CIMB - PlanPlus

advertisement

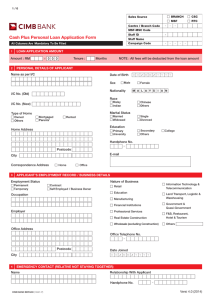

CIMB Wealth Advisors - Case Study This document is a high level Case Study outlining how PlanPlus Planit has been successfully implemented into a mutual fund company with backend data integration for different group of users. CIMB Wealth Advisors is also an example of a PlanPlus hosted client and illustrates how PlanPlus supports this type of customer. CIMB Wealth Advisors (CWA) a subsidiary of CIMB Group, (the 2 nd largest banking group in Malaysia) is one of the largest retail distribution arms in the financial services industry with a dynamic sales force of about 6,000 registered Unit Trust Consultants and Financial Planners. In year 2004, CWA obtained the CMSL (Capital Market Services License) for Financial Planning and set-­‐up the Financial Care Centre (FCC). The FCC was established with the aim to promote holistic financial advisory services and to develop the best talents in the industry for the benefit of their customers from the agency force. It was also with the aim to prepare the agency force to transition to a more professional consultant to be ready for the margin compression and the trends of the industry. In 2004 there were no influential role-­‐models as the financial planning industry was relatively new in the market. Upon conducting studies on the financial planning trends, operation, tools & technology in USA and Canada, CWA had adopted PlanPlus Planit which not only provide powerful technology and functionalities in helping the financial planners to carry out the advisory services but provided expertise as a strategic partner to help CWA to create a path differentiating them in the competitive Malaysia market. System Overview CIMB Unit Trust Platform – Xylog (Malaysia) CIMB PlanPlus Planit (hosted in Canada) Internet CIMB Wealth Advisors created a file of customer and investment holdings based on a PlanPlus standard format and transferred this to the PlanPlus-­‐IBM Datacentre in Canada using secure FTP. This was merged with data from Morningstar for asset allocation and daily pricing. Advisors access PlanPlus Planit over the Internet. Different User Levels enabled the transition from product to advisory selling PlanPlus Planit was initially used as a full fledge financial planning tool by the Financial Care Centre’s planners and later in 2007 , it was piloted to the mass agents as a “need-­‐based selling tool” in CIMB’s Wealth Advisor Training Course. With the flexibility of PlanPlus Planit to cater for different planning needs, CWA was able to adopt a different level of services CIMB Wealth Advisors (Malaysia) www.planplus.com as part of a transition strategy to develop the unit trust agents from merely product selling to advisory selling. Below is a summary of different levels of services and product offering using different levels of PlanPlus Planit. Financial Planners Unit Trust Agents Prospecting and Approach Initial Assessment & Evaluation – a Financial Health Check – a simplified Process comprehensive fact finding and Executive fact finding and analysis. Summary Report for clients. Engagement – Different • Fee-­‐based with fees and/or commissions • No separate fees level of services for different • Bronze Level -­‐ Investment Policy Statement • Focus on Investment Portfolio client’s needs Management • Silver level – Modular Planning ( Retirement Planning, Education Planning, Insurance • Financial Health Report with Needs Analysis etc) simplified Investment Policy Statement, retirement goals and • Gold Level – Life Goals Comprehensive education goals Planning Product Solutions Offering • Unit Trusts, Insurance, Trust Nomination, • Unit Trusts , Insurance, Trust Wills & Trusts, Housing Loans Nomination Asset Allocation Customised with 7 Asset Classes Customised with 4 Assets Classes Risk Profile CWA Customised CWA Customised Integration Yes -­‐ Back-­‐end unit trust platform Yes -­‐ Back-­‐end unit trust platform Subject Matter Experts providing on-­‐going Consultancy, Training & Support PlanPlus Planit is not just a tool with robust calculations and analyses that generates comprehensive and professional reports. It has incorporated the 6 steps of the financial planning process with best practices in which it has made the transition process easier and more effective. PlanPlus also provided their expertise and on-­‐going consultancy in a number of business and technical areas: • Fine tuning the current sales process with customization of documents for comprehensive, modular or single needs planning • • • • • • • Working with the Asset Management Group to establish 2 tiers of asset classes – a basic one for Unit Trust Agents and more advanced for planners. Also ongoing assistance and coaching on efficient frontier and other process to establish models implementation of the back office integration Consultancy and mentoring on financial planning services fee structure, financial planning and review processes Process and best practices training from various trips to the region Ongoing training with Breakfast and Learn, e-­‐learning modules, user guides Consumer education presentations in ½ day sessions sponsored by CIMB at the Securities Commission and other venues to help consumers understand the value of an asset allocation approach to investing. Introduction to the international planning community through organizations like FPA in US. The transitioning of product based selling to advisory based selling is not an overnight event, it requires time and resources to allow changes to happen within the organization, sales forces, sales process and even the clients. PlanPlus held true to the value of providing appropriate advice and always reinforced good planning behaviour with the advisors. With the continuous support and advice, this has helped CWA to accelerate its journey in becoming one of the pioneers of financial planning services and also to differentiate itself from the market as a total wealth solution provider in the Malaysian market. CIMB Wealth Advisors is a great example of a firm in an emerging market working with PlanPlus to successfully break new ground to introduce advice sales approaches to traditional product sales channels. CIMB Wealth Advisors (Malaysia) www.planplus.com