Handout 2 - Certified General Accountants Association of Canada

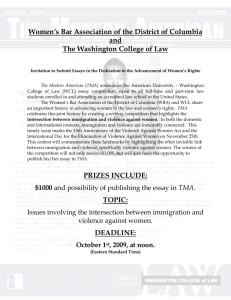

advertisement

FA4 Past Exam Questions Barbara M. Wyntjes, B.Sc., CGA Module 9: Past Exam Questions: PART 5: NOTE: I do NOT know the contents of the exam MULTIPLE CHOICE QUESTIONS: j. NH is a not-for-profit organization which owns several nursing homes. NH received donated materials with a fair value of $7,000 for use in one of its nursing homes. Although the donated material was appreciated, it would not have been purchased otherwise due to cash flow constraints. Which of the following best reflects proper accounting for the donated materials under the CICA Handbook? 1) The $7,000 of donated materials should not be recorded in the financial statements of NH. 2) The $7,000 of donated materials should only be recorded in the financial statements of NH if NH is using the deferral method of accounting. 3) NH has the option of either recording or not recording the $7,000 of donated materials in its financial statements. 4) The $7,000 of donated materials should only be recorded in the financial statements of NH if NH is using the restricted fund method of accounting. l. A small not-for-profit organization uses the services of 6 canvassers for its annual fund raising drive. How should the not-for-profit organization account for the donated time of its volunteer canvassers? 1) The donated time should be recorded at fair market value. 2) The donated time should be recorded at fair market value, but only if the organization would have purchased the services had they not been donated. 3) The fair market value of the donated time would not normally be recorded. 4) The fair market value of the donated time would be matched to the period in which the donations are used. m. TK is a not-for-profit organization which received a donated capital asset with a fair value of $20,000 on July 1, 2000. The capital asset has an expected life of 5 years, with no residual value. TK uses the straight-line method of amortization (and uses the halfyear rule for amortization in the year of acquisition). Which of the following is true regarding this donated capital asset, assuming TK uses the deferral method of accounting? (TK has a December 31 year-end.) 1) Contribution revenue will exceed amortization expense in 2000, and thereafter. 2) Contribution revenue will exceed amortization expense in 2000, but not thereafter. 3) Amortization expense will exceed contribution revenue in 2000. 4) Amortization expense will equal contribution revenue each year. 1 FA4 Past Exam Questions Barbara M. Wyntjes, B.Sc., CGA n. PJ is a not-for-profit organization (NFP) and has a relationship with QK, another NFP. This relationship gives PJ the continuing power to determine the strategic operating, investing, and financing policies of QK without the cooperation of others. This control of PJ over QK is evidenced in part by PJ’s ability to appoint 8 of QK’s 12 members of the board of directors. Which of the following is true? 1) PJ must consolidate the accounts of QK in its financial statements. 2) PJ may either consolidate the accounts of QK or use the equity method with footnote disclosures about QK. 3) PJ must use the equity method of accounting for QK with footnote disclosures about QK. 4) PJ may either consolidate the accounts of QK in its financial statements or provide footnote disclosures about QK. p. Under the deferral method for a not-for-profit organization, how should contributions received in the current year but restricted for operating expenses for one or more future periods be reported in the current year? 1) As revenue in the statement of operations 2) As deferred revenue on the balance sheet 3) As a direct increase to net assets 4) As a reduction of operating expenses on the statement of operations o. Mr. Able donated $100,000 to AWE University and specified that the principal amount not be spent but be maintained permanently. Interest on the invested funds can be used to award scholarships to third-year accounting students. How should the $100,000 contribution be reported by AWE University under the restricted fund method? 1) As revenue of the endowment fund 2) As revenue of the operating fund 3) As a direct increase in net assets of the endowment fund 4) As deferred revenue of the operating fund i) For the 1999 fiscal year, ZU Care, a not-for-profit organization, received $300,000 of unrestricted donations and $175,000 of donations designated specifically for cancer research. Unrestricted donations of $200,000 and restricted donations of $100,000 were expended in 1999 for current operations and cancer research, respectively. ZU did not set up a separate fund for the restricted donations. How much of the donations should be reported as revenue in the statement of operations for the 1999 fiscal year? 1) $300,000 2) $375,000 3) $400,000 4) $475,000 2 FA4 Past Exam Questions Barbara M. Wyntjes, B.Sc., CGA j. Which of the following reporting objectives for not-for-profit organizations allows the users to determine whether restricted funds were spent in accordance with the intended purpose? 