- JPH Group

advertisement

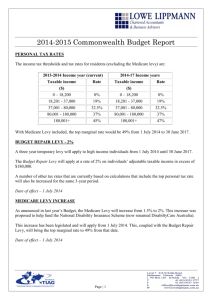

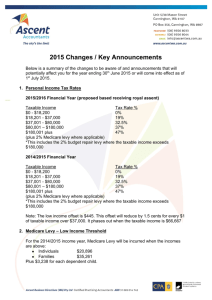

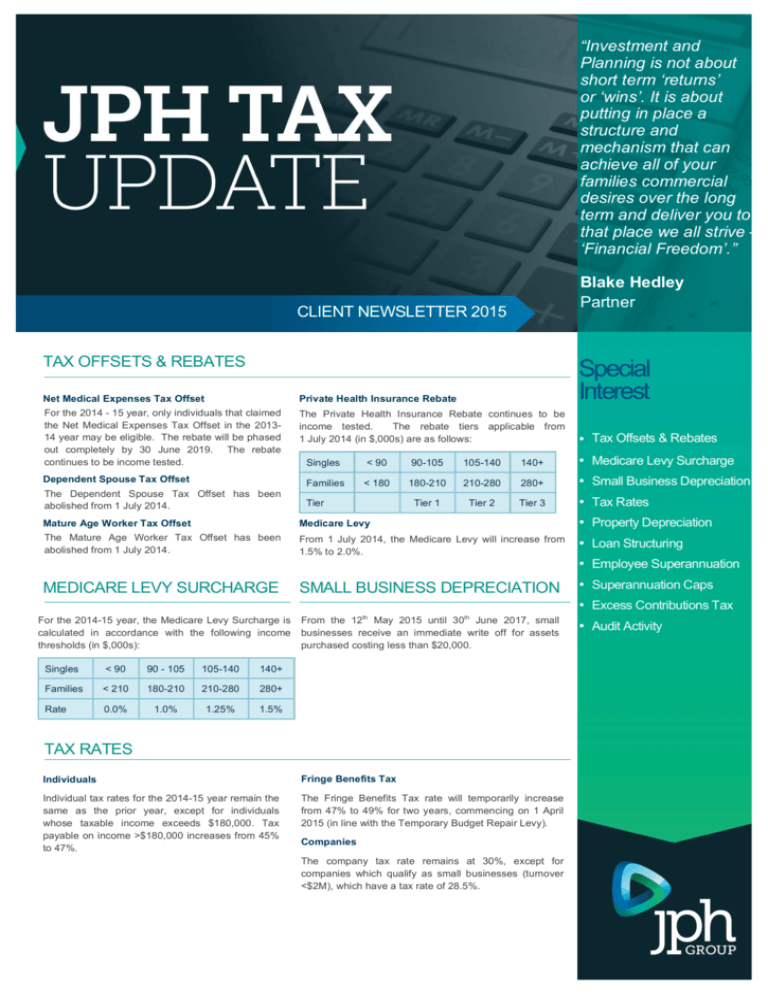

“Investment and Planning is not about short term ‘returns’ or ‘wins’. It is about putting in place a structure and mechanism that can achieve all of your families commercial desires over the long term and deliver you to that place we all strive – ‘Financial Freedom’.” Blake Hedley Partner CLIENT NEWSLETTER 2015 TAX OFFSETS & REBATES Net Medical Expenses Tax Offset Private Health Insurance Rebate For the 2014 -­ 15 year, only individuals that claimed the Net Medical Expenses Tax Offset in the 2013-­ 14 year may be eligible. The rebate will be phased out completely by 30 June 2019. The rebate continues to be income tested. The Private Health Insurance Rebate continues to be income tested. The rebate tiers applicable from 1 July 2014 (in $,000s) are as follows: Special Interest • Tax Offsets & Rebates Singles < 90 90-­105 105-­140 140+ • Medicare Levy Surcharge Dependent Spouse Tax Offset Families < 180 180-­210 210-­280 280+ The Dependent Spouse Tax Offset has been abolished from 1 July 2014. • Small Business Depreciation Tier Tier 1 Tier 2 Tier 3 • Tax Rates Mature Age Worker Tax Offset Medicare Levy • Property Depreciation The Mature Age Worker Tax Offset has been abolished from 1 July 2014. From 1 July 2014, the Medicare Levy will increase from 1.5% to 2.0%. • Loan Structuring MEDICARE LEVY SURCHARGE SMALL BUSINESS DEPRECIATION • Superannuation Caps • Excess Contributions Tax For the 2014-­15 year, the Medicare Levy Surcharge is From the 12th May 2015 until 30th June 2017, small calculated in accordance with the following income businesses receive an immediate write off for assets thresholds (in $,000s): purchased costing less than $20,000. • Employee Superannuation Singles < 90 90 -­ 105 105-­140 140+ Families < 210 180-­210 210-­280 280+ Rate 0.0% 1.0% 1.25% 1.5% TAX RATES Individuals Fringe Benefits Tax Individual tax rates for the 2014-­15 year remain the same as the prior year, except for individuals whose taxable income exceeds $180,000. Tax payable on income >$180,000 increases from 45% to 47%. The Fringe Benefits Tax rate will temporarily increase from 47% to 49% for two years, commencing on 1 April 2015 (in line with the Temporary Budget Repair Levy). Companies The company tax rate remains at 30%, except for companies which qualify as small businesses (turnover <$2M), which have a tax rate of 28.5%. • Audit Activity The Right Direction In: INVESTMENT PROPERTY DEPRECIATION > Taxation & Accounting > Mortgage Origination > Financial Planning, Insurance and Retirement Planning > Superannuation – Self Managed Superannuation As a building gets older and items within it deteriorate, they depreciate in vale. The Australian Taxation Office (ATO) allows property investors to claim deductions relating to the wear and tear on the building and the fixtures and fittings. If refurbishment or renovation works have been undertaken since 18 July 1985 (residential) and 20 July 1982 (non residential), the building will be eligible to claim the capital works allowance (Division 43). Such deductions can be claimed by any owner of an income producing property;; including residential rental properties. In short, depreciation reduces the amount of tax investors pay! Structural improvements (including fencing, paving, pergolas, garden sheds etc) constructed after February 1992 will attract the