96-643 The Texas Community Reinvestment 2009 Update

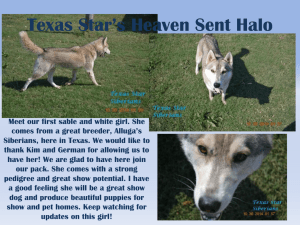

advertisement