Characteristics of Property, Plant, and Equipment Acquisition of

advertisement

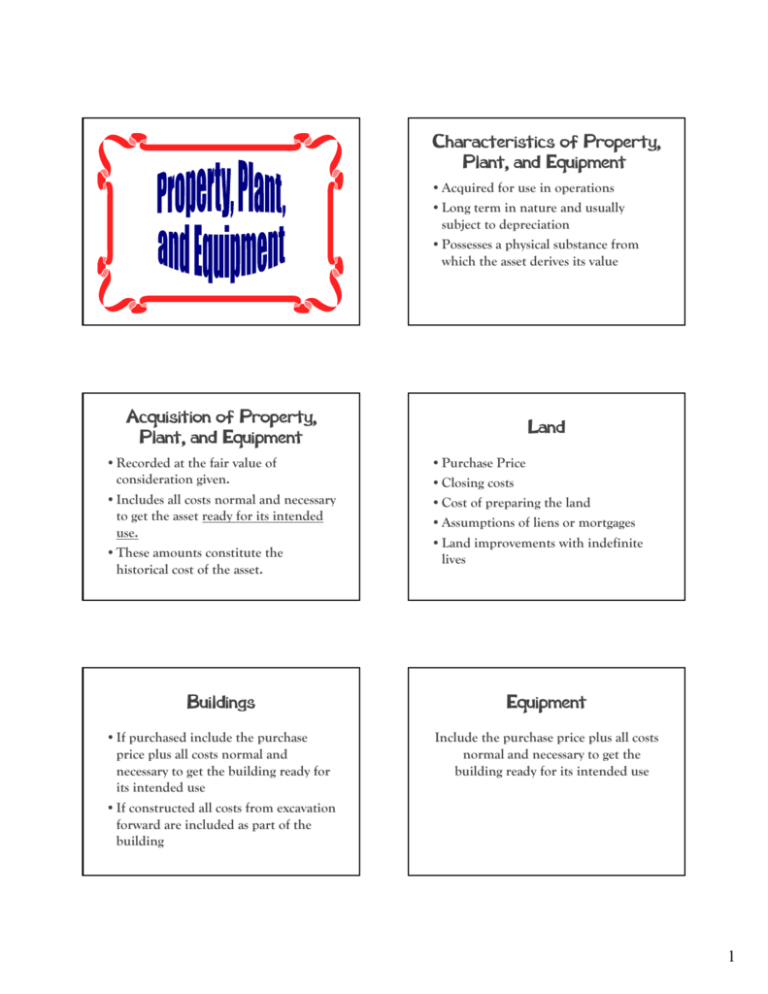

Characteristics of Property, Plant, and Equipment •Acquired for use in operations •Long term in nature and usually subject bj to depreciation d i i •Possesses a physical substance from which the asset derives its value Acquisition of Property, Plant, and Equipment •Recorded at the fair value of consideration given. •Includes I l d all ll costs normall and d necessary to get the asset ready for its intended use. •These amounts constitute the historical cost of the asset. Land •Purchase Price •Closing costs •Cost of preparing the land •Assumptions of liens or mortgages •Land improvements with indefinite lives Buildings Equipment •If purchased include the purchase price plus all costs normal and necessary to get the building ready for its intended use •If constructed all costs from excavation forward are included as part of the building Include the purchase price plus all costs normal and necessary to get the building ready for its intended use 1 Self Constructed Assets Capitalization of Interest •Direct costs are assigned to the asset •Overhead •Capital expenditures must be made •Interest must be incurred •Activities to prepare the asset for use must be ongoing – Direct Di t costt approach h – Full cost approach – Incremental cost approach •Interest costs--capitalize if conditions met. Capitalization of Interest •Weighted Average Accumulated expenditure. •Avoidable A id bl iinterest – Directly attributable – Weighted average of previous debt Lump-Sum Purchases •Sometime a group of assets are purchased in a single amount. •The The single amount must be allocated to each asset because accounting treatments differ. •The allocation is made based on a ratio of relative fair market values. Exchanges of Assets Gains and Losses Four different accounting treatments Basis of assets received less book value of assets given equals the gain or loss – – – – Dissimilar Assets Similar assets--loss situation Similar assets--gain situation--no boot Similar assets--gain situation--boot 2 Establishing Basis Dissimilar Assets Hierarchical Order Record the new asset at its basis. Recognize all gains and losses – FMV of asset given--if known – FMV of asset received--if received if more clearly evident – BV of asset given--last resort Similar Assets Loss Situation Similar Assets Gain Situation--No Boot Record the new asset at its basis. Recognize the loss Defer the gain by reducing the basis of the new asset Similar Assets Gain Situation--Boot Costs Subsequent to Acquisition Recognize only the portion of the gain attributable to the boot received Gain Recognized = Total Gain Cash Received X FMV of All Assets Received Defer the rest of the gain •Costs incurred to achieve future benefits are capitalized. •One One of three conditions must be present: – The useful life must increase. – The quantity produced must increase. – The quality of production must be enhanced. 3 Types of Capital Expenditures •Additions •Improvements and Replacements •Rearrangement and Reinstallation •Major Repairs Improvements and Extensions •An improvement substitutes a better asset for an existing one. •A A replacement l substitutes b i a similar i il asset for an existing one. Rearrangement and Reinstallation •Changes to an existing production facility. •Rearrangements R and d reinstallations i ll i are capitalized as new, separate assets. Additions •These are increases or extensions of existing assets. •Additions Addi i are capitalized i li d as new, separate assets. Improvements and Extensions There capitalization approaches. – Substitution approach. – Capitalize the new cost – Charge accumulated depreciation Major Repairs •Ordinary repairs are expensed. •Major repairs are capitalized as a new asset. 4 5