Manzana Fruitvale Branch Analysis: Problems & Solutions

advertisement

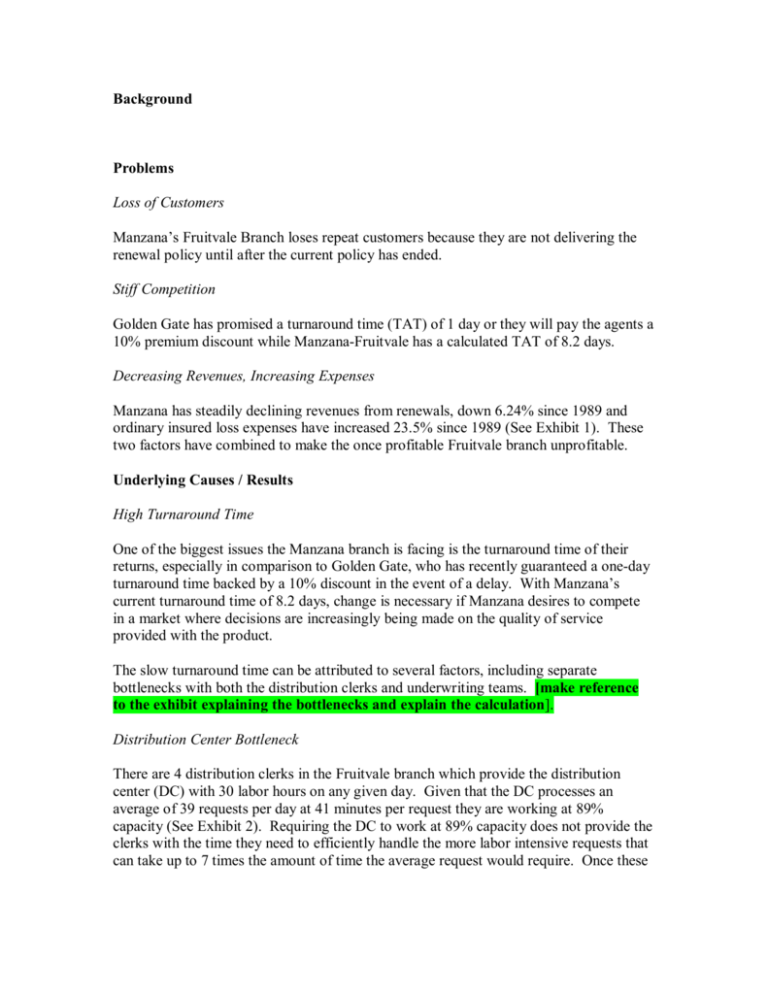

Background Problems Loss of Customers Manzana’s Fruitvale Branch loses repeat customers because they are not delivering the renewal policy until after the current policy has ended. Stiff Competition Golden Gate has promised a turnaround time (TAT) of 1 day or they will pay the agents a 10% premium discount while Manzana­Fruitvale has a calculated TAT of 8.2 days. Decreasing Revenues, Increasing Expenses Manzana has steadily declining revenues from renewals, down 6.24% since 1989 and ordinary insured loss expenses have increased 23.5% since 1989 (See Exhibit 1). These two factors have combined to make the once profitable Fruitvale branch unprofitable. Underlying Causes / Results High Turnaround Time One of the biggest issues the Manzana branch is facing is the turnaround time of their returns, especially in comparison to Golden Gate, who has recently guaranteed a one­day turnaround time backed by a 10% discount in the event of a delay. With Manzana’s current turnaround time of 8.2 days, change is necessary if Manzana desires to compete in a market where decisions are increasingly being made on the quality of service provided with the product. The slow turnaround time can be attributed to several factors, including separate bottlenecks with both the distribution clerks and underwriting teams. [make reference to the exhibit explaining the bottlenecks and explain the calculation]. Distribution Center Bottleneck There are 4 distribution clerks in the Fruitvale branch which provide the distribution center (DC) with 30 labor hours on any given day. Given that the DC processes an average of 39 requests per day at 41 minutes per request they are working at 89% capacity (See Exhibit 2). Requiring the DC to work at 89% capacity does not provide the clerks with the time they need to efficiently handle the more labor intensive requests that can take up to 7 times the amount of time the average request would require. Once these labor intensive requests hits the DC, the clerks become the bottleneck that inflates Fruitvale’s TAT. On top of that the clerks are asked to do more than just process requests. The clerks are also asked to analyze and decimate data published each month by the state insurance commissioner, research and verify competitor prices, oversee rating operations and handle all outgoing RAPS. Assuming that these activities occupy 1 hour of each clerk’s day (which is in our opinion, a conservative assumption), the clerks have only 26 labor hours available per day. This translates into the DC running at 103%, giving the clerks more work than they could possibly finish in the time allotted. Underwriting Team Bottleneck One of the main causes of the bottleneck with the underwriting team is the attitude toward the processing of RERUNs. Bob Melrose, the supervisor of underwriting, believes that RERUNs take care of themselves, saying “as for RERUNs, we’ve got plenty of advance notice, and customers usually renew their policies anyway.” For this reason, the underwriting teams put RERUNs on the backburner to complete the work on RUNs and RAPs first. The problem is that RERUNs are not released to the distribution clerks until the day before the work is due. With this process in place, there is no time to wait in order to finish the RERUN, or they will be late. Decreasing Revenues Since 1989 revenues from renewals have decreased 6.24% because Fruitvale cannot product the renewal policies on time (See Exhibit 1). Agents can only wait so long before they take their customers to an insurance agency that will respond to their needs in a timely manner. A request for policy renewal is automatically generated 30 days before each renewal is to