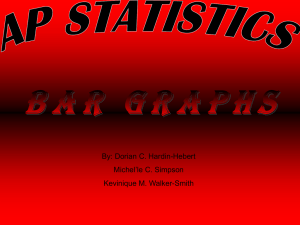

Market Share by Nutrition-Bar Type

advertisement

Sales of high-protein bars continue to climb as others stall By Abbey Lewis alewis@cspnet.com ased on numbers that indicate the category enjoyed an 18.8% jump in average weekly shipments per store, high-protein bars aren’t just for the gym anymore. But in a category full of niches, the energy/diet/granola bar segment better resembles a snowflake, in that no two nutrition bars are alike. Within the alternative-snack segment, the nutrition bar itself can be divided into four distinct subsegments: high-protein, energy, healthy snack and weight management/diet. And within those parameters, high-protein is king. Certainly, the public’s continued fascination with nutritional and diet fads account for high-protein bars’ continued hold over segment sales, B but once again, as with most trends this year, the economy also plays a part, those in the industry say. “Our bars, and other large protein bars, are meal replacements. And when you can find a meal replacement for $2.99 in this economy, it’s really a good value,” says Lucia Crater, a fitness junkie and director of c-store sales for METRx, Ronkonkoma, NY. “They’re a bellyfull. For women, that’s a lot of food! And for men, it’s really quite filling.” Indeed, consumers seem to be drawn to the healthy alternative of a high-protein bar. And the price point, though higher than others in the category, doesn’t seem to be scaring them away. Nielsen counts c-store nutritionbar sales at $209.4 million, up 3.7% during the 52 weeks ending Dec. 27, 2008. The high-protein-bar segment (the largest) owns one-third share of sales, posting the greatest dollar-sales growth, up 12.3%. “It’s a healthy alternative to a meal,” says Jim Powers of Detour, Minden, Market Share by Nutrition-Bar Type C-store sales, 52 weeks ending Dec. 27, 2008 The high-protein segment continued its hold on nutrition-bar sales with a 12.3% increase in c-store dollar volume in 2008, according to Nielsen, while “healthy snack” saw a 2.9% boost. Energy bars, meanwhile, dipped 2.1%, while dollar sales for products designed around specific diet plans fell 3.5%. Dollar share Sources: The Nielsen Co., U.S. Nutrition 86 CSP J u n e 2 0 0 9 High-protein 34.1% “Healthy snack” 28.6% Energy 28.6% Diet plans 8.7% Nutrition Bars by Brand 10 C-store sales, 52 weeks ending Dec. 28, 2008 More than 64% of nutrition-bar dollar sales in 2008 came from the top 10 brands, according to IRI. While Nestlé’s PowerBar Protein Plus led the pack, share was spread fairly evenly between the top three brands. Only four of the top 10, however, posted increases in dollar and unit sales during the second half of the year, all double-digit jumps. C-store sales ($ millions) Dollar sales increase* PowerBar Protein Plus Kellogg’s Special K Protein Clif PowerBar PowerBar Harvest MET-Rx Protein Plus Snickers Marathon PowerBar Triple Threat MET-Rx Big 100 Colossal MET-Rx Big 100 $19.9 $19.8 $19.2 $18.5 $17.0 $16.1 $14.9 $12.5 $11.0 $10.2 +18.6% +84.5% +21.8% –8.6% –6.8% –5.7% –5.0% –11.9% +46.3% –6.6% TOTAL (including brands not shown) $247.9 +3.3% Brand Source: Information Resources Inc. * 26 weeks ending Dec. 28, 2008 Nev. “Protein has gotten a lot of very favorable press over the past two to three years. You don’t necessarily have to get it from red meat, or any other source that may not be as healthy for “The unfortunate part is that probably half the retailers get it. The other half is trying to sell MoonPies.” you. It’s a good-for-you type of protein. … I think the consumer is quite willing to pay about $3 for a 3-ounce bar that is full of good stuff.” In CSP’s 2009 Category Management Handbook, Sheila McCusker, vice 88 CSP J u n e 2 0 0 9 president of strategic insights for Chicago-based Information Resources Inc., said the general perception has been that sales of snack items would decline in this volatile market. But through tracking of the economy’s effect on snack sales, IRI found that it’s not necessarily the case. “There’s increased demand because we’re eating at home more, we’re taking our lunches to work and school more, we’re entertaining at home more, so that all drives up demand,” she said. Average shipments of alternative snacks per store per week by c-store distributor McLane Co.—which includes meat snacks, and diet/meal replacement, energy, protein and healthy bars—rose 13.4% in 2008. This could indicate that, among other things, retailers are paying added attention to space allocation and placement of the category. “I really try to sell the whole category,” Powers says. “If I have a retailer that is willing to allocate time, attention and space to the category in their stores, they’re going to sell some bars. … The unfortunate part is that probably half the retailers get it. The other half is trying to sell MoonPies.” Adapting to Demand This year’s peanut recall threw a wrench in the plans of protein-bar manufacturers attempting to broaden their product assortment in light of the increasing demand for protein. Detour took two SKUs off convenience store shelves, even though “the chances of someone getting sick and killed from eating a Detour bar were absolutely slim to none. But you can’t take that chance,” Powers says. Now that they’re back in the swing of things, manufacturers are indeed ramping up their assortment—big time. Both Detour and MET-Rx say they now offer larger-sized bars in convenience stores. According to Crater, while c-stores have done a good job of luring female customers, the majority of the clientele is still men. To accommodate this consumer, MET-Rx offers its biggest bar in convenience stores. “A woman will buy something big and then she’ll wrap it up and put it in her purse and eat the rest later,” Crater says. “But a man is very unlikely to buy two very small things. Conversely, in food, drug and mass, the lion’s share of what we sell is smaller bars at 50 grams because most of the consumers in food, drug and mass are female and will be drawn to the smaller product.” Alternative-Snack Shipments Calendar year 2008 Average shipments per store per week grew by double digits in 2008 for many of the snack segments, including meat snacks, protein bars, trail mix and packaged popcorn. APSW Product type (dollars) PCYA* Meat snacks Diet/meal replacement Energy Healthy Protein $79.96 $4.75 $7.06 $5.98 $16.34 +11.7% +2.8% +2.2% –0.8% +18.8% Total alternative snacks $139.48 +13.4% Source: McLane Co. * Percent change from a year ago According to Detour’s Powers, their focus is making the good-foryou bar taste good: “I really think we’ve got two consumers—one is highly educated and is buying a bar because they know the protein is good 90 CSP J u n e 2 0 0 9 for them and they use it for exercise; and the other one, who is also very knowledgeable, [is looking for something] healthy, and they know the bar tastes good.” Crater concurs. The flavor and “This consumer is a lifestyle consumer … and they get flavor fatigue. So new flavors or textures are really important.” health combo is crucial to the niche’s success. “This consumer is a lifestyle consumer, in a lot of cases, not in all, but in many,” she says. “And they get flavor fatigue. So new flavors or textures are really important. “If you keep 80% of the set as the ‘golden oldies,’ the ones that have been in the set for years, and you mix it with 20% of the new stuff, it really takes care of this consumer,” Crater continues. “They can have their ‘Steady Eddie’ but they can also try something new to ■ relieve that flavor fatigue.”