Key Figures and Financial Statements Q4 FY 2014

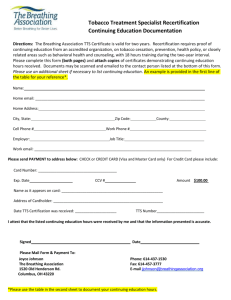

advertisement

Key figures Q4 and fiscal 2014 1 (preliminary; in millions of €, except where otherwise stated) Volume Orders – continuing operations Q4 2014 Q4 2013 20,733 20,298 2%2 Revenue – continuing operations Q4 2014 Q4 2013 20,621 20,559 1%2 Continuing operations Orders Revenue Q4 2014 Q4 2013 Actual 20,733 20,621 20,298 20,559 2% 0% % Change Comparable 2 FY 2014 FY 2013 Actual 2% 1% 78,350 71,920 79,755 73,445 (2)% (2)% % Change Comparable 2 1% 1% Profitability and Capital efficiency Income from continuing operations Q4 2014 Q4 2013 1,503 1,103 36% ROCE – continuing operations Q4 2014 Q4 2013 18.8% 14.5% Target corridor: 15 – 20% Net income Q4 2014 Q4 2013 1,498 1,068 40% Basic earnings per share (in €) – continuing and discontinued operations 3 Q4 2014 Q4 2013 1.72 1.19 44% Q4 2014 Q4 2013 % Change FY 2014 FY 2013 % Change Total Sectors Adjusted EBITDA Total Sectors profit in % of revenue (Total Sectors) 2,625 2,195 10.5% 2,391 1,711 8.2% 10% 28% 9,103 7,335 10.0% 8,131 5,842 7.9% 12% 26% Continuing operations Adjusted EBITDA Income from continuing operations Basic earnings per share (in €) 3 Return on capital employed (ROCE) 2,555 1,503 1.73 18.8% 2,221 1,103 1.23 14.5% 15% 36% 40% 9,139 5,400 6.24 17.2% 8,097 4,179 4.81 13.7% 13% 29% 30% Continuing and discontinued operations Net income Basic earnings per share (in €) 3 Return on capital employed (ROCE) 1,498 1.72 18.4% 1,068 1.19 13.4% 40% 44% 5,507 6.37 17.3% 4,409 5.08 13.5% 25% 25% Capital structure and Liquidity Industrial net debt / adjusted EBITDA – continuing operations 4 0.15 0.35 FY 2014 FY 2013 Free cash flow – continuing operations Q4 2014 Q4 2013 3,400 4,328 September 30, 2014 September 30, 2013 8,013 30,954 1,390 9,190 28,111 2,805 Cash and cash equivalents Total equity (Shareholders of Siemens AG) Industrial net debt Target corridor: 0.5 – 1.0 (21)% Q4 2014 Q4 2013 FY 2014 FY 2013 Continuing operations Free cash flow 3,400 4,328 5,399 5,378 Continuing and discontinued operations Free cash flow 3,450 4,336 5,201 5,328 Employees September 30, 2014 Employees (in thousands) Germany Outside Germany 1 June 30 – September 30, 2014 and October 1, 2013 – September 30, 2014. 2 Excluding currency translation and portfolio effects. 3 September 30, 2013 Continuing operations Total 5 Continuing operations Total 5 343 115 229 357 116 240 348 117 231 367 119 248 Basic earnings per share – attributable to shareholders of Siemens AG. For fiscal 2014 and 2013 weighted average shares outstanding (basic) (in thousands) for the fourth quarter amounted to 838,791 and 843,138 and for the fiscal years to 843,449 and 843,819 shares, respectively. 4 Calculated by dividing industrial net debt as of September 30, 2014 and 2013 by adjusted EBITDA. 5 Continuing and discontinued operations. CONSOLIDATED STATEMENTS OF INCOME (preliminary) For the three months and the fiscal years ended September 30, 2014 and 2013 (in millions of €, per share amounts in €) Three months ended September 30, 2014 2013 Revenue ............................................................................................................................. 20,621 20,559 Cost of sales ....................................................................................................................... (14,899) (15,169) Gross profit ........................................................................................................................ 5,722 5,391 Research and development expenses ................................................................................. (1,150) (1,124) Selling and general administrative expenses ...................................................................... (2,885) (2,946) Other operating income (expenses), net ............................................................................. 241 50 Income from investments accounted for using the equity method, net .............................. 157 159 Interest income ................................................................................................................... 278 239 Interest expenses ................................................................................................................ (195) (210) Other financial income (expenses), net .............................................................................. (125) (52) Income from continuing operations before income taxes ............................................. 2,042 1,506 Income tax expenses .......................................................................................................... (539) (403) Income from continuing operations ............................................................................... 1,503 1,103 Income (loss) from discontinued operations, net of income taxes ..................................... (4) (35) Net income ........................................................................................................................ 1,498 1,068 Year ended September 30, 2014 2013 71,920 73,445 (51,165) (53,309) 20,755 20,135 (4,065) (4,048) (10,424) (10,869) 461 76 582 510 1,058 947 (764) (784) (177) (154) 7,427 5,813 (2,028) (1,634) 5,400 4,179 108 231 5,507 4,409 Attributable to: Non-controlling interests ....................................................................................... Shareholders of Siemens AG ................................................................................. 52 1,446 62 1,006 134 5,373 126 4,284 Basic earnings per share Income from continuing operations ................................................................................... Income (loss) from discontinued operations ...................................................................... Net income ........................................................................................................................ 1.73 (0.01) 1.72 1.23 (0.04) 1.19 6.24 0.13 6.37 4.81 0.27 5.08 Diluted earnings per share Income from continuing operations ................................................................................... Income (loss) from discontinued operations ...................................................................... Net income ........................................................................................................................ 