expire. These requests, known as RERUNS, do not enter the request process until 29 days later, 1 day before the customer’s policy expires. If estimated TAT is 8.2 days it is amazing that not all RERUNS are late. Increasing Expenses The trend in the insurance market has been downward for some time and the market appears saturated. With numerous competitors vying for market share price wars are abundant. Insurance companies are forced to accept ever decreasing margins until the market as a whole becomes unprofitable. High Agent/Team Ratio The average Manzana branch serves 20 to 25 independent agents per underwriting team. The smallest branch serves 20 agents per team while the largest serves 21.43 agents per team. Fruitvale is currently serving 25.33 agents per team which potentially puts them at risk of becoming overloaded on requests, which leads to increasing TAT, which leads to decreasing revenues as customers take their business elsewhere. Renewals Increasingly Late RERUNS are increasingly late and the percentage of late RERUNS has increased almost 300% in the last two years. Currently, 44% of all RERUNS are late (See Exhibit 3). This number is unacceptable. How does Fruitvale expect to earn repeat business when almost 1 in 2 renewals arrive late? Broader Issues Faulty Processes and Procedures The biggest issue that Manzana must resolve in order to increase their profitability is their faulty processes and procedures. Improvements could be made in either the processes themselves or to the implementation of current processes, specifically within the distribution and underwriting departments. Market Competition The insurance market is an extremely competitive market with close competition. Historically, Manzana was a strong competitor in the market, but recently their internal problems have weakened their foothold in the marketplace. The products in the market are not very differentiated, so consumer’s decisions are largely based on customer service which is directly related to TAT and not one of Manzana’s current strengths. Available Options Service Fewer Agents Fruitvale can decrease the number of agents they service to bring them within the 20­25 Agents/Team average which would provide Fruitvale with more time to process fewer requests, thereby avoiding bottlenecks. Hire more Distribution Clerks Currently the distribution clerks are working at approximately 103% of capacity. If Fruitvale were to hire one more clerk, DC capacity utilization would then be reduced 82% which would provide the clerks with sufficient time to complete their job responsibilities and avoid being a bottleneck. Reallocate Current Labor Hours If one policy writer was allowed to work in the DC the DC bottleneck would be eliminated and the Policy Writing department would increase capacity utilization from 71%, currently the lowest of all departments, to 89%. Another option is having this policy writer “float” from the DC to the Underwriting department and back to policy writing as needed to decrease TAT. Implement Strict FIFO Manzana currently has a policy of using a straight FIFO system, though it is interpreted and implemented differently by all the different apartments. One recommendation is to actually implement the FIFO system as directed. This way no single type of process will be held back. A majority of the documents that are being submitted late are RERUNs, which are also considered to be the lowest priority by some departments. If the RERUNs are considered as an equal priority, fewer of them will be submitted late. Prioritize by Contribution Hour Another option is to establish the priority of different types of documents to be completed based on the contribution per hour for each type of document. This way the highest yield documents are never late because they are