Chapter 3 WHAT IS MONEY?

advertisement

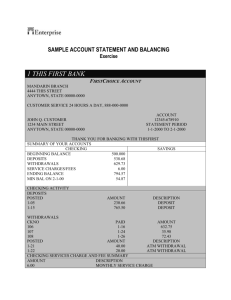

Chapter 3 WHAT IS MONEY? MEANING OF MONEY In ordinary conversation, we commonly use the word money to mean income ("he makes a lot of money") or wealth ("she has a lot of money"). Money (or money supply) refers to anything that is generally accepted in payment for goods or services or in the repayment of debts. Money is a stock concept. It represents a certain amount at a given point in time. Money is distinguished from wealth and income. Wealth of a person (or a nation) is the value of assets owned minus the value of liabilities owed (to foreigners in the case of a nation) at a point in time. The assets include those that are tangible (land, houses, furniture, cars, collectibles, arts and capital) and financial (money, bonds, etc.) Wealth serves as a store value. Wealth is a stock concept that is measured at a given point in time. Income refers to the flow of earnings per unit of time TYPES OF MONEY: Money consists of Currency: The paper notes and coins that people use in a country. They are money because government declares them so. (legal tender) Deposits at banks and other depository institutions are also money. Deposits are money because they can be converted into currency and because they are used to settle debts. Currently, deposits are the largest proportion of money. 1 Exercise: Are Checks money? The answer is no. The check is only a way to instruct your bank to transfer money from your account to another person’s account. However, deposit accounts are money Exercise: Is credit card considered money? The answer is No. It is not legal tender. What a credit-card purchases really represents is just an extremely convenient, pre-approved loan. It's only part of the transaction, since the merchant then goes to the bank that issued the credit card to get money, and the bank sends you a bill which must be paid with money. Credit card is just an ID card that lets you take out a loan at the moment you buy something. FUNCTIONS OF MONEY Money has three primary functions in any economy: as a medium of exchange, as a unit of account, and as a store of value. Of these three functions, its function as a medium of exchange is what distinguishes money from other assets such as stocks, bonds, and houses. Medium of Exchange Money is used as a medium of exchange in the form of currency or checks. It is used to pay for goods and services. The use of money as a medium of exchange promotes economic efficiency by minimizing the time spent in exchanging goods and services, which is called transaction cost. In a barter economy, transaction costs are high because people have to satisfy a “double coincidence of wants”; i.e., they have to find someone who not only has 2 a good or service they want but also wants the good or service they have to offer. It is very difficult to find another individual who has what you want, and wants what you have. With the invention of money, you no longer need to find another individual who has what you want, and wants what you have. All you need to do is to find someone who has what you want, and you buy it from him/her with "money". The problem of double coincidence of wants is avoided. Money reduces the high search costs that are characteristic of barter exchanges. Divisibility of money makes the exchange of different quantities of items possible and simple The use of money as a medium of exchange also promotes economic efficiency by allowing people to specialize in what they do best. Specialization increases productivity and enhances trade among people, which improves people’s standards of living Unit of Account Unit of account refers to the use of money to measure value in the economy; i.e., you can use it to price goods and services. Quoting prices in terms of dollars or dinars is a lot easier than quoting prices in terms of other goods. Before the invention of money (i.e., in the stage of bartering), prices were expressed in relation to the goods traded. For example. Ali traded 2 cows for 20 bushels of wheat with Maryam. In this case, 1 cow is worth 10 bushels. If Ali traded 3 cows for 6 sheep with Yosuf, each cow is worth 2 sheep. What is the price of sheep if Maryam and Yosuf traded with each other? If we have 10 goods in the barter system we would have 45 different prices N( N − 1 ) 10( 9 ) = = 45 while using money we need only 10 prices 2 2 With the invention of money, a unit of account has been chosen to measure the prices of goods and services. This makes the comparison of the prices among 3 goods and services easier. For example, the cow is worth 50 units of "money", the sheep 25 units, and a bushel of wheat 5 units. Using money as a unit of account reduces transaction costs (information and exchange costs) in an economy by reducing the number of prices that need to be considered. Store of Value The function of money as a store of value refers to the use of money to preserve purchasing power of money from the time income received until the time it is spent. This function facilitates the exchange of goods and services over time. Money is not unique as a store of value. There are many other assets can be used as a store of value such as stocks, bonds, real estate, collectibles, arts, etc. In fact, many such assets have advantages over money as a store of value. They earn a return while money (as cash) does not earn a return. However, money is the most liquid of all assets because it is the medium of exchange; it does not need to be converted into anything else to make purchase. Other assets involve transaction costs when they are converted into money. Liquidity refers to the relative ease and speed with which an asset can be converted into a medium of exchange. Money also has no default risk. Money in bank accounts earns some interest and is guaranteed against default by Central Bank’s deposit insurance. The problem of money as a store of values is that it loses value during inflation. 4 THE EVOLUTION OF MONEY AND THE PAYMENTS SYSTEM The payments system refers to the method of conducting transactions in the economy. The payment system and money have been evolving over centuries from commodity money at one point in history to e-money in the recent days, and innovations will not stop here. Commodity Money Commodity Money is money that is made up of precious metals or other valuable commodities that have intrinsic value (are valuable in their own right). Examples of commodity money could include gold, cows, and pretty shells. From ancient times until several hundred years ago commodity money functioned as the medium of exchange in most of the societies. In ancient times, people used rocks, leather, salt and shells as money The Roman Byzantine used gold coins (denarius) and the Persians used silver coins (drachma) as currency When the Prophet s.a.w. brought about economic reforms, he continued the use of the Roman denarius and the Persian drachma, known among the Arabs as dinar and dirham, respectively Gold played the role of money throughout human history Gold continued to be part of the international monetary system until the breakdown of Bretton Woods in 1971 The problem with a payments system based on precious metals is that 1. such a form of money is very heavy and is hard to transport from one place to another 2. Another problem is when the value of the precious metal increased more than its value as money, people used to melt the coins to use them as precious metal rather than as money. 