Unit Trust - CIMB Preferred

advertisement

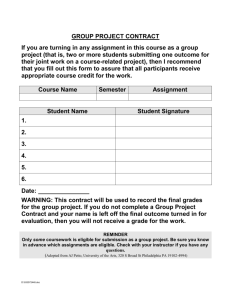

Wealth Management Solutions Campaign (“the Campaign”) for Unit Trust Terms and Conditions 1. The Campaign Period 1.1. The Campaign is organized by CIMB Bank Berhad (“the Bank”) and runs from 18 January 2012 to 30 June 2012, both dates inclusive (“Campaign Period”). The Bank reserves the right to change the duration, commencement and or expiry dates of the Campaign Period upon giving adequate notice. 2. Eligibility 2.1. The Campaign is open to all individuals residing in Malaysia, including Malaysian citizens, permanent residents or non Malaysian citizens, of 18 years and above who make the relevant investment in accordance with the terms and conditions herein (“Eligible Customer(s)”). 2.2. Employees of the Bank, CIMB Islamic Bank Berhad and CIMB Investment Bank Berhad are not eligible to participate in the Campaign. 3. Campaign The campaign consists of the following promotions: 3.1. Promotional Sales Charge for Unit Trust funds 3.2. Promotional Sales Charge for Unit Trust EPF funds 3.3. Complimentary Gift for Unit Trust EPF funds 3.4. Regular Investment Plan 4. Promotional Sales Charge for Unit Trust funds 4.1. Eligible Customers who invest in any one selected unit trust funds from selected Unit Trust Management Companies which shall be determined by the Bank (“Participating Equity Unit Trust Funds”) during the Campaign Period will be entitled to enjoy the relevant promotional sales charge (“Promotional Sales Charge”) as specified in the table below based on the relevant investment amount and subject to the terms and conditions herein. CIMB Preferred Promotional Investment Amount Promotional Sales Charge RM10,000 – RM49,999 3.28% 3.28% RM50,000 – RM149,999 2.88% 2.38% RM150,000 and above 2.50% 2.00% Sales Charge 4.2. To be entitled to the Promotional Sales Charge, the Eligible Customer must invest a minimum of RM10,000 in a single transaction in a Participating Equity Unit Trust Fund. Placement of Investment Amount in the Participating Equity Unit Trust Funds will enjoy the corresponding Promotional Sales Charge stated in the table above. Combination of investment amount in different Participating Equity Unit Trust Funds is permitted and the investment amount must be in a single transaction during the Campaign Period for purposes of ascertaining the Promotional Sales Charge applicable. 4.3. Pursuant to Clause 4.2, to be entitled to the CIMB Preferred Promotional Sales Charge, the Eligible Customer must be a CIMB Preferred customer at the point of investment. 4.4. The list of Participating Equity Unit Trust Funds is available upon request and is subject to change upon giving of adequate notice by the Bank. 4.5. The Promotional Sales Charge shall not be applicable for Eligible Customers who invest in any of the Participating Equity Unit Trust Funds using their Employees Provident Fund (EPF). In the event any investment made by an Eligible Customer is to be partially paid using withdrawal from the EPF (the “EPF Portion”), the EPF Portion shall be excluded from the computation of the investment amount in the Participating Equity Unit Trust Funds. 5. Promotional Sales Charge for Unit Trust EPF funds 5.1. Eligible Customers who invest a minimum of One Thousand (RM1,000) (“Investment Amount”) in a single transaction in any Participating Equity Unit Trust EPF Funds during the Campaign Period will be entitled to enjoy the promotional sales charge (“Promotional Sales Charge”) as specified in the table below. Investment Amount Promotional Sales Charge RM1,000 and above 2.88% 5.2. To participate in the Campaign, Customers must during the Campaign Period invest through the Bank in any Participating Equity Unit Trust EPF Funds using monies from their Employees Provident Fund (EPF). Combination of investment amount in different Participating Equity Unit Trust EPF Funds is permitted and the investment amount must be in a single transaction for purposes of ascertaining the Promotional Sales Charge applicable. 5.3. The Participating Equity Unit Trust EPF Funds shall be determined by the Bank at its sole and absolute discretion. The list of Participating Equity Unit Trust EPF Funds is available upon request and is subject to change from time to time by the Bank at its absolute discretion upon giving adequate notice 6. Complimentary Gift for Unit Trust EPF funds 6.1. Eligible Customers who invest a minimum of Fifty Thousand (RM50,000) in a single transaction in any Participating Equity Unit Trust EPF Funds during the Campaign Period will be entitle to one (1) Royal Selangor Photo frame (“Complimentary Gift”). 6.2. The Complimentary Gift will be delivered to the Eligible Customer’s address in the Bank’s record within 60 days after the date of disbursement of monies from the EPF and upon receipt by the Bank. 6.3. The Bank disclaims any responsibilities or liability for any damages, loss or injury whatsoever arising out of the Complimentary Gift. 6.4. Any complaint, compensation or request arising from or in connection with the Complimentary Gift must be filed with the merchant and/or manufacturer. 