Corporate Fuel Releases its Human Capital Solutions Industry

advertisement

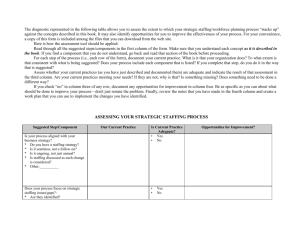

Corporate Fuel Advisors Human Capital Solutions Industry Quarterly Update (3Q 2015) Summary Table of Contents During 3Q15, the staffing market continued to grow, which is unusual at this point in the economic cycle (almost 6.5 years into an expansion). Industry Overview 2 Public Market Overview That said, many market segments are beginning to exhibits signs of moderation, including the largest segments, light industrial and clerical. 5 M & A Market Analysis 6 The October 2015 BLS and recent ASA reports support the industry slowdown trend. Corporate Fuel Advisors Overview 10 Select Business Services Experience 11 In its September 2015 update, Staffing Industry Analysts (SIA), increased its 2015 growth forecast for the industry to 7% from its 6% April 2015 forecast. This increase includes 1-2% growth for ACA pass-throughs in the industrial and office/clerical segments and we note that the report was prepared before more recent signs of moderation (see page 3). The focus for staffing companies should continue to be gross profit conversion, which measures how effectively a company manages its bill/pay spread and overhead expenses. While public company valuations still exceeded the S&P 500 valuation, they have contracted during 3Q15 and are moving toward convergence. The M&A market continued to be very healthy during 3Q15 with buyers still exceeding sellers and active public/private financing markets. Exhibits A: Public Company – Valuation Data James J. Janesky Managing Director 10 E. 40th Street Suite 3210 New York, NY 10016 646-572-0430 13 Industry Overview BLS and ASA Indexes While temporary employment continued to expand during 3Q15, which is unusual at this point in an economic cycle (almost 6.5 years into an expansion), the growth rate has moderated. According to the Bureau of Labor Statistics’ (BLS) most recent report, temporary employment rose 3.7% Y/Y in September 2015, which is the slowest rate since February 2010. Moreover, the BLS made significant downward revisions for temp help jobs in July and August. Although BLS data can be subject to substantial revisions at any point in the economic cycle, downward revisions have historically signaled negative staffing market trends and the data suggests close scrutiny is necessary going forward. The American Staffing Association (ASA) Index also exhibited signs of slower growth. This index is skewed towards the light industrial/clerical staffing; which tends to be more sensitive to cyclicality and generally leads an industry decline. The index is also reflective of staffing volume, not revenues, but the data has historically been directionally accurate and does support a moderation thesis. Temporary Employment Data Recession Recession 2,750 2,500 2,250 2,000 1,750 1,500 1,250 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1,000 2.1% 2.0% 1.9% 1.8% 1.7% 1.6% 1.5% 1.4% 1.3% 1.2% 1.1% 1.0% Penetration Rate (%) Temp Staffing Indexes Still Expanding But Slowing Number of Workers (in 000's) 3,000 ASA Staffing Index Temp Workers Temp Penetration Rate Source: Bureau of Labor Statistics Source: American Staffing Association (ASA) 2 Industry Overview (cont.) Segment Growth & Other Industry Data In its September 2015 update, Staffing Industry Analysts (SIA), increased its 2015 growth forecast for the industry to 7% from its 6% April 2015 forecast. This increase includes 1-2% growth for ACA pass-throughs in the industrial and office/clerical segments and we note that the report was prepared before more recent signs of moderation. Pass-through’s are also not considered signs that a market is growing. More recent economic and industry reports also project signs of a slowing economy. According to a National Association for Business Economics (NABE) survey, respondents reported slower profit and employment growth during 3Q15 and that 4Q15 expectations softened as well for those two areas. Large US industrial firms also project a protracted slowdown in sales and employment that will carry-over into 2016. Staffing Industry Forecast Several Segments Projected to Grow between 7% and 16% in 2015 $124.8B $59.4B IT Staffing: $25.7B Healthcare: $10.9B F&A: $6.8B Creative: $1.1B Education: $0.8B $64.2B IT Staffing: $27.2B Healthcare: $12.7B F&A: $7.4B Creative: $1.2B Education: $1.0B Direct Hire: $8.0B 2014 $17.6B Direct Hire: $9.2B 2015P Place & Search Commercial Source: Staffing Industry Analysts “US Staffing Industry Forecast: September 2015 Update”, September 15, 2015 3 $68.8B IT Staffing: $28.9B Healthcare: $14.2B F&A: $7.9B Creative: $1.2B Education: $1.1B $54.2B $52.1B $49.8B $15.6B $142.5B $133.9B $19.5B 2016P Professional Direct Hire: $10.3B Industry Overview (cont.) Gross Profit Conversion Gross Profit Conversion by Segment Staffing firms should continue to focus on one of the most important performance metrics in the industry: EBITDA as a Percent of Gross Profit. This metric measures how effectively a company manages its bill/pay spread and overhead expenses. Company Adecco S.A. Barrett Business Services Inc. General Employment Enterprises Inc. Kelly Services, Inc. ManpowerGroup Inc. Randstad Holding NV TrueBlue, Inc. Average Median A focus on this area should allow a company to avoid yielding to pricing pressure and expense growth, especially during times of revenue and profit softness. Companies with diligence in the area of gross profit conversion are also better prepared for growth as we exit an economic slowdown. Company BG Staffing, Inc. CDI Corp. Ciber, Inc. Hudson Global, Inc Kforce Inc. Mastech Holdings, Inc. On Assignment Inc. RCM Technologies Inc. Robert Half International Inc. Volt Information Sciences Inc. Average Median The chart to the right contains Gross Profit Conversion percentages for the various segments of the human capital industry. Companies with high EBITDA/GP rates historically garner the best valuations in both the public and private markets. Commercial Staffing Ticker SWX:ADEN NasdaqGS:BBSI AMEX:JOB NasdaqGS:KELY.A NYSE:MAN ENXTAM:RAND NYSE:TBI 2012 23.8% 8.6% 0.9% 10.8% 16.4% 16.6% 19.3% 13.8% 16.4% 2013 25.4% 8.4% NM 8.7% 20.5% 19.2% 19.8% 17.0% 19.5% 2014 27.1% NM NM 6.1% 23.2% 22.2% 21.7% 20.1% 22.2% LTM 27.9% NM 5.5% 7.3% 23.7% 22.8% 23.4% 18.4% 23.1% 2012 33.0% 19.4% 12.8% 1.5% 3.2% 21.3% 32.8% 16.5% 24.9% NM 18.4% 19.4% Executive and Retained Search Company Ticker 2012 Hays plc LSE:HAS 48.3% Heidrick & Struggles International Inc. NasdaqGS:HSII 24.5% Korn/Ferry International NYSE:KFY 39.8% Michael Page International plc LSE:MPI 14.4% Average 31.8% Median 32.2% Healthcare Staffing Company Ticker 2012 AMN Healthcare Services Inc. NYSE:AHS 25.0% Cross Country Healthcare, Inc. NasdaqGS:CCRN 2.8% Team Health Holdings, Inc. NYSE:TMH 52.3% Average 26.7% Median 25.0% 2013 35.9% 15.4% 11.6% NM 11.7% 27.1% 31.4% 19.9% 25.8% 1.6% 20.1% 19.9% 2014 30.2% 16.9% 10.0% NM 15.1% 27.3% 31.8% 22.9% 28.4% 6.4% 21.0% 22.9% LTM 33.8% 12.6% 12.0% NM 16.7% 23.3% 31.2% 20.1% 30.0% 3.7% 20.4% 20.1% 2013 46.9% 25.4% 37.3% 15.4% 31.2% 31.3% 2014 49.2% 27.8% 44.2% 16.2% 34.4% 36.0% LTM 52.9% 28.7% 47.1% 16.2% 36.2% 37.9% 2013 25.6% 5.5% 53.6% 28.2% 25.6% 2014 26.5% 10.0% 53.8% 30.1% 26.5% LTM 29.5% 13.2% 54.2% 32.3% 29.5% Source: Capital IQ, and CF Estimates 4 Professional Staffing Ticker AMEX:BGSF NYSE:CDI NYSE:CBR NasdaqGS:HSON NasdaqGS:KFRC AMEX:MHH NYSE:ASGN NasdaqGM:RCMT NYSE:RHI AMEX:VISI Public Market Overview Public Company Valuation Public company valuations contracted from 6/30/15 to 9/30/15. Current median multiples are between 0.4X and 1.2X revenues and between 9.7X and 15.6X EBITDA. Healthcare multiples lead the group due to demographic trends