1.71 (0.01) 1.71 1.22 (0.04) 1.18 6.18 0.13 6.31 4.76 0.26 5.03 CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (preliminary) For the three months and the fiscal years ended September 30, 2014 and 2013 (in millions of €) Three months ended September 30, Year ended September 30, 2014 2013 2014 2013 Net income ......................................................................................................................... 1,498 1,068 5,507 4,409 Remeasurements of defined benefit plans .......................................................................... Items that will not be reclassified to profit or loss......................................................... therein: Expenses from investments accounted for using the equity method ........................................................................................................... 1,169 1,169 45 45 288 288 394 394 (25) (4) (37) (121) Currency translation differences ........................................................................................ Available-for-sale financial assets ..................................................................................... Derivative financial instruments ........................................................................................ Items that may be reclassified subsequently to profit or loss ....................................... therein: Income (expenses) from investments accounted for using the equity method ........................................................................................................... 1,149 (154) (179) 816 (443) 141 (38) (340) 940 (56) (316) 569 (1,062) 183 45 (834) 26 (127) (85) (136) Other comprehensive income, net of income taxes ....................................................... Total comprehensive income ........................................................................................... 1,985 3,483 (295) 773 857 6,364 (440) 3,969 Attributable to: Non-controlling interests ....................................................................................... Shareholders of Siemens AG ................................................................................. 80 3,404 37 736 165 6,199 81 3,888 CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (preliminary) As of September 30, 2014 and 2013 (in millions of €) September 30, 2014 2013 ASSETS Cash and cash equivalents .......................................................................................................................... 8,013 Available-for-sale financial assets .............................................................................................................. 925 Trade and other receivables ........................................................................................................................ 14,526 Other current financial assets ...................................................................................................................... 3,710 Inventories .................................................................................................................................................. 15,100 Current income tax assets ........................................................................................................................... 577 Other current assets ..................................................................................................................................... 1,290 Assets classified as held for disposal .......................................................................................................... 3,935 Total current assets ....................................................................................................................................... 48,076 Goodwill ..................................................................................................................................................... 17,783 Other intangible assets ................................................................................................................................ 4,560 Property, plant and equipment .................................................................................................................... 9,638 Investments accounted for using the equity method ................................................................................... 2,127 Other financial assets .................................................................................................................................. 18,416 Deferred tax assets. ..................................................................................................................................... 3,334 Other assets. ................................................................................................................................................ 945 Total non-current assets ............................................................................................................................... 56,803 Total assets..................................................................................................................................................... 104,879 9,190 601 14,853 3,250 15,560 794 1,297 1,393 46,937 17,883 5,057 9,815 3,022 15,117 3,234 872 54,999 101,936 LIABILITIES AND EQUITY Short-term debt and current maturities of long-term debt........................................................................... 1,620 Trade payables ............................................................................................................................................ 7,594 Other current financial liabilities ................................................................................................................ 1,717 Current provisions ...................................................................................................................................... 4,354 Current income tax liabilities ...................................................................................................................... 1,762 Other current liabilities ............................................................................................................................... 17,954 Liabilities associated with assets classified as held for disposal ................................................................. 1,597 Total current liabilities ................................................................................................................................. 