Chapter 6

advertisement

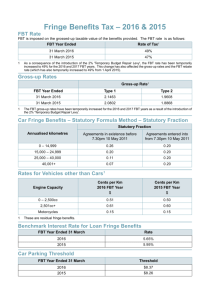

Chapter 6 Fringe benefits tax Objectives After reading this chapter, you should be able to: • identify a taxable fringe benefit provided to an employee; • calculate fringe benefits tax payable for common types of fringe benefits; • explain the method of reporting and paying FBT. 100 Part B: Other federal tax procedures OVERVIEW OF FBT Fringe benefits tax (FBT) is imposed under the Fringe Benefits Tax Assessment Act 1986 (Cth) and its Regulations. The Act is administered by the ATO. For FBT to apply, there must be an employer/employee relationship. Fringe benefits tax is a separate tax paid by employers on the taxable value of any defined fringe benefits provided to employees or their relatives. Any fringe benefits provided are in addition to wages paid to employees. Common types of employer-provided fringe benefits include the private use of motor vehicles, free or low-interest loans, and payments of employees’ private expenses. Fringe benefits tax is paid by employers, not employees. Employers could include individuals, partnerships or companies. Fringe benefits tax is payable irrespective of whether the employer is liable to pay other taxes such as income tax or goods and services tax (GST). From an employee’s point of view, there are no tax consequences for receiving an employer fringe benefit subject to FBT. This is because FBT is paid by the employer. Employers, however, might be required to record any fringe benefits provided on the relevant employee’s payment summary. Fringe benefits tax is an annual tax. An FBT year begins on 1 April and ends on the next 31 March. Relevant employers must self-assess their FBT payable by lodging an annual FBT return with the Australian Tax Office (ATO) by 21 May each year. Employers pay their FBT payable either by quarterly instalments or as a single lump sum, depending on the size of the annual FBT payable. In either case, the final payment must be paid by 21 May after the relevant FBT year. The FBT payable for any FBT year is determined by calculating the grossed-up taxable value of all fringe benefits provided to employees (or their relatives) during the year. A flat FBT rate applies to the total grossed-up taxable value of fringe benefits provided. The current FBT rate is 48.5 per cent. Any FBT payable is tax deductible to employers for income tax purposes. Exercises 6.1 (a) (b) What is fringe benefits tax? Who pays FBT? 6.2 Complete the following statement: ‘An FBT year is the annual period that begins on and ends on .’ 6.3 What is the current FBT rate? DEFINING FRINGE BENEFITS For FBT purposes, a fringe benefit is a benefit provided to an employee (or a relative) in respect of employment. The benefit is provided to the person because he or she is an employee. Note that sole traders are not employees of themselves; Chapter 6: Fringe benefits tax neither are partners employees of partnerships. Sole traders and partners own their businesses. Under FBT legislation, there are defined categories of taxable fringe benefits provided by employers to employees. Various fringe benefits are summarised in Table 6.1. Taxable fringe benefits do not include wages, leave entitlements or other remuneration paid to employees, which are subject to the PAYG system. Employer superannuation contributions paid for employees are also not fringe benefits for FBT purposes (see Ch. 7). Exercise 6.4 Indicate whether each of the following benefits provided by an employer to an employee is a taxable fringe benefit: (a) an employee receives a Christmas cash bonus from the employer; (b) a sales employee uses a company car to do family shopping on weekends; (c) an employer pays the school expenses for the children of an employee; (d) an employer provides an employee with an interest-free loan to purchase a home; (e) an employer allows employees to purchase trading stock at a discount; (f) a legal secretary receives free legal advice from one of the partners of her firm; (g) an employer pays extra superannuation contributions into a superannuation fund for its employees; (h) an employee is paid sick leave while absent from work; (i) a company pays its directors directors’ fees as well as salaries. TAXABLE VALUE OF FRINGE BENEFITS To determine any FBT payable, employers must first calculate the taxable value of all fringe benefits provided to employees during the FBT year. There are specific valuation rules for working out the taxable value of each fringe benefit shown in Table 6.1. This section calculates the taxable value for three of the most common fringe benefits: • car fringe benefits; • loan fringe benefits; • expense payment fringe benefits. Car fringe benefits A car fringe benefit occurs where a vehicle owned or leased by the employer is used or made available to an employee (or a relative) for private purposes. ‘Private purposes’ means any purpose other than in the course of producing 101 102 Part B: Other federal tax procedures Table 6.1 Fringe benefits categories Type of fringe benefit Description of fringe