The Cash Cow

G u i d e t o P r o f i t s w i t h ETF s

Volume 4, Number 1, January 2013

Market musings…

T

his final issue of 2012 closed before

the outcome of the fiscal cliff negotiations in Washington was completely known.

The chance exists that my words are finding you (and me) hurtling off the cliff, our

portfolios in financial chaos. But I doubt it

– Congress will either punt the tough stuff

into mid-2013, or work out some mix of

higher tax revenue (not rates) and trimmed

spending that provides both sides political

cover. Nothing else is feasible, given the

other alternatives.

Meanwhile, macro-economic considerations have taken a back seat. First the

elections, then the cliff negotiations, have

been at the forefront of investor thinking

since the summer. However, the trends

exist that will ensure a very interesting, and

potentially very profitable, 2013. In fact,

we think strength in the U.S. and Europe

may surprise you in next year’s first half,

while it is very likely China – increasingly

a bellwether for the rest of the world – will

do the same. Equity markets will benefit the

most from such scenarios, coupled as they

are with muted (for now) inflation levels, and

commodities will rise. On the other hand,

the bull market in bonds, especially U.S.

Treasurys, is at or near its end. With the

possible exception of some bottom-fishing

among beaten-down European sovereign

debt, we plan on staying clear of developedcountry fixed income instruments next year,

and suggest you do the same.

Finally, you will note that we’ve done a

major redesign of our newsletter. We’ve

freshened up the look, added data and

hopefully made it more useful and easier to read than ever before. Please

let me know what you think. In the

meantime, here’s to a profitable

and prosperous 2013.

Onward and Upward:

A New Look For A New Year

We embark on a redesign that makes Cash Cow

an even more useful tool

By Steven Lord

E

very successful product, regardless of industry or application, undergoes a life cycle as it

grows. Imitation, one of the first

signs that a new product is onto

something, demands differentiation. Competitors, eager to build

a better mousetrap, force innovation and pressure price. Feedback

from existing customers creates a

never-ending quest for incremental improvement. All can result in

new products and further growth.

Ultimately, few new products

last long in their original form.

They must adapt. If they don’t,

they disappear. Some, like Cessna’s

model 172, have changed much

more on the inside than on the

outside, while others – xBox, TVs,

cell phones of any stripe, etc. – can

now become obsolete the minute

they hit the shelves. The end result

is the same; successful products

must become adept at reinvention.

This newsletter is no different.

Our first issue in the fall of 2010

was designed to explore the use of

exchange-traded funds (ETFs) in

the portfolios of individual investors, and how these clever instruments could be useful in portfolio

strategy. Offering the ability to

www.LeebsCashCow.com / 1-800-258-1964

quickly and cheaply trade large

baskets of instruments, across esoteric markets and far-flung locales,

the number of ETFs and the assets

devoted to them has exploded.

Incidentally, it’s worth noting that as an innovation, ETFs

have had to adapt as well. It didn’t

take long for Wall Street product

mavens to figure out that the ETF

structure was something applicable in a dizzying array of permutations, and there are now more

than 1,400 ETFs boasting assets

over $1.2 trillion in the U.S. alone.

Because of this competition, sponsoring firms have lowered price,

come up with increasingly narrow,

opaque index ideas, and added

things like leverage and active

management in an effort to stay

competitive. For the individual

investor, these developments have

been very positive.

In a similar vein, we are instituting several changes to the

INSIDE

Lights Out: Selling PUI...................................... 3

The Best ETF Websites...................................... 4

Vanguard’s Category Killer................................ 5

Profits and Performance................................... 7

Recommended List............................................. 8

The

Cash Cow

Currencies

and Commodities

format and layout of Cash Cow,

drawn mostly from subscriber

feedback and our own thinking

about what best serves our readers.

Our content will continue to be a

mix of macro-economic analysis,

trend identification and specific

ETF recommendations, but we’ve

improved the way it is presented

and added additional elements to

make it more useful.

One of the more significant

modifications is the way the newsletter is organized. We’ve consolidated our prior subject headings,

which included Commodities,

Currencies, Sectors, Income and

Emerging Markets, into three:

Income, Capital Appreciation and

Hard Assets/Hedge. Income, naturally, will include all ETFs whose

principal attraction is dividend,

distribution and/or coupon income, and whose recommendation

is based first and foremost on total

annual yield. Capital Appreciation

will feature ETFs of all types whose

main attraction to us is a rising

price, and Hard Asset/Hedge will

consist of ETFs whose positions

are predominantly physical metals,

commodities or other hard assets,

or that can serve specifically as a

hedge against volatility in equity,

bond or currency markets.

