Old mutual glObal FtSE raFi® all WOrld indEx feeder fund

advertisement

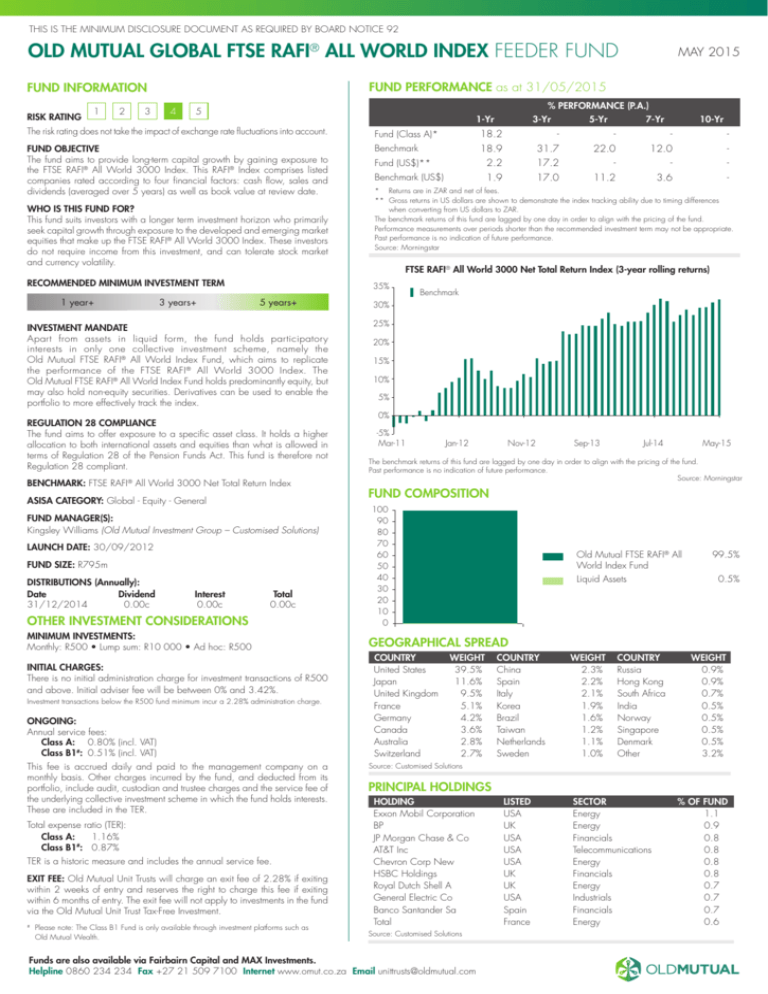

This is the Minimum Disclosure Document as required by Board Notice 92 Old mutual global FTSE rafi® ALL WORLD index feeder fund FUND PERFORMANCE as at 31/05/2015 FUND INFORMATION RISK RATING 1 2 3 4 % PERFORMANCE (P.A.) 5 The risk rating does not take the impact of exchange rate fluctuations into account. FUND OBJECTIVE The fund aims to provide long-term capital growth by gaining exposure to the FTSE RAFI® All World 3000 Index. This RAFI® Index comprises listed companies rated according to four financial factors: cash flow, sales and dividends (averaged over 5 years) as well as book value at review date. WHO IS THIS FUND FOR? This fund suits investors with a longer term investment horizon who primarily seek capital growth through exposure to the developed and emerging market equities that make up the FTSE RAFI® All World 3000 Index. These investors do not require income from this investment, and can tolerate stock market and currency volatility. RECOMMENDED MINIMUM INVESTMENT TERM 1 year+ 3 years+ 1-Yr REGULATION 28 COMPLIANCE The fund aims to offer exposure to a specific asset class. It holds a higher allocation to both international assets and equities than what is allowed in terms of Regulation 28 of the Pension Funds Act. This fund is therefore not Regulation 28 compliant. BENCHMARK: FTSE RAFI® All World 3000 Net Total Return Index ASISA CATEGORY: Global - Equity - General FUND MANAGER(S): Kingsley Williams (Old Mutual Investment Group – Customised Solutions) LAUNCH DATE: 30/09/2012 Fund size: R795m Distributions (Annually): DateDividendInterestTotal 31/12/2014 0.00c0.00c0.00c OTHER INVESTMENT CONSIDERATIONS MINIMUM INVESTMENTS: Monthly: R500 • Lump sum: R10 000 • Ad hoc: R500 INITIAL CHARGES: There is no initial administration charge for investment transactions of R500 and above. Initial adviser fee will be between 0% and 3.42%. Investment transactions below the R500 fund minimum incur a 2.28% administration charge. ONGOING: Annual service fees: Class A: 0.80% (incl. VAT) Class B1#: 0.51% (incl. VAT) This fee is accrued daily and paid to the management company on a monthly basis. Other charges incurred by the fund, and deducted from its portfolio, include audit, custodian and trustee charges and the service fee of the underlying collective investment scheme in which the fund holds interests. These are included in the TER. Total expense ratio (TER): Class A: 1.16% Class B1#: 0.87% TER is a historic measure and includes the annual service fee. Exit fee: Old Mutual Unit Trusts will charge an exit fee of 2.28% if exiting within 2 weeks of entry and reserves the right to charge this fee if exiting within 6 months of entry. The exit fee will not apply to investments in the fund via the Old Mutual Unit Trust Tax-Free Investment. Please note: The Class B1 Fund is only available through investment platforms such as Old Mutual Wealth. 3-Yr 5-Yr 7-Yr 10-Yr Fund (Class A)* 18.2 - - - Benchmark 18.9 31.7 22.0 12.0 - Fund (US$)** 2.2 17.2 - - - Benchmark (US$) - 1.9 17.0 11.2 3.6 - * Returns are in ZAR and net of fees. ** Gross returns in US dollars are shown to demonstrate the index tracking ability due to timing differences when converting from US dollars to ZAR. The benchmark returns of this fund are lagged by one day in order to align with the pricing of the fund. Performance measurements over periods shorter than the recommended investment term may not be appropriate. Past performance is no indication of future performance. Source: Morningstar FTSE