and the supply/demand imbalance of professionals. The rest of the group multiples are moving closer to the S&P 500 multiple as investors become concerned about future economic and staffing industry growth. Public Company EBITDA Valuations Public Valuations have contracted since June Enterprise Value / EBITDA Multiple 19.00x 17.00x 15.00x 13.00x 11.00x 9.00x 7.00x 5.00x Commercial Staffing Index Professional Staffing Index Executive and Retained Search Index Healthcare Staffing Index S&P 500 Index Note: Index Constituents Available in Exhibit A Source: Capital IQ Three Year Median Valuations Index EBITDA Multiple Commercial Staffing Index 11.5x Professional Staffing Index 12.6x Executive and Retained Search Index 12.5x Healthcare Staffing Index 14.8x S&P 500 Index 9.8x Note: Index Constituents Available in Exhibit A Source: Capital IQ, and CF Estimates 5 M & A Market Analysis 3Q Global Merger & Acquisition Overview The M&A market continued to be very healthy during 3Q15 with buyers still exceeding sellers, more private vs. public buyers and very few financial vs. strategic transactions. Both public and private financing markets are still attractive. Multiples for staffing companies vary by company size, level of skill sets, percent of direct hire revenues and EBITDA margins. Current multiples are in a range of 3.0x - 5.0x EBITDA for smaller companies and lower level skill set platforms to 8.0x - 10.0x EBITDA, or higher, for higher skill set platforms and larger companies. Public vs. Private Yearly Transaction Volume 120 112 Number of Deals 100 27% 73% 80 17 30 40 0 99 28 42 29 21 22 18 20 25 28 28 2010 2011 2012 Q1 Private (27 Transactions) Q2 Q3 37 30 18 26 29 26 24 2013 2014 2015 19 16 87 25 19 60 20 Public (10 Transactions) 86 82 111 Q4 Source: Capital IQ Source: Capital IQ 3Q Sector Activity Strategic vs. Financial Other (9 Transactions) 8% Commercial (7 Transactions) Technical (7 Transactions) 8% 5% 24% 11% IT Staffing (5 Transactions) 92% Healthcare (4 Transactions) Executive Search (3 Transactions) F&A (2 Transactions) Strategic (34 Transactions) Financial (3 Transactions) Source: Capital IQ Source: Capital IQ 6 14% 19% 19% M & A Market Analysis (cont.) 3Q Global Merger & Acquisition Activity Transaction Date Target / Issuer 09/29/2015 Milestone Operations Ltd 09/29/2015 Target Description Buyers / Investors Milestone Operations Ltd. provides recruitment services specializing in finding temporary and permanent jobs for professional drivers, w arehouse staff, and industry experts w ithin transport, distribution, industrial, and utility sectors.The company w as incorporated in 2005 and is based in London, United Kingdom. Staffline Group plc (AIM:STAF) Vision Technology Services, LLC Vision Technology Services, LLC provides IT talent and project management services. The company w as founded in 2001 and is based in Hunt Valley, Maryland. As of September 28, 2015, Vision Technology Services, LLC operates as a subsidiary of BG Staffing, LLC. BG Staffing, LLC 09/25/2015 RiseSmart, Inc. 09/25/2015 Selection Group Limited 09/24/2015 Hay Group Investment Holding B.V. Hay Group Investment Holding B.V. provides organizational and human consulting advices services and Financial services through its subsidiaries.The company is based in Zeist, Netherlands. Korn/Ferry International (NYSE:KFY) 09/24/2015 Healthcare Staffing Services, LLC Healthcare Staffing Services, LLC provides healthcare staffing services. The company recruits temporary travel nurses for urgent staffing needs to maintain the continuity of care for clients and patients. Healthcare Staffing Services, LLC is based in Greenw ood Village, Colorado. Thomas H. Lee Partners, L.P. 09/22/2015 RecruitPro, Inc. RecruitPro, Inc. provides temporary and temp-to-hire placement services to clients in the San Diego area. The company w as founded in 1989 and is based