Cross-Cutting Cleavages and Government Spending

advertisement

Cross-Cutting Cleavages

and Government Spending∗

Erik Snowberg

Stanford GSB

snowberg@stanford.edu

www.stanford.edu/∼ esnowber

[Secondary Economics Job Market Paper ]

Abstract

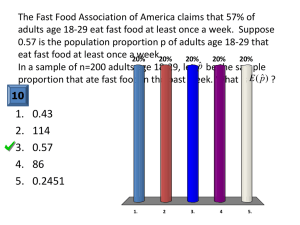

When racial groups differ in terms of their political sensitivity—the propensity of

group members to change their vote based on changes in redistribution promised by a

candidate—the racial composition of a political jurisdiction affects redistributive policy even when preferences are correlated only with income. Furthermore, the extent

to which race and class are cross-cutting is important. Although the concept of crosscutting cleavages is well-known in political science and sociology, its implications have

yet to be analyzed formally. This paper formally defines, develops and tests a model of

cross-cutting cleavages to better understand the complex relationships between race,

class, preferences, political sensitivity and redistributive policy. I show that the effect of cross-cutting cleavages on redistributive policy depends critically on economic

parity—the ratio of average black income to average income. The cross-cutting cleavages model makes six predictions that are all supported by data from large U.S. cities

between 1942 and 1972.

∗

I thank Keith Krehbiel, David Baron, Gerard Padró-i-Miquel and Romain Wacziarg for their support

and insightful comments. This work was supported in part by the SIEPR Dissertation Fellowship through a

grant to the Stanford Institute for Economic Policy Research.

1

Introduction

How does the racial composition of a jurisdiction affect redistributive policy, such as the taxation and spending decisions of governments? Recent research rationalizes observed correlations between racial composition and redistributive policy by assuming that the preferences

of the median voter, and thus policy, change based on the racial composition of a jurisdiction

(Alesina, Baqir and Easterly, 1999; Lind, 2007).1 This is in contrast with canonical models

of the size of government which assume that preferences for redistribution are correlated

only with income (Romer, 1975; Roberts, 1977; Meltzer and Richard, 1981).

This paper focuses on how behavior affects the mapping from preferences to redistributive policies when racial and class cleavages are cross-cutting. Similar to canonical models

of the size of government, the theory does not assume any differences in preferences for

redistribution within a class: the poor like it and the rich dislike it regardless of race. In

the cross-cutting cleavages model, changes in racial composition, or the racial cleavage, of a

jurisdiction alter redistributive policies due to persistent differences between racial groups in

political sensitivity. Political sensitivity is broadly defined to include the propensity of citizens to vote, and if they do vote, their willingness to change their vote based on slight changes

in redistribution promised by a candidate. Political sensitivity is similar to an elasticity of

votes from a group with respect to changes in redistribution promised by a candidate.

The cross-cutting cleavages model is an extension of the redistributive politics framework

of Lindbeck and Weibull (1987) and Dixit and Londregan (1996) and is motivated by data on

political sensitivity in U.S. cities between 1942 and 1972. In this framework, redistributive

policy, specifically the equilibrium tax rate, is determined by the relative sizes and political

sensitivities of the rich and the poor. Political sensitivity has not been widely and consistently

1

Austen-Smith and Wallerstein (2006), in the only other formal study of redistribution involving both

race and class, study redistribution in the presence of affirmative action policies. Alesina, Baqir and Easterly

(1999) intend their model to describe only spending on productive public goods, although it could be applied

to more general redistributive policies.

Marxists believe that race is used by the capitalist class to create divisions among workers. See Wilson

(1978) for a summary. For a formal treatment of this theory see Roemer (1998) and Lee, Roemer and Van der

Straeten (2007).

1

measured. To address this measurement limitation and to generate testable predictions, the

cross-cutting cleavages model focuses on cities in the United States between 1942 and 1972,

years during which within each race the rich were more politically sensitive than the poor

and within each class whites were more politically sensitive than blacks.

There are two main contributions of the model. The first contribution is to formally

define and study the implications of cross-cutting cleavages in redistributive politics. Crosscutting cleavages is an old concept from political science that has not been formalized. A

cleavage is simply a trait that divides a society into a number of groups. In the extreme,

when two cleavages are reinforcing, both cleavages define the same groups. To the extent

that cleavages define different groups—for example if there are both rich and poor whites

and blacks—they cross-cut to some extent.

The degree of cross-cuttingness thus describes a pattern of groups in a jurisdiction. Specifically, I define the cross-cuttingness of the racial and class cleavage as the correlation between

race and income. That is, if knowing a citizen’s race does not increase the accuracy of a prediction of his or her class, then cleavages are said to be perfectly cross-cutting. In contrast,

if knowing a citizen’s race allows a perfect prediction of his or her class, then cleavages are

perfectly reinforcing.

Cross-cuttingness is parameterized here by a new variable, economic parity—the ratio of

average black income to average income. If economic parity is less than one, that is, blacks are

on average poorer than whites, then a rise in economic parity increases the cross-cuttingness

of the racial and class cleavages, holding constant the proportion of the city that is black

(the racial cleavage) and average income (the class cleavage). The theory predicts that this

change will lead to an increase in tax rates and government spending. This is true even

blacks are on average richer than whites, at which point the racial and class cleavage become

less cross-cutting with an increase in economic parity. Thus, the relationship between the

cross-cuttingness of the racial and class cleavages and redistributive policy is non-monotonic

and depends on specific parameters of the model.

2

Despite the fact that the concept of cross-cutting cleavages has not been formally studied,

it has been linked to many outcomes of interest. For example, (Lipset, 1960, pp. 88-89)

notes “[T]he chances for stable democracy are enhanced to the extent that groups and

individuals have a number of crosscutting, politically relevant affiliations.” Lowi (1964,

p. 697) summarizes the work of pluralists on cross-cutting cleavages: “Truman (1951), for

instance, stresses overlapping membership as a source of conflict ... In contrast, Bauer, Pool

and Dexter (1963) found that ... this very overlapping membership was a condition for

cohesion.” Underlying these conclusions of a monotonic effect of cross-cutting cleavages on

the outcomes of interest is an assertion about how cross-cutting cleavages affect the ability

of groups to overcome collective action problems. Here, in contrast, cross-cutting cleavages

affect outcomes in a non-monotonic way and have an effect without assertions about collective

action problems.

The second main contribution of the model is to show that when racial groups differ

in terms of their political sensitivity, the racial composition of a jurisdiction affects redistributive policy even when preferences are correlated only with income. Thus, observed

correlations between racial composition and redistributive policy can be rationalized without speculative assumptions about preferences. This is advantageous as the components of

political sensitivity, especially turnout, are much easier to document than the preferences of

large groups of individuals.

The model makes six predictions, all of which are supported by data from large U.S. cities

between 1942 and 1972. As discussed below, many of these predictions differ from those in

the existing literature. Moreover, when politicians can flexibly target spending to different

groups the predictions of the cross-cutting cleavages model continue to hold while previous

models, such as those of Meltzer and Richard (1981) and Alesina, Baqir and Easterly (1999),

which are based on the median voter framework, cannot make predictions.

3

2

The Model

This section describes and then formalizes the setup and equilibrium of the cross-cutting

cleavages model. It concludes with a subsection that justifies the ordering of political sensitivity between rich and poor blacks and whites. The explanations of the results in Section 3

depend on the lemma and terms defined in this section.

The model describes an election in a city in which citizens vote for one of two candidates

based on their policy platforms. Platforms are binding and consist of a tax rate and level

of government spending. Citizens are characterized by their economic class and their race.