RAFI® All World 3000 Net Total Return Index (3-year rolling returns) 35% 5 years+ INVESTMENT MANDATE Apart from assets in liquid form, the fund holds participatory interests in only one collective investment scheme, namely the Old Mutual FTSE RAFI® All World Index Fund, which aims to replicate the performance of the FTSE RAFI ® All World 3000 Index. The Old Mutual FTSE RAFI® All World Index Fund holds predominantly equity, but may also hold non-equity securities. Derivatives can be used to enable the portfolio to more effectively track the index. # May 2015 Benchmark 30% 25% 20% 15% 10% 5% 0% -5% Mar-11 Jan-12 Nov-12 Sep-13 Jul-14 May-15 The benchmark returns of this fund are lagged by one day in order to align with the pricing of the fund. Past performance is no indication of future performance. Source: Morningstar FUND COMPOSITION 100 90 80 70 60 50 40 30 20 10 0 Old Mutual FTSE Rafi® All World Index Fund Liquid Assets 99.5% 0.5% Geographical Spread COUNTRY United States Japan United Kingdom France Germany Canada Australia Switzerland WEIGHT 39.5% 11.6% 9.5% 5.1% 4.2% 3.6% 2.8% 2.7% COUNTRY China Spain Italy Korea Brazil Taiwan Netherlands Sweden WEIGHT 2.3% 2.2% 2.1% 1.9% 1.6% 1.2% 1.1% 1.0% COUNTRY Russia Hong Kong South Africa India Norway Singapore Denmark Other WEIGHT 0.9% 0.9% 0.7% 0.5% 0.5% 0.5% 0.5% 3.2% Source: Customised Solutions PRINCIPAL HOLDINGS HOLDING Exxon Mobil Corporation BP JP Morgan Chase & Co AT&T Inc Chevron Corp New HSBC Holdings Royal Dutch Shell A General Electric Co Banco Santander Sa Total Source: Customised Solutions Funds are also available via Fairbairn Capital and MAX Investments. Helpline 0860 234 234 Fax +27 21 509 7100 Internet www.omut.co.za Email unittrusts@oldmutual.com Listed USA UK USA USA USA UK UK USA Spain France SECTOR Energy Energy Financials Telecommunications Energy Financials Energy Industrials Financials Energy % OF FUND 1.1 0.9 0.8 0.8 0.8 0.8 0.7 0.7 0.7 0.6 Old mutual global FTSE rafi® ALL WORLD index feeder fund FUND MANAGER INFORMATION FUND COMMENTARY as at 31/05/2015 The fund tracks the FTSE RAFI® All World 3000 Index and aims to replicate the return of the underlying index. The FTSE RAFI® All World 3000 Index offers exposure to both developed and emerging markets globally, by selecting and weighting the largest 3000 companies according Kingsley williams QUALIFICATIONS: BSc (Hons) to their fundamentals of dividends, cash flows, sales and book value, as opposed to market capitalisation. The FTSE RAFI® All World 3000 Index returned -0.85% for the month ended May 2015. MBA (Finance) Over the last 12 months, the FTSE RAFI® All World 3000 Index grew 1.94%. RAFI® CURRENT RESPONSIBILITY: has a fundamental price indifferent, contra-trading approach, which looks to overweight Kingsley is the Chief Investment Officer of the indexation capability within the undervalued stocks and underweight overvalued stocks. Customised Solutions boutique of Old Mutual Investment Group and is responsible for the indexation fund management process. This includes managing a team of investment professionals and providing direction and guidance on specific activities such as portfolio optimisation, trading strategy, liquidity screening and corporate actions, to ensure each of our benchmarks is tracked optimally. Kingsley joined Old Mutual in March 2008 as an investment analyst. He is currently a member of the Customised Solutions Executive Committee and has served in various capacities within the investment boutique, from daily fund management responsibilities to Head of Research and Product Development. PREVIOUS EXPERIENCE: Prior to joining