in La Jolla, California. CorTech, LLC. 09/21/2015 The Renick Group, Inc. The Renick Group, Inc. provides executive search services. The company w as founded in 2004 and is based in Roanoke, Virginia. Arevo Group Inc. 09/17/2015 StrategyHire StrategyHire provides executive search and staffing services in the IT sector. The company w as founded in 2002 and is based in Viana, Virginia. Sonoma Consulting, Inc. 09/16/2015 TRU Cyber LLC 09/15/2015 RiseSmart, Inc. provides career transition, management, and outplacement services to Fortune 1000 companies. RiseSmart, Inc. w as founded in Randstad Holding NV 2007 and is based in San Jose, California w ith an additional office in Pune, India. (ENXTAM:RAND) Selection Group Limited provides recruitment services for sales, engineering, accountancy, finance, legal, office services, and call center roles. SF Recruitment Ltd It also helps candidates w ith interview techniques. The company w as incorporated in 2007 and is based in Leeds, United Kingdom. TRU Cyber LLC provide clients w ith cyber security, data privacy, and information security staffing solutions. The company w as founded in 2015 TRU Staffing Partners, Inc. and is based in Brooklyn, New York. The First String Healthcare, Inc. The First String Healthcare, Inc., together w ith its subsidiaries, provides interim and permanent nurse management and executive recruitment to hospitals and healthcare related businesses in the United States. The company w as founded in 2002 and is based in Irvine, California. 09/09/2015 HEADS Recruitment Ltd. and Heads Engineering Ltd. 09/04/2015 Priority Personnel, Inc. 09/04/2015 PeopleShare, Inc. 09/01/2015 A+ Teachers Limited AMN Healthcare Services Inc. (NYSE:AHS) Heads Engineering Ltd. provides contract and permanent recruitment services to engineering and associated industries in the United Kingdom and overseas. HEADS Recruitment Ltd. provides recruitment services for various market sectors in the United Kingdom. The company is based in the United Kingdom. Groupe Proman SAS Priority Personnel, Inc. operates as a staffing company that provides temporary and long-term employees in light industrial, office-clerical, technical, professional, and retail occupations.The company w as founded in 1993 and is based in San Marcos, Texas. The Hamilton-Ryker Group, LLC PeopleShare, Inc. provides staffing services. The company specializes in temporary and contract staffing, temp to hire, direct hire, and flexible staffing services. The company w as incorporated in 2004 and is based in Philadelphia, Pennsylvania. Trivest Partners, L.P. A+ Teachers Limited provides education recruitment services for teachers in the United Kingdom. The company w as founded in 2003 and is based in Berkhamsted, United Kingdom. Servoca Plc (AIM:SVCA) Source: Capital IQ 7 M & A Market Analysis (cont.) 3Q Global Merger & Acquisition Activity (cont.) Transaction Date Target / Issuer 09/01/2015 Medical Solutions L.L.C. 08/31/2015 Bay Staffing Solutions, LLC 08/25/2015 Capita Pte. Ltd. 08/10/2015 OnPoint Partners, Inc. 08/06/2015 Bluefin Resources Pty Limited Target Description Buyers / Investors Medical Solutions L.L.C. operates as an interim clinical staffing company in the United States. It offers temporary RN travel jobs to healthcare professionals. Medical Solutions L.L.C. w as founded in 1997 and is headquartered in Omaha, Nebraska. Beecken Petty O'Keefe & Company; Heritage Group, LLC Bay Staffing Solutions, LLC provides recruitment services to customers in the San Francisco Bay Area. It specializes in administrative and professional placement services. The company is based in San Francisco, California. Atrium Staffing Services, Ltd. Capita Pte. Ltd. offers talent management, payroll processing, and temporary and contract placement services. It offers outsourcing services in Temp Holdings Co., Ltd. the areas of contract