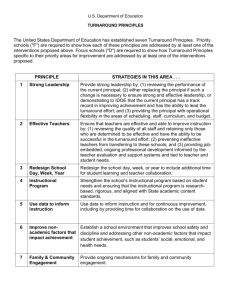

Manzana-2 - ManagementGroupSix

advertisement

Case 2- Manzana Insurance MGMT 601 –Monday - Spring 2011 Group 6- Amit Deshpande, Alex Coates, Natalie Lopez Overall Performance of Manzana-Fruitvale: The Fruitvale branch of Manzana Insurance is struggling right now. “Branch profitability was declining. The backlog policies had increases since 1989, and the number of new policies and endorsements appeared to be stagnating.” To make matters even worse their main competitor, Golden Gate, had no problem taking business away from Manzana while they were struggling. Exhibit 1 shows some of the key metrics for Manzana the past two years and for Golden Gate this year. This shows just how bad of shape Manzana-Fruitvale is in right now. Their renewals are decreasing and they have an extremely high renewals late number (44%). This has led to a very high renewal loss rate (47%) while Golden Gate’s is at just 15%. Even though renewals are the least profitable program for them, losing half of your current business each year is a major problem. Something has to be done to fix this. The current practice at Manzana was to do the new policies (RUNs and RAPs) first. These represented the highest value to the company and employee but doing this has greatly hurt the renewals (RERUNS). When employees get to work in the morning they sift through their work pile for RUNs and RAPs to do first. This practice was not considered company policy but it seems the underwriters were encouraged to do it. In the end, giving priority to new policies pushed renewals to the back of the line and is the main reason that Manzana is seeing ever increasing late and lost renewals. If the company wants the employees to focus on the more profitable new policies they must understand that renewals are going to suffer. Although renewals do not present the same initial value of new policies, losing renewals still represents a significant loss of business. In addition to the poor renewal numbers, Manzana’s turnaround time is much longer than Golden Gate. Golden gate currently has a turnaround time of 2 days (with a promise for 1 day turnaround in the future). On the other hand, Manzana saw their turnaround increase over the past year to 6 days. This is a huge competitive disadvantage for Manzana when agents typically steer their clients to the company with the lowest turnaround time. Turnaround time (TAT) is a key metric in the insurance industry. It can simply be defined as the number of days between the receipt of a new policy and the issuance of a final policy. Agents work mostly on commission so they will naturally lean towards a company with a low TAT. A lower turnaround time means they will get their commission sooner and will be able to sell more policies. “It is not uncommon for an agent to call an insurer for an estimate of the company’s TAT and then refer business elsewhere if issuing a new policy would take too long.” By having such a long TAT (compared to Golden Gate) Manzana is just handing policies over to Golden Gate. This combined with their huge renewal loss rate points to the fact that Manzana is in deep trouble. To make matters worse, Golden Gate has announced that they will implement a guaranteed turnaround time of 1 day. Meanwhile Manzana is currently sitting at a TAT of 6 days. Drastic changes need to be made at Manzana if they want to stay in business Theoretical TAT: The actual TAT at Manzana is currently 6 days. This means that the average policy takes 6 days to create. However, there is also a theoretical TAT. This is the TAT they should be able to achieve if everything is normally done. Exhibit 2 shows the first way to find theoretical TAT. Typically Fruitvale receives 40 requests per day. This can be a rough estimate for the flow rate for an average day. R=40/day. We also know that for the week ending 6 September 1991 they had 82 requests in process. This means that the inventory is 82. I=82. Using Little’s Law, which is T=I/R we find that the flow time for an average policy is 2.05 days. This is the theoretical turnaround time for Manzana-Fruitvale and is much lower than their actual TAT. Another way to find their theoretical TAT is using a flow chart. This can be found in Exhibit 3. The inventory numbers for this were found in the case (Exhibit 3). The flow times for each stage were also found in the case (Exhibit 4) and named “weighted average processing time per request”. With this information the flow rate (R) for each stage can be calculated using Little’s Law. After all the flow rates are calculated the bottleneck can be found. This is the stage that has the lowest flow rate. This is the weakest link and will establish what the maximum flow rate for the entire process is. In this case, Policy Writing is the bottleneck. That stage has a flow rate of 3.3/hour or 24.75/day. This is lower than the flow rate found from Manzana’s estimation of 40 requests per day (this is actually the demand rate). 24.75 days can be used as the flow rate for the process and 82 can be used as the inventory. This leads to a total flow time of 3.31 days. This calculation is shown in Exhibit 4. 3.31 days is another estimate of theoretical TAT (in addition to 2.05 days. While this is a longer time than the first calculation gave it is still much shorter than their current 6 day actual TAT. Causes Of The Problem: The current procedure to calculate TAT assumes that the activities wait for earlier activities to complete. From Exhibit 3, the Underwriting team starts work after 0.6 days after distribution clerk finish their current work. It is assumed that policies move from one activity to another in batches equal to the total number of current policies (work) with that department. Thus, TAT calculation as shown in Exhibit 3 (of the case) seem to be incorrect. The theoretical and actual TAT’s for Manzana are clearly very different. Theoretically it should be about 2-3 days but in reality the turnaround time is 6 days. They are not achieving anywhere close to the TAT that they could be and there are a number of reasons for this. One main reason for this problem is that the current practice at Manzana is to give priority to RUNs