Annual Report 2011

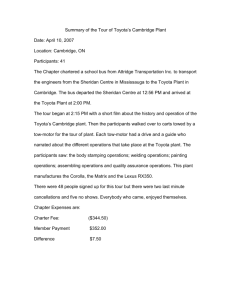

advertisement