7. Regular Investment Plan 7.1. Eligible Customers who sign up for any new Periodical Payment Instruction (PPI) in any one of the Participating Equity Unit Trust Funds with a minimum monthly investment amount of RM200 will be entitled to a promotional sales charge at 2.88% as set out below: Periodical Payment Instruction with Minimum Promotional Monthly Investment Amount Sales charge RM200 2.88% 8. Other Conditions 8.1. Any and all decisions made by the Bank in relation to every aspect of the Campaign shall be final and conclusive. Any subsequent correspondences, protests, appeals or enquiries will not be entertained. 8.2. The Eligible Customer is required to comply with all terms and conditions in respect of his/her investment in the relevant products under the Campaign. 8.3. The Bank shall not be liable to any Eligible Customer or any party for any loss or damage of whatsoever nature suffered by the Eligible Customer or any party (including but not limited to any injury or death, loss of income, profits or goodwill, direct or indirect, incidental, consequential, exemplary, punitive or special damages of any party) arising, in relation to the participation or non-participation in the Campaign. 8.4. The Bank reserves the right to cancel, terminate or suspend the Campaign upon giving adequate notice. For the avoidance of doubt, cancellation, termination or suspension by the Bank of the Campaign shall not entitle the Eligible Customer or any other persons whatsoever to any claim or compensation against the Bank for any losses or damages suffered or incurred as a direct or indirect result of the act of cancellation, termination or suspension. 8.5. The Bank reserves the right upon giving reasonable notice to vary (whether by addition, deletion, modification or, amendment) any of the terms and conditions herein. Any such variation of the terms and conditions herein shall be binding on the Eligible Customers and be deemed to be brought to the Eligible Customer’s attention through any notice (i) displayed at the Bank’s branches or premises; (ii) sent by the Bank to the Eligible Customer by post or any other means; or (iii) advertised by the Bank or (iv) the Bank’s website. 8.6. Investments in unit trusts are not obligations of, deposits in, guaranteed or insured by the Bank and are subject to investment risks, including the possible loss of the principal amount invested. Eligible Customers are advised to read the Master Prospectus of the respective funds before investing. Eligible Customers should also consider all fees and charges involved before investing. Past performance of the Fund is not an indication of future performance and income distributions are not guaranteed. Eligible Customers should rely on their own evaluation to assess the merits and risks of any investment. Eligible Customers who are in doubt as to the action to be taken should consult their professional advisers immediately. 8.7. In the event of any inconsistency or conflict between the English and Bahasa Malaysia version of the terms and conditions herein, the English version shall prevail. Notwithstanding the aforementioned where request is made by the Eligible Customer for the Bahasa Malaysia version of the terms and conditions herein, CIMB shall provide the same to the Eligible Customer and if the agreement is entered into on this basis, then the Bahasa Malaysia version of the Terms and Conditions shall prevail. 8.8. In the event of any complaints related to the Campaign, Eligible Customers may contact the Bank’s Customer Resolution Department bearing the following address, telephone and facsimile numbers (or bearing such other address, telephone and facsimile numbers which the Bank may change by notification to the Eligible Customers): Customer Resolution Department, Level 17, Menara BumiputraCommerce, 11 Jalan Raja Laut, 50350 Kuala Lumpur tel: 603 26192380 / Fax: 603 26913248. Wealth Management Solutions Campaign (“the Campaign”) for Unit Trust Terms and Conditions 1. The Campaign Period 1.1. The Campaign is organized by CIMB Islamic Bank Berhad (“the Bank”) and runs from 18 January 2012 to 30 June 2012, both dates inclusive (“Campaign Period”). The Bank reserves the right to change the duration, commencement and or expiry dates of the Campaign Period upon giving adequate notice. 2. Eligibility 2.1. The Campaign is open to all individuals residing in Malaysia, including Malaysian citizens, permanent residents or non Malaysian citizens, of 18 years and above who make the relevant investment in accordance with the terms and conditions herein (“Eligible Customer(s)”). 2.2. Employees of the Bank, CIMB Islamic Bank Berhad and CIMB Investment Bank Berhad are not eligible to participate in the Campaign. 