benefit Car fringe benefits A car owned or leased by an employer is used for private purposes by an employee (see next section). Loan fringe benefits An employer provides a loan to an employee interestfree or at an interest rate below the statutory rate for the FBT year (see next section). Expense payment fringe benefits An employer pays for, or reimburses, private expense incurred by an employee (see next section). Debt waiver fringe benefits An employer releases an employee from the obligation to repay any debt owed to the employer; the unpaid amount is a debt waiver fringe benefit. Housing fringe benefit An employer provides residential accommodation to an employee rent free or at a reduced rent. Meal fringe benefits An employer provides at least two meals a day to an employee who is also provided with residential accommodation by the employer. Airline transport fringe benefits An employee of an airline or travel agent is provided with free or discounted air travel on a standby basis. Living away from home allowance fringe benefits An employer pays an allowance to an employee to compensate for additional living expenses incurred because the employee is temporarily required to live away from his or her usual place of residence in order to perform employment duties. Entertainment provided by a tax-exempt organisation An employer who is wholly or partially exempt from paying income tax provides an employee with entertainment which is non-deductible for income tax purposes. Car parking fringe benefits An employer provides a car parking facility to an employee where there is a commercial car parking station available for all day parking within one kilometre which charges more than a specified fee per day. Property fringe benefits An employer provides an employee with property (e.g. goods, stock, real estate) either free or at a discount. Residual fringe benefits An employer provides an employee with any right, privilege, service or facility, not covered above (e.g. free use of employer’s property, provision of free services by employer). Chapter 6: Fringe benefits tax 103 assessable income for the employer. Examples of private use are shopping journeys, holiday travel and travel between home and work. If a vehicle is kept at or near the employee’s place of residence, it will also be deemed to be available for private use and subject to FBT. The vehicles covered include sedans, station wagons, mini buses, panel vans, utilities or any other vehicle designed to carry less than one tonne or fewer than nine passengers. The following vehicles, however, are exempt from FBT, if they are used by an employee only for travelling to and from work and other private use is minor. These vehicles include taxis, panel vans and commercial vehicles (except passenger-carrying ones) designed to carry a load of less than one tonne. Motor cycles and unregistered vehicles are also excluded from FBT. There are two methods of valuing car benefits: the statutory formula method, and the operating cost method. Employers can use either method for any vehicle each FBT year. Statutory formula method A statutory formula can be applied to calculate the taxable value of each vehicle benefit. The formula to apply for any vehicle is as follows: ABC D – E = Taxable value of car fringe benefit ($), where: A is the base value of the vehicle. If the employer owns the vehicle, this is the original cost price. Alternatively, if the vehicle is leased by the employer, it is the cost price of the vehicle when the lease commenced. Note, however, if the vehicle was owned or leased by the employer for more than four years before the beginning of the FBT year, the cost price is reduced by one-third. B is the relevant statutory fraction, which depends on the total number of kilometres travelled by the vehicle during the FBT year [see Booklet—Tax Rate Table E for FBT rates showing statutory fractions]. Where the car was used for only part of the year, the kilometres travelled is annualised. This is necessary to get the total distance that would have been travelled for the whole year. For example, the annualised distance travelled for a vehicle travelling 6000 kilometres over three months of usage would be: 12 months ¥ 6000 km = 24 000 km 3 months C is the number of days during the FBT year in which a car fringe benefit was provided in relation to the vehicle. 