1) Cash flow prediction 2) Stewardship 3) Performance evaluation 4) Measuring the cost of services rendered k. Which of the following is consistent with GAAP for large-scale not-for-profit organizations? 1) Expenditures for equipment are recognized on the statement of operations when the equipment is acquired by the organization, regardless of when it is used. 2) Expenditures for equipment are recognized on the statement of operations when the equipment is used by the organization, regardless of when it was acquired. 3) Expenditures for equipment are capitalized on the balance sheet and are not amortized. 4) Expenditures for equipment are recognized on the statement of operations when the equipment is paid for. l. Which of the following statements about accounting for capital assets for large-scale not-for-profit organizations is false? 1) Capital assets should be amortized over their useful lives with amortization being recognized as a direct charge to net assets. 2) Capital assets should be capitalized at fair value if they were contributed to the organization. 3) The net carrying value of capital assets not being amortized should be disclosed. 4) Contributions for the purchase in a future period of amortizable capital assets should be recorded as deferred revenue. n. The statement of changes in net assets for a not-for-profit organization is most similar to which of the following financial statements for a profit-oriented organization? 1) Balance sheet 2) Income statement 3) Cash flow statement 4) Statement of retained earnings o. AV Home Care is a not-for-profit organization with revenues of approximately $700,000. Which of the following contributions should be reported as a direct increase in net assets? 1) Endowment contributions for which an endowment fund is presented 2) Restricted contributions for which a corresponding restricted fund is presented 3) Restricted contributions for the purchase of land and for which a corresponding restricted fund is not presented 4) Unrestricted contributions 3 FA4 Past Exam Questions Barbara M. Wyntjes, B.Sc., CGA n. GK is a not-for-profit organization (NFP) that received a $50,000 donation on January 1, 1999, from a retired geography teacher. The donation was to be used to finance purchases to enhance GK’s 18th-century map collection. GK invested the donation in a 1year treasury bill and plans to spend the funds in the year 2000. GK uses the deferral method for reporting contributions, and therefore should account for the donation using which of the following approaches? 1) The $50,000 and related interest are recognized as revenue during 1999. 2) The $50,000 is recorded as a deferred contribution, and the related interest is recorded as investment income for 1999. 3) The $50,000 and related interest are both recorded in a deferred contribution account. 4) The donation and related interest should not be recorded on GK’s balance sheet or income statement, but the relevant details should be disclosed in GK’s notes to its financial statements. d. Which of the following reporting issues is not relevant to public sector organizations? 1) Cash or accrual accounting 2) Deferred tax accounting 3) Expenditure or expense accounting 4) Consolidation or extensive note disclosure Multiple Choice Solutions: j. 1. m. n. p. o. i. 1 3 4 4 2 1 3 j. k. l. n. o. n. d. 2 2 1 4 3 3 2 4 FA4 Past Exam Questions Barbara M. Wyntjes, B.Sc., CGA Part 6: Question 1: 15 marks TreesMeanAir Incorporated (TMA) is a not-for-profit organization that has been helping preserve Brazilian rainforests since 1989. Prior to the year ended June 30, 2001, its funding came exclusively from annual Government of Canada grants of approximately $300,000 per year. Due to recent changes to the government’s funding structure, TMA will no longer be receiving annual grants, but during the 2001-2002 fiscal year, TMA will be given a one-time $2,000,000 endowment to help support future projects. Additional funds must be raised from the general public, and the board of directors (the “board”) is confident that if they focus their efforts, fund raising should approximate $100,000 in 2001-2002, $400,000 in 2002-2003, and $600,000 per year thereafter. In addition, TMA has always expensed its capital assets such as furniture, fixtures, and