This step simplifies how our

recommendations and articles

are organized, and makes them

more aligned with the way investors actually use ETFs in their own

portfolios. In both our Capital Appreciation and Hard Assets/Hedge

sections, we plan on featuring

leveraged ETFs when appropriate and prudent to do so. In some

cases, our decision about where to

place an ETF may or may not be

The Cash Cow

yours – a high-yielding currency

ETF, for instance, could serve as an

income play or a hedge depending

on the individual investor. This is

to be expected, and doesn’t make

one or the other wrong. Our hope

is to give you one way of utilizing

a given ETF; there will obviously

be others.

We are also including more data

about each ETF we’re covering, as

well as specific advice about what

to do with each one. Importantly,

our best picks for new subscribers

or for those with new capital to deploy will be prominently featured.

ETF investors tend to be buy-andhold types by nature, so the goal

here is to give readers our thoughts

on the best ETFs to buy right now

in every issue.

In terms of content, we’re

adding ETF education to the list

of things we write about. Many

individual investors are unaware

of exactly how to use ETFs, as well

as the various tips and tricks available to maximize their benefits.

Many also do not know that all

ETFs are most certainly not created equal, and that major pitfalls

exist for the uninformed. We’ll

help de-mystify this asset class,

and help you better understand

what they can do for you.

Finally, we’ve also increased

the size of our graphics, added

some financial metrics to our

charts and made color, font & text

changes to make our newsletter

easier to read. The goal is to have

a publication that is at once easily

skimmed and also brimming with

useful information.

Hopefully, we’ve made Cash

Cow both more useful to our readers and ultimately of more value.

2

However, the ultimate test for any

product modification is whether

customers like it, so please contact us with your thoughts about

our first major face lift since we

launched. Send us an email to

cashcow@leeb.com, or visit www.

leebscashcow.com. v

The Cash Cow

Research Chairman: Stephen Leeb, Ph.D.

Publisher: Vicki Moffitt

Editor: Steven Lord

Managing Editor: Genia Turanova

Contributors:

Gregory Dorsey, David Sandell,

Kuen Chan, Genia Turanova

Creative Director: Ray Holland

Marketing Director: Matthew Warner

The Cash Cow, Stephen Leeb’s Guide to Currency &

Commodity Profits (ISSN: 2157-2011) is published

monthly by Fund World, LLC, 8 West 40th Street, New

York, NY 10018. Periodicals postage paid at New

York, NY, and additional mailing offices. The Cash

Cow, Stephen Leeb’s Guide to Currency & Commodity Profits, Volume 4, Number 1, 2013 by Fund World,

LLC, all rights reserved. The contents of this publication may not be reproduced in whole or in part without

consent of copyright owner. Subscription services (800)

258-1964 or write to The Cash Cow, PO Box 354, Williamsport PA 17703. Yearly subscription in USA: $199.

Canada and overseas: $259. POSTMASTER: Send address changes to The Cash Cow, Stephen Leeb’s Guide

to Currency & Commodity Profits, PO Box 354, Williamsport PA 17703. The Cash Cow, Stephen Leeb’s Guide to

Currency & Commodity Profits (LCC) is not registered

as a broker-dealer or investment adviser with the U.S.

Securities and Exchange Commission or any state securities authority. LCC and its information and content

providers make no representations or warranties of any

kind in connection with the subject matter of LCC or

the suitability of the information contained in LCC for

any purpose and are not liable for the timeliness, accuracy, or completeness of the information contained

herein. LCC is not responsible for any trades placed by

the recipients of LCC based on the information included

therein. Investment recommendations are not intended

to be construed as personal advice and readers should

consider their personal situation before making any investment. All opinions expressed and information and

data provided therein are subject to change without notice. LCC, its officers, directors, employees, associated

entities and/or clients of associated entities may currently maintain direct or indirect ownership positions in

financial instruments (i.e., stocks, bonds, options, warrants, etc.) whose underlying exposure is in the companies mentioned in LCC. Sources include Bloomberg,

Morningstar, Reuters and company/government data.

www.LeebsCashCow.com / 1-800-258-1964

January 2013

on the dividend bandwagon because special payouts need special

regulatory approval.