These characteristics are associated with different levels of political sensitivity. A citizen’s

class also induces a particular tradeoff between preferences for taxes and government spending: the rich have a lower ideal tax rate than the poor as is common in probabilistic voting

models. The electoral model is symmetric, and in equilibrium the candidates propose the

same platform. That platform maximizes a sum of weighted citizens’ utilities, where the

weights are given by the political sensitivity of the citizen’s class-race group. The resulting

tax rate lies between the ideal tax rates of the rich and the poor, and an increase in the

political sensitivity of one class moves the tax rate closer to that class’s ideal tax rate.

More formally, there is a unit measure of infinitesimal citizens. A citizen’s class is either

rich or poor i ∈ {R, P }, and her race is either black or white j ∈ {B, W }. The rich here would

be more accurately described as middle-class—the label rich is used for congruence with the

literature. There are thus four class-race groups indexed by ij ∈ {RW, RB, P W, P B}. The

P

proportion of a city from each group is given by λij ∈ [0, 1] where ij λij = 1. The proportion

of the city from class i is λi = λiB + λiW , i ∈ {R, P }, and the proportion of a city from race

j is λj = λRj + λP j , j ∈ {B, W }. Groups also differ in terms of their political sensitivity.

The political sensitivity ψ ij ≥ 0 of a class-race group ij is defined to include the propensity

of citizens in that group to vote, and if they do vote, their willingness to change their vote

based in slight changes in a candidate’s redistributive platform. The demographics of a city

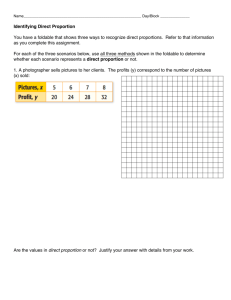

are illustrated in Figure 1.

4

Figure 1: A city is composed of rich and poor blacks and whites.

Poor citizens have exogenous pre-tax income y P regardless of race, and rich citizens

have exogenous income y R > y P regardless of race. The average income of race j is y j =

P

λRj y R +λP j y P

, and the average income of the city is y = ij λij y i . The utility U ij of a citizen

λj

from class i and race j is specified as

U ij (τ, g) = (1 − τ )y i + log(g),

(1)

where τ is a linear tax on income and g is per capita government spending.

A citizen’s ideal tax rate, when spending is constrained to equal tax revenue, depends

only on his or her own income, that is, preferences are solely class based as discussed in the

introduction. Rich and poor citizens have the same utility tradeoff between consumption

(1 − τ )y i and government spending g.2

2

The assumption that government spending is valued as the log of spending allows for a sharp prediction

about the effect of an increase in average income on the equilibrium tax rate in Propostion 1. If government

spending is valued according to some arbitrary strictly increasing, strictly concave function most results still

hold. Blacks may have a greater demand for government spending than whites (i.e. Bergstrom, Rubinfeld

and Shapiro (1982)), however, Rubinfield, Shapiro and Roberts (1987) show that this statistical pattern

5

There are two candidates, and each candidate chooses a platform to maximize his or

her vote share subject to the constraint that spending is less than tax revenue g ≤ τ y. As

candidates do not differ in any substantive way, in equilibrium both candidates propose the

same platform, as shown in Appendix A. As preferences in (1) do not depend on race, this

platform maximizes a sum of the weighted utilities of the rich and the poor. The weight for

i

class i is its political prominence ψ λi , the product of the class’s average political sensitivity

i

ψ =

λiB ψ iB +λiW ψ iW

λi

and size λi . Furthermore, in equilibrium the budget constraint binds

and per capita tax revenue τ y equals per capita spending g. These terms will be used

synonymously for spending.

Intuitively, for a fixed size, groups that are more likely to change their votes based

on changes in a candidate’s platform are more likely to swing the results of the election.

Candidates target these politically sensitive groups by moving their platform closer to the

group’s ideal policy to gain a greater vote share. For a fixed level of political sensitivity

larger groups can provide more votes, and hence greater swings in total vote share, which

enhances the group’s political prominence.

The equilibrium tax rate τ∗ and per capita tax revenue g∗ = τ∗ y are thus a function

of the vector of population proportions ~λ = {λRW , λRB , λP B , λP W }, the vector of political

~ = {ψ RW , ψ RB , ψ P B , ψ P W }, and the vector of incomes ~y = {y R , y P }. The results

sensitivity ψ

~ and examine demographic changes—that is, changes in ~λ, the

in Section 3 fix ~y and ψ

proportion of the population in each group. Section 4, which deals with robustness of the

theory, examines changes in the underlying income ~y of the rich and poor on the equilibrium.

Demographic changes effect the equilibrium tax rate τ∗ and per capita tax revenue g∗ =

P

τ∗ y through the relative political prominence of the poor

ψ λP

,

R

ψ λR

the ratio of the political

prominence of the poor to the political prominence of the rich.

Lemma 1 Changes in the equilibrium tax rate associated with any demographic change are

P

in the same direction as changes in the relative political prominence of the poor

ψ λP

R

ψ λR

asso-

arises due to a failure to account for the lower geographic mobility of blacks.

6

ciated with that demographic change.

P

If the relative political prominence of the poor

ψ λP

R

ψ λR

increases, so will the relative weight of

the poor in the candidate’s vote share maximization. Politicians respond by moving their

proposed tax rate closer to the ideal tax rate of the poor. Thus, the equilibrium tax rate

rises.

In contrast, consider a purely economic baseline—a social planner who maximizes total

social welfare. Since a social planner maximizes the unweighted sum of citizen’s utilities,

this is the same as the cross-cutting cleavages model when all class-race groups had the same

level of political sensitivity. The tax rate set by the social planner τs∗ =

1

y

depends only on

average income, whereas in the cross-cutting cleavages model the tax rate depends on the

relative political prominence of the poor. This highlights the role of politics in setting a tax

rate that differs from the economic baseline in the cross-cutting cleavages model.

2.1

Political Sensitivity

The relative political sensitivity of each class-race group ij is central to the predictions of the

model. Verba and Nie (1972), and Section 5.4, finds blacks are less likely to vote than whites,

and individuals with high socio-economic status are more likely to vote than individuals with

low socio-economic status. Verba, Schlozman and Brady (1995) finds similar patterns that

extend (often more strongly) to other political behavior such as participating in protests and

contributing to campaigns. Wilson (1960) and Dawson (1994) show that blacks are more

committed to one party or the other than whites. Wilson (1960) and Banfield and Wilson

(1963) find that blacks are more likely to be part of a local political machine, and hence

less politically sensitive than whites during the period under study. Pinderhughes (1987,

p. 113), in her study of Chicago politics, summarizes the difference in political sensitivity

between black and white voters as, “[B]lack voters ... consistently, almost uniformly, commit

themselves to the party, faction or individual candidate that is most supportive of racial

reform.”

7

As the above references make clear, a larger percentage of high-income than low-income

individuals vote, so the rich are more politically sensitive than the poor ψ Rj > ψ P j . Furthermore, a lower proportion of blacks than whites turnout to vote, and blacks are more likely

to be committed to one candidate or the other, so blacks are less politically sensitive than

~ where the

whites ψ iB < ψ iW . This establishes a partial ordering on political sensitivity ψ,

relationship between ψ RB and ψ P W is not determined. This ordering is sufficient to produce

the sharp predictions that are derived in the next section.3

3

Results

To generate predictions that can be tested with data available for the period under study, the

equilibrium tax rate can be re-written in terms of the variables of interest: average income y,

the proportion black λB and economic parity

yB

—the

y

ratio of average black income to average

B

income. Thus, the equilibrium tax rate will be written as τ∗ (y, λB , yy ) and the equilibrium

B

level of per capita tax revenue will be written as g∗ (y, λB , yy ). Taking a partial derivative of

the equilibrium tax rate with respect to one of the variables of interest implicitly keeps the

other two constant. This leads to straightforward tests of the model since the coefficient on

one of the variables of interest from a regression which includes all three variables of interest

is the estimated effect of changing that variable keeping the other two constant.