and RAPs over RERUNs. Renewals are less profitable to the company and employees so they are often not allowed to interfere with the progress of the more profitable new requests. This is the main reason for the increasingly late renewals and loss of renewals. In addition to delaying renewals and leading to lost policies, this practice also took up some of the employee’s time. They most likely spend a good deal of time searching through policies until they find a RUN or RAP. This can take up some of their time that could otherwise be spent on processing policies. Another cause of their problem is the attention they are paying to RAPs. These only amount to a new policy 15% of the time yet they are being given priorities over renewals that almost certainly will lead to a consistent sale for several years if handled right. In reality a new policy arriving from a RAP is pretty rare and the priority being given to them seems out of whack. Also, the fact that only 15% become RUNs is a source of variability in the system that can cause congestion and increase the average flow time. The due date for RERUNs is known 30 days in advance but they are being sent to the Distribution Clerks only 1 day in advance. This is adding to the late and lost renewals that have become such a problem for Manzana. Waiting for the last day makes the process less flexible and can also lead to a higher variability. Both of these raise the flow time and thus the actual TAT. The salary/plus program may be to blame for Manzana’s problems as well. These employees receive an incentive payment for each new policy written, but receive nothing for a renewal. When there is an incentive for employees to ignore RERUNs and focus on RUNs that is what will most likely happen. Manzana has seen the impact of the commission based salary for new policies only. It has led to a disregarding of renewals and an extremely high late/loss rate for these policies that employees have no incentive to complete. Surprisingly, even the way Manzana calculates TAT may have led to some of their problems. In the case (Exhibit 3) their calculations for Total TAT are shown. Instead of using the time for an average policy they use the 95th percentile standard completion time. This is a much higher number than the average (50th percentile). That is how they got such a high TAT (8.2 days). This is more of a worst case scenario type of calculation and should not be used in an industry when having a lower TAT can lead to much more business. Golden Gate looking much better in comparison (2 day TAT and future 1 day on RUNs) cannot be ignored as a reason for Manzana’s recent struggles. While John Lombard may think that Golden Gate will not be able to live up to their 1 day promise, the possibility has to be accepted. The guarantee is only for RUNs and if Golden Gate gives these the highest priority they may just be able to pull it off, which will lead to even bigger problems for Manzana. Recommendations: Manzana should modify their strategy in terms of the order in which they review policies. They are correct that a FIFO strategy will keep them most efficient, but their modifications to the FIFO strategy are causing problems. Not only are they wasting time in trying to sort the policies, they are doing it wrong. They should focus on RUNS first; RERUNS second, and RAINS and RAPs last (only 15% of RAPs become RUNS). They should also modify procedure for handling RERUNs. Their renewal loss rate is absolutely too high, mostly due to being late. There is no excuse for being late, especially when they always know the date they need to provide the renewal well ahead of time. Manzana should prepare documentation for the renewals approximately 30 days before the policy expires. They should then ensure that the agents receive the paperwork at least 1 week ahead of the expiration. If the due date is known a month in advance then they should be sent to Distribution much sooner. Even a week in advance would greatly increase their ability to adjust their schedules to make sure RERUNs are processed on time without disrupting the flow of new policies. Invest in procedure standardization. While the variation in the insurance business is high overall, be opportunities to standardize types of clients to eliminate rework. Re-visit Manzana employee compensation. The salary plus employees currently receive a bonus for every new policy written. This promotes their modified FIFO structure, which the case proves can be counter productive. The Salary-Plus program has also added approximately 10% to the Salary expense, and no significant increase in the number of new policies written. Marketing Opportunities: 1. While hard to tell, due to the method of calculating TAT, Manzana should evaluate their capability to turn around new requests for underwriting first, to result in a turnaround time of one day. They could then market this as direct competition to the new Golden Gate strategy. 2. Manzana should market that they can turn around ANY policy in less than 3 days, and if not, they will pay agents a penalty of 15%. This option requires them to go to a true FIFO strategy. Although GG will win out on RUNs, Manzana can gain an advantage in the other 3. The Fruitvale branch manager states that the branch is overstaffed. However, the manager fails to understand that there is a significant variation in the input process (processing time for different types of requests) that requires reserve capacity. There must be a compromise between productivity and utilization so that there is enough flexibility within the system to respond to the inherent variability in demand and request processing times. Exhibit 1: New Policies Endorsements Renewals Turnaround time (avg.) Renewals late Renewal loss rate Manzana Fruitvale This Year Last Year 326 278 206 235 2063 1253 6 days 44% 47% 5 days 20% 33% Golden Gate This Year 375 300 1400 2 days NA 15% Exhibit 2: R=40/day I=82 T=I/R T=82/40 TAT=2.05 days Exhibit 3: DISTRIBUTION I=16 R=23.4/hr T=.683 hrs Exhibit 4: Policy Writing = Bottleneck R=3.3/hr or 24.75/day I=82 T=I/R TAT=3.31 days UNDERWRITING I=52 R=109.86/hr T=.473 hrs RATING I=11 R=9.36/hr T=1.173 hrs POLICY WRITING I=3 R=3.3/hr T=.913 hrs