executives, temporary hires, project/event hires, and recruitment process outsourcing. Capita Pte. Ltd. w as incorporated in (TSE:2181) 2007 and is based in Singapore. OnPoint Partners, Inc. provides staffing services in Chicago. The company specializes in direct-hire placements and interim staffing. It focuses on various applicable talents that range from executive financial management to accounting support staff. The company w as founded in 2004 and is based in Chicago, Illinois. Catapult Staffing LLC Bluefin Resources Pty Limited offers permanent and contract recruitment services in the areas of data analytics, market research, risk management, technology, investment and w ealth management, banking and finance, digital, project services, and marketing in Australia. The company w as founded in 2003 and is based in Sydney, Australia. Outsourcing, Inc. (TSE:2427) 08/06/2015 Veritaaq Technology House Inc. Veritaaq Technology House Inc. provides information technology (IT) consulting services to private and public sector organizations in Canada. Veritaaq Technology House Inc. w as founded in 1983 and is based in Ottaw a, Canada. Experis US, Inc. (Manpow er NYSE:MAN) 08/05/2015 ScaleneWorks People Solutions ScaleneWorks People Solutions LLP, a human capital management consulting company, offers talent acquisition services. ScaleneWorks People LLP Solutions LLP w as founded in 2010 and is based in Bengaluru, India. CDI Corp. (NYSE:CDI) 08/04/2015 Hospital Physician Partners, Inc. Hospital Physician Partners, Inc. provides emergency and hospital medicine contract management services. The company offers emergency medicine management and staffing services in the United States. Hospital Physician Partners, Inc. w as incorporated in 2009 and is based in Hollyw ood, Florida. The company has additional offices in Durham, North Carolina; and Plantation and Hollyw ood, Florida. Schumacher Group 08/03/2015 Agile Resources, Inc. 07/29/2015 The York Companies Inc. 07/27/2015 EMAGINE GMBH 07/23/2015 Pertemps People Development Group Ltd. Agile Resources, Inc. provides information technology (IT), staff augmentation, and consulting services in the United States. The company w as founded in 2003 and is based in Alpharetta, Georgia. General Employment Enterprises Inc. (AMEX:JOB) The York Companies Inc. offers staffing and recruiting services. The company w as founded in 1979 and is headquartered in Louisville, Kentucky. Elw ood Staffing Services, Inc. EMAGINE GMBH provides customized staffing solutions in the areas of information technology (IT), engineering, and business services. The company is based in Eschborn, Germany w ith locations in Berlin, Munich, Dusseldorf, Hamburg, and Stuttgart, Germany; Paris, France; and London, United Kingdom. Financière Valérien SAS Pertemps People Development Group Ltd. provides w elfare to w ork, training, and recruitment services to government and private companies in Australia and the United Kingdom. The company w as founded in 1997 and is headquartered in Birmingham, United Kingdom. Serendipity (WA) Pty Ltd Source: Capital IQ 8 M & A Market Analysis (cont.) 3Q Global Merger & Acquisition Activity (cont.) Transaction Date Target / Issuer Target Description Buyers / Investors 07/20/2015 RedSnapper Recruitment Ltd. RedSnapper Recruitment Ltd. provides staffing services for the law enforcement, offender supervision, regulatory enforcement, and counter fraud w ork communities in the United Kingdom. The company w as incorporated in 2004 and is based in London, United Kingdom. Acumin Consulting Ltd. 07/17/2015 Premier Legal Staffing, Inc. Premier Legal Staffing, Inc. operates as an executive search company. The company is based in Camarillo, California w ith offices in Fremont, California; Singapore; Pune, Bengaluru, and Mumbai, India; Scottsdale, Arizona; and Princeton, New Jersey. Intellisw