Nonetheless, both our utility

picks have done very well – PUI,

which yields 2.5 percent, is up over

One particular utility ETF provides all the sector

19 percent for us while XLU, which

yields 3.9 percent, has returned

exposure income investors need

over 14 percent. Both are focused

on the utility sector, but that’s

s expected, several of our

special and accelerated dividends

where the similarity ends. PUI

dividend-oriented ETF recom- that took place in the final weeks of

concentrates on the less-regulated,

mendations came under pressure

2012. Whether such steps are actufaster-growing side of the business,

during the recent fiscal cliff negoti- ally advantageous to investors is a

while XLU offers exposure to all

ations, with fears of higher tax rates matter of debate; special dividends

aspects of the utility industry. In

on payouts sending some investors

just shift capital from the balance

addition, PUI is a small as XLU is

in such instruments to the exits.

sheet to shareholders, who then see

large; the former has a mere

However, the impact was less

$40 million in assets, while the

Utilities Sector Select SPDR (XLU)

than many predicted; well over

later boasts over $4 billion.

39

half of all assets in dividendAccordingly, trading liquidity

38

generating equities (including

at XLU is much larger, making

37

ETFs) are held in tax-sheltered

it easier to trade, while XLU

accounts like 401Ks and IRAs,

36

charges a mere 0.18 percent

which means although tax concompared to PUI’s 0.63 per35

siderations make good press,

cent per year.

34

they’re not primary concern

Given these disparities, we

33

to a very large segment of the

suggest taking profits in PUI

32

income-investing public.

and keeping XLU. Of the two,

Dec-11

Apr-12

Aug-12

Dec-12

Moreover, investors are still

XLU gives you better expo$34.92

Yield

3.90%

facing a yield desert with limited Recent Price

sure to the utilities in PUI’s

AUM

$6.04B

ADV

6.9 mil.

ability to generate income. This

portfolio than the other way

Expense Ratio

0.18%

NAV

$34.92

means the market environment

around. We suggest parting

is strategically more important to

the price of the stock drop by the

with PUI and concentrating your

income investors than the tax struc- special dividend amount. No net

utility investments into the Vanture. Ultimately, dividends taxed at

new value is created. Nonetheless,

guard fund. It tracks the industry

higher rates are obviously preferable many companies even issued large

by investing in all 31 utility comto no dividends at all, an investing

amounts of debt in order to fund

panies in the S&P 500 and weights

truism loudly echoed by no one less

these one-time payouts, a dubious

them according to market capitalthan Warren Buffett. And note that

exercise in cost-benefit math if ever ization. XLU boasts four stars from

only those in the highest income

there was one.

Morningstar.

brackets (i.e. those least likely to be

One sector virtually absent from

What to do now: Sell PUI and

living off their portfolio income)

these shenanigans was Utilities,

book the gain. There is just no

will be dealing with the highest tax

represented in our recommended

reason to leave a 16% percent

rate in the first place.

list via Utilities Select Sector

gain on the table when a more

When all is said and done, we

SPDR (XLU) and PowerShares

liquid, higher-yielding and less

think the biggest impact of the

Dynamic Utilities (PUI). Due to

expensive alternative exists. If you

fiscal cliff on dividend stocks (and

their regulated nature, most utiliown XLU already, hold it; if you

their ETFs) will be the surge in

ties were precluded from jumping

don’t, buy it. v

Lights Out: We Part Ways

With One of Two Utility Picks

A

The Cash Cow

3

www.LeebsCashCow.com / 1-800-258-1964

The

Cash Cow

Currencies

and Commodities

ETFs. The three largest ETF families are Blackrock (iShares), State

Street and Vanguard, responsible for

over $1 trillion of the $1.4 trillion

in assets currently devoted to ETFs.

Other popular ones include Invesco

(PowerShares), Van Eck, ProShares,

and WisdomTree.

ProShares has become the top

shop for so-called “alternative” ETFs,

i.e. those that employ leverage, go

short, or hedge things like global

inflation or volatility. These ETFs

are among the most complicated

and riskiest out there, and while we

generally don’t think that the use of

the leverage, especially double- and

triple-leverage, is desirable (its use

often comes with too much of a

tracking error), some of these ETFs

can be useful for trading and/or

hedging. Of course, like any tool,

the more you understand them, the

better you can use them. And don’t

forget to review a prospectus before

investing; visit the ProShares website

for more.