202 104 Part B: Other federal tax procedures D is the number of days in the FBT year. E is the amount of the recipient employee’s payment (if any) for the use of the car or for non-reimbursed car expenses paid. Example 1 Dellway Pty Ltd provides a car to an employee, which was used for both business and private purposes. The following information is given for the FBT year: • car used by employee for whole of the FBT year • cost price of car $18 000 • when purchased 3 years ago • total kilometres travelled during the FBT year 19 820 km • employee payments or contributions to expenses $0 • number of days car held and available for private use 365 days Say the relevant statutory fraction based on the annual kilometres travelled during the FBT year is 0.20. The taxable value of the car benefit is calculated as follows using the statutory formula method: $18 000 ¥ 0.20 ¥ 365 days 365 days – $0 = $3600 Operating cost method The operating cost method uses specific costs to value each vehicle benefit. Employers who choose this method must keep a log book for each relevant vehicle for any consecutive twelve-week period during the year and subsequently every five years. A log book shows how the actual business percentage use of the vehicle is worked out. The formula to apply for any vehicle under the operating cost method is as follows: C ¥ (100% BP) – R = Taxable value of car fringe benefit ($), where: C is the total annual operating costs of running the car during the FBT year. Annual operating costs include: • petrol and oil; • repairs and maintenance; • registration and insurance; • lease payments (if vehicle is leased); • depreciation and imputed interest (if vehicle is owned). Depreciation is calculated by multiplying the depreciated written-down value of the car at the start of the FBT year by 22.5 per cent. If the car was purchased or disposed during the FBT year, depreciation is apportioned to reflect part-year use. Chapter 6: Fringe benefits tax Similarly, the imputed interest is calculated by multiplying the depreciated value of the car at the start of the FBT year by the statutory interest rate (see next section). BP is the business percentage use gathered from the log book. R is the amount of the recipient employee’s payment (if any) for use of the car or for non-reimbursed car expenses paid. Example 2 Use the same information as shown in the previous example. The following additional information is also given for the FBT year: • business use percentage as per log book 82% • statutory interest rate (say, is) 7.55% • operating costs comprise: — petrol $2 150 — repairs and maintenance $1 107 — registration and insurance $1 264 • depreciated written-down value of car at start of FBT year $12 120 • depreciation calculated as follows: $12 120 ¥ 22.5% ¥ 365 days = $2727 365 days • imputed interest calculated as follows: $12 120 ¥ 7.55% ¥ 365 days = $915 365 days The taxable value of the car benefit is worked out as follows under the operating cost method: Total operating costs: $2150 + $1107 + $1264 + $2727 + $915 = $8163, therefore: $8163 ¥ (100% – 82%) – $0 = $1469 In these two examples, the employer would choose to use the operating cost method to minimise the FBT payable. Loan fringe benefits If an employer provides an employee with a very low-interest or interest-free loan for private purposes, a taxable fringe benefit arises. Loans include advances of money or the provision of credit, but not loans of property. The taxable value of a loan fringe benefit is the amount by which the current statutory interest calculated on the loan exceeds the amount of interest that has actually been charged on it for the FBT year. That is: 105 106 Part B: Other federal tax procedures = 202 Taxable value of loan fringe benefit ($) (statutory interest % – actual interest %) ¥ loan amount ($) The statutory interest rate is the standard variable bank rate for owneroccupied housing loans at the start of the FBT year. The rate is published by the Reserve Bank of Australia [see Booklet—Tax Rate Table E for FBT rates showing the statutory interest rate]. Example Dellway Pty Ltd loans an employee $10 000 for private purposes at the start of the FBT year. The interest rate charged on the loan is 3 per cent. Assume the statutory interest rate is 7.55 per cent. The taxable value of the loan benefit for the FBT year is calculated as follows: (7.55% – 3%) ¥ $10 000 = $455 Expense payment fringe benefits An expense-payment fringe benefit arises when an employer pays (or reimburses) the private expenses of an employee. Private expenses of an employee include telephone accounts, children’s school fees, private health insurance, mortgage repayments, rates and holiday travel costs. The taxable value of the benefit is the amount of the expense the employer pays (or reimburses) to the employee. The taxable value, however, is reduced by the amount of any employee contribution received. If there is any part of the expense that the employee would have otherwise been entitled to claim as an allowable income tax deduction, the taxable value is also reduced by that amount. This is provided the employer’s payment was intended to cover only the business-use portion of the employee’s bill paid. Figure 6.1 shows how the taxable value of an expense payment fringe benefit is calculated. Example Dellway Pty Ltd pays the following private expenses of an employee during the FBT year: • private health insurance $960 • children’s school fees $2 400 The employee did not contribute to the payment of these expenses and is not entitled to claim them as an allowable income deduction. The taxable value of the expense payment fringe benefit here is the amount of the expenses paid, being $3360. Chapter 6: Fringe benefits tax Figure 6.1 Taxable value