Fringe Benefits Tax - Griffith University

advertisement

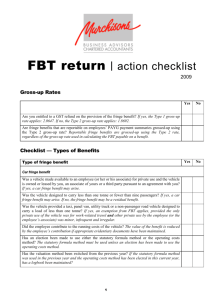

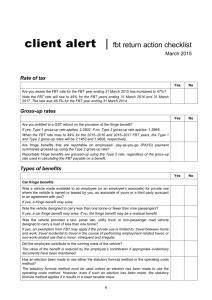

FINANCIAL MANAGEMENT PRACTICE MANUAL GRIFFITH UNIVERSITY Topic FRINGE BENEFITS TAX Procedure Category Taxation Updated 12.02 08/2006 RELATED POLICIES, PROCEDURES AND FORMS Policies Procedures Forms Fringe Benefits Tax FBT Entertainment Checklist and Expense Form FRINGE BENENFITS TAX 1 INTRODUCTION The University is required to pay Fringe Benefits Tax (FBT) in accordance with the legislative requirements of the Fringe Benefits Tax Assessment Act 1986 (FBT Act). Areas of the University responsible for the incurring of expenditure which becomes a taxable benefit in terms of the FBT Act are charged, unless exempted, with the resultant FBT expense payable by the University. In respect of a Taxable Benefit being provided to an employee under a Salary Sacrifice Arrangement, the FBT incurred by the University is recovered from the employee as part of the arrangement A detailed statement of the University’s position on FBT is contained in the Fringe Benefits Tax section of the Finance and Business Services website. Definitions: “Benefits” are defined broadly and includes any right, privilege, service or facility but excludes payments of salary or wages, eligible termination payments or contributions to complying superannuation funds. “Employees” are defined under the Act as current, future or former employees. Associates are also caught and these would include relatives of employees and employees of related entities. “Fringe Benefits’’ are benefits provided by the University (or associate of the University), in respect of employment, to an employee (or associate of the employee). A fringe benefit can be viewed as a type of "payment" to or for an employee but is different to salary or wages. 2 STATEMENT OF PRACTICE Fringe Benefits Tax is: • assessed annually with the year of tax spanning from 1 April to 31 March; • administered on the basis of self-assessment. Where a FBT liability exists, the employer must lodge an annual return together with the tax payable by 21 May. FBT is payable by the University on the taxable value of all non-exempted fringe benefits provided. The taxable value may be reduced where the employee contributes to the cost of the benefit. A reduction in the taxable value may also be available where the employee would have obtained a tax deduction had the expense been incurred privately. This is known as the "otherwise deductible" rule. PRINT WARNING: Printed copies of this manual or part thereof should not be regarded as the current version. ALWAYS refer to the electronic copy for the latest version. Filename: 1202 - Fringe Benefits Tax V1.01 (1).doc Page 1 of 4 FINANCIAL MANAGEMENT PRACTICE MANUAL GRIFFITH UNIVERSITY FBT effectively doubles the cost of any fringe benefits that are provided to staff. The table below depicts the additional cost to the University when providing fringe benefits. The total cost of the benefit should always be considered before providing the benefit. Benefit No GST input tax credit is available GST input tax credit is available Type of Benefit Type 2 Type 1 Fringe Benefit $100 $110 (NB: $100 net cost after credit) $87 (100 x 1.8692 x 0.465) $106 (110 x 2.0647 x 0.465) $187 $206 (after recovery of GST) FBT Total Cost 2.1 TAXABLE BENEFITS The following benefits are included in the calculation of FBT: • Entertainment • Car • Accommodation • Living Away from Home Allowance (LAFHA) • In House Property (Meal) • Expense Payment • Loans • Salary Packaging Fringe benefits received by an employee exceeding $1,000 ($2,000 from 1st April 2007) are reported on the Payment Summary for that employee. 