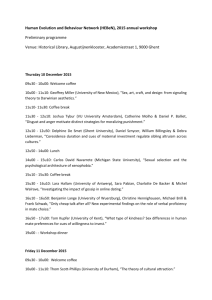

Nestlé & Kraft Foods (International Business Strategy)

advertisement