Net Assets / Equity - Archdiocese of Saint Paul and Minneapolis

advertisement

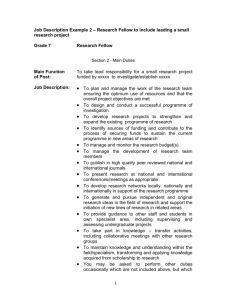

Chapter 11 X Net Assets / Equity The net assets of a parish represent its financial worth. These values are calculated as the excess or deficiency of assets over liabilities. Net assets are found on the Statement of Financial Position (Balance Sheet), along with Assets and Liabilities. The net asset balances may be categorized into as many as four classes depending on the existence or absence of donor restrictions or board designations. The purpose of this policy is to provide guidance in categorizing, recording and reporting parish and school net assets on parish financial statements or, in the case of an independent regional school, the school financial statements. ACCOUNTING POLICY The Archdiocese of Saint Paul and Minneapolis has defined a standardized chart of general ledger accounts for use by all parishes and schools. Separate accounts are established for unrestricted, temporarily restricted and permanently restricted net assets and the related income and expense accounts. Unrestricted net assets may also be designated for specific purposes by leadership. This chapter is closely aligned to Chapter 12, Revenue Recognition. SCOPE When a parish or school receives a donor contribution or special gift, it must be classified into one of the following three net asset categories; unrestricted, temporarily restricted or permanently restricted. The reasons for classification are to establish proper accounting treatment for the gift and determine appropriate financial statement disclosure. In order to choose the proper category for a donation, staff must know the distinction between the category labels designated and restricted. Designations are not necessarily related to a specific gift and are made by authorized leadership. Restrictions are made by a donor at the time of the donation and can only be changed by communication from the donor. The donor has the most powerful influence over a gift. He or she may restrict a gift for a particular purpose. Leadership, including the pastor, does not have authority to contradict or change a donor restriction without the donor’s permission. As long as there are no donor restrictions on a particular donation, authorized leadership may designate the donation for a specific purpose. This designation may be changed or removed at a later date as long as the change is authorized using the appropriate process. It is recommended that a parish, independent or regional school develop a written policy regarding receipt of gifts with donor restrictions and designation of gifts by leadership. CHAPTER 11 – NET ASSETS/EQUITY PAGE 1 OF 10 Net Asset Categories Listed below (in order from no restriction to greatest level of restriction) are the categories for Net Asset classification. Unrestricted Net Assets are donor contributions with no specific conditions or restrictions. The parish/school can use the funds as leadership sees fit as long as the use meets the parish/school’s tax exempt purpose. Examples include Sunday giving or a contribution to the parish/school with no specific obligation or conditions. See journal entry example # 11-1. Parish or Board Designated Contributions (Unrestricted Designated) are contributions without donor restrictions, but subject to leadership designations. Leadership may decide to set aside unrestricted contributions for a specific use. An example of an unrestricted-board designated contribution is a large contribution that has not been restricted in any manner by the donor but the leadership decides to direct the funds to a specific purpose such as a building project. See journal entry example # 11-2. Temporarily Restricted Net Assets result from contributions given for a specific purpose or for use in a specific time period. These restrictions can only be eliminated when the funds are spent for the restricted purpose OR in the case of a time restriction when the appropriate amount of time passes. An example of a temporarily restricted contribution would be a gift received by a parish for a specific program or project. Other examples include capital campaign contributions and school scholarship fund contributions given for use in a specific school year. Any unfulfilled restrictions should be reviewed by the pastor, trustees, and finance council or independent/regional school board on a regular basis or at a minimum, annually. If the restrictions are not fulfilled, a decision must be made as to whether the funds must be returned to the donor(s) or if the donor(s) could be contacted to alter the restriction. See journal entry example # 11-3 and # 11-5. Journal entries should also be made if the restriction has to do with debt reduction contributions. The entries will not be reflected on the Statement of Activities (Income Statement), only on the Statement of Financial Position. Permanently Restricted Net Assets result from donor contributions given to be held in perpetuity. These restrictions generally cannot be eliminated through the passage of time. An example of a permanently restricted contribution would be an endowment or large donation where a donor prohibits the parish or school from spending the initial gift, but allows spending of the interest/investment income associated with the gift. As a note, the investment income from such a gift may also be temporarily restricted by the donor. In these situations, the donor may require that these funds be held in a specific bank or investment account so interest earnings may be tracked. See journal entry example # 11-4. Recording of Net Assets Net asset recording and reporting processes vary depending on the level of designation/restriction. See decision tree # 11-6 for an illustration to help determine the classification of gifts. Unrestricted Net Assets increase when unrestricted income exceeds unrestricted expenses and decrease when unrestricted expenses exceed unrestricted income. The CHAPTER 11 – NET ASSETS/EQUITY PAGE 2 OF 10 balance of net unrestricted net assets is displayed on the Statement of Financial Position. See journal entry example # 11-1. Restricted and Designated Net Assets involve more detailed recording and reporting. Once the restricted gift is accepted or leadership designates funds for a particular purpose, the parish or school has an obligation to track contributions against expenses incurred. Designated and Restricted Net Assets involve the following four steps for proper recording and reporting. 1) Upon acceptance of a gift, the necessary general ledger accounts must be determined. (See Chapter 3, Parish/School Chart of Accounts Structure). These typically include revenue and expense accounts on the Statement of Activities and a net asset/equity account on the Statement of Financial Position. Net asset activity should be recorded in a separate fund or within non-operating accounts. 2) As contributions are received and spent during any given month, the activity should be recorded in the appropriate revenue and expense accounts. This activity should be recorded in a separate fund or non-operating accounts. This separation allows income and expense to be recognized without affecting the bottom line of the operating income statement. 3) At month-end, a summary journal entry is made to update net asset balances. The entry should adjust the balance up or down based on net revenue and expense account activity during the month. 4) At each month-end (and year-end), a reconciliation to net asset balances against detailed records is done as a part of the period end. See decision tree # 11-7 for an illustration to help determine if a restriction remains. As a note, processes outlined above may be adjusted for parishes/schools that wish to reflect some designated/restricted revenues and expenses within their operating account activity. In the case of a parish/school that budgets for designated revenue and/or spending during the year, it may be more appropriate to show this activity within operating accounts. Examples of this type of net asset treatment are school scholarship funds or endowment fund revenues that are included in the annual operating budget. Reporting of Net Assets All categories of net asset balances are disclosed in the Net Assets section of the Statement of Financial Position. In the case of designated and restricted gifts, the numbers on the Statement of Financial Position represent remaining balances of restricted or designated contributions (net of related expenses) in each net asset class, as of the report date. The Undesignated Net Asset portion of the Net Assets section on the Statement of Financial Position represents the remainder of parish, independent or regional school equity available for future operating activities. CHAPTER 11 – NET ASSETS/EQUITY PAGE 3 OF 10 The Statement of Financial Position/Balance Sheet follows the following formula: Assets = Liabilities + Net Assets/Equity Please see Chapter 1, Important Concepts for more detailed information. Revenues and expense activities related to Net Asset contributions are reflected on the Statement of Activities. Generally, this activity is recorded in non-operating revenue and expense accounts. However, under certain circumstances, designated fund revenues and expenses may flow through operating