Sri Lanka successfully prices USD500 million sovereign bond offering

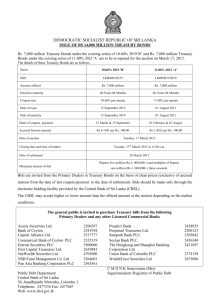

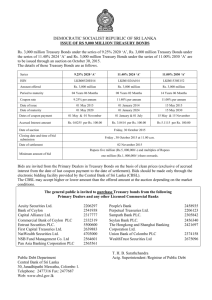

advertisement

Communications Department 30, Janadhipathi Mawatha, Colombo 01, Sri Lanka. Tel : 2477424, 2477423, 2477311 Fax: 2346257, 2477739 E-mail: dcommunications@cbsl.lk, communications@cbsl.lk Web: www.cbsl.gov.lk Press Release Issued By Date Public Debt Department 16 October 2009 FOR RELEASE OUTSIDE THE UNITED STATES ONLY Sri Lanka successfully prices USD500 million sovereign bond offering Yesterday, the Democratic Socialist Republic of Sri Lanka priced a USD500 million 5-year sovereign bond issue (the “Offering”), with a coupon of 7.40%. This represents Sri Lanka’s first international offering following the end of the internal conflict. The Government will use the net proceeds from the Offering to supplement available concessional funds to develop infrastructure projects that have previously been approved by the Government and included in the current 2009 Budget. Central Bank of Sri Lanka Governor Ajith Nivard Cabraal commented: “We are very pleased with the outcome of our latest sovereign US Dollar bond issue. The strong response signifies the heightened confidence of investors globally in Sri Lanka and the country’s enhanced growth prospects following the end of the conflict. This transaction broadens our international investor base substantially and enhances Sri Lanka’s financial flexibility for the future.” The Offering attracted an orderbook that was over-subscribed by more than thirteen times one of the highest level of over-subscription of any sovereign US Dollar bond offering during 2009 yearto-date. Orders were received from two hundred and sixty-nine (269) investors. By geography, 45% of the bonds allocated to investors in the United States, 31% to Europe and 24% to Asia. By investor type, 78% of the bonds were allocated to Fund Managers, 8% to Banks, 7% to Retail, 4% to Insurance Companies and Pension Funds and 3% to other investors. The Offering is in 144A / Reg.S format and the bonds mature on 22nd January 2015. The bonds are rated B by Standard & Poor’s and B+ by Fitch Ratings, and will be listed on the Singapore Exchange. The coupon of 7.40% is significantly lower than the coupon of 8.25% on Sri Lanka's inaugural USD bonds issued in October 2007. HSBC, J.P. Morgan and The Royal Bank of Scotland acted as joint lead managers and joint bookrunners on the Offering. This press release does not constitute an offer of securities for sale in the United States or elsewhere. The securities referred to above are not being registered under the U.S. Securities Act of 1933, as amended (the "Securities Act") and may not be offered or sold in the United States absent registration under the Securities Act or pursuant to an exemption from such registration. Any public offering of securities to be made in the United States will be made by means of a prospectus that may be obtained from the issuer and it will contain detailed information about the issuer, including certain statistical and other economic data. No public offering of the securities will be made in the United States, and the issuer does not intend to register any part of the offering in the United States.