COMMITTED TO THOSE LINKED TO THE LAND

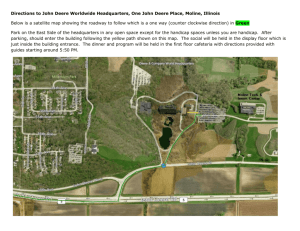

advertisement