computer equipment. It has made no mention of capital assets in its financial statements other than to include a line on the income statement entitled “Capital asset expenses.” You, a CGA, have recently been appointed to the board of TMA. Under terms of the endowment agreement, TMA will be required to provide audited financial statements that comply with the CICA Handbook for the year ended June 30, 2002 and subsequent years. Required a. Describe the key differences in accounting for unrestricted, endowment, and restricted contributions under the deferral method of accounting for contributions. b. Describe how TMA should account for its $2,000,000 endowment if it uses the restricted fund method of accounting for contributions. Include the journal entry that TMA should make upon receipt of the $2,000,000 endowment. c. Explain how TMA should account for its pledges outstanding at June 30, 2002. d. Was TMA’s accounting treatment of capital assets for the years up to June 30, 2001 acceptable according to CICA Handbook requirements? Explain why or why not. e. Explain what changes (if any) you would recommend regarding TMA’s accounting for capital assets, to ensure that TMA is in compliance with the terms of the endowment agreement in 2001- 2002 and for the foreseeable future. 5 FA4 Past Exam Questions Barbara M. Wyntjes, B.Sc., CGA SOLUTION Question 1: a) • Unrestricted contributions are reported as revenue in the period received. • Endowment contributions are not shown as revenue in the operating statement; they are shown as an increase to net assets in the statement of changes in net assets. • Restricted contributions are matched against related expenses and recognized as revenue only when the related expense is incurred. Therefore, they may be shown as current year revenue, revenue in a future period, or they may be deferred and amortized, depending on the nature of the related expenses. If the contribution is for land, there would be no related expense and it would be treated as a direct increase to net assets. b) Under the restricted fund method, TMA should record the endowment contribution as revenue in the year received. The journal entry to record this should be: Cash.......................................................................... 2,000,000 Revenue — endowment fund .............................................. 2,000,000 c) If TMA had the ability to estimate the collectibility of the pledges based on historical results, and if it were reasonably assured of collection, it could set up the pledges as “contributions receivable.” However, since the pledges arose as part of the first fundraising drive, such an estimation would be impractical, and the pledges should only be recorded at the time the cash is received. d) Because TMA would have been considered a small organization (with revenue under $500,000) for the years up to June 30, 2001, it had the option of capitalizing and subsequently amortizing its capital assets, or expensing them as acquired. Therefore, TMA’s accounting treatment was acceptable under CICA Handbook section 4300 requirements. e) TMA should change its accounting for capital assets to a policy of capitalizing and subsequently amortizing such assets. This would provide better matching and would ensure that TMA remains in compliance with CICA Handbook section 4300 requirements in future years when its revenue is projected to exceed the small organization threshold of $500,000. 6 FA4 Past Exam Questions Barbara M. Wyntjes, B.Sc., CGA PART 7: Question 2 (10 marks) Senior Transitions Ltd. (STL) is a not-for-profit organization (NFP) that has been set up to assist senior citizens who wish to move into nursing homes. STL provides counseling services and owns several moving trucks and related equipment. Two full-time paid counsellors are on staff to help seniors cope emotionally with the transition to nursing homes. STL’s accountant had been implementing changes to its reporting system and financial statements in order to ensure that the organization is in compliance with CICA Handbook requirements. However, the accountant recently quit to take a new position at another NFP. You, a recently qualified CGA, have just been hired. Your first task is to complete the implementation of the Handbook requirements. In particular, you have been asked to provide advice to the board of directors regarding the following matters relating to the December 31, 1999 year-end financial statements. • Accounting for contributions: STL has received a government grant of $500,000 for each of the last 5 years to cover its operating costs. It also runs an annual campaign where it telephones potential donors and asks for cash contributions and/or