3. Campaign The campaign consists of 4 promotions: 3.1. Promotional Sales Charge for Unit Trust funds 3.2. Promotional Sales Charge for Unit Trust EPF funds 3.3. Complimentary Gift for Unit Trust EPF funds 3.4. Regular Investment Plan 4. Promotional Sales Charge for Unit Trust funds 4.1. Eligible Customers who invest in any one selected Shariah compliant unit trust funds from selected Unit Trust Management Companies which shall be determined by the Bank (“Participating Equity Unit Trust Funds”) during the Campaign Period will be entitled to enjoy the relevant promotional sales charge (“Promotional Sales Charge”) as specified in the table below based on the relevant investment amount and subject to the terms and conditions herein. CIMB Preferred Promotional Investment Amount Promotional Sales Charge RM10,000 – RM49,999 3.28% 3.28% RM50,000 – RM149,999 2.88% 2.38% RM150,000 and above 2.50% 2.00% Sales Charge 4.2. To be entitled to the Promotional Sales Charge, the Eligible Customer must invest at least RM10,000 in a single transaction in a Participating Equity Unit Trust Fund. Placement of Investment Amount in the Participating Equity Unit Trust Funds will enjoy the corresponding Promotional Sales Charge stated in the table above. Combination of investment amount in different Participating Equity Unit Trust Funds is permitted and the investment amount must be in a single transaction for purposes of ascertaining the Promotional Sales Charge applicable. 4.3. Pursuant to Clause 4.2, to be entitled to the CIMB Preferred Promotional Sales Charge, the Eligible Customer must be a CIMB Preferred customer at the point of investment. 4.4. The list of Participating Equity Unit Trust Funds is available upon request and is subject to change upon giving of adequate notice by the Bank and is subject to other terms and conditions of the respective Participating Equity Unit Trust Funds which are separate from these terms and conditions. 4.5. The Promotional Sales Charge shall not be applicable for Eligible Customers who invest in any of the Participating Equity Unit Trust Funds using their Employees Provident Fund (EPF). In the event any investment made by an Eligible Customer is to be partially paid using withdrawal from the EPF (the “EPF Portion”), the EPF Portion shall be excluded from the computation of the investment amount in the Participating Equity Unit Trust Funds and shall be deemed to be a separate transaction. 5. Promotional Sales Charge for Unit Trust EPF funds 5.1. Eligible Customers who invest at least One Thousand (RM1,000) (“Investment Amount”) in a single transaction in any Participating Equity Unit Trust EPF Funds during the Campaign Period will be entitled to enjoy the promotional sales charge (“Promotional Sales Charge”) as specified in the table below. Investment Amount Promotional Sales Charge RM1,000 and above 2.88% 5.2. To participate in the Campaign, the Eligible Customers must during the Campaign Period invest through the Bank in any Participating Equity Unit Trust EPF Funds using monies from their Employees Provident Fund (EPF) . Combination of investment amount in different Participating Equity Unit Trust Funds is permitted and the investment amount must be in a single transaction for purposes of ascertaining the Promotional Sales Charge applicable. 5.3. The Participating Equity Unit Trust EPF Funds shall be selected unit trust EPF funds from selected unit trust management companies determined by the Bank at its sole and absolute discretion. The list of Participating Equity Unit Trust EPF Funds is available upon request and is subject to change from time to time by the Bank at its absolute discretion upon giving adequate notice 6. Complimentary Gift for Unit Trust EPF funds 6.1. The Eligible Customers who invest at least Fifty Thousand (RM50,000) in a single transaction in any Participating Equity Unit Trust EPF Funds during the Campaign Period will be entitle to one (1) Royal Selangor Photoframe (“Complimentary Gift”). 6.2. The Complimentary Gift will be delivered to the Eligible Customer’s address in the Bank’s record within 60 days after the date of disbursement of monies from the EPF. 6.3. The Bank disclaims any responsibilities or liability for any damages, loss or injury whatsoever arising out of the Complimentary Gift. 6.4. Any complaint, compensation or request arising from or in connection with the Complimentary Gift must be filed with the merchant and/or manufacturer. 7. Regular Investment Plan 7.1. Eligible Customers who sign up for any new Periodical Payment Instruction (PPI) in any one of the Participating Equity Unit Trust Funds with a minimum monthly investment amount of RM200 will be entitled to a promotional sales charge at 2.88% as set out below: Periodical Payment Instruction with Minimum Promotional Monthly Investment Amount Sales charge RM200 2.88% 8. Other Conditions 8.1. Any and all decisions made by the Bank in relation to every aspect of the Campaign, including the Eligible Customer’s entitlement to the relevant applicable promotional sales charge, and entitlement to the promotions under the Campaign shall be final and conclusive. Any subsequent correspondences, protests, appeals or enquiries will not be entertained. 