The variables of interest were chosen because a changes in these variables map into

changes in a particular aspect of the cleavage structure: a change in average income y alters

the class cleavage, a change in the proportion black λB alters the racial cleavage, and a

change in economic parity

yB

y

alters the cross-cuttingness of the racial and class cleavage,

or, given the definition of cross-cuttingness in Section 1, the statistical independence of race

3

The model does not take into account the potential endogeneity of political sensitivity. For example,

Washington (2006) finds that having black candidates on the ballot changes turnout patterns. This is not

be a particular concern, as in her study both white and black turnout increases at levels that are roughly

proportional to the overall turnout level of each group. In addition, Alesina and La Ferrara (2000) find that

other forms of engagement respond to the level of diversity in a community.

8

and class.4

The following three subsections examine how the equilibrium tax rate changes with an

increase in one of the variables of interest. Each subsection begins by describing the demographic change that increases one of the variables of interest keeping the other two constant.

This demographic change combined with Lemma 1 provides the intuition for how the equilibrium tax rate changes with the variable of interest. Each subsection concludes with a

brief discussion of the result and any associated corollaries. The final subsection considers

spending that may be targeted to different class-race groups and derives a testable prediction

about per capita welfare spending.

3.1

Changes in Class Composition

Consider a change in class composition, such as increasing the proportion rich and thus

average income, holding the other two variables of interest constant. This creates four

constraints that specify how the the proportions of the population ~λ change. An increase

in average income y, holding constant the proportion black λB and economic parity

yB

,

y

changes the underlying proportions of class-race groups as illustrated in Figure 2. Because

the proportion black is unchanged, there is no change in the racial cleavage. A greater

R

proportion of the city is rich, which increases their political prominence ψ λR . Because the

rich favor a lower tax rate τ politicians curry favor with this increasingly important group

by reducing the tax rate.

Proposition 1 An increase in average income, holding constant the proportion black and

B

economic parity, decreases the equilibrium tax rate:

∂τ∗ (y,λB , yy )

∂y

< 0.

4

Changes in average income, y, and the proportion black, λB , have effects on the statistical independence

of the race and class cleavages. However, these effects cannot be signed, whereas a change in economic parity,

yB

y , has unambiguous effects on the orthoganality of race and class. The definition of cross-cuttingness

here differs from Rae and Taylor (1970). Their measure of cross-cuttingness is based on the increase in

fractionalization introduced by adding another cleavage.

9

Figure 2: An increase in average income alters the class cleavage.

This prediction is in contrast to that of the median voter model of the size of government,

such as the two class version of the Meltzer and Richard (1981) model in Persson and Tabellini

(2000, Chapter 3.3). The median voter model predicts that an increase in the proportion

of the population that is rich generally raises the tax rate. This occurs because the median

voter, who is poor, votes for a higher tax rate because there is now more money in the city

to appropriate for his or her purposes. Because the median voter model makes predictions

about per capita tax revenue g = τ y the prediction that the tax rate will rise holds as

long as average income does not increase too much. If average income increases rapidly, the

predicted increase in per capita tax revenue may be accompanied by a decrease in the tax

rate.

The cross-cutting cleavages model considered here has the reverse indeterminacy—when

average income increases, the direction of the change in tax rates is well defined, but the diB

B

rection of the change in per capita tax revenue g∗ (y, λB , yy ) = τ∗ (y, λB , yy )y is indeterminate

B

because τ∗ (y, λB , yy ) decreases and y increases.

10

Figure 3: An increase in the proportion black alters the racial cleavage.

Corollary 1 An increase in average income, holding constant the proportion black and economic parity, has an indeterminate effect on equilibrium per capita tax revenue.

3.2

Changes in Racial Composition

A change in the proportion black λB , keeping average income y and economic parity

yB

y

fixed, maintains the proportion of the black population that is rich. Because average income

is kept constant, for every increase in the proportion of poor (rich) blacks, there must be

a corresponding decrease in the proportion of poor (rich) whites. If average black income

is less than average white income, y B < y, as illustrated in Figure 3, this implies that the

proportion of the white population that is rich must increase slightly.

11

Proposition 2 An increase in the proportion of the city that is black, holding constant

average income and economic parity, depends on the relative difference in political sensitivity

between races across classes,

ψ P W −ψ P B

.

ψ RW −ψ RB

In particular, the tax rate increases if and only if:

ψP W − ψP B

<Q

ψ RW − ψ RB

P

where Q =

ψ λP λRB

.

R

ψ λR λP B

The equilibrium tax rate increases with the proportion black if the difference in political

sensitivity between blacks and whites across the poor is smaller than the difference in political

sensitivity between blacks and whites across the rich. How much smaller depends on Q.

Intuitively, if the difference in political sensitivity is higher across the rich, an increase in

the proportion of the city that is black reduces the average political sensitivity of the rich

more than it reduces the average political sensitivity of the poor. This increases the relative

political prominence of the poor, so by Lemma 1, the equilibrium tax rate increases.

Alesina, Baqir and Easterly (1999) predict that if the proportion black is less than onehalf, an increase in the proportion black decreases spending on productive public goods.

If the logic of their model is extended to all government spending, then the prediction of

the cross-cutting cleavages model stands in contrast, as spending may increase with the

proportion black. Interestingly, this is not the result of blacks being on average poorer than

whites, as the average income of the population and of blacks are both held constant in the

proposition. Rather, the predictions are driven by differences in political sensitivity between

races that depend on class.

The theory here depends on an inequality, the direction of which is uncertain based on

previous research. In the empirical section, the limited data on turnout, a component of

political sensitivity, will be examined to see if the statistical patterns in that data match

those implied by the statistical patterns in taxation data and Proposition 2. Additionally,

the next two subsections derive testable predictions that depend on whether the tax rate

12

Figure 4: The cross-cuttingness of the race and class cleavage increase with economic parity.

increases or decreases with an increase in the proportion black.

3.3

The Effects of Cross-Cuttting Cleavages

The final variable of interest, economic parity

yB

,

y

is unique to this model.5 An increase in

economic parity, holding constant average income y and the proportion black λB , corresponds

to an increase in the proportion of blacks that are rich, and a corresponding increase in the

proportion of whites that are poor, as illustrated in Figure 4.

The proportion of the rich that are black and the proportion of the poor that are white

both increase with economic parity. This increases the average political sensitivity of the

poor and decreases the average political sensitivity of the rich as blacks are less politically

sensitive than whites. Because average income y is held constant, the proportion of the city

that is rich (or poor) does not change. Thus, the relative political prominence of the poor

5

The ratio of average black income to average white income is used in sociological studies as a measure of

economic deprivation of blacks rather than as a parameterization of the cross-cuttingness of racial and class

cleavages. See for example Spilerman (1970) and Olzak, Shanahan and McEneaney (1996).

13

P

ψ λP

R

ψ λR

rises, leading politicians to increase the tax rate.

Proposition 3 An increase in economic parity, holding constant the proportion black and

B

average income, increases the equilibrium tax rate:

∂τ∗ (y,λB , yy )

B

∂ yy

> 0.

If average black income is less than average income y B < y as in Figure 4, an increase in

economic parity

yB

y

brings the racial and class cleavages closer to statistical independence.

That is, the cleavages become more cross-cutting. However, if average black income is greater

than average income, then an increase in economic parity will decrease the cross-cuttingness

of the racial and class cleavages. Regardless of whether cross-cuttingness increases or deB

creases, an increase in economic parity increases the equilibrium tax rate, τ∗ (y, λB , yy ). This

shows the difficulty of making general predictions about the effects of cross-cutting cleavages.

To understand the effects of increasing or decreasing levels of cross-cuttingness, one must

be specific about which cleavages one is examining, and how the groups created by those

cleavages relate to one another through political and economic mechanisms.

Finally, the previous two propositions lead to a straightforward corollary.

