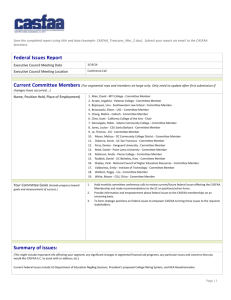

March - Casfaa

advertisement