ift Softw are, Inc. 07/09/2015 S & B Staffing S & B Staffing provides staffing services. The company offers temporary, temp-to-hire, and direct hire staffing services. It provides staffing services for positions in fields, such as accounting, administrative, bookkeeping, claims processing, clerical, customer service, data entry, engineering, financial, human resources, information technology, insurance, light industrial/w arehouse, management, manufacturing, marketing, paralegal, sales, secretarial, supervisory, technical, and w arehouse. The company w as founded in 1989 and is based in Albany, New York. H. W. Temps, Inc. 07/09/2015 Lighthouse Placement Services, Lighthouse Placement Services, LLC provides staffing services for engineering and technical professionals in Eastern Massachusetts and LLC Southern New Hampshire. The company w as founded in 2001 and is based in Haverhill, Massachusetts. Staffing 360 Solutions, Inc. (NasdaqCM:STAF) 07/07/2015 Reichard Staffing Solutions and Reichard Staffing Group Inc. and Rdw Staffing LLC provide staffing services. The companies are based in the United States. RDW Professional Staffing Alluvion Staffing, Inc. 07/06/2015 Complete Staffing Services, Inc. Complete Staffing Services, Inc. provides commercial staffing solutions. The company w as founded in 1974 and is based in Houston, Texas. Active Temporaries Ltd. 07/03/2015 Neville Gee Limited 07/02/2015 Eveready Staffing and Training Incorporated 07/01/2015 P. Murphy And Associates, Inc. P. Murphy And Associates, Inc. provides integrated information technology staffing assistance for companies. The company w as founded in 1981 and is based in Burbank, California. 07/01/2015 Legacy Engineering, LLC Neville Gee Limited provides technical and commercial temporary and permanent recruitment services. The company w as founded in 1973 and is Ideal Recruit Ltd based in Burnley, United Kingdom. Eveready Staffing and Training Incorporated provide staffing solutions for businesses and job seekers. The company offers temporary, temporary-to-hire, and direct hire staffing solutions for various positions, such as administrative and clerical, manufacturing, skilled trades, and more. The company w as founded in 2009 and is based in Ogden, Utah. Chartw ell Staffing Services, Inc. Intellisw ift Softw are, Inc. Legacy Engineering, LLC provides technical and management professionals to the aerospace and defense industry. The company w as founded PDS Tech, Inc. in 1998 and is based in Irvine, California. Source: Capital IQ 9 Corporate Fuel Advisors Overview General Overview Founded in 2005, Corporate Fuel Advisors is a New York-based investment banking firm that provides a full range of advisory services to middle market companies. Corporate Fuel Advisors prides itself on providing independent advice and senior leadership on every assignment. Capabilities: Mergers & Acquisitions Recapitalizations Strategic Advisory Fairness Opinions Business Succession Planning Leadership & Talent Recruiting ESOPs Business Valuations Divestures Management Buyouts Raising Debt Raising Growth Capital Going Private Initiatives Restructurings Focus: Companies with revenues between $10-200mm Transaction size of $5-100mm A broad range of industries with over 400 transactions completed since 2005 Industries Served: Healthcare Food & Fragrance IT & Software Industrial Consumer Products Business Services Business Services Practice Overview Areas of Focus: IT Staffing / Solutions Finance & Accounting Engineering Staffing Educational Technology Professional Consulting Healthcare Staffing Marketing / Advertising Lead Generation Technology Contacts Business Services Team James J. Janesky Marc E. Hirschfield General Partners Matthew D. Luczyk John C. Simons Charles S. Lachman Managing Director Vice President Associate Partner Partner jim@corporatefuel.com marc@corporatefuel.com