Tax Parcel Management Practices

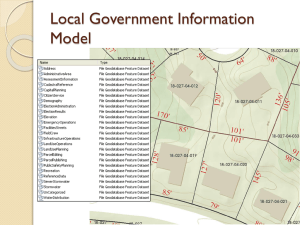

advertisement

608-742-9616 FAX: 608-742-9806 E-MAIL: land.information@co.columbia.wi.us WEBSITE: www.co.columbia.wi.us/columbiacounty/landinformation L an d In f orm ati on Dep ar tme nt 400 DeWitt Street Portage, WI 53901 DEFINITION: TAX PARCEL A Tax Parcel is a division of land developed for the sole purpose of creating a complete, accurate, and equitable unit of taxation in support of taxpayers contributing a fair share of support for the community services received. Tax parcels must be held in one ownership. Tax parcel mapping is “The creation of accurate representations of property boundary lines at appropriate scales to provide a graphic inventory of parcels for use in accounting, appraising, and assessing. Such maps show dimensions and the relative size and location of each tract with respect to other tracts. Also known as assessment maps and cadastral maps.” 1 A Parcel Number is “An identification number, which is assigned to a parcel of land to uniquely identify that parcel from any other parcel within a given taxing jurisdiction.”2 "Just as a tax map is a graphic representation of a legal description, a parcel number is a simple numeric/alphabetic reference to the same legal description." 3 "Parcel numbers should be permanent and change only when the boundaries of the parcel itself are changed. Changing parcel boundaries is generally handled either through the use of hyphen-suffix systems, or through retiring number systems...Due to the inherent maintenance problems and the confusion, which may result from the use of hyphenated or suffixed numbers, the retiring system is generally considered to be the better system. It is important that the parcel number be as permanent as possible..."4 PROCEDURES FOR MANAGING TAX PARCELS: 1. A tax parcel must be held in one ownership. 2. Descriptions are taken from the recorded deeds of record (certified survey, subdivision plat, deeds, etc…) Each description must be checked and laid out to account for all land in the county. 3. Tax parcel lines created for metes and bounds descriptions are drawn and the acreage calculated. 4. Sec 70.23(1), says that 'The assessor shall enter upon the assessment roll...a correct and pertinent description of each parcel of real property in the assessment district...' Every assessment requires a legal description of the property sufficient to convey title to a grantee in a tax deed. This is necessary to protect the local district from having a non-collectable tax charged back by the county. 5. Tax Parcels are combined using Land Information Department forms only where a correct and pertinent description is available, not created by the Land Information Department, and where other criteria such as: parcels are contiguous and located within the same tax districts, ownership of all parcels is identical, no delinquent taxes are due on any of the parcels, an authorized representative of the local taxing district signs this request. 6. Tax Parcels are split using Land Information Department forms only where a correct and pertinent description is available, not created by the Land Information Department, and where other criteria such as: no delinquent taxes are due on any of the parcels, an authorized representative of the local taxing district signs this request. 1 Property Assessment Manual for Wisconsin Assessors, Wisconsin Department of Revenue Administrative & Procedural Manual Volume 1, Part 1 2005. Appendix G Page 4 2 Property Assessment Manual for Wisconsin Assessors, Wisconsin Department of Revenue Administrative & Procedural Manual Volume 1, Part 1 2005, Appendix G Page 3 3 Property Assessment Manual for Wisconsin Assessors, Wisconsin Department of Revenue Administrative & Procedural Manual Volume 1, Part 1 2005, Section 5 Page 31 4 Property Assessment Manual for Wisconsin Assessors, Wisconsin Department of Revenue Administrative & Procedural Manual Volume 1, Part 1 2005, Section 5 Page 31 Page |2 7. Tax Parcels are identified using a unique number. 