accounts. DEFINITIONS Parish/Board Designated Contributions (Unrestricted Designated): Unrestricted net asset that have been identified for a specific use, as determined by authorized leadership. Endowment Fund: An investment fund set up by a parish, independent or regional school in which regular withdrawals from the fund are used for ongoing operations or specific purpose. Most often the principal portion of the endowment is permanently restricted from use. Leadership: Parish leadership includes the Corporate Board, the pastor, two trustees, and members of the pastoral and finance councils. Parish and school leadership would include the pastor, trustees, and school board members. Independent/regional school leadership would include the pastors of sponsoring parishes as well as the remaining school board. Also, the moderator (or canonical administrator) would be included if he was not one of the pastors from the sponsoring schools. Permanently Restricted Net Asset: An asset with a permanent donor imposed restriction such as an endowment fund. Statement of Activities (Income Statement): A financial statement that measures an entity’s financial performance over a specific accounting period. Financial performance is assessed by giving a summary of how a parish and or school incurs its revenues and expenses. It also shows the increase and decrease in net assets incurred over a specific accounting period, typically over a fiscal quarter or year. Statement of Financial Position (Balance Sheet): A financial statement that summarizes an entity’s assets, liabilities and net assets at a specific point in time. These three balance sheet segments give readers an idea as to what the entity owns and owes. The balance sheet follows the following formula: Assets = Liabilities + Net Assets/Equity Temporarily Restricted Net Asset: An asset that has a donor imposed restriction such as fulfilling a specific purpose and/or the passage of time. Unrestricted Net Asset: An asset that has no donor imposed restrictions. CHAPTER 11 – NET ASSETS/EQUITY PAGE 4 OF 10 IMPLEMENTATION GUIDANCE & JOURNAL ENTRIES Journal Entry Examples: 11-1 Unrestricted Net Assets At the end of the year: Debit: Year-End Revenue Balances Credit: Year-End Expense Balances Debit: Unrestricted Net Assets (offset of expenses) Credit: Unrestricted Net Assets (offset of revenues) xxxxx xxxxx xxxxx xxxxx Note that most accounting software automatically records this entry. Check with your software provider before making this entry. 11-2 Parish/Board Designated Contributions: At the time of donation: Debit: Cash Credit: Revenue: Unrestricted Revenue At the time of designation: Debit: Unrestricted Net Assets Credit: Parish/Board Designated Net Assets xxxxx xxxxx xxxxx xxxxx When expenses are incurred for the designated purpose: Debit: Expense xxxxx Credit: Cash xxxxx Debit: Parish/Board Designated Net Assets Credit: Unrestricted Net Assets xxxxx xxxxx Note, a journal entry to adjust the classification of net assets may be done on a monthly basis versus each time revenue is recognized or an expense is incurred. 11-3 Temporary Restrictions: At the time of the donation: Debit: Cash Credit: Revenue-Temporarily Restricted Debit: Unrestricted Net Assets Credit: Temporarily Restricted Net Assets xxxxx xxxxx xxxxx xxxxx Note, that most accounting software automatically records this entry. Check with your software provider before making this entry. At the time that the restriction is met: Debit: Expense Credit: Cash Debit: Temporarily Restricted Net Assets Credit: Unrestricted Net Assets CHAPTER 11 – NET ASSETS/EQUITY xxxxx xxxxx xxxxx xxxxx PAGE 5 OF 10 To record the release from Temporarily Restricted to Unrestricted equal to the expense. Note, a journal entry to adjust the classification of net assets may be done on a monthly basis versus each time revenue is recognized or an expense is incurred. 11-4 Permanent Restrictions: At the time of the donation: Debit: Cash Credit: Revenue-Permanently Restricted Debit: Unrestricted Net Assets Credit: Permanently Restricted Net Assets xxxxx xxxxx xxxxx xxxxx Note, that most accounting software automatically records this entry. Check with your software provider before making this entry. If restricted cash account set up: Debit: Cash-Restricted Credit: Cash xxxxx xxxxx To record earnings on Permanently Restricted (Endowment) Fund Investments: Debit: Cash or Investments (Unrestricted or Restricted) xxxxx Credit: Endowment Income xxxxx (If applicable): Debit: Unrestricted Net Assets Credit: Temporarily Restricted Net Assets xxxxx xxxxx To record distributions from an Endowment Fund: Debit: Cash xxxxx Credit: Investment xxxxx Debit: Permanently Restricted Net Asset Credit: Unrestricted Net Asset xxxxx xxxxx Note, a journal entry to adjust the classification of net assets may be done on a monthly basis versus each time revenue is recognized or an expense is incurred. 