A large number of web sites offer

data about any virtually listed ETF,

which is tremendously important

when researching a particular fund’s

portfolio positions, weightings,

underlying returns, and other information about the entire universe of

ETFs. These sites become important

when you are trying to determine

which ETF is the best way to play a

particular idea. Our list, in no particular order, appears nearby.

Note that general financial websites – wsj.com, Yahoo Finance, etc.

– are useful for ideas and some basic

data, but don’t expect many groundbreaking insights. Bloomberg has

news and a fairly strong screener

that helps you narrow down the

available choices. SeekingAlpha is

good for idea trolling – it boasts a

ton of articles written by investors,

but they’re usually no more adept

at ETF investing than anyone else.

Finally, of the data sites, we use

ETFdb.com and ETFchannel.com

the most – the former has the most

complete set of data points about

every ETF we have found, and the

latter has a useful function that lets

you search for which ETFs hold a

particular stock. v

4

www.LeebsCashCow.com / 1-800-258-1964

Tools of the Trade

We explore the best websites for research

and information on ETFs

E

xchange-traded funds are unique

instruments in numerous ways,

and are especially useful to individual

investors. Distinct from equities,

bonds and mutual funds, ETFs can

provide access to an investment

avenue or strategy otherwise unavailable, mitigate risk, and allow you to

speculate on whole sectors, currencies, commodities and countries via a

single position. And they’re universally quicker and less expensive to trade

than any comparable alternative. In

fact, the major reason why ETFs have

become so popular with individual

investors is that so much can be accomplished so easily for so little.

For all their utility, however, ETFs

are generally more complicated

that individual stocks or bonds. As

simple as the core concept may be,

investors continually misunderstand

things like an ETF’s portfolio construction, tax issues, use of leverage,

and tracking errors between an ETF

and its underlying index or instruments. And as the number and

complexity of ETF alternatives has

grown, the need for investors to do

some additional research has only

increased. By doing a little homework, you can ensure the ETF you

have just purchased will actually do

what you’d like it to, and that you

won’t get any nasty surprises.

Thankfully, there are resources

available. Not all are good, and many

are bland & superficial. However,

we’ve found a number to be useful,

especially in helping research fund

The Cash Cow

characteristics, news and relevant data.

Always start your research into a

new ETF at the sponsor’s home page.

Virtually all ETF families have fairly

comprehensive information about

their products available online,

including a prospectus and up-todate net asset values. Larger fund

families also offer background white

papers and other content related

to the types and strategies of their

Best ETF Web Sites

Etfdb.com

Morningstar.com

etfconnect.com

etftrends.com

finance.yahoo.com

indexuniverse.com

wsj.com

etfdailynews.com

seekingalpha.com

benzinga.com

bloomberg.com

etfchannel.com

January 2013

reason, many such funds are much

larger and less volatile than their

equivalent country-specific ones.

One broad emerging market

ETF that is attractive at the moment is also one of the biggest.

Vanguard’s massive fund offers broad exposure

Vanguard’s Emerging Markets

ETF (VWO) was one of the first

for low cost

emerging-market funds, and

boasts a whopping $56.8 bilnvestors look to emerging marfinancial sophistication, commod- lion in assets. Extraordinarily

diversified, VWO offers exposure

kets for a number of reasons,

ity consumption, etc. They might

to 22 countries and 890 equity

not the least of which has been

offer diversification benefits to an

positions, using a capitalizationthe theory that they provide iminvestor loaded with U.S. equities,

portant portfolio diversification.

but these markets are also popular weighted approach that favors the

largest companies regardless of

Prior to 2008, this diversification

because despite the swings, they

domicile at the expense of those

was thought to hedge U.S. equity

are the ones in which long-term

nations with larger economies

portfolios from a variety of risks,

growth is basically assured.

but smaller, less developed

including economic, currency

Vanguard MSCI Emerging Mkts (VWO) capital markets.

and market risk. Since the

After years tracking the

46

financial crisis, however, inMSCI Emerging Markets

vestors have learned the hard

44

Index, VWO is shifting to

way that emerging markets

42

the FTSE Emerging Markets

are not always as decoupled

40

Stock Index as its benchmark.

from developed ones as we

38

The major difference between

initially thought, especially

the two indices is South

36

in acute bearish phases. In

Korea – it makes up nearly 15

fact, they can be much more

34

percent of the MSCI Index

volatile, due to low liquidity,

32

but is not present the FTSE

Dec-11

Apr-12

Aug-12

Dec-12

meager share floats and rapid

Emerging Markets Index.