of expense payment fringe benefit Amount of private expense paid or reimbursed by employer ($) less Amount of any employee contribution received ($) less Amount of employer's payment intended to cover the business-use portion of the employee's bill paid ($) equals Taxable value of expense payment fringe benefit ($) Exercises 6.5 6.6 6.7 6.8 Distinguish between private use and business use of an employer’s motor vehicle. Give an example of each. What are the two optional methods used to work out the taxable value of a car fringe benefit? How is the statutory interest rate determined for each FBT year? What is the statutory interest rate for the current FBT year? Give three examples of employees’ private expenses paid by an employer which are taxable fringe benefits. CALCULATING FBT PAYABLE Because FBT is based on a self-assessment system, employers must calculate their FBT payable (if any) for each FBT year. Table 6.2 summarises the steps to follow for calculating an employer’s annual FBT payable for any FBT year. 107 108 Part B: Other federal tax procedures Table 6.2 Summary of FBT calculation steps Step one: Identify each taxable fringe benefit provided to employees during the FBT year. Step two: Calculate the taxable value of each fringe benefit. Step three: Total the taxable values of each fringe benefit to calculate the aggregate taxable value. Step four: Apply the gross-up factor to the total taxable value to work out the grossed-up taxable amount (there are different gross-up factors for Type 1 and Type 2 fringe benefits). Step five: Apply the FBT rate (%) to the grossed-up taxable amount to calculate the annual FBT payable. Steps one and two The calculation process begins by totalling the taxable values of any fringe benefits provided to employees during the FBT year (see Table 6.1). Step three The sum or aggregate of the taxable values of all fringe benefits provided must next be grossed-up to determine the grossed-up amount—also called the fringe benefits taxable amount. Step four The gross-up factor to apply depends on whether the fringe benefits provided are classified as Type 1 or Type 2 benefits. Type 1 benefits are those where the employer is entitled to claim GST input tax credits for GST paid when acquiring the benefit. An example of a Type 1 benefit is where an employer buys a business vehicle to provide for the private use of an employee. The price paid by the employer for the vehicle includes GST. Type 2 benefits refer to all other fringe benefits provided—being benefits where the employer is not entitled to claim a GST input tax credit. The gross-up factor to apply is calculated according to either of the following formulas: (a) Type 1 benefit gross-up factor: FBT rate + GST rate (1 – FBT rate) ¥ (1 + GST rate) ¥ FBT rate (b) Type 2 benefit gross-up factor: 1 1 – FBT rate Chapter 6: Fringe benefits tax Example If the FBT rate is 48.5 per cent (and the GST rate is 10%), the gross-up factor to apply is therefore: (a) For Type 1 benefits: 0.485 + 0.10 = 2.129 189 (1 - 0.485) ¥ (1 + 0.10) ¥ 0.485 (b) For Type 2 benefits: 1 = 1.9417 1 - 0.485 The aggregate taxable value of the fringe benefits provided is multiplied by the gross-up factor. The gross-up factor to apply depends on whether the benefits are categorised as Type 1 or Type 2 benefits. Step five Once the grossed-up taxable amount is known, the FBT rate is applied to calculate the tax payable; that is: aggregate taxable value ($) ¥ Type 1 or 2 gross-up factor ($) ¥ FBT rate (%) = FBT payable ($) Example The taxable values of car fringe benefits an employer provided to employees during the FBT year are summarised as follows: Gross taxable value of benefits $ • car 1 (under statutory formula) 1840 • car 2 (under actual operating cost) 3630 Total taxable value of benefits Less Taxable employee value of contributions benefits $ $ 220 0 1 620 3 630 5 250 Say the car benefit under the statutory method is categorised as a Type 1 benefit, whereby the employer claimed a GST input tax credit at the time of acquisition. The other car benefit is classified as a Type 2 benefit. Assume the FBT rate is 48.5 per cent (and the GST rate is 10%). The grossed-up taxable amount is calculated as follows: 109 110 Part B: Other federal tax procedures $1620 (Type 1 benefit) ¥ 2.129 189 (gross-up factor) $3630 (Type 2 benefit) ¥ 1.9417 (gross-up factor) = = Total grossed-up taxable amount $ 3 449 7 048 10 497 The FBT payable is therefore calculated as: $10 497 ¥ 48.5% = 5 091 Exercises 6.9 Explain the difference between Type 1 and Type 2 fringe benefits. 6.10 If the aggregate taxable value of fringe benefits provided to employees during the FBT year were $3600, and all the benefits provided are Type 1 benefits: (a) Calculate the grossed-up taxable amount. (b) Calculate the FBT payable. 