36,598 Long-term debt ........................................................................................................................................... 19,326 Post-employment benefits........................................................................................................................... 9,324 Deferred tax liabilities ................................................................................................................................ 552 Provisions ................................................................................................................................................... 4,071 Other financial liabilities ............................................................................................................................ 1,620 Other liabilities ........................................................................................................................................... 1,874 Total non-current liabilities ......................................................................................................................... 36,767 Total liabilities ............................................................................................................................................... 73,365 Equity Issued capital, no par value ......................................................................................................................... 2,643 Capital reserve ............................................................................................................................................ 5,525 Retained earnings ........................................................................................................................................ 25,729 Other components of equity ........................................................................................................................ 803 Treasury shares, at cost ............................................................................................................................... (3,747) Total equity attributable to shareholders of Siemens AG ......................................................................... 30,954 Non-controlling interests ............................................................................................................................ 560 Total equity .................................................................................................................................................... 31,514 Total liabilities and equity ............................................................................................................................ 104,879 1,944 7,599 1,515 4,485 2,151 19,701 473 37,868 18,509 9,265 504 3,907 1,184 2,074 35,443 73,312 2,643 5,484 22,663 268 (2,946) 28,111 514 28,625 101,936 CONSOLIDATED STATEMENTS OF CASH FLOWS (preliminary) For the three months ended September 30, 2014 and 2013 (in millions of €) Three months ended September 30, 2014 2013 Cash flows from operating activities Net income ..................................................................................................................................................................... Adjustments to reconcile net income to cash flows from operating activities - continuing operations Loss from discontinued operations, net of income taxes............................................................................................ Amortization, depreciation and impairments ............................................................................................................. Income tax expenses .................................................................................................................................................. Interest (income) expenses, net .................................................................................................................................. (Gains) losses on disposals of assets related to investing activities, net..................................................................... Other (income) losses from investments .................................................................................................................... Other non-cash (income) expenses ............................................................................................................................ Change in assets and liabilities Inventories............................................................................................................................................................. Trade and other receivables ................................................................................................................................... Trade payables ...................................................................................................................................................... Other assets and liabilities ..................................................................................................................................... Additions to assets leased to others in operating leases ............................................................................................. Income taxes paid ...................................................................................................................................................... Dividends received .................................................................................................................................................... Interest received ......................................................................................................................................................... Cash flows from operating activities - continuing operations ................................................................................... Cash flows from operating activities - discontinued operations ..................................................................................... Cash flows from operating activities - continuing and discontinued operations ..................................................... Cash flows from investing activities Additions to intangible assets and property, plant and equipment ................................................................................. Acquisitions