Monthly Investment Review

RBC Regent Strategy Fund Canadian Dollar Bond 1-5 Year

As at January 31, 2016 - Data in Canadian Dollars

Objective

To provide shareholders with as high a level of total return as is

consistent with preservation of capital through investing in high

grade Canadian Dollar fixed income securities with a maximum

maturity not exceeding five years.

Benchmark

FTSE TMX Canadian Short Term Fed

Fund Particulars

Class F (CAD)

Fund

Size

Yield

NAV per

Share

Bloomberg

Code

ISIN

Code

29.8mm

1.08

101.07

RBCCNBF JY

GB00B07G6W49

Fund Size (CAD): 29.8mm

Investment Manager

RBC Global Asset Management Inc.

PERFORMANCE (Total Return)

Class F (CAD)

Benchmark (CAD)

1 Month

3 Months

YTD

1 Year

3 Years

5 Years

SI*

Launch Date

0.2%

0.3%

0.6%

0.7%

0.2%

0.3%

0.5%

0.9%

2.3%

2.2%

2.3%

2.4%

3.4%

3.4%

18-Apr-05

--

* Since Inception

Returns more than one year are annualized. Class F since inception performance is calculated from the first month-end following inception. Benchmark

since inception performance is calculated from the first month-end following Class F inception. Prior to Sep 01, 2007, the benchmark was the FTSETMX Cda 15 Euro Index. From Apr 18, 2005 to November 21, 2013 the product was managed by RBC Caribbean. Starting on November 22, 2013 the product is managed

by RBC Global Asset Management Inc. For full details of fees and conditions applying to each Class, please refer to the Fund prospectus.

