Additional Tier 1 capital instruments

advertisement

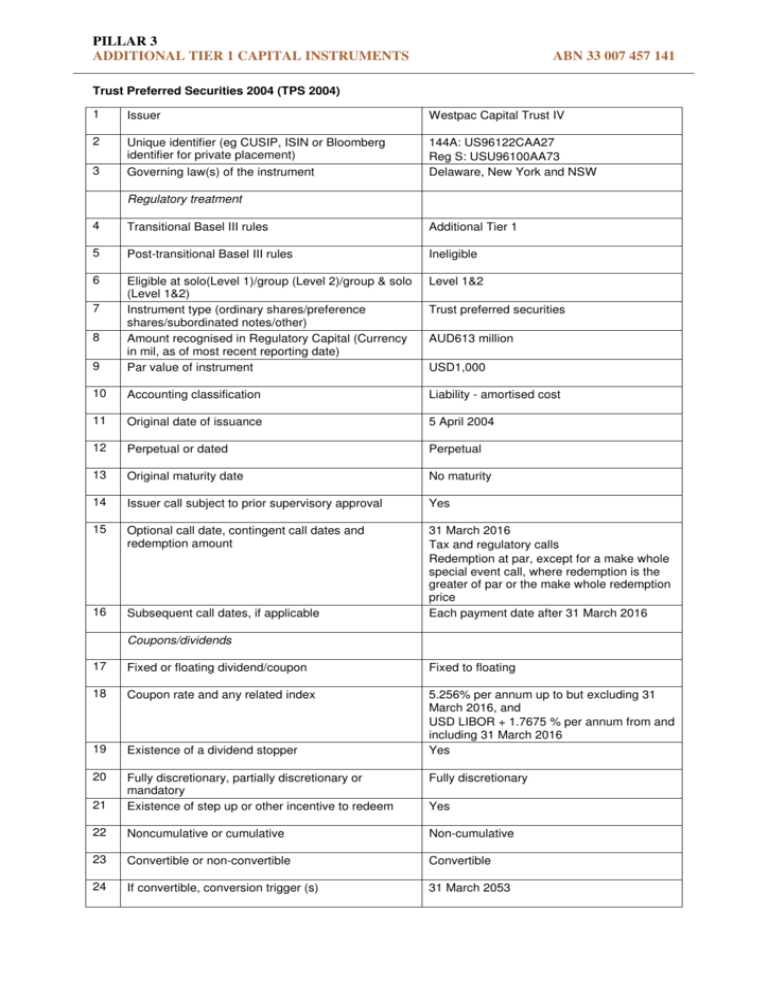

PILLAR 3 ADDITIONAL TIER 1 CAPITAL INSTRUMENTS ABN 33 007 457 141 Trust Preferred Securities 2004 (TPS 2004) 1 Issuer Westpac Capital Trust IV 2 Unique identifier (eg CUSIP, ISIN or Bloomberg identifier for private placement) 3 Governing law(s) of the instrument 144A: US96122CAA27 Reg S: USU96100AA73 Delaware, New York and NSW Regulatory treatment 4 Transitional Basel III rules Additional Tier 1 5 Post-transitional Basel III rules Ineligible 6 Level 1&2 9 Eligible at solo(Level 1)/group (Level 2)/group & solo (Level 1&2) Instrument type (ordinary shares/preference shares/subordinated notes/other) Amount recognised in Regulatory Capital (Currency in mil, as of most recent reporting date) Par value of instrument USD1,000 10 Accounting classification Liability - amortised cost 11 Original date of issuance 5 April 2004 12 Perpetual or dated Perpetual 13 Original maturity date No maturity 14 Issuer call subject to prior supervisory approval Yes 15 Optional call date, contingent call dates and redemption amount 16 Subsequent call dates, if applicable 31 March 2016 Tax and regulatory calls Redemption at par, except for a make whole special event call, where redemption is the greater of par or the make whole redemption price Each payment date after 31 March 2016 7 8 Trust preferred securities AUD613 million Coupons/dividends 17 Fixed or floating dividend/coupon Fixed to floating 18 Coupon rate and any related index 19 Existence of a dividend stopper 5.256% per annum up to but excluding 31 March 2016, and USD LIBOR + 1.7675 % per annum from and including 31 March 2016 Yes 20 Fully discretionary 21 Fully discretionary, partially discretionary or mandatory Existence of step up or other incentive to redeem 22 Noncumulative or cumulative Non-cumulative 23 Convertible or non-convertible Convertible 24 If convertible, conversion trigger (s) 31 March 2053 Yes PILLAR 3 ADDITIONAL TIER 1 CAPITAL INSTRUMENTS Westpac discretion Failure to pay Change of control of trusts Event of default Dissolution APRA events (under a contractual approach) Appointment of a statutory manager New Zealand laws (under a contractual approach) 31 March 2054 – optional holder right to convert Westpac preference shares into Westpac ordinary shares Always convert fully 25 If convertible, fully or partially 26 If convertible, conversion rate 27 If convertible, mandatory or optional conversion 28 If convertible, specify instrument type convertible into 29 Westpac Banking Corporation 30 If convertible, specify issuer of instrument it converts into Write-down feature 31 If write-down, write-down trigger(s) N/A 32 If write-down, full or partial N/A 33 If write-down, permanent or temporary N/A 34 N/A 35 If temporary write-down, description of write-up mechanism Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument) 36 Non-compliant transitioned features Yes 37 If yes, specify non-compliant features No Basel III loss absorption features Step up features Each trust preferred security will be exchanged for one American Depositary Receipt representing 40 Westpac preference shares Each Westpac preference share may convert into USD25 value of Westpac ordinary shares subject to a 5% conversion discount on 31 March 2054 Optional or mandatory Optional for holder right of conversion into ordinary shares on 31 March 2054 Additional Tier 1 or Common Equity Tier 1 None Ranks behind Tier 2 Capital Trust Preferred Securities 2006 (TPS 2006) 1 2 3 4 5 6 Issuer Unique identifier (eg CUSIP, ISIN or Bloomberg identifier for private placement) Governing