of businesses, net of cash acquired ............................................................................................................ Purchase of investments ................................................................................................................................................. Purchase of current available-for-sale financial assets ................................................................................................... Change in receivables from financing activities ............................................................................................................. Disposal of investments, intangibles and property, plant and equipment ....................................................................... Disposal of businesses, net of cash disposed .................................................................................................................. Disposal of current available-for-sale financial assets .................................................................................................... Cash flows from investing activities - continuing operations .................................................................................... Cash flows from investing activities - discontinued operations...................................................................................... Cash flows from investing activities - continuing and discontinued operations ...................................................... Cash flows from financing activities Purchase of treasury shares ............................................................................................................................................ Other transactions with owners ...................................................................................................................................... Issuance of long-term debt ............................................................................................................................................. Repayment of long-term debt (including current maturities of long-term debt) ............................................................. Change in short-term debt and other financing activities ............................................................................................... Interest paid .................................................................................................................................................................... Dividends attributable to non-controlling interests......................................................................................................... Cash flows from financing activities - continuing operations ................................................................................... Cash flows from financing activities - discontinued operations ..................................................................................... Cash flows from financing activities - continuing and discontinued operations ..................................................... Effect of deconsolidation of OSRAM on cash and cash equivalents .................................................................................. Effect of changes in exchange rates on cash and cash equivalents ..................................................................................... Change in cash and cash equivalents .................................................................................................................................. Cash and cash equivalents at beginning of period............................................................................................................... Cash and cash equivalents at end of period ......................................................................................................................... Less: Cash and cash equivalents of assets classified as held for disposal and discontinued operations at end of period .............................................................................................................................................................. Cash and cash equivalents at end of period (Consolidated Statements of Financial Position) ................................... 1,498 1,068 4 628 539 (83) (177) (98) (149) 35 851 403 (29) (248) – 202 1,344 372 691 (315) (99) (394) 61 263 4,085 74 4,159 690 608 722 912 (82) (390) 101 213 5,057 38 5,095 (685) (24) (60) (223) (819) 136 17 248 (1,411) (37) (1,448) (729) (75) (123) (114) (1,048) 2,040 6 14 (29) (50) (78) (646) (3) 309 (420) (2,243) (150) (23) (3,176) – (3,176) – 269 (197) 8,231 8,034 – – – (774) (975) (150) (18) (1,918) 306 (1,612) (476) (65) 2,863 6,370 9,234 21 8,013 44 9,190 CONSOLIDATED STATEMENTS OF CASH FLOWS (preliminary) For the fiscal years ended September 30, 2014 and 2013 (in millions of €) Cash flows from operating activities Net income ..................................................................................................................................................................... Adjustments to reconcile net income to cash flows from operating activities - continuing operations (Income) from discontinued operations, net of income taxes..................................................................................... Amortization, depreciation and impairments ............................................................................................................. Income tax expenses .................................................................................................................................................. Interest (income) expenses, net .................................................................................................................................. (Gains) losses on disposals of assets related to investing activities, net..................................................................... Other (income) losses from investments .................................................................................................................... Other non-cash (income) expenses ............................................................................................................................ Change in assets and liabilities Inventories............................................................................................................................................................. Trade