Corollary 2 A change in the proportion black or in economic parity, keeping the other two

variables of interest fixed, leads to changes in the equilibrium level of per capita tax revenue

that are in the same direction as changes in the equilibrium tax rate.

A change in either the proportion black λB or economic parity

yB

y

keeps average income y

B

B

fixed. Thus, the change in per capita tax revenue g∗ (y, λB , yy ) = τ∗ (y, λB , yy )y will be in

the same direction as, and proportional to, the change in the tax rate.

3.4

Targeted Government Spending

The data analyzed in Section 5 provides information on aggregate local government spending

in several categories. Only one of these categories, spending on public welfare, can be thought

of as targeted to a particular group, in this case the poor. To utilize these data, an additional

14

prediction that depends on whether the equilibrium tax rate increases or decreases with an

increase in the proportion black (Proposition 2), is derived in this subsection when politicians

can target spending to different groups.

There are several reasons why a politician may be able to target spending to some groups

while excluding others. For example, there may be intrinsic differences in preferences for

different types of spending between groups. Additionally, to the extent that different groups

live in different areas of a city, politicians may be able to target spending to certain groups

that would be preferred equally by all groups: all citizens might like spending on parks, but

only if the park is located in their neighborhood.

Preferences are now specified as

i

j σ

σ

1

log

+ log

,

U (τ, ~σ ) = (1 − τ )y +

i

2

λ

λj

ij

i

(2)

where σ i is spending directed to class i ∈ {R, P } and σ j is spending directed to race j ∈

{B, W }. As shown in Subsection 4.1, all the previous results continue to hold with this

utility function. This utility function captures the intuition that, for example, rich and poor

blacks both have some similar preferences (σ j ) and some dissimilar preferences (σ i ) over

types of government spending.6 In addition, the value to a citizen of spending targeted to

race is independent of a citizen’s class, and each citizen values per capita spending directed

to race and class equally.7

6

Wilson (1978) argues that class is more important than race in black political identities. Other scholars,

such as Huckfeldt and Kohfeld (1989) disagree. This utility function takes the middle ground on this issue

by considering both.

7

The assumption that the rich might like increased government spending because it can be targeted

to them differs from the theoretical literature on this subject. However, it is clear that such targeting is

feasible. For example, in the period under study, Katzman (1968), Owen (1972) and Sexton (1961) all find

that education spending favors the rich in various municipalities. In other types of government expenditure,

Martin (1969) and Levy, Meltsner and Wildavsky (1974) both find that library expenditures primarily benefit

the rich, and Community Council of Greater New York (1963) finds that the rich benefit more from parks

than the poor do.

15

In equilibrium, the level of spending on race or class k ∈ {R, P, B, W }, σ∗k is:

k

σ∗k

ψ λk

=

,

2γ

R

P

ψ λR y R + ψ λP y P

where γ =

.

y

(3)

Holding γ constant, total spending on a race or class increases with the political prominence

of that group. Groups that are more sensitive and larger, thus more likely to be pivotal in

voting, are better provided for by politicians than small and politically insensitive groups.

Proposition 4 An increase in the proportion black, holding constant average income and

economic parity, will increase per capita spending on the poor if and only if the equilibrium

tax rate increases:

∂σ∗P

≥0

∂λB

B

⇐⇒

∂τ∗ (y, λB , yy )

∂λB

≥ 0.

In Proposition 2, whether tax rates rise or fall with an increase in the proportion black

depends on how that change affected the relative political prominence of the rich and poor.

When the relative political prominence of the poor increases, so does the tax rate - but as

can be seen from (3) this is also the condition that leads to an increase in per capita spending

on the poor.8

Changing racial composition has several well specified effects even though preferences

do not depend on race. Instead, the cross-cutting cleavages model makes sharp predictions

~ In sumwith only an empirically supported ordering on the vector of political sensitivities ψ.

mary, when the proportion black increases, holding constant average income and economic

parity, the equilibrium tax rate, per-capita tax revenue and per-capita spending on the poor

all increase or all decrease depending on the values of the vector of political sensitivities.

Specifically, all three of these variables will rise if and only if the difference in political sensitivity between blacks and whites across the poor is smaller than the difference in political

8

Per-capita spending on the poor may increase or decrease with an increase in average income or economic

parity. The intuition above does not apply in those cases because it ignores the effect of increasing the

political prominence of the poor on γ. In the case of an increase in the proportion black this omission is

inconsequential, but it is important when considering increases in average income or economic parity.

16

sensitivity between blacks and whites across the rich.

4

Robustness of the Theory

This section establishes that the above predictions are robust to relaxing two assumptions,

and makes no new testable predictions. First, it finds that all the main results hold when

politicians can very flexibly target spending to groups. Second, changes in the parameters

of interest driven by changes in the income of the rich and poor, rather than changes in the

population proportions of different groups, do not alter the main results.

4.1

Targeting

Suppose there are K different types of government spending, σ k , k ∈ {1, 2, 3, ..., K}. A

citizen in class i and race j then has utility given by:

U ij (τ, ~σ )

(1 − τ )y i +

=

K

X

k

αijk log

k=1

s.t.

K

X

k=1

where the condition

PK

k=1

αijk = 1 ,

X

βk

σ

ij

ij λ 1{αijk >0}

!

P

(4)

λij αijk > 0 , β k ∈ (0, 1]

ij

αijk = 1 ensures that each class-race group ij has the same

utility tradeoff between government spending and consumption. This maintains the earlier

assumption that preferences over tax rates depend only on a citizen’s class. Note that

some αijk s could be negative, allowing for types of government spending that bring positive

P

utility to one group and negative utility to another. The assumption that ij λij αijk > 0

ensures that in equilibrium all types of government spending are greater than zero.9 The

β k parameters capture how rival a particular form of government spending is. For a type

of spending k, β k = 1 means that the type of government spending is perfectly rival, and

9

If some type of government spending were zero then some groups would have infinite utility, and other

groups would have negative infinite utility, and equilibrium existence would no longer be guaranteed.

17

as β k → 0 that type of spending moves towards being perfectly nonrival. Finally, dividing

P

spending by ij λij 1{αijk >0} captures the idea that spending is shared among the groups

that gain positive utility from that form of government spending.10 The politicians’ budget

P

k

constraint is now K

k=1 σ ≤ τ y. Note that the single type of government spending in (1)

and the targeting in the previous section given by (2) are special cases of the utility function

in (4).

Even when politicians have the ability to flexibly target government spending, the main

results do not change.

Robustness Result 1 Propositions 1, 2 and 3 hold if citizen utility is given by (4).

Alesina, Baqir and Easterly (1999) show that racial diversity may lead to decreases in government spending due to diversity of preferences for different types of spending. In the

cross-cutting cleavages model adding preference diversity about spending does not affect the

results.11

4.2

Changes in Income Levels

All previous results attribute changes in the variables of interest—the proportion black λB ,

average income y and economic parity

yB

—to

y

changes in the population proportions of each

group ~λ = {λRW , λRB , λP B , λP W }. Changes in the last two variables of interest, however,

may be due to changes in the income of the rich and the poor ~y = {y R , y P }. Even if this is

the case, the relevant results still hold.

Robustness Result 2 An increase in average income through changes in ~y , holding economic parity constant, leads to a decrease in the equilibrium tax rate. An increase in economic parity through changes in ~y , holding average income constant, leads to an increase in

the equilibrium tax rate if and only if average black income is less than average income.

10

Note that I make no distinction between government spending for productive and consumptive purposes.

That is, adding preference diversity does not change the level of taxation and spending, or the comparative statics of the model.

11

18

5

Empirical Evidence

There are few established facts about the effect of race, class and the cross-cuttingness of

racial and class cleavages on tax rates. This section identifies some of these facts and assesses

the extent to which the predictions of the cross-cutting cleavages model are observed in

data from large U.S. cities between 1942 and 1972. It then examines turnout patterns to

determine whether the patterns in this limited data on political sensitivity are consistent

with the model.