shifts in capital flows that can

Recent Price

$42.64

Yield

3.30%

However, over the past de$56.8 B

ADV

20.8 mil.

wreak havoc on even the most AUM

Expense Ratio

0.18%

NAV

$42.11

cade, the returns and volapromising emerging market.

tility measures of these two

On the other hand, when

indices have been essentially idenETFs have made accessing

risk appetite returns in force to

tical, suggesting the switch will

emerging markets easier and

global markets, emerging marhave minimal impact on VWO’s

kets can handily outperform

cheaper than ever before. Virtuperformance.

ally every large developing natheir more developed peers in

As one would expect from an

tion boasts at least one dedicated

the U.S., Japan and Europe. And

ETF

of this size and mandate,

ETF, and in many cases several.

in the background, it is useful

VWO heaviest concentrations are

Additionally, multi-market and

to remember that their volatility notwithstanding, emerging

regional ETFs have blossomed and in China, Korea, Brazil, Taiwan

and South Africa. 60 percent of

markets fundamentally have the

not only provide investors expothe fund’s assets are devoted to

sure to specific emerging counwind at their backs in terms of

Asian nations, and 21 percent to

tries, but diversify that exposure

growth in the number and wealth

Latin America. A further 10 perof high and middle-class consum- by spreading risk across a number

ers, infrastructure investment,

of nations and currencies. For this cent is dedicated to emerging na-

The Best All-Around

Emerging Market ETF

I

The Cash Cow

5

www.LeebsCashCow.com / 1-800-258-1964

The

Cash Cow

Currencies

and Commodities

ahead of themselves. Indeed, anations in Europe (primarily Russia) levels for a great one-stop option

in emerging markets.

and 8 percent to South Africa.

lysts estimate the industry has to

Sector exposure is concentrated

build 2.1-2.6 million new homes

n Meanwhile, we suggest taking

in Financials, at 24 percent of

in 2016 in order to justify current

profits in three of our capital apassets. This is unsurprising given

valuations, compared to annual

the tendency for banks, insurance

preciation plays. The “third rail”

pace of roughly 365,000 this year

companies and other financial

of our speculation on Canada,

and 1.3 million new homes in

services firms to be among the

iShares’ MSCI Canada Index

2005. The industry has to not

largest and most liquid equities in

(EWC), has returned just over 7

only surpass the pre-crisis peak, it

developing nations. Interestingly,

percent since our write-up last

has to do it in convincing fashion

Technology stocks are next, at 14

July, a respectable if not earthand in a much tougher lending

percent, although this number will shattering result. Weakness in

environment.

drop once South Korea (currently

commodities and strength in the

In other words, it’s not that we

14 percent of the portfolio)

don’t like the industry imis dropped from the portfomediate future; it’s that we

S&P Homebuilders SPDR (XHB)

lio. Consumer stocks account

think stock prices have already

29

for 16 percent of assets, with

discounted it. XHB did phe27

basic Materials and Energy at

nomenally well for us in 2012,

25

12.5 percent and 11.5 percent,

rising 28 percent since our

23

respectively.

recommendation in February,

21

Nearly 90 percent of VWO’s

and we’re not above booking a

19

positions are classified as

strong profit when one exists.

17

large- or mega-capitalization

We’ll return to XHB if prices

15

stocks. The average company

come off a bit. Sell.

13

in the fund has a market cap

Finally, take profits in MarDec-11

Apr-12

Aug-12

Dec-12

of over $18 billion, meanket Vectors Indonesia Index

Recent Price

$25.84

Yield

0.85%

ing this fund definitely has a

(IDX). Although Indonesia

AUM

$2.25 B

ADV

6.9 mil.

blue-chip tilt to it. This can be Expense Ratio

is a very interesting country

0.35%

NAV

$26.30

seen as an advantage, though,

from an emerging markets

U.S. dollar kept pressure on Casince larger companies in emergperspective, it is represented in

ing markets are typically dominanadian stocks through the second

both our new recommendation

half of 2012. Going forward, we

tors in their industries and have

Vanguard Emerging Markets

have exposure to Canada by way

significant entrenched advantages

ETF (VWO) as well as EGShares

of our mining & energy ETFs as

both economically and politically.