and other receivables ................................................................................................................................... Trade payables ...................................................................................................................................................... Other assets and liabilities ..................................................................................................................................... Additions to assets leased to others in operating leases ............................................................................................. Income taxes paid ...................................................................................................................................................... Dividends received .................................................................................................................................................... Interest received ......................................................................................................................................................... Cash flows from operating activities - continuing operations ................................................................................... Cash flows from operating activities - discontinued operations ..................................................................................... Cash flows from operating activities - continuing and discontinued operations ..................................................... Cash flows from investing activities Additions to intangible assets and property, plant and equipment ................................................................................. Acquisitions of businesses, net of cash acquired ............................................................................................................ Purchase of investments ................................................................................................................................................. Purchase of current available-for-sale financial assets ................................................................................................... Change in receivables from financing activities ............................................................................................................. Disposal of investments, intangibles and property, plant and equipment ....................................................................... Disposal of businesses, net of cash disposed .................................................................................................................. Disposal of current available-for-sale financial assets .................................................................................................... Cash flows from investing activities - continuing operations .................................................................................... Cash flows from investing activities - discontinued operations...................................................................................... Cash flows from investing activities - continuing and discontinued operations ...................................................... Cash flows from financing activities Purchase of treasury shares ............................................................................................................................................ Other transactions with owners ...................................................................................................................................... Issuance of long-term debt ............................................................................................................................................. Repayment of long-term debt (including current maturities of long-term debt) ............................................................. Change in short-term debt and other financing activities ............................................................................................... Interest paid .................................................................................................................................................................... Dividends paid to shareholders of Siemens AG ............................................................................................................. Dividends attributable to non-controlling interests......................................................................................................... Cash flows from financing activities - continuing operations ................................................................................... Cash flows from financing activities - discontinued operations ..................................................................................... Cash flows from financing activities - continuing and discontinued operations ..................................................... Effect of deconsolidation of OSRAM on cash and cash equivalents .................................................................................. Effect of changes in exchange rates on cash and cash equivalents ..................................................................................... Change in cash and cash equivalents .................................................................................................................................. Cash and cash equivalents at beginning of period............................................................................................................... Cash and cash equivalents at end of period ......................................................................................................................... Less: Cash and cash equivalents of assets classified as held for disposal and discontinued operations at end of period .............................................................................................................................................................. Cash and cash equivalents at end of period (Consolidated Statements of Financial Position) ................................... Year ended September 30, 2014 2013 5,507 4,409 (108) 2,411 2,028 (295) (527) (526) 92 (231) 2,804 1,634 (164) (292) (326) 671 336 200 205 (1,203) (371) (1,828) 