capital works allowance. Soft landscaping cannot be claimed. Quantity Surveyors are recognised by the ATO under TR 97/25 as being appropriately qualified to estimate construction costs of a building for tax purposes. A capital allowance and tax depreciation report can be prepared by BMT Quantity Surveyors to allow a client to easily recover missed depreciation benefits (up to a period of two years) by amending previous tax returns. > Business Consulting > Finance What are the key dates? > Wealth Creation As a general rule, any property constructed after 18 July 1985 (residential) and 20 July 1982 (non-­ residential) is eligible for the capital works allowance. > Lawyers Get In Touch LOAN STRUCTURING JPH has entered into an exclusive arrangement with one of the major four banks to provide our clients with up to 90% loan for the acquisition of residential or investment property, without incurring mortgage insurance. 6/60 Albert South Melbourne, VIC Locked Bag Albert Park, VIC t 03 9686 f 03 9645 e w Tax Implications Not only do we have the ability to offer our clients a unique loan offering in the residential property space but our consultants also pay particular attention to the taxation implications in structuring loan advances to ensure that our clients optimise their tax position and achieve substantial savings over the term of the loan. When you earn a lot of money you generally have two options;; pay a lot of tax or pay a lot of interest. The key difference is, when you pay interest you own the asset with it! Negative gearing is a powerful way to dilute your taxation liability. Structuring the loan correctly at the beginning is vital in minimising your taxation liability and building your personal wealth. Monday to 8:00am to 7 8:00am to EMPLOYEE SUPERANNUATION SUPERANNUATION CAPS Superannuation Guarantee Charge (SCG) Contribution Cap Limits The minimum SGC for employees will increase to 9.5% from 1 July 2014. It will remain at 9.5% for four years. The concessional contributions cap from 1 July 2014 individuals aged 49 years and over is $35,000. The concessional contributions cap for all other individuals is $30,000. The compulsory employer superannuation contributions will continue to increase until it reaches 12% in 2022. Please note that are EXCESS CONTRIBUTIONS TAX The Government will allow individuals the option of withdrawing superannuation contributions (and allocated earnings) in excess of the non-­ concessional contributions cap made from 1 July 2013, where any inadvertent breach would have resulted in a substantial tax penalty. Any excess contributions withdrawn will count towards assessable income and be taxed at individual marginal tax rates. Up to 85% of excess concessional contributions can be withdrawn, taxed at the individual marginal tax rate. The non-­concessional contributions cap remains at $180,000 per annum or $540,000 over 3 years (only available to those under 65 years of age). AUDIT ACTIVITY Audit hot spots this year will be work related expenses, such as: • remuneration (e.g. paid to a spouse) • motor vehicle deductions using the 'log book' method and 'work-­horse' vehicles (e.g. utes) • home office expenses, particularly CGT traps • self education expenses related to specialist and self-­development courses. Data Matching The ATO's data matching capabilities continue to increase. This includes matching income details with various third parties, including overseas entities and other revenue offices.