the highest priority, whereas any documents that are late due to high­volume will be the lower­contribution margin items. Expedite RERUNs Currently, RERUNs are being generated 30 days before the anniversary date of the policy, but they are not being given to the distribution clerks until the day before the anniversary. This is so the most current rates are used in issuing the policy, but many of the RERUNs are being completed late. If the RERUNs are given to the distribution clerks one to two weeks earlier, they can be run through the cycle with the straight FIFO process being implemented and completed in a timely manner. Prioritize RERUNs Another option would be to give the RERUNs to the distribution clerks when they are generated 30 days before the anniversary. Instead of implementing a straight FIFO system, the RERUNs would be given a lower priority, so they are worked on by the different departments during down time. This would decrease the intensity of the high­ pressure bottleneck periods and result in less time with no work being done. The disadvantage of this is that the most current market information may not be used, however, RERUNs would be submitted on time resulting in fewer lost revenues. Integrate Computer Automation One possibility is to implement enhanced computer automation in Manzana’s processes. The rating department would be easiest to automate, using a pre­established algorithm to establish current rates. An information system could be developed to make this process much more effective and efficient. Exhibit 1 1989 Gross Premiums New policies Endorsements Renewals 1991 1st 2nd 3rd 4th 1st 2nd Quarter Quarter Quarter Quarter Quarter Quarter Quarter $ 1,546 18.51% $ 1,635 18.39% $ 1,684 18.94% $ 1,763 20.04% $ 1,763 19.88% $ 2,024 23.81% $ 2,172 24.40% 96 1.15% 117 1.32% 138 1.55% 134 1.52% 134 1.51% 158 1.86% 133 1.49% 6,710 80.34% 7,140 80.30% 7,067 79.50% 6,898 78.41% 6,971 78.61% 6,317 74.33% 6,596 74.10% 100.00% $ 8,901 100.00% $ 8,352 Commissions Other Expenses 1990 4th 100.00% $ 8,892 100.00% $ 8,889 100.00% $ 8,797 100.00% $ 8,868 100.00% $ 8,499 856 10.25% 909 10.22% 916 10.30% 924 10.50% 929 10.48% 948 11.15% 1,005 11.29% 85 1.02% 87 0.98% 99 1.11% 132 1.50% 96 1.08% 130 1.53% 0.00% 121 1.36% Net Underwriting Revenue 7,411 88.73% 7,896 88.80% 7,874 88.58% 7,741 88.00% 7,843 88.44% 7,421 87.32% 7,775 87.35% Ordinary Insured Losses Extraordinary Losses Less: Branch Protection* 4,928 59.00% 5,602 63.00% 5,778 65.00% 5,718 65.00% 6,030 68.00% 6,155 72.42% 6,453 72.50% ­ 0.00% ­ 0.00% ­ 0.00% ­ 0.00% 612 6.90% ­ 0.00% ­ 0.00% Gross Underwriting Results Operating Expenses Office rent Property and Equipment Depreciation Finance charge** Salaries Plus Program*** Branch protection Branch allocation**** Other Branch Profit (Loss) Caption ­ 0.00% ­ 0.00% ­ 0.00% ­ 0.00% 400 4.51% ­ 0.00% ­ 0.00% 4,928 59.00% 5,602 63.00% 5,778 65.00% 5,718 65.00% 6,242 70.39% 6,155 72.42% 6,453 72.50% 2,483 29.73% 2,294 25.80% 2,096 23.58% 2,023 23.00% 1,601 18.05% 1,266 14.90% 1,322 14.85% 33 0.40% 36 0.40% 36 0.40% 36 0.41% 36 0.41% 40 0.47% 40 0.45% 7 0.08% 8 0.09% 7 0.08% 6 0.07% 1 0.01% 1 0.01% 2 0.02% 13 0.16% 15 0.17% 15 0.17% 15 0.17% 15 0.17% 16 0.19% 16 0.18% 4 0.05% 5 0.06% 5 0.06% 5 0.06% 5 0.06% 5 0.06% 5 0.06% 961 11.51% 935 10.52% 935 10.52% 935 10.63% 935 10.54% 1,028 12.10% 1,028 11.55% ­ 0.00% 80 0.90% 83 0.93% 87 0.99% 87 0.98% 90 1.06% 97 1.09% 100 1.20% 100 1.12% 100 1.12% 100 1.14% 100 1.13% 100 1.18% 100 1.12% 120 1.44% 120 1.35% 120 1.35% 120 1.36% 120 1.35% 150 1.76% 150 1.69% 7 0.08% 5 0.06% 9 0.10% 5 0.06% 7 0.08% 10 0.12% 5 0.06% 1,245 14.91% 1,304 14.66% 1,310 14.74% 1,309 14.88% 1,306 14.73% 1,440 16.94% 1,443 16.21% $ 1,238 14.82% $ 990 11.13% $ 786 8.84% $ 714 8.12% $ 295 3.33% $ (174) ­2.05% $ (121) ­1.36%