8. Tax Parcel numbers change only when the geometry of a tax parcel is changed as a resulting from recorded deeds of record, otherwise tax parcel numbers are permanent. TAX PARCEL NUMBERING: New tax parcels are created and the existing parcel number (parent) is inactivated when the geometry of existing parcels are changed. 1. Tax Parcels are identified using a unique number. 2. Standard Tax Parcel Numbering a. Use for all standard splits created via recorded deeds, Certified Survey Map (CSM), or Land Information Department Tax Parcel Split Form b. Parent tax parcel number will be retained as the leading number c. New divisions are managed following the decimal holder followed by an added zero and the lot number i. EX) Parcel 1 split into two lots = 1.01, 1.02 d. Remnant parcels are added at the end of the lot numbering sequence i. EX) Remnant parcel = 1.03 e. NOTE: If „1‟ is not available, the next consecutive number will be used in the same format (1.04, 1.05). f. NOTE: If split is followed by a second split, the new parcel(s) would follow the numbering system in consecutive order (1.06, 1.07) with remnant(s) at the end of the sequence (1.08). g. NOTE: If two or more parents are involved, use the dominant parent (if applicable) as the leading number for new tax parcels. Remnant parcels should have the parent parcel of each remnant as the leading number and then the decimal, zero, and number following the zero. i. EX) Parent parcels 2 (40 acres) and 3 (20 acres) split into Lot 1 of CSM and two remnants = CSM lot 2.01, Remnants 2.02 and 3.01 h. NOTE: Tax parcels created by subdivision and condominium plats are the exception to this rule. A new parent tax parcels number is created at the end of the tax parcel roll for the effected municipality. 3. Subdivision Plats and Condominium Plats a. Parent tax parcel number is dropped b. New leading number (parent number) is assign that places the new tax parcels at the end of the tax roll c. Lot numbers i. Added to the new parent parcel leading number following the decimal holder ii. EX) Lot 1 = 2000.1, Lot 2 = 2000.2 d. Out lots i. Original Plat out lots added as „OL‟outlot# following the decimal holder 1. EX) Out lot 1 to the Original Plat = 2000.OL1 ii. Addition out lots added as Addition#‟OL‟outlot# 1. EX) Out lot 1 to the 1st Addition = 2000.1OL1, Out lot 2 to the 1st Addition = 2000.1OL2 e. Plats containing blocks and lots i. Begin with Block 1 Lot 1 numbering each lot consecutively higher ii. EX) Block 1 Lot 1 through Block 1 Lot 10 = 2000.1 through 2000.10, Block 2 Lot 1 through Block 2 Lot 10 = 2000.11 through 2000.20 f. NOTE: If a lot or an out lot is subsequently split, a new leading number will be assigned and a lot number will be added following the decimal holder. i. EX) Tax parcel 2000.1 of a subdivision plat is split into two lots by a CSM, a new number would be assigned as follows for the new lots: 3000.01 (CSM Lot 1) and 3000.02 (CSM Lot 2). ii. NOTE: If an existing out lot is split, do not use „OL‟ in the new number. Use the „1.01‟ system described above. Page |3 4. Non-conforming parcels a. Situations where the numbering system as described above will not work, determine what would be the best alternative while trying to conserve the history of the parcel(s) where possible yet assigning a number(s) that is representative of the action taking place. i. EX) City of Portage purchased small portions of several lots along the Portage Canal and used one description for each of those areas. 1. Parent parcels – 1224, 1225, 1226 for one area; 1251, 1252, 1253 for another area; and etc. 2. The last parcel number on the City of Portage tax roll is 5000 3. New parcels are 6001, 6002, etc 4. Remnants are 1224.01, 1225.01, 1226.01, 1251.01, etc. SOURCES: Property Assessment Manual for Wisconsin Assessors, Wisconsin Department of Revenue Administrative & Procedural Manual Volume 1, Part 1 2005. Wisconsin Real Property Listers Association Manual for Wisconsin, 2003 Revision Wisconsin State Statutes, Chapter 70 –General Property Taxes Wisconsin Department of Revenue Wisconsin Department of Administration Wisconsin Land Information Association Wisconsin Real Property Listers Association North Central Regional Association of Assessing Officers International Association of Assessing Officers