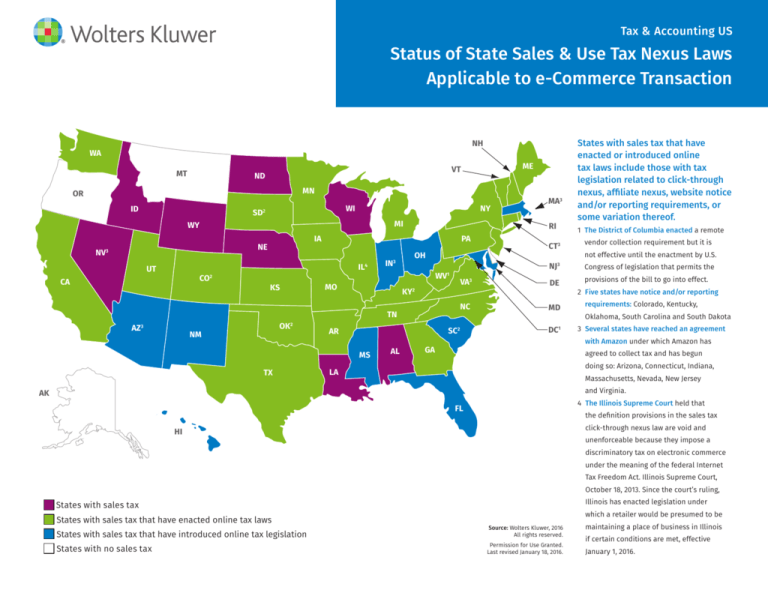

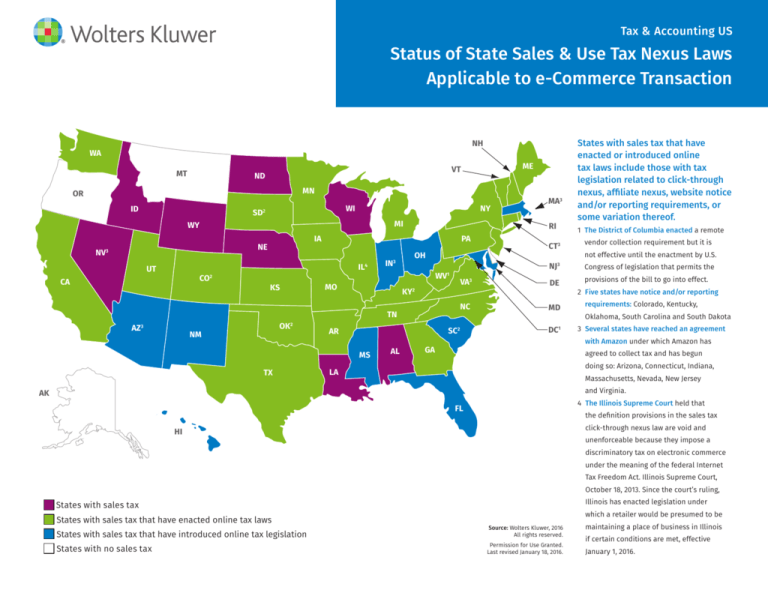

Tax & Accounting US

Status of State Sales & Use Tax Nexus Laws

Applicable to e-Commerce Transaction

NH

WA

MT

ME

VT

ND

MN

OR

ID

WY

SD

MI

UT

CO2

CA

AZ3

PA

IL4

KS

OK2

NM

WV1

KY

TN

vendor collection requirement but it is

NJ3

Congress of legislation that permits the

NC

MD

2

AL

CT

DE

SC

AR

1 T

he District of Columbia enacted a remote

3

VA

3

2

MS

TX

OH

IN3

MO

MA3

RI

IA

NE

NV3

NY

WI

2

States with sales tax that have

enacted or introduced online

tax laws include those with tax

legislation related to click-through

nexus, affiliate nexus, website notice

and/or reporting requirements, or

some variation thereof.

DC1

GA

not effective until the enactment by U.S.

provisions of the bill to go into effect.

2 F ive states have notice and/or reporting

requirements: Colorado, Kentucky,

Oklahoma, South Carolina and South Dakota

3 S

everal states have reached an agreement

with Amazon under which Amazon has

agreed to collect tax and has begun

doing so: Arizona, Connecticut, Indiana,

LA

Massachusetts, Nevada, New Jersey

and Virginia.

AK

4 T

he Illinois Supreme Court held that

FL

the definition provisions in the sales tax

click-through nexus law are void and

HI

unenforceable because they impose a

discriminatory tax on electronic commerce

under the meaning of the federal Internet

Tax Freedom Act. Illinois Supreme Court,

October 18, 2013. Since the court’s ruling,

Illinois has enacted legislation under

States with sales tax

States with sales tax that have enacted online tax laws

which a retailer would be presumed to be

States with sales tax that have introduced online tax legislation

Source: Wolters Kluwer, 2016

All rights reserved.

States with no sales tax

Permission for Use Granted.

Last revised January 18, 2016.

maintaining a place of business in Illinois

if certain conditions are met, effective

January 1, 2016.