11-5 Entries for payments that reduce a liability on Statement of Financial Position: At the time of payment of a liability: Debit: Debt Principal Payment Credit: Cash Debit: Temporarily Restricted Net Assets Credit: Unrestricted Net Assets xxxxx xxxxx xxxxx xxxxx To record the release from Temporarily Restricted to Unrestricted equal to the expense. Note, a journal entry to adjust the classification of net assets may be done on a monthly basis versus each time revenue is recognized or an expense is incurred. CHAPTER 11 – NET ASSETS/EQUITY PAGE 6 OF 10 Classifying Receipts: The following decision tree will assist you in correctly classifying receipts and ensuring proper accounting recognition. CHAPTER 11 – NET ASSETS/EQUITY PAGE 7 OF 10 End of Period Review Procedures: The following decision tree will assist in the reconciliation of net asset balances. Additionally it will aid in the review of donor imposed restricted balances in order to determine if the designation is still valid. As a note, restricted designations can only be removed by the donor so contact with the donor may be necessary. CHAPTER 11 – NET ASSETS/EQUITY PAGE 8 OF 10 Sample Financial Statement Presentation: Balance Sheet Statement of Financial Position as of 06/30/20XX 1000 1020 1020 1090 1110 CURRENT ASSETS Checking Account Savings Account Building Improvement Savings Tuition Receivable Prepaid Expenses LONG-TERM ASSETS 1310 Church building 1300 Land 1200 Endowment Account Last Year Current Year 200,000 70,000 513,050 500,000 2,300 1,800 29,000 15,000 1,200 1,000 995,000 425,000 83,750 1,000,000 425,000 95,000 CURRENT LIABILITIES 2100 Accounts Payable 2110 Salaries Payable LONG-TERM LIABILITIES 2400 Building Loan 3000 3050 3100 3200 TOTAL ASSETS $ 2,249,300 $ 2,107,800 Last Year Current Year 108,250 13,000 2,500 875,000 800,000 NET ASSETS Unrestricted Net Assets 1,167,500 1,180,500 Unrestricted -Board Designated Bld Repairs 2,300 1,800 Temporarily Restricted-Mission Trip 12,500 15,000 Permanently Restricted-Endowment Fund 83,750 95,000 TOTAL LIAB & NET ASSETS $ 2,249,300 $ 2,107,800 Income Statement Statement of Activities for the fiscal year ended 06/30/20XX 4000 4010 4070 4310 4235 4340 OPERATING ACTIVITY REVENUES Envelope Plate Bequest-Special Gift School Tuition & Fee Income Program Fees Rental Revenue 50XX 60XX 6500 50XX 60XX 62XX 6230 6410 EXPENSES Church Salaries & Benefits Church Operations Expense ASPM Assessments School/Program Salaries & Benefits School/Program Expense School Facility Expense Loan Interest Expense Rental Building Expense 1,000,000 10,000 25,000 750,000 250,000 165,000 $ 2,200,000 625,000 200,000 105,000 915,000 70,000 200,000 50,000 22,000 $ 2,187,000 NET OPERATING SURPLUS 8XXX 8XXX 8XXX 9XXX 9XXX 9XXX $ DESIGNATED/NONOPERATING ACTIVITY REVENUES Temporarily Restricted - Mission Trip Collections Board Designated - Building Fund Income Permanently Restricted - Endowment Fund Income $ EXPENSES Temporarily Restricted - Mission Trip Travel Expense Board Designated - Building Fund Contractor Fee Permanently Restricted - Endowment Fund Mailing $ NET DESIGNATED/NONOP ACTIVITY $ 13,000 4,000 500 12,000 16,500 1,500 1,000 750 3,250 13,250 Statement of Cash Flows for the fiscal year ended 06/30/20XX Use of cash from operations: Plus Net Operating Surplus Plus Net Board Designated Surplus Less Temporarily Restricted Loss Change in Tuition Receivable Change in Prepaid Expense Change in Accounts Payable Change in Salaries Payable Total use of cash from operations Use of cash from investment activity: Plus Permanently Restricted Surplus Change in Endowment Account Total use of cash from investment activity Use of cash from construction activity: Church Building Costs Use of cash from debt activity: Loan Principal Payments Total use of cash for all activity Beginning Cash Balance - 7/1/20xx Ending Cash Balance - 6/30/20xx CHAPTER 11 – NET ASSETS/EQUITY $ 13,000 2,500 (500) 14,000 200 (95,250) 2,500 (63,550) 11,250 (11,250) (5,000) $ (75,000) (143,550) 715,350 571,800 PAGE 9 OF 10 REFERENCES AND RESOURCES Archdiocesan Chart of Accounts is found at these locations: 1. Electronically on the Archdiocese of Saint Paul and Minneapolis Extranet under: Finance and Administration Parish Financial Manual Chapter 3: Parish/School Chart of Accounts Structure 2. Hard copy located in the Parish Financial Manual Chapter 3, Parish/School Chart of Accounts Structure. CHAPTER 11 – NET ASSETS/EQUITY PAGE 10 OF 10