FUND INFORMATION

Top Ten Holdings

Current

Canada Housing Trust 2.35% 15/12/2018

Province of Ontario 4.2% 08/03/2018

Province of British Columbia Canada 3.7% 18-12-2020

Province of Alberta 1.6% 15/06/2018

Toyota Credit Canada 2.48% 19/11/2019

Canadian Credit Card Trust II 1.83% 24-03-2020

BCIMC Realty Corp 2.79% 02/08/2018

Glacier Credit Card Trust 2.75% 20/11/2018

Omers Realty Corp 2.5% 05/06/2014

Canadian Imperial Bank of Commerce/Canada 2.22% 07-03-2018

Total

29.1%

9.8%

8.6%

6.8%

4.1%

4.0%

3.9%

3.8%

3.8%

3.8%

77.8%

Cash and Equivalents

Purchases

N/A

Sales

N/A

3.4%

No. of Holdings

15

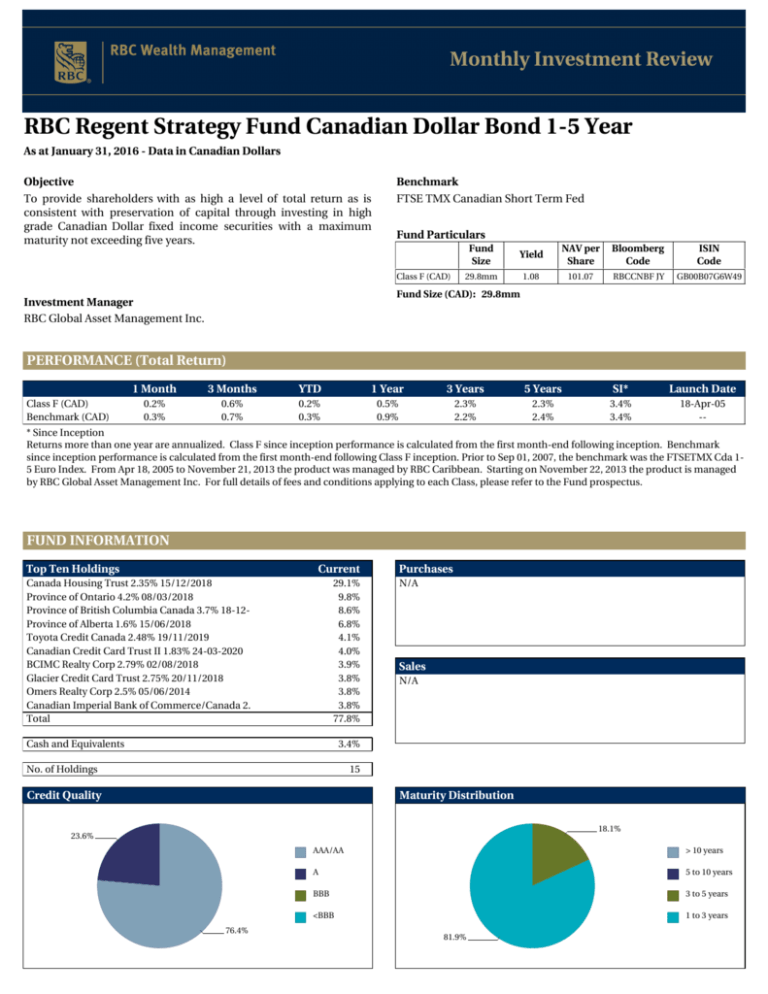

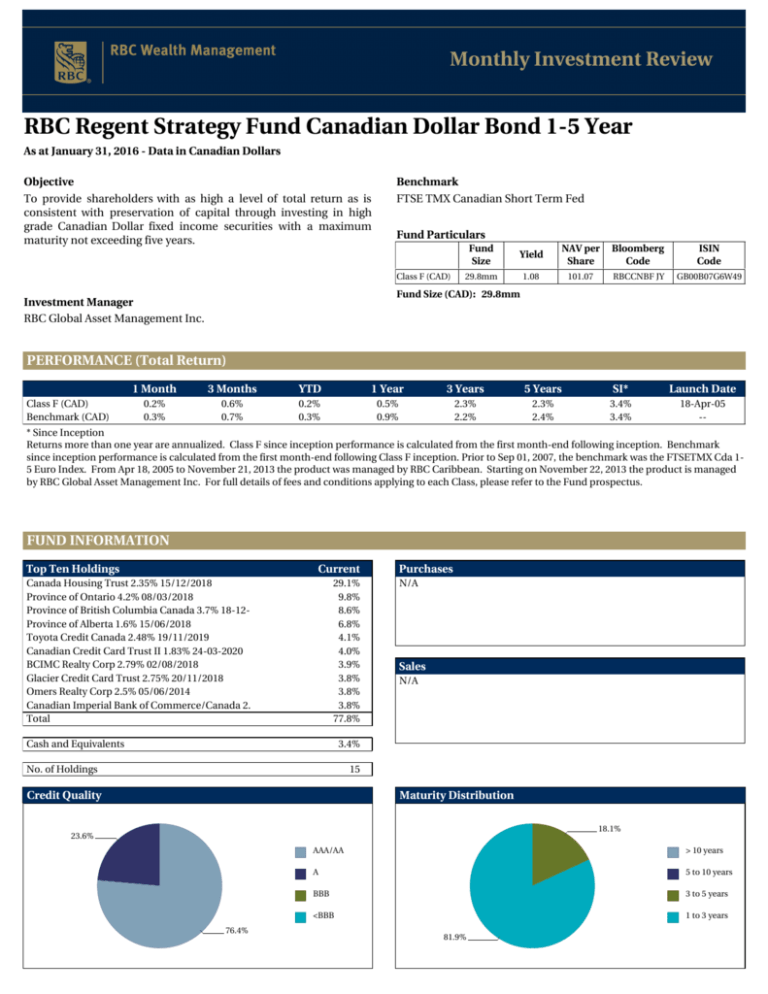

Credit Quality

Maturity Distribution

18.1%

23.6%

76.4%

AAA/AA

> 10 years

A

5 to 10 years

BBB

3 to 5 years

<BBB

1 to 3 years

81.9%

Monthly Investment Review

RBC Regent Strategy Fund Canadian Dollar Bond 1-5 Year

As at January 31, 2016 - Data in Canadian Dollars

PERFORMANCE ANALYSIS

Top 5 Contributors

Beginning

Weight

Security

Return

Security

Contribution

30.1%

8.9%

10.2%

4.3%

7.1%

0.4

0.5

0.1

0.2

0.1

0.11

0.04

0.01

0.01

0.00

Beginning

Weight

Security

Return

Security

Contribution

3.9%

3.9%

3.9%

4.0%

3.9%

(0.1)

0.0

0.0

0.0

0.1

(0.01)

0.00

0.00

0.00

0.00

Canada Housing Trust 2.35% 15/12/2018

Province of British Columbia Canada 3.7% 18-12-2020

Province of Ontario 4.2% 08/03/2018

Toyota Credit Canada 2.48% 19/11/2019

Province of Alberta 1.6% 15/06/2018

Bottom 5 Contributors

Omers Realty Corp 2.5% 05/06/2014

Canadian Imperial Bank of Commerce/Canada 2.22% 07-03-2018

Toronto-Dominion Bank 2.17% 02/04/2014

BCIMC Realty Corp 2.79% 02/08/2018

Bank of Nova Scotia 2.37% 11/01/2018

Portfolio Characteristics

Convexity

Modified Duration

Yield to Maturity

Portfolio

Benchmark

11.01

2.60

1.08

9.89

2.66

0.61

Value Added Chart

3 Year Rolling Added Value

Monthly Added Value in Up Markets

Monthly Added Value in Down Markets

0.6%

0.4%

0.2%

0.0%

-0.2%

-0.4%

May-11

Sep-11

Jan-12

May-12

Sep-12

Jan-13

May-13

Value added calculation is based on performance of Class F Shares.