Emerging Markets Consumer

well as two of our currency recom- (ECON). We’ve been in IDX since

VWO’s top five positions make

up over 8.5 percent of the portmendations, so it is still fairly well

November 2010 and don’t have

represented in our list. Sell EWC.

folio, led by companies such as

much to show for it, so we sugWe also suggest selling our

Samsung, China Mobile, America

gest heading to the sidelines for

Movil and Taiwan Semiconductor. homebuilders ETF, S&P’s Homenow. We’ll return to Indonesia

We like VWO for its ability to

builders (XHB). Although seconce a stronger growth picture has

engage a broad swath of emergtor data is encouraging and we

returned.

believe the industry is still in the

ing market equity markets in one

What to do now: Buy Vanearly stages of a multi-year reETF. Typical of a Vanguard fund,

guard’s Emerging Markets ETF

expenses are kept to a minimum

covery, so many people have been (VWO). Sell iShares MSCI Canada

while trading liquidity is large

looking for a recovery in housing

Index (EWC), S&P Homebuilders

and bid-ask spread concerns are

stocks for so long, the stock prices (XHB) and Market Vectors Indoof U.S. homebuilders have gotten

nonexistent. Buy VWO at current

nesia Index (IDX). v

The Cash Cow

6

www.LeebsCashCow.com / 1-800-258-1964

January 2013

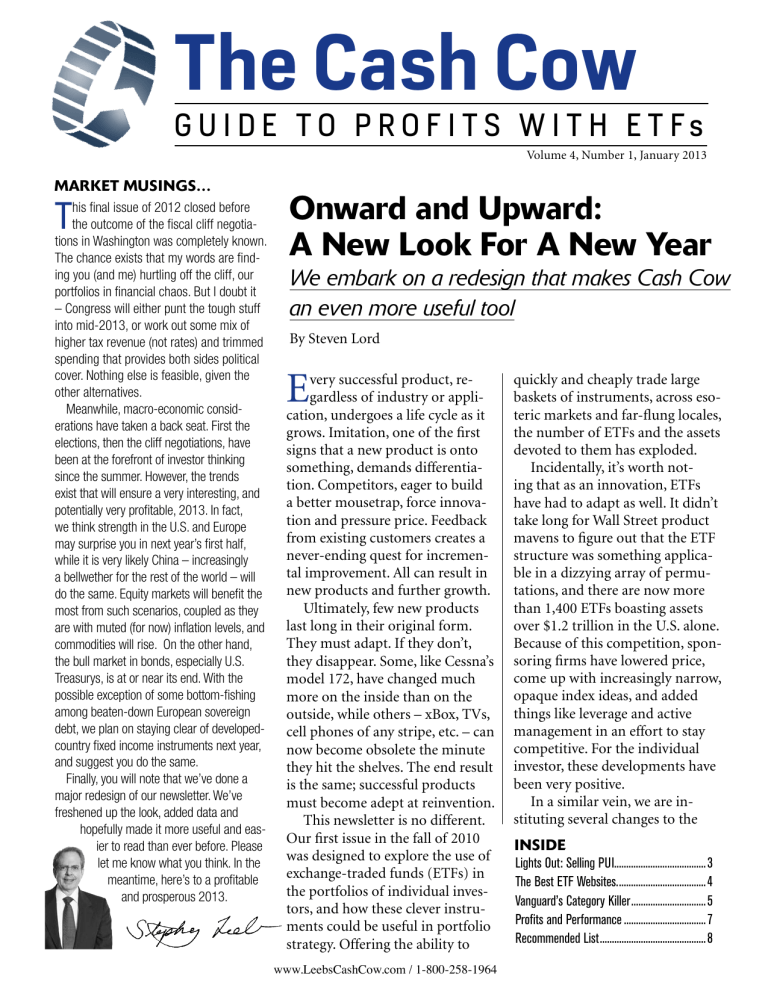

Profits and Performance

Our revised recommended list is easier to read

and follow

T

his issue marks the debut of

a new feature in Cash Cow

whose primary aim is to make our

advice easier to replicate in your

portfolios and thus a more useful

tool in your investment endeavors.

After all, that is the point of our

newsletter.

To this end, we will still be

speaking frankly about which of

our recommendations are working

well, which ones are not, and which

are our best ideas at the moment,

but now it will also be better reflected in the page 8 table. Our goal

remains for Cash Cow to become

an essential investment resource

for you instead of merely casual

reading.