The predictions of the cross-cutting cleavages model are straightforward to test as they

isolate the effect of increases in one of the three variables of interest—average income y, the

proportion black λB and economic parity

yB

—holding

y

the other two constant. Estimating

a specification of the form

x = α + βy y + βλB λB + β yB

y

yB

+

y

(5)

produces coefficients β that are the correlation of the dependent variable x with one of the

variables of interest, holding the other two constant. For example, if the dependent variable

is the tax rate τ , then βy is an estimate of the effect of increasing average income on the tax

rate holding constant the proportion black and economic parity.12

The predictions of the cross-cutting cleavages model are summarized in Table 1 in terms

of the coefficients in (5). When the proportion black increases, holding constant average

income and economic parity, the equilibrium tax rate, per-capita tax revenue and per-capita

spending on the poor all increase or all decrease depending on the values of the vector of

political sensitivities. That is, βy is predicted to be greater than zero or all less than zero

for all three dependent variables, depending on the condition in Proposition 2. When these

12

Related studies have measured ethnic diversity using the fractionalization or polarization measures (Easterly and Levine, 1997; Alesina, Baqir and Hoxby, 2004; Montalvo and Reynal-Querol, 2005), but when there

are two groups fractionalization= 2λB (1 − λB ) = 21 polarization, making the coefficient on proportion black

(λB ) both easier to interpret and theoretically motivated. For more on the measurement of polarization see

Esteban and Ray (1994).

19

Table 1: Summary of Theoretical Predictions

Dependent Variable

Independent

Variable

Tax Rate

(τ )

Per-Capita Spending

(g)

Per-Capita Spending

on the Poor (σ P )

βλB > 0

βλB > 0

βλB > 0

(λB )

βλB < 0

βλB < 0

βλB < 0

Average Income

(y)

βy > 0

no

prediction

no

prediction

Economic Parity

B

( yy )

β yB > 0

β yB > 0

no

prediction

Proportion Black

y

y

three coefficients are greater than zero, the cross-cutting cleavages model predicts that the

difference in political sensitivity between races across classes should be larger for the rich

than for the poor.

The following subsection briefly describes the taxation data; detailed information on the

data can be found in Appendix B. The middle subsections examine the data in a panel and

cross-sections of cities. The final subsections examine the limited data on political sensitivity

to make a final attempt at falsifying the cross-cutting cleavages model.

5.1

Taxation and Spending Data

The taxation and spending data are from U.S. cities with a population over 100,000 at

approximately five year intervals between 1942 and 1972. The population threshold is chosen

to select for cities with active political communities and to ensure data availability.13 The

time range is chosen because U.S. cities experienced large changes in ethnic makeup and

in the relative income of blacks during this period. The study ends in 1972 to avoid the

13

Banfield and Wilson (1963) find that small cities have distinct forms of political organization—usually

involving just a few individuals—from larger cities.

20

unmodeled effects of Asian and Hispanic immigration.14 Moreover, this period predates the

passage of Proposition 13 in California in 1978, which significantly altered the dynamics of

local taxation.

15

Income data is not easily available before 1940.

The main predictions of the theory are in terms of tax rates, however, tax rate data are

not available. The data do contain per capita tax revenue g = τ y and average income y for

each city. Dividing per capita tax revenue by average income gives a measure of the central

tendency of tax rates, τ̂ . Gramlich and Rubinfeld (1982) and others have found that the

income elasticity of property-tax payments is one, which supports the modeling assumption

that local tax rates can be approximated as a linear tax on income without the distortionary

effects of an income tax.16

5.2

Panel Data Analysis

Estimates from a cross-section of cities may reflect the selection of citizens into cities based

on tax rates rather than the selection of tax rates by politicians based on the demographics

of the city (Tiebout, 1956). Thus, a panel specification with city fixed effects is preferred as

it isolates the effects of demographic changes within a city over time. The empirical results

hold in cross-sectional data as well, as shown in the next subsection.

Table 2 estimates the linear, fixed-effects specification

xct = α +

βλB λB

ct

+ βy y ct + β yB

y

yB

ct

+ χ(controlsct ) + θt + µc + ct ,

y ct

(6)

where t indexes time and c indexes cities, using a panel of U.S. cities between 1942 and

1972. The city level dummy µc removes unobserved heterogeneity between cities, and the

14

It is possible that Hispanic populations may have had an effect before 1972. To control for this possibility

Table 7 drops observations from states that share a border with Mexico.

15

The next year where data is available is 1982. When examining expenditure data from the local level it

is common to conduct the analysis before Proposition 13 in California and Proposition 2 12 in Massachusetts.

For example, see Epple and Sieg (1999) and Epple, Romer and Sieg (2001).

16

Using this estimated tax rate as a proxy for a linear income tax is the same as using income as a proxy

for wealth. This specification also treats renters and homeowners similarly, which is common in the public

finance literature. For example see Epple, Romer and Sieg (2001).

21

year dummies θt control for any national shocks to the dependent variable.17

The controls are largely the same as those in Alesina, Baqir and Easterly (1999) and

attempt to capture other possible determinants of tax rates. Because the predictions of

the Meltzer and Richard (1981) model are in terms of the ratio of median to average income, adding this ratio as a control ensures that the cross-cutting cleavages model explains

variation in addition to that explained by Meltzer and Richard (1981). The population in

school controls for the spending needs of the city, as schools are an important component of

local government spending. This also controls for differences in preferences for government

spending and taxation that a more and less educated populace might have. The population

controls for any scale effects that might be present in larger communities. The number of

government employees controls for any propensity for patronage through city jobs a political

regime might have. Finally, the percent of the population over 65 controls for the effect of

seniors on spending found in Poterba (1997).

The results in Table 2 are supportive of the cross-cutting cleavages model. In accordance

with Proposition 1 the coefficient on average income y is negative and statistically significant.

When per capita tax revenue is the dependent variable the coefficient on average income

changes sign when controls are added and is not statistically significant in either column.

The coefficient on economic parity is positive and significant in all columns, conforming with

the prediction in Proposition 3 and Corollary 2. Finally, the coefficients on the proportion

black are positive when the tax rate τ̂ is the dependent variable. Corollary 2 then implies that

the coefficients on proportion black should be positive when per-capita tax revenue g is the

dependent variable, which is also the case. This has specific implications for the coefficient

on the proportion black when per-capita spending on the poor σ P is the dependent variable,

and specific implications for the pattern of political sensitivity across all four groups, both of

which will be tested. Finally, the standard deviation of the residuals from regressions of tax

rates and per capita tax revenue on the time and city fixed effects are 0.3 and 65 respectively.

17

Hausman (1978) tests reject the appropriateness of random-effects specifications in most of the specifications in Table 2.

22

Table 2: Panel Results

Dependent Variable:

Tax Rate

(τ̂ )

Per-capita Tax

Revenue (τ y)

Proportion Black

1.75∗∗∗

(0.47)

1.66∗∗∗

(0.48)

329∗∗∗

(106)

314∗∗∗

(104)

Average Income

-0.93∗∗∗

(0.30)

-0.55∗

(0.32)

-72.8

(65.1)

16.9

(69.1)

Economic Parity

0.33∗∗

(0.16)

0.31∗∗

(0.16)

81.4∗∗

(33.2)

61.8∗

(35.1)

Median to Average

Income Ratio

-0.85

(0.56)

-240∗∗

(107)

Population in School

-0.09

(0.07)

-12.6

(15.8)

-0.09∗∗∗

(0.03)

-21.3∗∗∗

(5.63)

City Employees

1.44∗∗

(0.58)

408∗∗∗

(135)

Senior

-5.44∗∗

(2.28)

-542∗∗∗

(426)

Population

Constant

R2

n (city × year)

9.08∗∗∗

(2.79)

7.02∗∗

(3.08)

651

(609)

158

(656)

0.897

828

0.910

806

0.853

828

0.882

806

Notes: ∗∗∗ ,∗∗ ,∗ denotes statistical significance at the 1%, 5% and

10% levels, respectively. All columns contain year and city

fixed effects. White (1980) heteroskedastictic-consistent

standard errors in parenthesis.

