contributions cap over a three year period and is based on the cap of the first year in which the rule applies. Superannuation Guarantee Charge YEAR SG RATE INCREASE YEAR 2012-2013 9% 0.25% 2016-2017 2013-2014 9.25% 0.25% 2017-2018 2014-2015 9.50% 0.50% 2018-2019 2015-2016 10% 0.50% 2019-2020 Note Amount in a quarterly contribution period is $45,750 SG RATE INCREASE 10.5% 11% 11.5% 12% 0.50% 0.50% 0.50% INTEREST RATE July-September 2012 3.660% October-December 2012 3.620% January-March 2013 3.240% April-June 2013 2.950% July-September 2013 2.950% October-December 2013 2.950% January-March 2014 2.950% Until the rates beyond June 2013 are published, overpayments interest and Credit for No-TFN offset will be calculated using the latest published rate of 2.950%. Luxury Car Limit (DCL) INCOME YEAR CAR LIMIT 2011-2013 2009, 2010 2008 $57,466 $57,180 $57,123 Fringe benefits tax 2012-13 FBT RATE Fringe benefits taxable amount – gross-up rate 46.5% Type 1 benefits – 2.0647 Type 2 benefits – 1.8692 Disclaimer: All information contained herein has been sourced from Australian Master Tax Guide 2013 (CCH) and/or the Australian Tax Office. MYOB has made every effort to ensure the accuracy and completeness of this information, however MYOB, its staff and agents will not be liable for any errors or omissions. MYOB Technology Pty Ltd ABN 30 086 760 269. AAD55401-0213 accountants@myob.com.au 1300 555 666 myob.com.au