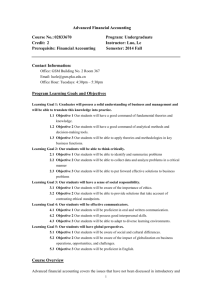

American Red Cross FY12 Financial Results A message

advertisement