A n n u a l R e p o r t 2 0 1 0 SECURITIES AND

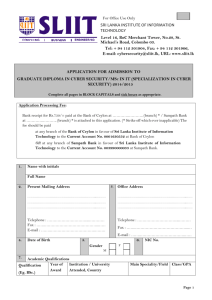

advertisement