23

Thus, the explanatory variables can account for much of the remaining variation.

As discussed in Subsection 3.4 the data separates local government expenditures into

several categories, only one of which, spending on public welfare, is targeted to a specific

group—in this case the poor. Proposition 4 predicts that if tax rates increase with the

proportion black, so should per capita spending on the poor.

Table 3 estimates (6) with per capita public welfare expenditures as the dependent variable.18 The deficiency of this regression as a test of the proposed theory should be noted.

Public welfare spending is only one type of spending that may be preferred by the poor. Thus,

increases in public welfare spending may be accompanied by decreases in, for example, police protection for the poor, which the data does not measure. Regardless, per capita public

welfare spending increases with the proportion black, in accordance with Proposition 4.

5.3

Cross-Sectional Analysis

As a first check on the robustness of the panel results the linear specification

τ̂c = α + β1 λB

c + β2 y c + β3

yB

c

+ χ(controlsc ) + c

yc

(7)

is estimated in 1960, 1967 and 1972, where c denotes a city. The results are presented in

Table 4. These years are chosen because a control for education (the percent of the city with

at least four years of college) is available for these years. Analyses of other available cross

sections are substantively similar.19

The results of the cross-sectional analysis are once again supportive of the cross-cutting

cleavages model. In the cases where the coefficients on the variables of interest are statistically significant, a one-standard deviation in each of the independent variables is associated

18

The reduced sample size is due to the fact that local public welfare spending is not reported by the

Census Bureau for all years.

19

That is to say that two of the variables of interest have significant coefficients in the expected direction

while the coefficient on the third variable of interest is insignificant. The p-value on the coefficient for average

income βy in Column 2 of Table 4 is 0.13.

24

Table 3: Local Public Welfare Spending

Dependent Variable:

Per-Capita Public

Welfare Spending (σ P )

Proportion Black

376∗∗∗

(127)

300∗∗∗

(115)

Average Income

58.2

(37.3)

27.5

(34.1)

Economic Parity

-21.9

(20.4)

-25.0

(21.3)

Median to Average

Income Ratio

-95.8

(78.8)

Population in School

-14.8

(16.7)

Population

-4.22

(4.35)

City Employees

406∗∗∗

(113)

Senior

158

(261)

Constant

-568

(356)

-228

(343)

R2

n (city × year)

0.601

675

0.720

662

Notes: ∗∗∗ ,∗∗ ,∗ denotes statistical significance at the

1%, 5% and 10% levels, respectively. All columns

contain year and city fixed effects. White (1980)

heteroskedastictic-consistent standard errors in

parenthesis.

25

Table 4: Cross-sectional Results

Dependent Variable: Tax Rate (τ̂ )

1960

1967

1972

Proportion Black

0.64

(0.68)

0.50

(0.71)

2.39∗∗

(0.99)

2.23∗∗

(0.90)

2.21∗∗

(1.01)

1.86∗∗

(0.89)

Average Income

-1.55∗∗

(0.61)

-1.08

(0.70)

-0.24

(0.84)

0.47

(0.88)

-0.48

(0.87)

0.02

(0.83)

Economic Parity

2.50∗∗∗

(0.41)

2.50∗∗∗

(0.51)

3.72∗∗∗

(0.80)

4.13∗∗∗

(1.01)

2.54∗∗∗

(0.81)

2.62∗∗∗

(0.80)

Median to Average

Income Ratio

-1.92

(1.49)

-2.22

(1.83)

-1.06

(1.93)

Population in School

-0.57

(0.64)

-0.53

(1.08)

0.27

(1.03)

College

-1.27

(3.22)

0.09

(3.84)

0.47

(2.69)

Population

0.06

(0.12)

0.03

(0.25)

-0.20

(0.25)

City Employees

2.29∗∗

(0.96)

2.47∗∗

(1.21)

5.40∗∗∗

(1.70)

Proportion Senior

1.22

(2.44)

0.19

(2.74)

2.87

(3.65)

Constant

14.32∗∗∗

(6.02)

11.46∗

(6.35)

0.95

(8.39)

-4.29

(8.14)

4.28

(8.75)

-0.16

7.82

R2

n (cities)

0.328

122

0.468

122

0.267

131

0.431

131

0.174

141

0.403

141

Notes: ∗∗∗ ,∗∗ ,∗ denotes statistical significance at the 1%, 5% and 10% levels, respectively.

White (1980) heteroskedastictic-consistent standard errors in parenthesis.

26

with a one-third to one-half standard deviation change in the tax rate.

5.4

Turnout Patterns across Race and Class

The pattern of empirical findings and Proposition 2 imply an additional testable result of

the cross-cutting cleavages model. Specifically, tax rates rose with the proportion black, so

Propostion 2 predicts (since it is an if and only if statement) that the difference in political

sensitivity between races should be larger for the rich than for the poor. Turnout data can

thus be used to try to falsify the theory. The two separate analysis of turnout data in this

subsection fail to do so.

The American National Election Study (ANES) asks approximately 1,000 U.S. citizens

every other year whether or not they voted. The ANES also provides data on a respondent’s

race and rough data on where a respondent is in the country-wide income distribution. Panel

A of Table 5 classifies any respondent with income in the top third of the distribution as

rich.20 A respondent’s report of whether or not he or she voted is regressed on an indicator

for race, an indicator for whether the respondent was classified as rich, and the product of

these indicators. The condition in Propostion 2 requires the coefficient on the product of

the indicators, Black × Rich, to have a negative sign. While this is the case across all four

columns, in none of the columns is the coefficient statistically significant.

The first column of Panel A reports regression results for all urban respondents. Columns

2 and 4 restrict the sample to years with no presidential election. Columns 3 and 4 restrict

the sample to respondents in the top third or bottom third of the income distribution.

This later sample selection is made to draw a starker contrast between the rich and other

respondents. The data presented in the first panel do not falsify the theory, although there

are severe data limitations: in the first column only 219 black respondents are classified as

rich.21

20

Specifically, the data describes whether the respondent’s income was between the 0-16 percentile, 16-33

percentile, 33-66 percentile, 66-95 percentile or 95-99 percentile of the income distribution. Given the sparse

data, there is no flexibility in this cutoff.

21

It is well known that ANES respondents often report that they have voted when in fact they have not.

27

Table 5: Voter Turnout Patterns Match those required by Proposition 2

Panel A: ANES Turnout Data

Dependent Variable: Did Respondent Vote?

Rich and Very Poor

Respondents Only

offyear

only

offyear

only

Indicator for Black

−0.05∗∗

(0.02)

−0.09∗∗∗

(0.03)

-0.02

(0.03)

-0.06

(0.04)

Indicator for Rich

0.15∗∗∗

(0.02)

0.14∗∗∗

(0.02)

0.20∗∗∗

(0.02)

0.20∗∗∗

(0.03)

Black × Rich

-0.02

(0.04)

-0.00

(0.06)

-0.04

(0.04)

-0.02

(0.07)

R2

n (respondents)

0.135

6296

0.157

2879

0.195

3862

0.228

1743

Panel B: ROAD Turnout Data

Dependent Variable: MCD Group Turnout

Non-Homogenous

Areas Only

offyear

only

offyear

only

Proportion Black

-0.04

(0.03)

-0.06

(0.05)

0.01

(0.04)

0.03

(0.05)

Proportion Black ×

Average Black Income

0.68

(3.14)

1.61

(4.84)

0.22

(2.85)

-3.68

(4.15)

Proportion White ×

Average White Income

4.46∗∗∗

(0.26)

3.43∗∗∗

(0.38)

4.60∗∗∗

(0.58)

3.29∗∗∗

(0.87)

R2

n (MCD Group × year)

0.439

4257

0.186

2239

0.589

1177

0.357

582

Notes: ∗∗∗ ,∗∗ ,∗ denotes statistical significance at the 1%, 5% and 10% levels,

respectively. All regressions include state × year fixed effects.