Accordingly, we have been

trimming the number of recommendations carried by this service

in order to concentrate our ideas

into a smaller number of ETFs. Too

many picks essentially defeats the

purpose of this newsletter, which

is to help sort the over 1,400 ETFs

available into coherent and profitable investment ideas.

We keenly understand that the

sheer volume of choices can sometimes make it difficult to distill the

wheat from the chaff; going forward, we will have a much tighter

group of picks.

Our Recommended List on

page eight continues to be exactly

The Cash Cow

that – suggested additions and

deletions among the ETFs we are

favoring at the moment. We do

not expect every one of our ideas

will find its way into your portfolio, but rather those that fit your

personal goals, strategies and risk

tolerances.

If nothing else, we’d like Cash

Cow to give you new ideas about

ways to engage markets, sectors,

instruments, currencies and commodities using ETFs, one of the

cheapest and most versatile innovations to hit Wall Street in several

generations.

We’ve also instituted a system to

help both existing and new subscribers quickly determine our best

ideas at any given moment. Marked

with a star on the Recommended

List, these picks are what we con-

sider to be core holdings suitable

for just about any investor and

portfolio. These are the ones we’d

buy if we could only take a small

handful of our ideas – those we

believe will provide the best and/

or broadest exposure to the various

strategic trends unfolding in commodities, emerging markets, equity

and bond markets over the next

2-3 years. Additionally, these stars

signify which ETFs are the best

places to start for investors who are

new to our service or just getting

their feet wet with ETFs.

Finally, our recent position

closeouts appear nearby, with an

average 8.45 percent gain. The purpose of this table is to provide you

with a sense of our overall performance, since our Recommended

List only includes active recommendations. This also gives us a

way, albeit somewhat unscientific,

to measure the aggregate gain or

loss of our suggestions instead of

losing such information to eternity

once a recommendation has been

closed out. Over time, this system

will give us a way to measure Cash

Cow’s performance against a variety of well-known benchmarks. v

PAST Closeouts

iPath DJ-UBS Copper Total Return ETN (JJC)

-13.00%

iShares Barclays TIPS Bond (TIP)

6.80%

iShares Dow Jones US Pharmaceuticals (IHE)

18.70%

iShares S&P SmallCap 600 Growth (IJT)

21.70%

Market Vectors High Yield Municipal Bond (HYD)

22.80%

Market Vectors Oil Services (OIH)

8.10%

PIMCO Total Return (BOND)

5.00%

PowerShares DB Base Metals (DBB)

-13.70%

SPDR Technology Select Sector (XLK)

19.50%

Average: 8.45%

7

www.LeebsCashCow.com / 1-800-258-1964

Cash Cow Recommended List

Name/Symbol

Recom.

Date

January 2013

Recent

Price

Total

Return

Expense

Ratio Opinion

Annual

Yield

Notes

INCOME

iShares High Dividend Equity (HDV)

1/6/12

60.02

12.1%

0.40%

Hold

3.3%

Fiscal cliff pressured price

Dow Jones Intern. Real Estate (RWX)

9/5/12

41.40

8.6%

0.61%

Buy H

3.8%

Hit another 52-wk. high

iShares Floating Rate Note (FLOT)

8/6/12

50.46

0.9%

0.20%

Buy

1.0%

Stable as bonds rally again

iShares MSCI Australia Index Fund (EWA)

11/8/10

25.18

6.3%

0.52%

Buy

4.6%

Great yield, solid appr. Potential

iShares S&P U.S. Preferred Stock Index (PFF)

10/4/12

39.63

0.3%

0.48%

Buy

5.7%

Unique situation in pfd. stocks

PowerShares Dynamic Utilities (PUI)

8/4/11

17.27

15.5%

0.63%

SELL

2.7%

SELL

PowerShares International Dividend Acheivers (PID) 11/7/11

15.52

6.0%

0.59%

Hold

3.2%

Relative outperformance

S&P Emerging Markets Dividend (EDIV)

2/8/12

44.58

-11.6%

0.62%

Buy

5.9%

Continued bottom at $42-$44

Utilities Select Sector (XLU)

7/6/11

35.43

10.4%

0.18%

Hold

4.1%

Rebounding. See page 3

Vanguard Dividend Appreciation (VIG)

6/6/11

59.80

13.3%

0.18%

Buy H

2.1%

Best combo of yield + apprec.

