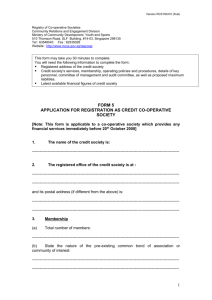

CSBI_CFS1212_CARD SME Bank_ Inc

advertisement