pledges to cover special needs such as the acquisition of new trucks. Over the past 3 years, STL has run 3 successful campaigns and raised a total of $150,000, $40,000 of which was restricted for the purchase of a truck. STL used $40,000 to acquire a new truck and the remainder for general operating purposes. During the 1999 campaign, $30,000 in cash was raised and pledges were received for an additional $21,500. The pledges are expected to be paid to STL by March 31, 2000. • Accounting for capital assets: STL has always accounted for its capital assets on a cash basis (that is, the expenditures were expensed in the year of purchase). Required Prepare a memorandum to the board of directors explaining how the following matters/items should be accounted for under CICA Handbook requirements, in order to ensure that STL can get an unqualified audit opinion from its auditors. Write one memorandum that covers both (i) and (ii). 6 marks i) How should STL account for contributions and contributions receivable to ensure that it is in compliance with CICA Handbook requirements. 3 marks ii) How should STL account for capital assets to ensure that it is in compliance with CICA Handbook requirements. 1 mark allocated for format!!!!! 7 FA4 Past Exam Questions Barbara M. Wyntjes, B.Sc., CGA SOLUTION Question 2: Date: June 20, 2000 To: Board of Directors From: CGA Re: Senior Transitions Ltd. (STL) — Handbook requirements As requested, I have completed my analysis of the CICA Handbook requirements to assist STL in its accounting for contributions and capital assets. i) Accounting for Contributions (Section 4410): As a not-for-profit organization (NFP) that wishes to ensure that it is in compliance with CICA Handbook requirements, STL should consider the following when finalizing its method of accounting for contributions: • STL may account for its contributions using either the deferral method or the restricted fund method. Under the deferral method, contributions for which externally imposed restrictions remain unfulfilled (such as contributions made specifically for the acquisition of new trucks) are maintained as deferred contributions on the statement of financial position. The contributions for the purchase of trucks should be recognized as revenue on the same basis as the amortization expense relating to the trucks, to ensure proper matching of revenues and expenses (see also my discussion of capital assets below). Amounts received under the government grant should be recognized as unrestricted current revenue, unless the government has imposed restrictions on the use of the funds. Unrestricted donations received in the annual campaign should be recognized as current revenue in this period. • Alternatively, if the restricted fund method is used, STL would prepare financial statements which include a general fund and a separate restricted fund relating to donations for trucks. The total of the two funds would also be shown in the financial statements. Additional funds could also be created as necessary. The restricted contributions for the purchase of trucks would be recognized as revenue in the fund each year. Contributions that are not subject to restrictions, such as the government grant and unrestricted donations received in the annual campaign, should be included as current revenue of the general fund. If a separate fund is not established for restricted funds, then the restricted funds would be accounted for in a manner similar to the deferral method. • The pledges of $21,500 can be recognized as an asset, pledges receivable, if they represent a reasonable estimate of the amount to be received and ultimate collection is reasonably assured. STL can use the results of its past telephone campaigns to assess the uncertainty associated with the ultimate collection of the outstanding pledges. 8 FA4 Past Exam Questions Barbara M. Wyntjes, B.Sc., CGA ii) Accounting for Capital Assets (Section 4430): Because STL has annual revenues that exceed $500,000 on an annual basis, it must comply with the full requirements of the CICA Handbook per section 4430. Therefore, the moving trucks should be recorded at cost, and amortized over their useful lives in a systematic and rational manner. Rather than expensing the trucks in the year of purchase, the trucks should be capitalized and related amortization should be recognized as an expense each year. Donated capital assets should be capitalized at their fair market value. Accounting for contributions for capital assets is included in the discussion of section 4410. If you require any further information relating to these matters, please contact me. Sincerely, You, CGA (Do NOT write your name on the exam paper) THE END 9