matthew@corporatefuel.com john@corporatefuel.com charles@corporatefuel.com (646) 572-0430 (646) 572-0423 (646) 572-0425 (646) 572-0419 (646) 572-0422 Corporate Fuel Advisors ♦ 10 E. 40th Street, Suite 3210, New York, NY 10016 ♦ 212-260-2743 www.corporatefuelpartners.com 10 Select Business Services Experience CF has undertaken assignments for a variety of business services companies, examples of which are shown below Technical project management and staffing firm − Providing valuation and evaluation of strategic options. IT consulting/solutions firm with a financial services industry focus – Advising to explore strategic alternatives IT solutions/staffing firm – Targeted buy side and market analysis Online employment & education lead generation firm – Advising on refinancing of debt $100 million full service recruitment, temporary staffing and retained search firm – Provided valuation and evaluation of strategic options National architectural, engineering, planning and environmental consulting firm – Advised on series of acquisitions; completed two tactical purchases – Recruited and placed COO and CFO for the Company’s senior management team Facilities management and maintenance company providing construction and maintenance staff to US government facilities domestically and internationally – Advised the owners on acquisitions Accounting and finance outsourced services to businesses and high net worth individuals – Ongoing advisory 11 Select Business Services Experience (cont.) Marketing services business providing writers and branding resources to major financial services companies – Advised on a sale of the Company Electric company that provides linemen for electrical network systems – Advised on a sale of the Company Home healthcare aide business – Provided valuation services Medical transcription services business – Advised on the sale of the Company Financial services consulting firm – Business provides finance, credit and risk, operations, compliance and technology support to investment managers, family offices, banks, broker dealers and institutional investors – Advised on the sale of the Company Training and consulting firm active in corporate compliance and ethics – Completed sale of the Company – Recruited and placed CFO $40 million staffing business – Recruited and placed CFO CF principals have had extensive involvement as bankers and consultants in the executive and online recruiting spaces – Lenders to four executive recruiting companies, of which two were $50 million + businesses 12 Exhibit A: Public Company – Valuation Data Commercial Staffing Enterprise Value Revenues Gross Profit Gross Profit Margin EBITDA EBITDA Margin Enterprise Value / Revenues Enterprise Value / EBITDA Com pany Nam e Ticker Date Adecco S.A. SWX:ADEN 6/30/2015 $14,566.6 $23,416.3 $4,392.1 18.8% $1,226.4 5.2% 0.6 x 11.9 x Barrett Business Services Inc. NasdaqGS:BBSI 6/30/2015 $374.9 $699.3 $329.7 47.2% ($43.3) -6.2% 0.5 x NM General Employment Enterprises Inc. AMEX:JOB 6/30/2015 $73.5 $40.4 $13.8 34.1% $0.8 1.9% 1.8 x NM Kelly Services, Inc. NasdaqGS:KELY.A 6/28/2015 $635.8 $5,527.0 $900.6 16.3% $65.4 1.2% 0.1 x 9.7 x Manpow erGroup Inc. NYSE:MAN 9/30/2015 $6,868.8 $19,497.1 $3,313.5 17.0% $784.5 4.0% 0.4 x 8.8 x Randstad Holding NV ENXTAM:RAND 6/30/2015 $11,196.6 $20,338.8 $3,780.2 18.6% $860.7 4.2% 0.6 x 13.0 x TrueBlue, Inc. NYSE:TBI 9/25/2015 $1,292.2 $2,576.3 $608.9 23.6% $142.4 5.5% 0.5 x 9.1 x Average $5,001.2 $10,299.3 $1,905.5 25.1% $433.8 2.3% 0.6 x 10.5 x Median $1,292.2 $5,527.0 $900.6 18.8% $142.4 4.0% 0.5 x 9.7 x Enterprise Value / Revenues Enterprise Value / EBITDA Professional Staffing Enterprise Value Revenues Gross Profit Gross Profit Margin EBITDA EBITDA Margin Com pany Nam e Ticker Date BG Staffing, Inc. AMEX:BGSF 6/28/2015 $108.3 $181.6 $37.6 20.7% $12.7 7.0% 0.6 x 8.5 x CDI Corp. NYSE:CDI 6/30/2015 $129.1 $1,066.7 $196.4 18.4% $24.8 2.3% 0.1 x 5.2 x Ciber, Inc. NYSE:CBR 6/30/2015 $311.1 $830.9 $215.0 25.9% $25.9 3.1% 0.4 x 12.0 x Hudson Global, Inc NasdaqGS:HSON 6/30/2015 $52.5 $533.0 $207.1 38.8% ($12.8) -2.4% 0.1 x NM Kforce Inc. NasdaqGS:KFRC 6/30/2015 $908.8 $1,282.5 $397.4 31.0% $66.2 5.2% 0.7 x 13.7 x Mastech Holdings, Inc. AMEX:MHH 6/30/2015 $47.8 $113.5 $20.7 18.2% $4.8 4.2% 0.4 x 10.0 x On Assignment Inc. NYSE:ASGN 6/30/2015 $2,950.6 $1,934.0 $622.3 32.2% $194.3 10.0% 1.5 x 15.2 x RCM Technologies Inc. NasdaqGM:RCMT 7/4/2015 $79.5 $188.9 $51.9 27.5% $10.4 5.5% 0.4 x 7.6 x Robert Half International Inc. NYSE:RHI 9/30/2015 $6,542.2 $5,011.8 $2,075.1 41.4% $623.1 12.4% 1.3 x 10.5 x Volt Information Sciences Inc. AMEX:VISI 8/2/2015 $289.0 $1,562.6 $239.8 15.3% $9.0 0.6% 0.2 x 32.2 x Average $1,141.9 $1,270.6 $406.3 26.9% $95.8 4.8% 0.6 x 12.8 x Median $209.0 $948.8 $211.0 26.7% $18.7 4.7% 0.4 x 10.5 x Source: Capital IQ Pricing As of October 23, 2015 13 Exhibit A: Public Company – Valuation Data (cont.) Executive and Retained Search Enterprise Value Revenues Gross Profit Gross Profit Margin EBITDA EBITDA Margin Enterprise Value / Revenues Enterprise Value / EBITDA Com pany Nam e Ticker Date Hays plc LSE:HAS 6/30/2015 $3,138.9 $6,043.1 $503.4 8.3% $266.2 4.4% 0.5 x 11.8 x Heidrick & Struggles International Inc. NasdaqGS:HSII 6/30/2015 $316.1 $495.3 $156.7 31.6% $44.9 9.1% 0.6 x 7.0 x Korn/Ferry International NYSE:KFY 7/31/2015 $1,527.0 $1,044.4 $302.9 29.0% $142.6 13.7% 1.5 x 10.7 x Michael Page International plc LSE:MPI 6/30/2015 $2,188.3 $1,674.9 $865.0 51.6% $140.5 8.4% 1.3 x 15.6 x Average $1,792.6 $2,314.4 $457.0 30.2% $148.6 8.9% 1.0 x 11.3 x Median $1,857.7 $1,359.6 $403.1 30.3% $141.6 8.7% 1.0 x 11.2 x EBITDA EBITDA Margin Enterprise Value / Revenues Enterprise Value / EBITDA Healthcare Staffing Enterprise Value Revenues Gross Profit Gross Profit Margin Com pany Nam e Ticker Date AMN Healthcare Services Inc. NYSE:AHS 6/30/2015 $1,463.4 $1,221.9 $376.6 30.8% $111.2 9.1% 1.2 x 13.2 x Cross Country Healthcare, Inc. NasdaqGS:CCRN 6/30/2015 $490.0 $755.7 $190.3 25.2% $25.1 3.3% 0.6 x 19.5 x Team Health Holdings, Inc. NYSE:TMH 6/30/2015 $5,019.9 $3,221.4 $594.3 18.4% $322.3 10.0% 1.6 x 15.6 x Average $2,324.4 $1,733.0 $387.1 24.8% $152.9 7.5% 1.1 x 16.1 x Median $1,463.4 $1,221.9 $376.6 25.2% $111.2 9.1% 1.2 x 15.6 x Source: Capital IQ Pricing As of October 23, 2015 CORPORATE FUEL ADVISORS , a New York-based investment banking firm, provides a full range of advisory services to middle market companies. The firm advises on mergers and acquisitions, and raising debt and equity capital. CFA concentrates on small to mid-size enterprises with revenue between $10 million and $200 million. The diverse experience of our partners and unique market focus allows us to bring an unmatched level of expertise to our clients. We conduct securities-related transactions through our wholly owned affiliate, Corporate Fuel Securities, LLC, a registered broker dealer. Member FINRA and SIPC. Corporate Fuel Advisors gathers its data from sources it considers reliable but does not guarantee the accuracy or completeness of the information provided in this publication. Officers, partners or employees may have investments in the securities of the companies discussed in this publication. Corporate Fuel may from time to time seek or provide investment banking services from the companies contained in this report. Any public companies included in the Corporate Fuel Advisors indices are companies commonly used for industry information to show performance within a sector. These indices do not include all public companies that could be included within the sector and do not imply benchmarks. This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by Corporate Fuel Advisors or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. 14