Select Credit Union Annual Report 2013

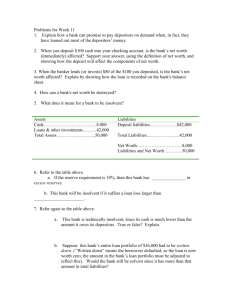

advertisement