law(s) of the instrument Regulatory treatment Transitional Basel III rules Post-transitional Basel III rules Eligible at solo(Level 1)/group (Level 2)/group & solo (Level 1&2) 2 Westpac RE Limited AU0000WCTPA9 NSW Additional Tier 1 Capital Ineligible Level 1&2 PILLAR 3 ADDITIONAL TIER 1 CAPITAL INSTRUMENTS 7 8 9 10 Instrument type (ordinary shares/preference shares/subordinated notes/other) Amount recognised in Regulatory Capital (Currency in mil, as of most recent reporting date) Par value of instrument Accounting classification 11 12 13 14 15 Original date of issuance Perpetual or dated Original maturity date Issuer call subject to prior supervisory approval Optional call date, contingent call dates and redemption amount 16 Subsequent call dates, if applicable Coupons/dividends Fixed or floating dividend/coupon Coupon rate and any related index 17 18 19 20 21 22 23 24 Existence of a dividend stopper Fully discretionary, partially discretionary or mandatory Existence of step up or other incentive to redeem Noncumulative or cumulative Convertible or non-convertible If convertible, conversion trigger (s) 25 26 If convertible, fully or partially If convertible, conversion rate 27 28 29 If convertible, mandatory or optional conversion If convertible, specify instrument type convertible into If convertible, specify issuer of instrument it converts into Write-down feature If write-down, write-down trigger(s) If write-down, full or partial If write-down, permanent or temporary If temporary write-down, description of write-up mechanism Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument) 30 31 32 33 34 35 3 Trust preferred securities AUD755 million AUD100 Non-controlling interests in consolidated subsidiary 21 June 2006 Perpetual No maturity Yes 30 June 2016 Tax, regulatory or change of control reasons, also includes a clean up call right Redemption at par Each payment date after first call date Floating (90 day bank bill rate + 1% per annum) x (1 – tax rate) up to and including 30 June 2016, and (90 day bank bill rate + 2% per annum) x (1 – tax rate) from but excluding 30 June 2016 Yes Fully discretionary Yes Non-cumulative Convertible 30 June 2016 and each payment date thereafter Tax, regulatory and change of control reasons and clean up call right Events of default APRA events (contractual approach) 30 September 2055 May convert fully or partially Each trust preferred security converts into one Westpac preference share or in other circumstances each trust preferred security converts into AUD 100 worth of ordinary shares subject to 2.5% discount and a maximum conversion number Mandatory or optional Common Equity Tier 1 or Additional Tier 1 Westpac Banking Corporation No N/A N/A N/A N/A Ranks behind Tier 2 Capital PILLAR 3 ADDITIONAL TIER 1 CAPITAL INSTRUMENTS 36 37 Non-compliant transitioned features If yes, specify non-compliant features Yes No Basel III loss absorption features Step up features Stapled Preferred Securities II (SPS II) 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Issuer Unique identifier (eg CUSIP, ISIN or Bloomberg identifier for private placement) Governing law(s) of the instrument Regulatory treatment Transitional Basel III rules Post-transitional Basel III rules Eligible at solo (Level 1)/group (Level 2)/group & solo (Level 1&2) Instrument type (ordinary shares/preference shares/subordinated notes/other) Amount recognised in Regulatory Capital (Currency in mil, as of most recent reporting date) Par value of instrument Accounting classification Original date of issuance Perpetual or dated Original maturity date Issuer call subject to prior