2.2 EXCLUDED BENEFITS The following benefits are excluded (this list is not exhaustive): • notebook computer, laptop computer or similar portable computer subject to use being primarily for business purposes (this exemption is limited to one per year per employee); • protective clothing - e.g. overalls, laboratory coats; • briefcase, calculator, electronic diary subject to use being primarily for business purposes; • computer software if same is used in employment; • an employee's subscription to a trade or professional journal; • costs of removal and storage or household effects of employees who are required by the University to change job locations; and • travel and accommodation related to employee interviews or selection tests. • fees for an airport lounge membership eg Qantas Club membership PRINT WARNING: Printed copies of this manual or part thereof should not be regarded as the current version. ALWAYS refer to the electronic copy for the latest version. Filename: 1202 - Fringe Benefits Tax V1.01 (1).doc Page 2 of 4 FINANCIAL MANAGEMENT PRACTICE MANUAL GRIFFITH UNIVERSITY • newspapers and periodicals provided to employees for work related use • recreational or child care facilities if provided on the University’s premises • standard car parking at the University • minor benefits eg. small gifts given to employees as a reward for a special achievement 3 RESPONSIBILITIES 3.1 DEPARTMENTS/ELEMENTS A statutory responsibility exists for ensuring that proper accounts and records are kept of University transactions. Departments/Elements are responsible for identifying fringe benefits as they are paid and gathering the information required to determine what portion of entertainment expenditure is subject to FBT. Adequate supporting documentation must accompany all transactions processed as entertainment. To assist with this documentation, payments relating to food and drink expenditure are to be accompanied by a FBT Entertainment Checklist and Expense Form. The form has been designed to satisfy the substantiation requirements of the ATO and simultaneously, assist in the calculation of the tax payable. Departments/Elements must also obtain declarations with respect to benefits being paid in accordance with the “Otherwise Deductible” rule. 3.2 LOGISTICS OFFICE The Logistics Office maintains records of University Motor Vehicle use by employees and calculates FBT payable by the University based on the Statutory Fraction derived by annualising the kilometres travelled by each employee. 3.3 GRIFFITH ACCOMMODATION The Manager, Griffith Accommodation provides information in respect of meals and accommodation provided to Residential Advisors and Heads of Colleges, to support calculation of FBT applicable. 3.4 PAYROLL SERVICES Business Services have a responsibility to: • recognise taxable benefits and advise the Manager, Financial Accounting of benefits being paid under salary sacrifice arrangements for consolidation with other benefits provided; • manage and monitor the value of salary sacrifice benefits provided on a regular basis to ensure any shortfall in FBT is recovered from the employee; • ensure Reportable Benefit information is included on Payment Summaries as advised by the Tax Compliance Officer; • remit Payroll Tax on Fringe Benefits as advised by the Manager, Financial Accounting. 3.5 FINANCE AND BUSINESS SERVICES (PFS) The Manager, Financial Accounting, PFS is required to: • provide advice and training to University staff; PRINT WARNING: Printed copies of this manual or part thereof should not be regarded as the current version. ALWAYS refer to the electronic copy for the latest version. Filename: 1202 - Fringe Benefits Tax V1.01 (1).doc Page 3 of 4 FINANCIAL MANAGEMENT PRACTICE MANUAL GRIFFITH UNIVERSITY • reconcile and record FBT expenses in a timely manner to meet the University’s statutory reporting and lodgement obligations • prepare and arrange lodgement of the University’s annual Fringe Benefits Tax Return • collate and prepare Reportable Benefits Summary for inclusion in Employees Payment Summary; • calculate payroll tax payable on Fringe Benefits and advise HRM of amount to be included in regular payroll tax payments; 4 RECORDS The University must retain supporting documentation for all accounting transactions and information, which substantiates the calculation of FBT. Records are to be kept for five years. The Manager, Financial Accounting will liaise with University Elements to ensure that appropriate processes are established for recording and substantiating FBT calculations. 5 FURTHER INFORMATION For further information, contact Manager, Financial Accounting – Ext 57024. PRINT WARNING: Printed copies of this manual or part thereof should not be regarded as the current version. ALWAYS refer to the electronic copy for the latest version. Filename: 1202 - Fringe Benefits Tax V1.01 (1).doc Page 4 of 4