White (1980) heteroskedastictic-consistent standard errors in parenthesis.

28

Panel B of Table 5 presents a second attempt to falsify the theory. Data from the Record

of American Democracy (ROAD) (King et al., 1997) is used in ecological regressions to

examine the effects of race and income on aggregate turnout in Minor Civil Division groups

(MCD Group - a level of data aggregation unique to this dataset) from 1986-1990.22

Turnout πmt is regressed on the proportion black λB the proportion black times average

black income λB y B and the proportion white times average white income λW y W . Panel B

estimates the specification

B B

W W

π mt = α + β1 λB

mt + β2 λmt y mt + β3 λmt y mt + θst + mt ,

(8)

where π is the observed turnout in MCD Group m at time t. θst is a state-year fixed effect,

introduced to control for turnout shocks due to particularly competitive statewide elections.

The partial derivative of the observed turnout with respect to the proportion of the city

B

that is black times average black income λB

mt y mt is β2 . In the cross-cutting cleavages model,

P

turnout is given by π = ij λij π ij . The derivative with respect to λB y B , keeping constant

λB and λW y W is given by:

dπ dλB y B λB ,

=

λW y W

π RB − π P B

yR − yP

thus

π RB − π P B

β2

=

RW

P

W

π

−π

β3

The point estimates of the coefficient on proportion black times average black income β2

are statistically indistinguishable from zero, so once again the condition in Proposition 2 is

satisfied. However, β2 is not statistically different from β3 , the coefficient on the proportion

white times average white income. Once again the analysis does not falsify the theory.

Sigelman (1982) finds that the tendency to over-report is stronger for blacks than for whites, and Hill and

Hurley (1984) finds that wealthier blacks are more likely to over-report than poor blacks or wealthier whites.

These patterns would strengthen the results of the analysis in Panel A of Table 5.

22

While it would be preferable to have data from the period under study, this data is the only easily

available dataset that is matched with demographic data at a level lower than congressional districts. For a

brief description of the data in ROAD see King and Palmquist (1997). It is important to note both that the

analysis of ROAD data uses OLS regressions and does not use the ecological inference techniques of King

(1997), and that ecological regressions generally suffer from aggregation bias which may bias results either

up or down.

29

Columns 3 and 4 of Panel B attempt to produce more precise estimates by eliminating MCD

Groups where less than five percent of the population is black or less than five percent of

the population is white, but this has little effect.23

Overall, the data are supportive of the cross-cutting cleavages model. The patterns in

taxation and spending data are consistent with the theory. Moreover, the taxation data

implies a specific prediction about the relative values of political sensitivity for each classrace group. Turnout data does not falsify this prediction.

5.5

Empirical Robustness

The large demographic changes in U.S. cities during the period under study were accompanied by large political and social changes, especially in the South. This subsection examines

two possible ways in which these changes may bias the results in Table 2.

In the cross-cutting cleavages model a decrease in the supression of black turnout increases

their political sensitivity, and leads to an increase in the equilibrium tax rate because blacks

are on average poorer than whites. If a decrease in the political repression of blacks were

correlated with one of the variables of interest, we might be observing the effects of this

decrease rather than the effects of demographic changes. For example, it might be easy to

suppress black voter turnout if blacks are a small proportion of the population, but impossible

when they are a large proportion of the population. This would bias the coefficient on the

proportion black upwards.24

Using data from the ANES, Table 6 examines the ratio of the average turnout of blacks

to average turnout

πB

π

across states and time. Because there are very few respondents in

each state for a given year, ten years worth of data from the ANES are used to estimate a

23

The exception is Column 3 where the p-value on a Wald (1943) test that β2 6= β3 is 0.14.

Oberholzer-Gee and Waldfogel (2005), in a study of political behavior in the late 1990s, find that

minority turnout increases with the size of the local minority population as the result of changes in media

structure. Leighley (2001), using ANES data, finds little evidence of rising black turnout with the proportion

of a community that is black. The racial threat hypothesis (Key, 1949) would predict that relative black

voter turnout decreases when the proportion black increases. If this hypothesis is correct, it would bias the

coefficient on proportion black downwards and hence is not of particular concern.

24

30

single state-decade observation of relative turnout. These estimates are then regressed on

demographic data from the decennial census.25 Panel A of Table 6 creates these state-decade

observations using all respondents in a state, whereas Panel B uses only urban respondents.

Table 6 shows that of the three variables of interest, only economic parity is robustly

correlated with relative black turnout. Because rich blacks are more politically sensitive than

poor blacks, an increase in economic parity is associated with an increase in the relative

political sensitivity of blacks in the cross-cutting cleavages model. Panel B confirms this

pattern for urban respondents, although the standard errors are somewhat larger because

the Census Bureau and the ANES, which supply the right and left-hand side variables

respectively, use different definitions of what constitutes an urban area.26

Even if relative black turnout were correlated with one of the variables of interest, if

black political sensitivity were increasing in a relatively uniform way across the country, the

effect of this increase would be controlled for by the year fixed effects in (6). However, it is

likely that that the relative political sensitivity of blacks increased at different rates in the

South as compared with the rest of the country. Year by south fixed effects are added to

the specification in (6) in Columns 1 and 4 of Table 2 to control for this possibility. The

inclusion of these fixed effects do not affect the results in Table 2. Columns 2 and 5 take this

approach one step further by including census division by year fixed effects.27 This reduces

the coefficient on economic parity by half as economic parity is highly correlated with the

fixed effects, but the other coefficients on the variables of interest are robust.

Finally, states that border Mexico have historically had larger Hispanic populations and

the different racial dynamics created by this population may affect the local tax rate. To

control for this Columns 3 and 6 drop data from the states that border Mexico: California, New Mexico, Arizona and Texas. Dropping these states does not affect the results in

25

The ANES does not identify a respondent’s location until 1956. The sample period is from 1956-1984

to increase the amount of data. Results are very similar if we omit data from 1976-1984.

26

The second panel has fewer observations because the U.S. Census dataset (PUMS) dataset does not

identify urban vs. rural respondents in states with less than 250,000 urban or rural residents.

27

There are nine census divisions in the U.S. each containing 4-6 states in close proximity to one another.

31

Table 6: Relative Voter Turnout of Blacks Increases as Relative Black Income Increases

Dependent Variable:

Ratio of Black Turnout to Overall Turnout

all

states

1960

and

1970

southern

states

nonsouthern

states

all

states

nonsouthern

states

Panel A: All Respondents

Economic Parity

1.46∗∗∗

(0.48)

1.37∗∗∗

(0.51)

2.24∗

(1.20)

2.29∗∗

(0.97)

2.66∗∗∗

(0.93)

3.51∗∗∗

(1.24)

Proportion Black

-0.03

(0.31)

-0.20

(0.41)

-0.91∗

(0.51)

1.56

(1.70)

-4.98∗∗∗

(1.64)

-4.64

(11.6)

Average Income

0.01

(0.08)

0.13

(0.15)

0.00

(0.16)

-0.07

(0.12)

-1.11

(1.29)

-2.22

(2.36)

State and Year

Fixed Effects

No

No

No

No

Yes

Yes

0.131

93

0.203

93

0.306

45

0.132

48

0.579

93

0.565

48

R2

n (state × decade)

Panel B: Urban Respondents Only

Economic Parity

1.06∗

(0.62)

1.08

(0.72)

1.99

(1.56)

2.55∗

(1.31)

2.68

(1.91)

4.45∗

(2.27)

Black

0.10

(0.34)

0.22

(0.52)

-0.54

(0.80)

0.73

(1.42)

-4.50∗∗

(1.76)

-4.82

(9.66)

Average Income

0.01

(0.07)

0.09

(0.20)

-0.08

(0.16)

-0.11

(0.12)

-1.31

(-2.29)

2.65

(3.30)

State and Year

Fixed Effects

No

No

No

No

Yes

Yes

0.083

71

0.088

49

0.115

34

0.156

37

0.499

71

0.541

37

R2

n (state × decade)

Notes: ∗∗∗ ,∗∗ ,∗ denotes statistical significance at the 1%, 5% and 10% levels, respectively.