5 Paper Currency Paper currency refers to pieces of paper that function as a medium of exchange. Originally, paper currency carried a guarantee that it was convertible into a fixed quantity of precious metal. Fiat Money Fiat money refers to paper currency decreed by governments as legal tender. Legal tender means that money must be legally accepted as payment for debts Today all national currencies are fiat, that is, neither backed by nor redeemable for gold. Currencies such as dollars or dinars do not have intrinsic value, because they are not really useful other than as money. Without legal tender they are nothing but pieces of paper Fiat money is lighter but it has the problem of counterfeiting and it is hard to transport large amounts because of their bulk. Checks A check is an instruction from you to your bank to transfer money from your account to someone else’s account when he deposits the check. The introduction of checks was a major innovation that improved the efficiency of the payments system. The use of Checks has the advantage of: 1. Reducing transaction costs associated with the payments system, and 2. Improve economic efficiency. 3. Another advantage of checks is that they can be written for any amount up to the balance in the account, making transactions for large amount much easier. The disadvantage of using checks is that 1. It takes time to get checks from one place to another which creates problems for the needed urgent payments. 6 2. In addition it takes several days to clear a check you have deposited before you can use its funds. 3. The paper work to process checks has its cost too. Electronic Payment The development of inexpensive computers and the spread of the internet now make it cheap to pay bills electronically. Electronic payments result in cost saving compared to payments by checks. Electronic payments technology can substitute not only for checks, but also for cash in the form of electronic money (or e-money). E-money refers to money that exists only in electronic form and involves transfer of money. Some forms of e-money include: o A debit card, which looks like credit cards, enables consumers to purchase goods and services by electronically transforming funds directly from their bank accounts to the merchant’s account. o Automatic bill-paying: whereby money is transferred straight from your bank account to the phone company, the power company, the local tax collector, according to prior arrangements you have made. Pay-by-phone works similarly. o E-cash, which is used on the internet to purchase goods or services. A consumer get e-cash by setting up an account with a bank that has links to the internet and then has the e-cash transferred to his PC. Then he can buy goods and services by transferring money directly from his PC to the seller. o A more advanced form of e-money is the stored-value card. o The simplest form of the stored value card is purchased for a preset amount that the consumer pays upfront, like a prepaid phone card. o The more sophisticated stored-value card is known as a smart card 7 o A smart card contains a computer chip that allows it to be loaded with digital cash from the owner’s bank account whenever needed. Are electronic payments considered part of the money in the country? Actually no. They provide access to bank accounts, which are already in the money supply. These are really just more efficient and convenient ways of making payments than the old ones. CHARACTERISTICS OF MONEY The forms that money has taken on depend heavily on how well it performs the three functions we have discussed earlier. The following are some of the characteristics that an item should have in order to perform the three functions of money efficiently 1. Must be easily standardized, making it simple to ascertain its value. 2. Must be widely accepted in payments for goods and services and for settling other business obligations; i.e., must have intrinsic value or made acceptable by decree of law (assigned legal tender status) 3. Must be divisible, so that it can be used for exchange of a range of values 4. Must be stable and durable; i.e., does not deteriorate, perish or erode due to its own structure and composition 5. Must be easy to carry around 6. Must be limited in supply 7. Must not be easily counterfeited 8 MEASURING MONEY SUPPLY (MONETARY AGGREGATES) Economists and governments have a broader measure of what money is than cash. M1 The narrowest measure of money is M1, which includes assets that can be used directly as a medium of exchange. M1 = Currency +Traveler’s Checks + Demand deposits + Other checkable deposits Note that the currency component of M1 includes only paper money and coins in circulation in the hands of the non-bank public and does not include cash that is held in ATMs or banks vaults. The traveler’s checks component of M1 includes only traveler’s checks not issued by banks. The demand deposits component includes business checking accounts that do not pay interest as well as traveler’s checks issued by banks. The other checkable deposits item includes all other checkable deposits, particularly checking accounts held by households that pay interest, such as NOW (negotiated order of withdrawal) and ATS (automatic transfer from savings). M1 is considered by the central bank perfectly liquid assets, i.e. pure medium of exchange. M2 M2 is a broader measure of money than M1. It includes items that are contained in M1 and a few other items. M2 adds to M1 other assets that have check-writing features (money market deposit accounts and money market mutual fund shares) and other assets that are highly liquid at a very little cost (savings deposits and small-denomination time deposits) M2 = M1 + savings deposits + small–denomination time deposits + money market deposit accounts + Money market mutual fund shares. 9 Saving deposits are non-transactions deposits that can be added to or taken out at any time. Small–denomination time deposits are certificates of deposit (CDs) with a denomination of less than $100,000 that can only be redeemed at a fixed maturity date without a penalty. Money market deposit accounts (i.e. interest bearing accounts) are short term accounts that pay interest and allow limited withdrawals. They are similar to money market mutual funds, but are issued by banks. Money market mutual fund shares are retail accounts on which households can write checks. Money market mutual funds are interest-bearing shares in pools of funds accumulated by investment companies. The funds are invested in short-term securities. The components of M2 (other than M1) are considered as the assets that emphasize the function of money as a store of value. However, they can also be used as medium of exchange (with some delay). There is another measurement of money which is M3. M3 is the broadest measure for money, includes some of the “longer-term” money market instruments. The components of M3 (other than M2) are assets of mostly large businesses and institutions. They are very non-liquid assets, and hence not used as medium of exchange. 10