our boutique, Kingsley was a business and quantitative analyst at Stanlib Asset Management from 2004 to 2007. Kingsley began his career in 2000 ING Groep is one of the overweight counters in the FTSE RAFI® All World 3000 Index. For the year, the stock has returned 43.49% in euros and this has added to the performance of the RAFI® All World vs the MSCI ACWI. ING Groep is a banking company based in the Netherlands. The good returns have been driven by a sharp rise in first quarter earnings as the bank benefited from a pick-up in lending activity and lower provisions from bad loans. Coca-Cola, a consumer staples group based in the US, is one of the larger underweights in the FTSE RAFI® All World 3000 Index. The underweight position relative to other global indices of the FTSE RAFI® All World 3000 Index has not hurt performance as Coke has performed relatively poorly returning 3.22% for the year. Note: * All returns are in USD unless otherwise stated. with Merrill Lynch and held various positions in New York, London and Johannesburg. Kingsley has 15 years of investment related work experience. Funds are also available via Fairbairn Capital and MAX Investments. Helpline 0860 234 234 Fax +27 21 509 7100 Internet www.omut.co.za Email unittrusts@oldmutual.com Unit trusts are generally medium- to long-term investments. Shorter term fluctuations can occur as your investment moves in line with the markets. Fluctuations or movements in exchange rates may cause the value of underlying international investments to go up or down. As a result, there are no guarantees with regard to the performance of the fund. Unit trusts can engage in borrowing and script lending. International investments could be accompanied by additional risks such as potential constraints on liquidity and the repatriation of funds, macroeconomic risks, political risks, foreign exchange risks, tax risks, settlement risks and potential limitations on availability of market information. The fund’s TER reflects the percentage of the average Net Asset Value of the portfolio that was incurred as charges, levies and fees related to the management of the portfolio. A higher TER does not necessarily imply a poor return, nor does a low TER imply a good return. The current TER cannot be regarded as an indication of future TERs. A schedule of fees, charges and maximum adviser fees is available from Old Mutual Unit Trust Managers Ltd (OMUT). You may buy/sell your investment at the ruling price of the day (calculated and valuated at 15h00 on a forward pricing basis and 17h00 at month-end for Old Mutual RAFI® 40 Tracker Fund, Old Mutual Top 40 Fund and Old Mutual SYm|mETRY Equity Fund of Funds). Daily prices are available on the OMUT website and media. A feeder fund is a portfolio that, apart from assets in liquid form, consists solely of participatory interests in a single portfolio of a collective investment scheme. The portfolio performance is calculated on a NAV-NAV basis and does not take any initial fees into account. Income is reinvested on the ex-dividend date. Actual investment performance will differ based on the initial fees applicable, the actual investment date, the date of reinvestment of income and dividend withholding tax where applicable. Performances are in ZAR and as at 31 May 2015. Sources: Morningstar and Old Mutual Investment Group. Old Mutual is a member of the Association for Savings and Investment South Africa (ASISA). Registration number: 1965 008 47106. Please contact OMUT for additional information. Trustee: Standard Bank, PO Box 54, Cape Town 8000. Tel: +27 21 401 2002, Fax: +27 21 401 3887.