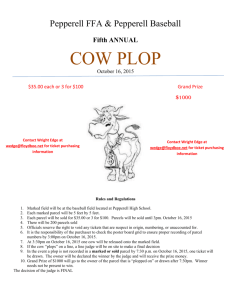

WV Tax Parcel database design

advertisement

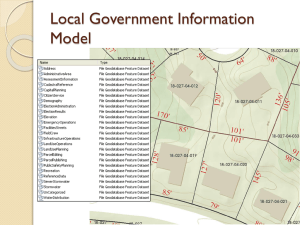

WV Tax Parcel Mapping Best Practices May 14th 2013 Topics to Cover 1. 2. 3. 4. 5. 6. Introduction Conversion methods and recommended practices Tax Parcel database design Maintaining & editing parcel data in ESRI 10x Data Driven pages and WV hardcopy Tax Map standards Parcel Fabric Introductions / Atlas Tax Parcel Background GIS Tax Parcel & E911 Mapping WV, NC, SC, GA, MD, VA, MS, IN, PA From Deed , Plat , & Best Fit Typical Delivery in ArcGIS 9x or 10x AutoCadd Atlas WV Tax Parcel & E911 Experience Hampshire- Tax Parcels & 911 Addressing Greenbrier- Tax Parcels Mineral- Tax Parcels & 911 Addressing Preston- Tax Parcels Pendleton- Tax Parcels & 911 Addressing Wetzel- Tax Parcels & 911 Addressing Lincoln- Tax Parcels Conversion Methods Deeds and Plats – – Best Fit – – All referenced parcels mapped by legal documents Most precise conversion method but most costly Parcels mapped by “heads-up” digitizing method Least accurate but most cost efficient Hybrid Method (Most Popular) – – Use Plats where available to build base framework Good accuracy and cost efficient Conversion Guidelines Gather source information – – – – Current IAS export Orthophotos Digital Tax Maps and Plats GIS base layers Centerlines Hydro Any other relevant miscellaneous layers Conversion Guidelines Geo-reference Tax Maps – – – Use Orthophotos Careful of using existing vector data Avoid Image warping Locate Plats – – – Plat references available by Parcel Number? Use vicinity information on Plats Create a place holder feature class for Plats Conversion Guidelines Create Base Centerlines – – – Digitize precise centerlines Use geometric curves Use Orthophotos Buffer Right-of-Way widths – – – – WVDOH common widths Scaled widths from rectified Tax Maps Block style Right-of-Way Geometry DOT Right-of-Way plans Conversion Guidelines Hydro Features – – Update existing Hydro if available Re-capture all major Hydro features Miscellaneous – – – E911 Centerlines Address Points Older parcel vector data Conversion Guidelines Construct parcels using COGO – – – +/- 30% of parcels by COGO Adjust Right-of-Way where needed Inventory plats accordingly Best Fit remaining parcels – – – – – COGO parcels as Control Orthophotos Rectified Tax Maps Acreage Right-of-Way Network Conversion Guidelines Annotation – – Create annotation for all text on Tax Maps Adhere to WV Specifications Attribution – – Points/Polygons: Parcel ID, Acreage, Feature & Compilation Code, Plat Reference, etc. Feature Code lines Conversion Guidelines Topology – – Build Topology rules up front Maintain Topology day to day Reconcile with Tax Data – – – – Find records that appear in IAS but not in vector data Find parcels in vector data that do not appear in IAS Review these findings Ultimate goal is 100% match; Achievable? WV Tax Parcel database design Points, Lines, & Polygons Allows users to efficiently meet WV State specifications Compatible with ArcGIS 9x or 10x environment Can be loaded into ESRI Local Government Model Designed around IAS Works with “Out of the Box” ESRI Core Technology Simplistic design while meeting all GIS requirements – Efficient for day to day editing, management and topology Data Demonstration Points, Lines, & Polygons Advantages: – – – – Most efficient method for maintaining Tax Parcel datasets Retain survey information Maximize use of Arc tools and topology Maximize Cartographic display abilities Data Demonstration Data Driven pages Supported by ESRI Dynamic WV State Spec map Page definitions Maplex Label Engine included in Arc 10.1 Data Demonstration Parcel Fabric An ESRI supported approach focusing specifically on land records management. Custom ESRI apps geared toward model Released in 10, recommended version is 10.1 SP1 Parcel Fabric Atlas Experience Advantages – – – Parcel History Maintaining survey information Lines and polygons work as one Data Demonstration Question and Answer