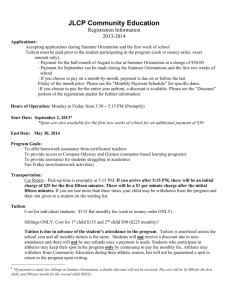

Tuition Discount Policy

advertisement

CONCORDIA COLLEGE Policy and Procedure Manual Subject: Concordia Tuition Allowance Section: Benefits Number: 3.1 Effective Date: 08/01/2011 Scope: Benefitted Faculty, Administrative and Support staff Purpose Concordia College’s tuition waiver benefit provides continuing opportunities for education development for eligible employees, their spouses and dependent children. Policy Concordia College encourages the enhancement of your personal development and education. You may choose to take one class per semester at Concordia College with a 90% discount. Classes must be scheduled in accordance with the work needs of your department, and arranged in advance with your supervisor. All spouses and dependent children of Concordia College benefitted employees with at least a half-time status, are eligible for a Concordia College tuition allowance. Dependent children must meet the FAFSA eligibility requirements. Married children who no longer qualify as a dependent (as defined by the IRS) and meet all other qualifying criteria as described below remain eligible for the tuition allowance. The IRS requires the employee to be taxed on the amount of the tuition allowance granted to a child who is not a dependent. The tuition allowance relates to the tuition and general fees, not including room and board, as listed in the College catalog. The tuition allowance is granted as follows, pro-rated based on FTE: Employees .5 FTE and greater or (benefit eligible) 1st Year – no discount 2nd Year – 23% discount x FTE 3rd Year – 45% discount x FTE 4th Year – 68% discount x FTE 5th Year – 90% discount x FTE Tuition allowance is not intended to replace gift assistance available from state, federal or private sources. An applicant for tuition allowance must apply for financial aid. Dependents of employees who are recipients of Concordia-sponsored scholarships may receive a combination of our scholarships and employee tuition discount which would not exceed tuition. Total gift assistance, through the tuition allowance and other sources, cannot exceed the College comprehensive fee (tuition, fees, room, and board). Upon the death of an employee who has served seven years or more, the student tuition discount will remain in tact for a student that is already enrolled at the college or will be enrolled within a year. Spouses may take one class per semester (up to four credits) at a 90% tuition discount. A spouse who has not earned a bachelor’s degree and has taken fewer than 153 course credits at any higher education institution may take more than once class a semester and receive a discount on all classes based on the schedule above. Tuition allowance does not qualify towards graduate level or accelerated nursing program courses. Procedures/Guidelines To qualify for the tuition allowance a dependent must meet the following eligibility requirements: 1) Dependents are defined as those unmarried children, 24 years of age or under, fulltime student and the child is primarily dependent upon employee for financial support. Children include: • Natural or legally adopted children; • Stepchildren if: a. They have a permanent parent-child relation with you; and b. You claim them as tax dependents for the previous and current calendar year; and c. They are a student as described above. 2) Child has not obtained a bachelor’s degree. 3) Child has attended less than nine semesters of any college or university or the equivalent. 4) Child has earned fewer than 153 academic tuition credits or the equivalent at any higher education institution. Post Secondary Education Options Program (PSEOP), and Advanced Placement credits count towards the 153 credits. Credits for music ensembles, lessons or other similar non-academic tuition credits do not count towards this total. 5) Child meets the admissions standards of Concordia. Tuition discount applies to May Seminar, Summer Session I and II, Fall and Spring Semesters. Once a student has been accepted through admissions or approved for attending May Seminar, the parent/employee can apply for the tuition discount by completing the Concordia College Tuition Discount form and sending to Human Resources. The discount in effect prior to the start of the semester, will apply. To continue to qualify for the discount for the semester, an employee must remain employed past mid-semester. In the event an employee separates from employment prior to mid-semester, the discount will be forfeited. History: Revised 08/01/2011; Effective 06/01/2008; Approved 05/19/2008; Sources FAFSA Eligibility Requirements President’s Cabinet