White (1980) heteroskedastictic-consistent standard errors in parenthesis.

32

Table 7: Robustness Checks

Dependent Variable:

Tax Rate (τ̂ )

Tax Revenue

per capita (τ y)

Proportion Black

1.62∗∗∗

(0.54)

2.41∗∗∗

(0.62)

1.75∗∗∗

(0.52)

429∗∗∗

(121)

580∗∗∗

(138)

335∗∗∗

(117)

Average Income

-0.81∗∗∗

(0.29)

-0.86∗∗

(0.34)

-0.85∗∗∗

(0.35)

57.2

(60.8)

58.5

(75.1)

-48.7

(76.0)

Economic Parity

0.36∗∗∗

(0.17)

0.15

(0.18)

0.37∗∗

(0.17)

73.9∗∗

(31.7)

41.7

(30.9)

83.5∗∗

(36.6)

Constant

6.57∗∗

(2.45)

6.47∗∗

(3.19)

6.80∗∗∗

(3.39)

-680

(566)

-1010

(701)

156

(731)

North / South ×

Year Fixed Effects

Yes

No

No

Yes

No

No

Division ×

Year Fixed Effects

No

Yes

No

No

Yes

No

Year Fixed Effects

No

No

Yes

No

No

Yes

Border States

Omitted

No

No

Yes

No

No

Yes

R2

n (city × year)

0.902

828

0.920

828

0.894

682

0.871

828

0.895

828

0.852

682

Notes: ∗∗∗ ,∗∗ ,∗ denotes statistical significance at the 1%, 5% and 10% levels,

respectively. White (1980) heteroskedastictic-consistent standard errors in parenthesis.

All columns include city fixed effects.

Tabel 2 and shows that any potential bias introduced by the inability to control for Hispanic

population due to data limitations in the sample period is small.28

6

Conclusion

Canonical political economy models of government taxation and spending focus on the conflict between the rich and the poor over redistribution. This paper adds race to this equation.

However, it focuses on the consequences of the empirical fact that blacks and whites exhibit

28

Other robustness checks that do not substantively alter the results include splitting the sample around

the median population, dropping any year from the data, changing the units of measurement of many of the

control variables and splitting the sample into south/non-south samples.

33

different levels of political sensitivity, rather than the consequences of speculative differences

between races in preferences.

Considering race and class together allows me to formalize an old concept from political

science—that of cross-cutting cleavages—and examine its impact on the taxation and spending decisions of local governments. Specifically, the degree to which race and class cross-cut

each other exhibits a non-monotonic relationship with taxation and spending levels. This

non-monotonic relationship is mediated by economic parity—the degree to which different

races have similar distributions of income.

The model produces six predictions in total. All of these predictions are consistent with

correlations in the data from large U.S. cities between 1942 and 1972. In sum, adding

race and focusing on political sensitivity allows us to understand a richer set of patterns of

government taxation and spending decisions.

34

Appendix A

Theoretical Derivation and Proofs

There are two candidates c ∈ {1, 2} who seek to maximize their own vote share. Candidates

propose binding platforms that consist of a tax rate, τ c , and a level of government spending,

P

g c , subject to a budget balancing constraint: g c ≤ ij λij τ c y i = τ c y.

Following the terminology in Grossman and Helpman (2001, Chapter 3), in addition

to the positions candidates take on the pliable issue of spending, there are other issues,

such as charisma or a reputation for pursuing non-economic race related policies on which

candidates have fixed positions. A citizen from class-race group ij turns out to vote with

exogenously given probability π ij . Of the citizens who turn out to vote from class-race

group ij a proportion 1 − ξ ij is exogenously committed to voting for one candidate or the

other based on the fixed positions of the candidates. The remaining citizens that vote and

would consider voting for either candidate receive an extra utility for candidate 1 of x,

where x is the realization of a random variable drawn independently for each citizen from

a cumulative distribution function F (x).29 Each group varies in the relative prominence of

fixed versus pliable issues, with ζ ij indexing the prominence a member of class-race group

ij puts on pliable issues. A citizen in class-race group ij votes for candidate 1 if and only if

x + ζ ij U ij (τ 1 , g 1 ) ≥ ζ ij U ij (τ 2 , g 2 ), that is, if x ≤ ζ ij (U ij (τ 1 , g 1 ) − U ij (τ 2 , g 2 )).

The vote share S 1 for candidate 1 is given by

S1 =

X

λij π ij (1 − ξ ij )φij + ξ ij F (ζ ij (U ij (τ 1 , g 1 ) − U ij (τ 2 , g 2 ))) ,

(A.1)

ij

where φij is the proportion of exogenously committed voters in class-race group ij who vote

for candidate 1. The vote share of candidate 2 is given by an analogous expression so a Nash

Equilibrium in pure strategies where both candidates propose the same platform exists.

To ensure the existence of a symmetric equilibrium the probability density function, f (x) = F 0 (x), is

assumed to be symmetric about zero. For the necessary second-order conditions to hold F (x) cannot change

too quickly around zero. I follow the rest of the literature and assume that the second-order conditions hold.

For a discussion, see Acemoglu and Robinson (2006, Chapter 12).

29

Appendicies–1

In (A.1) the first term inside the brackets is constant, and in equilibrium candidate 1

takes the platform of candidate 2 as given. Thus the first-order conditions of each candidate’s

maximization problem are the same as the first-order conditions of the following problem:

max

τ,g

max

τ,g

X

λij ψ ij U ij (τ, g) s.t. g ≤ τ y

ij

X

i

ψ λi U i (τ, g) s.t. g = τ y

(A.2)

i∈{R,P }

i

where ψ ij = π ij ξ ij ζ ij > 0 is a class-race group’s political sensitivity, ψ =

λiB ψ iB +λiW ψ iW

λi

, and

i

ψ λi is a class’s political prominence. Each candidates’ Lagrangian L is given by:

L = (1 − τ )ŷ + ψ log(g) − γ (g − τ y) ,

R

P

R

(A.3)

P

where ŷ = ψ λR y R + ψ λP y P and ψ = ψ λR + ψ λP . The first order conditions yield

dL

= −ŷ + γy = 0

dτ

and

dL

ψ

= − γ = 0.

dg

g

taken together with the budget constraint, g∗ = τ∗ y, the equilibrium level of government

spending, g∗ , and tax rate, τ∗ , are given by:

g∗ =

ψy

ŷ

and

τ∗ =

ψ

ŷ

(A.4)

As noted in Section 2, the equilibrium tax rate and per capita tax revenue is re-written

P

B

in terms of ij λij , y, λB and yy , and partial derivatives are taken with respect to these last

~ and letting ~λ vary. This is equivalent to changing

three variables holding constant ~y and ψ

P

B

from the ~λ basis into another basis ~b = { ij λij , y, λB , yy } and taking partial derivatives

in this latter basis. Taking derivatives in the ~λ basis in the direction of a particular basis

vector in ~b makes the algebra more tractable. For the proofs, the equilibrium tax rate will

be written as τ∗ (~λ) and the equilibrium level of per-captia tax revenue will be written as