6.11 The aggregate taxable value of fringe benefits provided to employees during the FBT year is $7280. Of these benefits, $4600 are Type 1 benefits and the other benefits are Type 2. (a) Calculate the grossed-up taxable amount. (b) Calculate the FBT payable. REPORTING AND PAYING FBT Annual FBT returns WWW Employers must self-assess any FBT liability for each FBT year. This is done by completing an annual FBT return (available from the ATO) for the relevant FBT year, which runs from 1 April to the next 31 March. The return is due at the ATO by 21 May after the end of the relevant FBT year. Alternatively, FBT returns can be lodged online via the Internet (go to www.ato.gov.au). The employer’s tax file number must be shown on all FBT returns lodged. Payment of FBT An employer’s FBT liability is due to be paid to the ATO by 21 May after the FBT year ends. Employers who are lodging an FBT return for the first time, or whose FBT liability for the previous year was less than $3000, pay the tax as a lump sum. Payment is due when the return is due. A completed remittance advice (available from the ATO) must also accompany the payment. Payments can be made personally at the post office or mailed direct to the ATO. Chapter 6: Fringe benefits tax If the employer’s FBT liability in the previous FBT year was $3000 or more, the employer must pay FBT for the following year by quarterly instalments during the year. The instalments are notified on the Business Activity Statement (BAS) or Income Activity Statement (IAS) for each quarter and are based on last year’s FBT liability. Payment of a final balance might also be necessary with the lodgement of the annual FBT return. The due dates for FBT instalments are as follows: Instalment Due date First FBT instalment Second FBT instalment Third FBT instalment Fourth FBT instalment Final FBT balance required (if any) 28 28 28 28 21 July October February April May Employers may vary any quarterly FBT instalments notified by the ATO on the BAS (or IAS), if they believe their expected annual FBT payable will be lower. The general interest charge is payable, however, if estimated instalments are too low. Fringe benefits tax instalments paid are credited against the annual FBT liability, self-assessed at the end of the FBT year. The instalments paid are subtracted from the annual tax assessed when the FBT return is lodged for the FBT year. If there is a shortfall, a final balance is payable; for an overpayment, the excess is claimed as a refund. Other administrative requirements Employers are required to disclose, on payment summaries issued to employees, the grossed-up taxable value of most fringe benefits they provide to employees where the value of the benefit exceeds $1000. Reportable benefits here include car fringe benefits, loan fringe benefits and expense payment fringe benefits provided. For FBT purposes, employers must keep records explaining how they calculated their FBT liability for five years after the date of the relevant transactions. Exercises 6.12 6.13 What is the due date for lodging an annual FBT return? In what circumstances are quarterly instalments of FBT paid? OFFENCES AND PENALTIES Table 6.3 shows some of the main offences and maximum penalties under FBT legislation and the Taxation Administration Act 1953 (Cth). 111 112 Part B: Other federal tax procedures Table 6.3 Offences and penalties Type of offence Maximum penalty Failure to lodge FBT return 200 per cent of FBT False or incorrect FBT return 200 per cent of FBT avoided Late payment of FBT and/or FBT instalments General interest charge is payable on FBT from date it was due Chapter 6: Fringe benefits tax Key terms annual FBT liability employee employer FBT year fringe benefit gross-up factor grossed-up taxable amount statutory fraction statutory interest rate taxable value For updates and other online resources, head to your Online Learning Centre at www.mhhe.com/au/birt Quick quiz Each of the following multiple-choice items has one correct answer. Select the letter which corresponds with the correct answer. 1. Which one of the following payments by an employer to an employee is subject to FBT? (a) annual cash bonuses for work performance (b) reimbursements for work-related travel (c) earnings for overtime work (d) none of the above. 2. Which one of the following fringe benefits provided by an employer to an employee is not subject to FBT? (a) superannuation contributions (b) domestic expenses paid (c) subsidised employer loans (d) private use of employer’s car. 3. To calculate any taxable value of a loan fringe benefit provided to an employee, you need to know the: (a) statutory interest rate (b) fringe benefits rate (c) statutory fraction (d) personal tax rate. 4. The total taxable value of fringe benefits (all Type 1 benefits) provided to employees during the FBT year was $1800. If the FBT rate is 48.5 per cent, the grossedup taxable amount is therefore: (a) $873 (b) $1800 113 114 Part B: Other federal tax procedures (c) $3495 (d) $3833 (e) $4126. 5. Using the information given in the previous item, the FBT payable is: (a) $873 (b) $1695 (c) $1859 (d) $3000 (e) none of the above. 