333 977 7,230 (131) 7,100 (256) (326) (208) 818 (377) (2,164) 356 837 7,186 154 7,340 (1,831) (31) (335) (613) (2,501) 518 112 317 (4,364) 339 (4,026) (1,808) (2,786) (346) (157) (2,175) 2,462 (26) 76 (4,759) (317) (5,076) (1,066) (20) 527 (1,452) 801 (617) (2,533) (125) (4,485) (2) (4,487) – 214 (1,199) 9,234 8,034 (1,394) (15) 3,772 (2,927) 8 (479) (2,528) (152) (3,715) 319 (3,396) (476) (108) (1,717) 10,950 9,234 21 8,013 44 9,190 SEGMENT INFORMATION (continuing operations - preliminary) As of and for the three months ended September 30, 2014 and 2013 (in millions of €) Additions to Intersegment Orders(1) External revenue revenue Total revenue Profit Assets Free cash flow intangible assets Amortization, and property, plant depreciation and and equipment impairments September 30, Sectors Energy ...................................................................... Healthcare ................................................................. Industry..................................................................... Infrastructure & Cities .............................................. Total Sectors ................................................................ Equity Investments ........................................................ Financial Services (SFS) ............................................... Reconciliation to Consolidated Financial Statements Centrally managed portfolio activities ...................... Siemens Real Estate (SRE)....................................... Corporate items and pensions ................................... Eliminations, Corporate Treasury and other reconciling items .................................................. Siemens ........................................................................ 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 7,097 3,773 4,141 5,862 7,609 3,726 4,397 4,816 7,070 3,579 4,312 5,247 7,375 3,472 4,185 4,991 68 5 493 189 61 8 466 229 7,138 3,584 4,804 5,437 7,436 3,480 4,650 5,220 403 611 698 482 564 616 365 167 1,680 11,126 6,661 5,180 1,621 10,732 6,410 4,973 1,274 763 846 1,084 1,514 862 853 971 182 97 155 99 196 83 173 90 135 140 129 81 200 143 182 163 20,208 20,023 – – 180 303 755 – 52 764 – 44 2,195 1,711 65 109 120 107 24,646 2,571 21,970 23,736 2,488 18,661 3,968 – 533 – 542 – 485 – 687 – 109 4,200 6 278 6 15 48 53 3 565 4 3 558 39 (154) 4,697 (1,859) (234) 4,747 (1,987) 14 (39) (46) (38) (48) 9 2 122 22 2 141 31 2 77 22 1 98 19 53,009 54,525 2,042 1,506 104,879 101,936 (606) 3,400 (79) 4,328 – 685 (3) 729 (7) 628 (8) 851 20,872 20,548 – – 231 347 93 631 47 77 653 96 (1,142) (1,422) 20,733 20,298 123 66 45 81 95 57 – – 20,621 20,559 (1,379) (1,407) – – 20,963 20,787 – – 231 347 126 631 48 84 653 96 (1,379) (1,407) 20,621 20,559 72 (99) 26 (440) 113 (395) 4 (39) (1) This supplementary information on Orders is provided on a voluntary basis. It is not part of the Consolidated Financial Statements subject to the audit opinion. SEGMENT INFORMATION (continuing operations - preliminary) As of and for the fiscal years ended September 30, 2014 and 2013 (in millions of €) Additions to Intersegment Orders(1) External revenue revenue Total revenue Profit Assets Free cash flow intangible assets Amortization, and property, plant depreciation and and equipment impairments September 30, Sectors Energy .................................................................... Healthcare ............................................................... Industry................................................................... Infrastructure & Cities ............................................ Total Sectors .............................................................. Equity Investments ...................................................... Financial Services (SFS) ............................................. Reconciliation to Consolidated Financial Statements Centrally managed portfolio activities .................... Siemens Real Estate (SRE)..................................... Corporate items and pensions ................................. Eliminations, Corporate Treasury and other reconciling items ................................................ Siemens ...................................................................... 2014 2013 2014 2013 2014 2013 2014 2013 28,646 12,819 17,103 21,001 28,797 13,004 16,688 21,894 24,380 12,401 15,346 18,291 26,425 12,626 15,256 17,149 251 29 1,718 643 212 22 1,640 730 24,631 12,429 17,064 18,934 70,418 71,456 – – 746 961 2,641 – 191 2,605 – 111 9 2,136 120 10 2,159 163 79,569 80,382 – – 937 1,072 302 2,405 305 296 2,490 471 (5,169) (4,956) 78,350 79,755 297 270 190 386 332 309 – – 71,920 73,445 (5,098) (5,048) – – 2013 2014 2013 2014 2013 2014 2013 2014 2013 26,638 12,649 16,896 17,879 1,569 1,955 2,027 2,033 2,252 1,563 1,487 291 1,680 11,126 6,661 5,180 1,621 10,732 6,410 4,973 1,591 2,067 2,170 1,280 1,595 2,227 2,280 372 449 303 358 247 425 241 384 239 507 553 544 296 610 577 638 379 73,059 74,061 – – 937 1,072 7,335 5,842 328 411 465 409 24,646 2,571 21,970 23,736 2,488 18,661 7,108 81 1,356 – 1,289 – 522 6,473 126 857 31 69 194 230 396 2,491 472 44 241 (938) (113) 168 (836) (154) 4,697 (1,859) (234) 4,747 (1,987) (37) (170) (675) (142) (112) (422) 6 370 70 7 364 83 4 264 78 4 309 91 (5,098) (5,048) (48) (70) 53,009 54,525 (1,430) (1,403) (3) 1,831 (4) 1,808 (29) (34) 306 2,405 310 71,920 73,445 2014 7,427 5,813 (1) This supplementary information on Orders is provided on a voluntary basis. It is not part of the Consolidated Financial Statements subject to the audit opinion. 104,879 101,936 5,399 5,378 1,900 2,204 – – 2,411 2,804 SUPPLEMENTAL DATA ADDITIONAL INFORMATION (I) (continuing operations - preliminary) Orders, Revenue, Profit, Profit margin developments and growth rates for Sectors For the three months ended September 30, 2014 and 2013 (in millions of €) Orders 2014 2013 Actual Sectors Energy Sector ......................................... therein: Power Generation ........................... Wind Power .................................... Power Transmission ....................... Revenue % Change therein Comp. 2014 Currency Portfolio 2013 % Change Actual Profit therein Comp. 2014 Currency Portfolio 2013 Profit margin % Change 2014 2013 7,097 7,609 (7)% (5)% 0% (2)% 7,138 7,436 (4)% (2)% 0% (2)% 403 564 (28)% 5.7% 7.6% 3,994 1,805 1,321 4,586 1,511 1,532 (13)% 19% (14)% (10)% 17% (14)% 0% 3% 0% (3)% 0% 0% 3,990 1,619 1,551 4,079 1,619 1,749 (2)% 0% (11)% 2% 0% (11)% 0% 0% (1)% (4)% 0% 0% 520 (66) (67) 538 179 (42) (3)% n/a (58)% 13.0% (4.0)% (4.3)% 13.2% 11.1% (2.4)% Healthcare Sector .................................. 