What can be done about Monopolies and Oligopolies? Public Policy

What can be done about Monopolies and Oligopolies?

Public Policy towards Monopolies

We have seen that monopolies, in contrast to competitive markets, fail to allocate resources efficiently. Monopolies produce less than the socially desirable quantity of output and, as a result, charge prices above marginal cost.

Policy makers in the government can respond to the problem of monopoly in one of four ways:

A. By trying to make monopolized industries more competitive

Competition and Consumer Act which is also known as the Trade Practices Act (Australia’s main competition laws) gives the government various ways to promote competition as it preventing anti-competitive behavior. The Act allows the government used to control mergers and to prevent those with substantial market power from using that power to restrict or harm competition.

Competition laws are designed to raise social welfare so the government must be able to determine which mergers are desirable and which are not. However, measuring and comparing the social benefit from merger synergies with the social costs of reduced competition is difficult. Competition laws prohibit mergers of large companies and prevent them from coordinating their activities in ways that make markets less competitive, but such laws may keep companies from merging to gain from synergies.

B. By regulating the behavior of the monopolies

Regulation is often used when the government is dealing with a natural monopoly. Most often, regulation involves government limits on the price of the product. While we might believe that the government can eliminate the deadweight loss from monopoly by setting the monopolist’s price equal to its marginal cost, there are major obstacles to this - it is hard to keep a monopoly in business, achieve marginal-cost pricing, and give the monopolist incentive to reduce costs.

When regulators tell a natural monopoly that it must set price equal to marginal cost, two problems arise. The first is that, because a natural monopoly has a constant marginal cost that is less than average cost, setting price equal to marginal cost means that the price is less than average cost, so the firm will lose money. The firm would exit the industry unless the government subsidized it, but getting revenue for such a subsidy would cause the government to raise other taxes, increasing their deadweight loss. The second problem is that it gives the monopoly no incentive to reduce costs.

Price cap regulation allows the regulated firm to keep all of the benefits from lower costs for a fixed period of time.

This is more encouraging of innovation that simple average cost pricing.

C. By turning some private monopolies into public enterprises

Rather than regulating a monopoly run by a private firm, the government can run the monopoly itself. Monopolies run by private firms have incentives to: (1) reduce costs if they think they will get some of the benefit in the form of higher profits and (2) abuse market power if it raises profits.

The government’s ownership choice will depend on which of these incentives are stronger and have the biggest effect on economic wellbeing and on whether the government can effectively control the actions of a private owner or a public bureaucrat. Governments have been tending to rely more on private ownership and regulation and less on public ownership to control natural monopolies. However, private monopolies can be taken over by the government,

but the companies are not as likely to be well run.

D. By doing nothing at all

Sometimes the costs of government regulation outweigh the benefits. Therefore, some economists believe that it is best for the government to leave monopolies alone. For instances, the competition protection areas are largely covered by the Trade Practice Act and deal with different aspects regulating mergers, the creation of monopolies and other anti-competitive conduct thus the business often argues that the restrictions on mergers are too tight and that the Trade Practices Act needs to be updated - relaxing merger laws. Sometimes doing nothing at all may seem to be the best solution, but there are clearly deadweight losses from monopoly that society will have to bear.

Public Policy towards Oligopolies

Corporation among oligopolies is undesirable from the standpoint of society as a whole, because it leads to production that is too low and prices that are too high. To move the allocation of resources closer to socially desirable level, policymakers’ should try to induce firms in an oligopoly to compete rather than cooperate.

Restraint of trade and competition laws

One way of the policy to discourage co-operation amongst the oligopolies is thorough common law. Getting into agreements and contracts is a common way to trade in developed and developing countries and is usually support by the legal system of a country as far as it encourages effective trade practices when it comes to free trade economies.

Trade Practices Act makes it illegal for corporations to make a contract or arrangement that would substantially lessen competition and it also extends this by making it illegal for firms for firms to form a cartel so that they can agree o agree to fix, control or maintain prices above a competitive level. This law means that oligopolies cannot agree to act together and make their markets less competitive.

Conclusion

Market is a place where buyers and sellers meet and exchange goods or services. And now if we extend this concept a little more, there are certain conditions which create the structure of a market. Such conditions can be condensed in the following –

• Number of Buyers

• Number of sellers

• Buyer Entry Barriers

• Seller Entry Barriers

• Size of the firm

• Product Differentiation/ Homogeneous Product

Oligopoly

• Market Share

• Competition

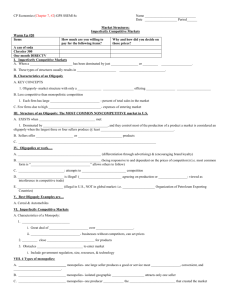

Thus, the following chart to provide the overall understanding of the varied market structures –

Market

Structure

Perfect

Competition

Monopoly

No. of buyers

Many

Many

No. of

Sellers

Many

One

Buyer

Entry barriers

No

No

Seller

Entry

Barriers

No

Yes

Size of the firm

Relatively

Small

Relatively

Large

Average

Product differentiation

No, homogeneous product

No substitute

Homogeneous/diff goods/services erentiated

Market

Share

Small

Many Few No Yes

Highest

Average

Competition

Fierce

No competition

High

However, perfect competition, monopoly and oligopoly can lead to deadweight loss. Governments around the world have responded to this by enacting laws that restrict the behavior of perfect competition, monopolies and oligopolies.

They also have policies that aim to improve the efficiency of these market structures as well.