6. The FBT year ends on: (a) 31 March (b) 1 April (c) 28 April (d) 21 May (e) 30 June. 7. If an annual FBT return is required, it must be lodged by: (a) 31 March (b) 28 April (c) 30 April (d) 21 May (e) 30 June. 8. If your FBT paid last year was $860, the FBT for next year is paid to the ATO by: (a) monthly instalments (b) quarterly instalments (c) annual lump sum (d) none of the above. 9. Relevant records must be kept for FBT purposes for: (a) three years (b) five years (c) six years (d) seven years. 10. Which one of the following statements is incorrect? (a) Employers must disclose their income tax file number on an FBT return. (b) Fringe benefits tax paid by an employer is an allowable deduction for income tax purposes. (c) Every employer must lodge an annual FBT return. (d) Late payers of FBT are liable for the general interest charge. Chapter 6: Fringe benefits tax True or false Indicate whether each of the following statements is true or false. 1. The FBT system is administered by the federal remuneration authority. 2. Fringe benefits tax applies to payer/contractor relationships. 3. Fringe benefits tax is paid by employees. 4. Sole traders cannot provide taxable fringe benefits to themselves. 5. Directors’ fees paid by companies are taxable fringe benefits. 6. Fringe benefits tax is a quarterly tax. 7. Fringe benefits tax taxpayers self-assess their FBT liability. 8. All fringe benefits provided must be disclosed on payment summaries issued to payees. Practical problems 6.1 During the FBT year, Westend Pty Ltd provided a car to an employee that was used for both business and private purposes. The company began leasing the vehicle during the previous FBT year. The following information is given for the current FBT year: • car used by employee for whole of the FBT year • list price of car (at start of lease) $34 000 • when leased 1 year ago • total kilometres travelled during FBT year 25 820 km • employee payments or contributions to expenses $0 • number of days car held and available for private use 365 days • business use percentage as per log book 74% • operating costs comprise: — petrol $2 980 — repairs and maintenance $1 240 — registration and insurance $2 120 — lease payments $7 200 • the car benefit is a Type 2 fringe benefit. 115 116 Part B: Other federal tax procedures To do: (a) Calculate the taxable value of the car benefit under both the statutory formula method and the operating cost method. (b) Which method is preferable? Why? [Refer to the Booklet—Tax Rate Table E for FBT rates showing the standard FBT rate, statutory fractions and the statutory interest rate.] 202 6.2 During the FBT year, Norm’s Real Estate Agency provided a car to an employee, which was used for both business and private purposes. The following information is given for the FBT year: • car used by employee for whole of the FBT year • cost price of car $26 000 • when purchased 2 years ago • total kilometres travelled during FBT year 26 640 km • employee payments or contributions to expenses $150 • number of days car held and available for private use 365 days • business use percentage as per log book 88% • operating costs comprise: — petrol $3 360 — repairs and maintenance $1 420 — registration and insurance $1 834 • depreciated value of car at start of FBT year $19 772 • the car benefit is a Type 1 fringe benefit. To do: (a) Calculate the taxable value of the car benefit under both the statutory formula method and the operating cost method. (b) Which method is preferable? Why? (c) Complete the following calculations for the FBT return: • total taxable value $ • grossed-up taxable amount $ • FBT payable $ [Refer to the Booklet—Tax Rate Table E for FBT rates showing the standard FBT rate, statutory fractions and the statutory interest rate.] 202 6.3 The following fringe benefits were provided by Sefton Pty Ltd to employees for the FBT year: • The company provides an employee with a car that was available for private use every day. The company purchased the vehicle in the previous FBT year for $36 000. The vehicle travelled 24 000 kilometres in the year and the employee contributed $1500 to the running costs. No log book was maintained. Chapter 6: Fringe benefits tax 117 • A loan of $40 000 at 3 per cent per annum interest was made to an employee at the start of the FBT year, to renovate her private residence. The employee pays interest only on the loan. • The company paid the following private expenses for an employee: — children’s school fees $500 — private health insurance $750 — home council rates $600 — holiday travel $1 000 — home telephone $200 If the employee had paid the telephone bill himself, he would have been able to claim $300 as an allowable deduction. The employer’s payment was intended to cover only the business-use portion of the employee’s telephone bill. Only the car benefit provided was a Type 1 fringe benefit. To do: (a) Calculate the company’s total FBT liability for the FBT year. (b) When must the company lodge its FBT return for the FBT year? When must it pay FBT to the ATO? (The FBT paid for the previous FBT year was $1200.) [Refer to the Booklet—Tax Rate Table E for FBT rates showing the standard FBT rate, statutory fractions and the statutory interest rate.] 202