8.2. All gifts under the Campaign are not transferable or redeemable or exchangable for cash or credit of any kind. 8.3. The Bank reserves the right to substitute the gifts under the Campaign with another item of similar value, upon giving adequate prior notice. 8.4. The Eligible Customer is required to sign all relevant standard documents in respect of his/her investment in the relevant products under the Campaign. 8.5. The Bank shall not be liable to any Eligible Customer or any party for any loss or damage of whatsoever nature suffered by the Eligible Customer or any party (including but not limited to any injury or death, loss of income, profits or goodwill, direct or indirect, incidental, consequential, exemplary, punitive or special damages of any party) arising, in relation to the participation or non-participation in the Campaign. 8.6. The Bank reserves the right to cancel, terminate or suspend the Campaign upon giving adequate notice. For the avoidance of doubt, cancellation, termination or suspension by the Bank of the Campaign shall not entitle the Eligible Customer or any other persons whatsoever to any claim or compensation against the Bank for any losses or damages suffered or incurred as a direct or indirect result of the act of cancellation, termination or suspension. 8.7. The Bank reserves the right upon giving reasonable notice to vary (whether by addition, deletion, modification or, amendment) any of the terms and conditions herein. Any such variation of the terms and conditions herein shall be binding on the Eligible Customers and be deemed to be brought to the Eligible Customer’s attention through any notice (i) displayed at the Bank’s branches or premises; (ii) sent by the Bank to the Eligible Customer by post or any other means; or (iii) advertised by the Bank or (iv) the Bank’s website. 8.8. Investments in unit trusts are not obligations of, deposits in, guaranteed or insured by the Bank and are subject to investment risks, including the possible loss of the principal amount invested. Eligible Customers are advised to read the Master Prospectus of the respective funds before investing. Eligible Customers should also consider all fees and charges involved before investing. Past performance of the Fund is not an indication of future performance and income distributions are not guaranteed. Eligible Customers should rely on their own evaluation to assess the merits and risks of any investment. Eligible Customers who are in doubt as to the action to be taken should consult their professional advisers immediately. 8.9. In the event of any inconsistency or conflict between the English and Bahasa Malaysia version of the terms and conditions herein, the English version shall prevail. Notwithstanding the aforementioned where request is made by the Eligible Customer for the Bahasa Malaysia version of the terms and conditions herein, CIMB shall provide the same to the Eligible Customer and if the agreement is entered into on this basis, then the Bahasa Malaysia version of the Terms and Conditions shall prevail. 8.10. In the event of any complaints related to the Campaign, Eligible Customers may contact the Bank’s Customer Resolution Department bearing the following address, telephone and facsimile numbers (or bearing such other address, telephone and facsimile numbers which the Bank may change by notification to the Eligible Customers): Customer Resolution Department, Level 17, Menara BumiputraCommerce, 11 Jalan Raja Laut, 50350 Kuala Lumpur tel: 603 26192380 / Fax: 603 26913248. 8.11. The Eligible Customer is not covered by the compensation fund under section 152 of the Capital Markets and Services Act 2007 (CMSA). The compensation fund does not extend to the Eligible Customer who has suffered monetary loss as a result of a defalcation or fraudulent misuse of moneys or other property, by a director, officer, employee or representative of the Bank. Where the Eligible Customer suffers monetary loss in the above circumstances related to the acts of the Bank’s employees, the Eligible Customer may lodge a complaint with our Customer Resolution Department as set out in clause 6.11. The Eligible Customer who is not satisfied with our Customer Resolution Department decision may refer the case to the Financial Mediation Bureau or the Securities Industry Dispute Resolution Centre within six (6) months of receiving a final decision from CRU. The Eligible Customer should note that his/her complaint will only be dealt with by either one of the above channel that the Eligible Customer chooses to refer his/her case to.