supervisory approval Optional call date, contingent call dates and redemption amount Subsequent call dates, if applicable Coupons/dividends Fixed or floating dividend/coupon Coupon rate and any related index 21 22 23 24 Existence of a dividend stopper Fully discretionary, partially discretionary or mandatory Existence of step up or other incentive to redeem Noncumulative or cumulative Convertible or non-convertible If convertible, conversion trigger (s) 25 26 If convertible, fully or partially If convertible, conversion rate 27 28 29 If convertible, mandatory or optional conversion If convertible, specify instrument type convertible into If convertible, specify issuer of instrument it converts into Write-down feature If write-down, write-down trigger(s) If write-down, full or partial If write-down, permanent or temporary If temporary write-down, description of write-up 30 31 32 33 34 4 Westpac Banking Corporation AU0000WBCPB5 NSW Additional Tier 1 Ineligible Level 1&2 One subordinated note stapled to one preference share AUD908 million AUD100 Liability - amortised cost 31 March 2009 Perpetual No maturity Yes Tax, regulatory or change of control reasons Redemption at par N/A Floating (90 day bank bill rate + 3.8% per annum) x (1 – tax rate) Yes Fully discretionary None Non-cumulative Convertible 30 September 2014 and each payment date thereafter Tax, regulatory or change of control reasons May convert fully or partially Each SPS II converts into AUD 100 worth of ordinary shares subject to 1% discount and maximum conversion number Mandatory or optional Common Equity Tier 1 Westpac Banking Corporation None N/A N/A N/A N/A PILLAR 3 ADDITIONAL TIER 1 CAPITAL INSTRUMENTS 35 36 37 mechanism Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument) Non-compliant transitioned features If yes, specify non-compliant features Ranks behind Tier 2 Capital Yes No Basel III loss absorbency Convertible Preference Shares 1 2 Issuer Unique identifier (eg CUSIP, ISIN or Bloomberg identifier for private placement) Westpac Banking Corporation AU0000WBCPC3 3 Governing law(s) of the instrument Regulatory treatment Transitional Basel III rules Post-transitional Basel III rules Eligible at solo (Level 1)/group (Level 2)/group & solo (Level 1&2) Instrument type (ordinary shares/preference shares/subordinated notes/other) Amount recognised in Regulatory Capital (Currency in mil, as of most recent reporting date) Par value of instrument Accounting classification Original date of issuance Perpetual or dated Original maturity date Issuer call subject to prior supervisory approval Optional call date, contingent call dates and redemption amount NSW 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Subsequent call dates, if applicable Coupons/dividends Fixed or floating dividend/coupon Coupon rate and any related index 21 22 23 24 Existence of a dividend stopper Fully discretionary, partially discretionary or mandatory Existence of step up or other incentive to redeem Noncumulative or cumulative Convertible or non-convertible If convertible, conversion trigger (s) 25 26 If convertible, fully or partially If convertible, conversion rate 27 28 If convertible, mandatory or optional conversion If convertible, specify instrument type convertible into 5 Additional Tier 1 Ineligible Level 1&2 Preference shares AUD1,190 million AUD100 Liability - amortised cost 23 March 2012 Perpetual No maturity Yes 31 March 2018 Tax, regulatory or change of control reasons Redemption at par Each payment date after 31 March 2018 Floating (180 day bank bill rate + 3.25% per annum) x (1- tax rate) Yes Fully discretionary None