Vanguard REIT Index (VNQ)

6/6/11

64.97

14.6%

0.12%

Buy

3.4%

RE uptrend gaining steam

Average position return: 6.94%

Hard Assets/Hedge CurrencyShares Australian Dollar Trust (FXA)

10/12/10

104.89

14.7%

0.40%

Hold

Steady in spite of new interest rate cut

CurrencyShares Canadian Dollar Trust (FXC)

9/7/11

100.31

-0.4%

0.40%

Buy

Highly correlated to commodity moves

ETFS Physical Platinum Shares (PPLT)

9/14/10

157.18

-0.9%

0.60%

Buy

Outshining gold and silver at the moment

iShares Silver Trust (SLV)

4/5/11

31.93

-16.7%

0.50%

Buy

Correcting from $36. Weaker $ will help

PowerShares DB Commodity Index (DBC)

10/12/10

27.64

9.9%

0.93%

Buy H

PowerShares DB G10 Currency Harvest (DBV)

9/14/10

26.02

13.9%

0.81%

Buy

New 52-wk high on weaker USD

ProShares UltraShort Yen ETF (YCS)

3/7/12

45.86

1.1%

0.95%

Buy

Trend shift has held; Next stop $48

SPDR Gold Shares (GLD)

9/14/10

164.50

32.6%

0.40%

Buy H

Core ETF holding as inflation hedge

Vanguard Extended Duration Treasury Index (EDV)

10/4/11

128.47

7.1%

0.13%

Hold

Yields 2.8%. Rallied during fiscal cliff

WisdomTree Dreyfus Brazilian Real Fund (BZF)

9/14/10

18.60

-5.4%

0.45%

Buy

Continued flat; NAV over $29

Sector rotation will benefit this ETF

Average position return: 5.6%

Capital Appreciation

Consumer Staples Select Sector (XLP)

5/3/12

35.93

6.1%

0.18%

Buy

Good defensive play + good upside

EGShares China Infrastructure (CHXX)

6/5/12

18.80

22.3%

0.85%

Hold

Signs of China rebound increasing

EGShares Emerging Mkts Consumer (ECON)

9/5/12

25.76

11.3%

0.85%

Buy

New 52-wk high. Excellent LT play

First Trust ISE Global Copper Index (CU)

1/6/12

29.20

-2.1%

0.70%

Buy

Copper at 6-mo. High on China econ.

iShares Latin America 40 Index (ILF)

3/7/12

42.33

-9.2%

0.50%

Buy

Yields 3.1%. Best Lat. Amer. ETF avail.

iShares MSCI Brazil Index Fund (EWZ)

12/7/11

52.77

-11.2%

0.59%

SELL

SELL

iShares MSCI Canada Index (EWC)

7/3/12

28.13

5.8%

0.52%

SELL

SELL

iShares MSCI Switzerland Index (EWL)

9/5/12

26.31

10.3%

0.52%

Hold

New 52-wk high. Strong inflows in Dec.

iShares MSCI Thailand Invest. Market Index (THD)

11/8/10

78.50

10.9%

0.60%

Buy

New 52-wk high. Top Asian market

iShares MSCI Turkey Invest Mkt Index (TUR)

5/3/12

64.08

27.8%

0.59%

Buy

New 52.-wk high. Top Emerging market

iShares MSCI United Kingdom Index (EWU)

1/6/12

17.83

12.3%

0.52%

Hold

Yields 3.5%. Great global exposure

Market Vectors Agribusiness (MOO)

1/6/12

52.02

6.6%

0.53%

Buy

Relative strength vs. rest of equity mkt.

Market Vectors Indonesia Index (IDX)

11/8/10

28.54

-3.7%

0.61%

SELL

SELL

Market Vectors Morningstar Wide Moat (MOAT)

6/5/12

21.83

18.0%

0.49%

Buy H

Large-caps with competitive advantages

S&P Biotech Select Sector(XBI)

8/5/11

87.65

1.8%

0.35%

Buy

S&P Energy Select Sector (XLE)

7/3/12

71.13

5.1%

0.18%

Buy H

Top energy ETF for multi-mkt exposure

S&P Homebuilders (XHB)

2/7/12

25.57

27.9%

0.35%

SELL

SELL

Vanguard Emerging Markets ETF (VWO)

12/7/12

42.89

New

0.18%

Buy

Largest emerging market fund available

Average position return: 8.2%

Data as of 12/06/12 Bold = mentioned in this issue H = Buy “first” pick for new subscribers

Volatile at end of year; buy on dips