This report is incomplete without the Legal Disclaimer included on the last page

Sep-13

Jan-14

May-14

Sep-14

Jan-15

May-15

Sep-15

Jan-16

Monthly Investment Review

RBC Regent Strategy Fund Canadian Dollar Bond 1-5 Year

As at January 31, 2016 - Data in Canadian Dollars

Manager and Registrar

RBC Regent Fund Managers Limited, PO Box 194, 19-21 Broad

Street, St Helier, Jersey, Channel Islands, JE4 8RR

Administrator

RBC Offshore Fund Managers Limited, PO Box 246, Canada

Court, Upland Road, St Peter Port, Guernsey, Channel Islands,

GY1 3QE

Dealing

Dealing takes place on a daily basis (between 9am and 4 pm

(Jersey time) on days on which the banks in Jersey are open for

business) with the Shares being issued and redeemed at a

single dealing price equal to the mid market value of the assets

of the Share Class at 5pm (Jersey time) on the previous

business day (or such other time or day determined by the

Manager). The dealing price will be calculated and expressed to

at least four significant figures and rounded to the nearest

unit of currency. The resultant shares will be issued to three

decimal places.

DISCLAIMER

This review has been issued by RBC Regent Fund Managers Limited (“the Manager”) on behalf of RBC Regent Strategy Fund Limited (“the

Fund”).

The Jersey Financial Services Commission (the “Commission”) has granted to the Fund under the Collective Investment Funds (Jersey) Law

1988, as amended (the “Funds Law”) a fund certificate (“Certificate”) as a “Company Issuing Units”. The Commission is protected by the

Funds Law against liability arising from the discharge of its functions under the Funds Law. It must be distinctly understood that in giving

this consent the Commission does not take any responsibility for the financial soundness of the Fund or for the correctness of any statements

made or opinions expressed with regard to the Fund.

Investment in the Fund is through the purchase of shares (“Shares”). This review does not constitute an offer to transact business in the

Shares in any jurisdiction where such an offer would be considered unlawful. The Shares have not been and will not be registered under the

United States Securities Act of 1933, as amended (the “1933 Act”). Except in a transaction which does not violate the 1933 Act, they may not

be directly or indirectly offered or sold in the United States of America, or any of its territories, possessions or areas subject to its jurisdiction,

or to nationals or residents thereof (“US Persons”) including the estate of any such US Person or any corporation, partnership or other entity

created or organised under the laws of the United States or any political sub-division thereof. The Shares have also not been registered with

any authority in Canada and therefore may not be directly or indirectly offered or sold to any resident of any of its jurisdictions. In addition,

the Fund's shares are not being marketed to investors domiciled within the European Economic Area.

Investment in the Fund is only open to certain clients of RBC and is not available to the general public. Certain RBC Wealth Management

offices may not be able to promote the Fund and, depending upon their citizenship and residency, the Shares may not be available to certain

clients or types of clients (for example, applications for Shares made by US Persons or Canadian residents will not be accepted).

Before deciding to invest in the Fund, potential investors should read the latest Prospectus document and note the important regulatory

disclosures and risk warnings, restrictions and acknowledgements contained therein. Readers should also note that, in some or all respects,

the regulatory regime applying in Jersey (including any investor protection or compensation schemes) may well be different from that of their

home jurisdiction. The past performance of any Fund class is not necessarily a guide to any future performance of that class. The price and

value of investments can fall as well as rise and investors may not receive, on redemption of their Shares, the original amount invested.

Changes in rates of exchange between currencies may have an independent effect, which may be favourable or unfavourable, on the value of

investments and income derived from them.

Source: FTSE TMX Global Debt Capital Markets Inc., dba PC-Bond. Copyright © FTSE TMX Global Debt Capital Markets Inc. All rights

reserved. The information contained herein may not be redistributed, sold or modified or used to create any derivative work without the

prior written consent of PC-Bond.

RBC Regent Fund Managers Limited, 19/21 Broad Street, St. Helier, Jersey, Channel Islands, JE4 8RR.

® Registered trademark of Royal Bank of Canada.™ Trademark of Royal Bank of Canada. Used under licence.