Non-cumulative Convertible 31 March 2018 and each payment date thereafter 31 March 2020 Capital trigger Tax, regulatory or change of control May convert fully or partially Each CPS converts into AUD 100 worth of ordinary shares subject to 1% discount and maximum conversion number Mandatory or optional Common Equity Tier 1 PILLAR 3 ADDITIONAL TIER 1 CAPITAL INSTRUMENTS 29 30 31 32 33 34 35 36 37 If convertible, specify issuer of instrument it converts into Write-down feature If write-down, write-down trigger(s) If write-down, full or partial If write-down, permanent or temporary If temporary write-down, description of write-up mechanism Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument) Non-compliant transitioned features If yes, specify non-compliant features Westpac Banking Corporation None N/A N/A N/A N/A Ranks behind Tier 2 Capital Yes No non-viability loss absorption features Westpac Capital Notes 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Issuer Unique identifier (eg CUSIP, ISIN or Bloomberg identifier for private placement) Governing law(s) of the instrument Regulatory treatment Transitional Basel III rules Post-transitional Basel III rules Eligible at solo (Level 1)/group (Level 2)/group & solo (Level 1&2) Instrument type (ordinary shares/preference shares/subordinated notes/other) Westpac Banking Corporation AU0000WBCPD1 Amount recognised in Regulatory Capital (Currency in mil, as of most recent reporting date) Par value of instrument Accounting classification Original date of issuance Perpetual or dated Original maturity date Issuer call subject to prior supervisory approval Optional call date, contingent call dates and redemption amount AUD1,383 million Subsequent call dates, if applicable Coupons/dividends Fixed or floating dividend/coupon Coupon rate and any related index Existence of a dividend stopper Fully discretionary, partially discretionary or mandatory Existence of step up or other incentive to redeem Noncumulative or cumulative Convertible or non-convertible If convertible, conversion trigger (s) 6 NSW N/A Additional Tier 1 Level 1&2 Subordinated notes AUD100 Liability at amortised cost 8 March 2013 Perpetual No maturity Yes 8 March 2019 For tax, franking or regulatory reasons Redemption at par N/A Floating (90 day bank bill rate + 3.2% per annum) x (1 – tax rate) Yes Fully discretionary None Non-cumulative Convertible 8 March 2021 and each payment date thereafter Change of control Capital trigger PILLAR 3 ADDITIONAL TIER 1 CAPITAL INSTRUMENTS 25 26 If convertible, fully or partially If convertible, conversion rate 27 28 29 If convertible, mandatory or optional conversion If convertible, specify instrument type convertible into If convertible, specify issuer of instrument it converts into Write-down feature If write-down, write-down trigger(s) 30 31 32 33 34 35 36 37 If write-down, full or partial If write-down, permanent or temporary If temporary write-down, description of write-up mechanism Position in subordination hierarchy in liquidation (specify instrument type immediately senior to instrument) Non-compliant transitioned features If yes, specify non-compliant features 7 Non-viability trigger by APRA (contractual approach) May convert fully or partially Each Westpac Capital Note converts into AUD 100 worth of ordinary shares subject to 1% discount and maximum conversion number Mandatory Common Equity Tier 1 Westpac Banking Corporation Yes Following capital or non-viability trigger if conversion does not occur within 5 business days (under a contractual approach) May be full or partial Permanent N/A Ranks behind Tier 2 Capital No N/A