3,773 therein: Diagnostics ..................................... 1,037 3,726 1% 1% 0% 0% 3,584 3,480 3% 3% 0% 0% 611 616 (1)% 17.1% 17.7% 1,026 1% 2% 0% 0% 1,037 1,026 1% 2% 0% 0% 110 82 34% 10.6% 8.0% Industry Sector ...................................... 4,141 therein: Industry Automation ....................... 2,114 Drive Technologies ........................ 2,174 4,397 (6)% (5)% 0% 0% 4,804 4,650 3% 4% 0% 0% 698 365 91% 14.5% 7.8% 2,089 2,410 1% (10)% 2% (9)% 0% 0% 0% 0% 2,291 2,648 2,200 2,574 4% 3% 4% 4% 0% 0% 0% 0% 414 283 289 84 43% >200% 18.1% 10.7% 13.2% 3.3% Infrastructure & Cities Sector .............. therein: Transportation & Logistics ............. Power Grid Solutions & Products... Building Technologies.................... Total Sectors .......................................... 4,816 22% 21% 1% 0% 5,437 5,220 4% 4% 0% 0% 482 167 190% 8.9% 3.2% 2,759 1,752 1,591 1,639 1,564 1,524 20,872 20,548 58% (3)% 3% 2% 54% (2)% 2% 2% 4% (1)% 0% 0% 0% 2,195 1,985 0% 1,780 1,733 0% 1,544 1,596 (1)% 20,963 20,787 11% 3% (3)% 1% 10% 4% (3)% 2% 1% (1)% 0% 0% 0% 108 0% 206 0% 192 (1)% 2,195 (78) 103 168 1,711 n/a 99% 14% 28% 4.9% 11.6% 12.4% (4.0)% 6.0% 10.5% 5,862 SUPPLEMENTAL DATA ADDITIONAL INFORMATION (I) (continuing operations - preliminary) Orders, Revenue, Profit, Profit margin developments and growth rates for Sectors For the fiscal years ended September 30, 2014 and 2013 (in millions of €) Orders 2014 Sectors Energy Sector ...................................................... 28,646 therein: Power Generation ............................... 15,478 Wind Power ........................................ 7,748 Power Transmission ........................... 5,586 2013 Revenue % Change Actual Comp. therein Currency Portfolio 2014 2013 % Change Actual Comp. Profit therein Currency Portfolio 2014 2013 Profit margin % Change 2014 2013 28,797 (1)% 4% (3)% (1)% 24,631 26,638 (8)% (3)% (3)% (1)% 1,569 1,955 (20)% 6.4% 7.3% 16,366 6,593 5,700 (5)% 18% (2)% 0% 19% 2% (4)% (2)% (4)% (2)% 13,909 15,242 0% 5,500 5,174 0% 5,310 6,167 (9)% 6% (14)% (4)% 9% (10)% (3)% (3)% (3)% (2)% 0% 0% 2,186 (15) (636) 2,126 3% 306 n/a (156) >(200)% 15.7% (0.3)% (12.0)% 13.9% 5.9% (2.5)% Healthcare Sector ............................................... 12,819 therein: Diagnostics ......................................... 3,834 13,004 (1)% 3% (4)% 0% 12,429 12,649 (2)% 2% (4)% 0% 2,027 2,033 0% 16.3% 16.1% 3,942 (3)% 1% (4)% 0% 3,942 (3)% 1% (4)% 0% 417 350 19% 10.9% 8.9% Industry Sector ................................................... 17,103 therein: Industry Automation........................... 8,412 Drive Technologies ............................ 9,210 16,688 2% 5% (3)% 0% 17,064 16,896 1% 4% (3)% 0% 2,252 1,563 44% 13.2% 9.2% 8,143 9,024 3% 2% 5% 5% (3)% (3)% 1% 0% 8,194 9,208 2% 0% 4% 3% (3)% (2)% 1% 0% 1,401 843 1,038 527 35% 60% 16.8% 9.1% 12.7% 5.7% Infrastructure & Cities Sector ........................... 21,001 therein: Transportation & Logistics ................. 9,184 Power Grid Solutions & Products ...... 6,481 Building Technologies ....................... 5,587 Total Sectors ............................................................ 79,569 21,894 (4)% (4)% (2)% 2% 18,934 17,879 6% 6% (3)% 3% 1,487 291 >200% 7.9% 1.6% 10,040 6,392 5,769 80,382 (9)% 1% (3)% (1)% (13)% 6% (1)% 2% (1)% (5)% (2)% (3)% 5% 7,615 6,318 0% 6,005 6,102 0% 5,569 5,754 0% 73,059 74,061 21% (2)% (3)% (1)% 14% 3% (1)% 1% (2)% (4)% (2)% (3)% 8% 0% 0% 0% 440 566 501 7,335 (448) 403 351 5,842 n/a 41% 43% 26% 5.8% 9.4% 9.0% (7.1)% 6.6% 6.1% 3,834 8,353 9,211 SUPPLEMENTAL DATA ADDITIONAL INFORMATION (II) (continuing operations - preliminary) Reconciliation from Profit / Income before income taxes to adjusted EBITDA For the three months ended September 30, 2014 and 2013 (in millions of €) Income (loss) from investments Profit Sectors Energy Sector ................................................................. therein: Power Generation ..................................... Wind Power .............................................. Power Transmission.................................. Healthcare Sector .......................................................... therein: Diagnostics ............................................... Industry Sector .............................................................. therein: Industry Automation ................................. Drive Technologies .................................. Infrastructure & Cities Sector ...................................... therein: Transportation & Logistics ....................... Power Grid Solutions & Products ............ Building Technologies ............................. Total Sectors ....................................................................... Equity Investments ........................................................ Financial Services (SFS) ................................................ Reconciliation to Consolidated Financial Statements Centrally managed portfolio activities ........................ Siemens Real Estate (SRE) ......................................... Corporate items and pensions ..................................... Eliminations, Corporate Treasury and other reconciling items .................................................... Siemens ............................................................................... Depreciation and impairments accounted for using the equity Financial income Adjusted Amortization and impairment of other of property, plant and equipment Adjusted Adjusted method, net (expenses), net EBIT intangible assets and goodwill EBITDA EBITDA margin 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 403 564 65 2 (12) (7) 351 569 25 46 110 153 486 769 520 (66) (67) 611 538 179 (42) 616 5 49 8 2 7 1 3 2 (7) (3) (3) 2 (3) (2) (2) 11 523 (111) (71) 608 534 179 (43) 602 14 7 4 62 16 8 3 64 55 29 25 78 60 30 39 79 592 (75) (43) 748 611 217 (1) 745 20.9% 21.4% 110 698 82 365 — — — 1 2 (2) 1 (2) 108 700 81 366 45 44 48 77 49 85 51 105 202 829 180 548 17.2% 11.8% 414 283 482 289 84 167 — — 6 — 1 3 (2) — (5) (1) (1) (4) 415 283 481 290 84 167 32 11 34 65 13 60 34 51 48 36 69 103 481 345 562 390 166 330 10.3% 108 206 192 2,195 65 120 (78) 103 168 1,711 109 107 4 2 — 73 60 17 1 2 — 9 108 17 (3) (1) (1) (18) 4 141 (2) (2) — (2) 1 100 107 204 193 2,140 — (38) (78) 103 169 1,704 1 (11) 16 6 11 165 — 1 16 30 14 248 — 1 16 20 11 320 — 47 64 25 13 440 — 52 140 231 214 2,625 — 10 2 158 195 2,391 1 42 72 26 (440) (99) 113 (395) 5 — (1) 28 — — — (25) (143) (1) (27) (93) 67 51 (296) (126) 140 (302) — — 5 — — 4 2 77 17 — 98 15 69 128 (274) (125) 238 (283) 4 2,042 (39) 1,506 1 157 (3) 159 (1) (42) — (23) 4 1,928 (36) 1,370 — 171 — 254 (7) 456 (8) 597 (2) 2,555 (44) 2,221 6.8% 10.3% 6.3% SUPPLEMENTAL DATA ADDITIONAL INFORMATION (II) (continuing operations - preliminary) Reconciliation from Profit / Income before income taxes to adjusted EBITDA For the fiscal years ended September 30, 2014 and 2013 (in millions of €) Income (loss) from investments Profit Sectors Energy Sector ................................................................. therein: Power Generation ..................................... Wind Power .............................................. Power Transmission.................................. Healthcare Sector .......................................................... therein: Diagnostics ............................................... Industry Sector .............................................................. therein: Industry Automation ................................. Drive Technologies .................................. Infrastructure & Cities Sector ...................................... therein: Transportation & Logistics ....................... Power Grid Solutions & Products ............ Building Technologies ............................. Total Sectors ....................................................................... Equity Investments ........................................................ Financial Services (SFS) ................................................ Reconciliation to Consolidated Financial Statements Centrally managed portfolio activities ........................ Siemens Real Estate (SRE) ......................................... Corporate items and pensions ..................................... Eliminations, Corporate Treasury and other reconciling items .................................................... Siemens ............................................................................... Depreciation and impairments accounted for using the equity Financial income Adjusted Amortization and impairment of other of property, plant and equipment Adjusted Adjusted method, net (expenses), net EBIT intangible assets and goodwill EBITDA EBITDA margin 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013 1,569 1,955 129 (39) (41) (27) 1,481 2,022 101 132 406 478 1,988 2,631 8.1% 9.9% 2,186 (15) (636) 2,027 2,126 306 (156) 2,033 32 52 29 6 32 (8) 20 8 (22) (12) (10) 23 (16) (6) (10) (19) 2,177 (55) (655) 1,999 2,110 320 (167) 2,045 57 31 14 245 68 32 13 266 204 109 89 308 222 103 114 311 2,438 85 (552) 2,551 2,399 454 (39) 2,622 20.5% 20.7% 417 2,252 350 1,563 — 2 — (4) 25 2 (27) (16) 392 2,248 377 1,583 184 242 196 296 200 302 211 342 776 2,792 784 2,220 16.4% 13.1% 1,401 843 1,487 1,038 527 291 — 2 28 — (5) 26 4 (2) (17) (4) (11) (14) 1,396 843 1,476 1,041 542 279 196 45 127 240 56 154 119 182 170 123 219 226 1,711 1,070 1,772 1,404 817 658 440 566 501 7,335 328 465 (448) 403 351 5,842 411 409 16 10 2 165 297 66 18 8 — (10) 372 85 (12) (3) (2) (33) 29 552 (7) (6) — (75) 23 389 435 560 501 7,203 1 (153) (459) 401 352 5,928 16 (64) 65 22 40 715 — 5 39 57 58 848 — 5 57 70 40 1,185 — 190 99 78 46 1,356 — 225 556 652 581 9,103 1 41 (321) 536 456 8,131 16 166 44 241 (938) (113) 168 (836) 55 — (2) 69 — — (2) (103) (360) (2) (109) (246) (9) 344 (576) (180) 278 (590) 1 1 19 2 1 17 3 263 59 2 307 74 (5) 608 (498) (177) 586 (498) (48) 7,427 (70) 5,813 1 582 (6) 510 35 118 30 9 (83) 6,728 (94) 5,293 — 741 — 873 (29) 1,670 (34) 1,931 (112) 9,139 (128) 8,097 9.4% 3.7% SUPPLEMENTAL DATA ADDITIONAL INFORMATION (III) (continuing operations - preliminary) External revenue of Sectors by regions For the fiscal years ended September 30, 2014 and 2013 (in millions of €) External revenue (location of customer) Europa, C.I.S., Africa, Middle East 2014 2013 % Change Sectors Energy Sector ..................................................... Healthcare Sector .............................................. Industry Sector .................................................. Infrastructure & Cities Sector .......................... Reconciliation to Siemens ........................................ Siemens ................................................................... 12,766 4,391 8,906 11,560 1,107 38,732 14,382 4,392 8,839 10,494 1,283 39,390 (11)% 0% 1% 10% (14)% (2)% therein Germany 2014 2013 % Change 2,507 880 4,141 2,763 566 10,857 2,246 903 4,145 2,635 723 10,652 12% (2)% 0% 5% (22)% 2% 2014 7,013 4,729 2,592 4,075 348 18,756 Americas 2013 % Change 7,155 4,815 2,718 4,288 668 19,644 (2)% (2)% (5)% (5)% (48)% (5)% Asia, Australia 2014 2013 % Change 4,601 3,281 3,848 2,656 47 14,433 4,888 3,419 3,699 2,367 38 14,411 (6)% (4)% 4% 12% 24% 0% 2014 24,380 12,401 15,346 18,291 1,502 71,920 Total 2013 26,425 12,626 15,256 17,149 1,989 73,445 % Change (8)% (2)% 1% 7% (24)% (2)% External revenue of Sectors as a percentage of regional and Siemens total revenue Percentage of regional external revenue (location of customer) Sectors Energy Sector ..................................................... Healthcare Sector .............................................. Industry Sector .................................................. Infrastructure & Cities Sector .......................... Reconciliation to Siemens ........................................ Siemens ................................................................... Europa, C.I.S., Africa, Middle East Change 2014 2013 in pp therein Germany 2014 2013 52% 35% 58% 63% 74% 54% 10% 7% 27% 15% 38% 15% 54% 35% 58% 61% 64% 54% (2.1) pp 0.6 pp 0.1 pp 2.0 pp 9.2 pp 0.2 pp 8% 7% 27% 15% 36% 15% Change in pp 1.8 pp (0.1) pp (0.2) pp (0.3) pp 1.3 pp 0.6 pp 2014 Americas 2013 29% 38% 17% 22% 23% 26% 27% 38% 18% 25% 34% 27% Change in pp 1.7 pp (0.0) pp (0.9) pp (2.7) pp (10.4) pp (0.7) pp Percentage of Siemens Asia, Australia 2014 2013 19% 27% 25% 15% 3% 20% 19% 27% 24% 14% 2% 19% Change in pp 2014 Total 2013 0.4 pp (0.6) pp 0.8 pp 0.7 pp 1.2 pp 0.4 pp 34% 17% 21% 25% 2% 100% 36% 17% 21% 23% 3% 100% Change in pp (2.1) pp 0.1 pp 0.6 pp 2.1 pp (0.6) pp