File - Keenan Meitz

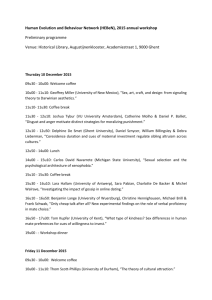

advertisement

MKTG 3350 Marketing Research and Analytics Project 1: Target Market Analysis and Segmentation for OZO Coffee Co Jesse Hiss -­‐ Jesse.Hiss@colorado.edu Billy Kirscher -­‐ Billykirscher@gmail.com Kyle May -­‐ Kyle.May@colorado.edu, Keenan Meitz – Keenan.Meitz@colorado.edu Tyler Reeb -­‐ Tylerreeb@yahoo.com Table of Contents Executive Summary ................................................................................................................ 3 Secondary Research ................................................................................................................ 4 Target Market Research Analysis ................................................................................... 13 Focus Group Design & Analysis ........................................................................................ 18 Survey Design & Analysis ................................................................................................... 25 Works Citied ........................................................................................................................... 29 2 Executive Summary Greg Lefcourt, Director of Retail Operations of Ozo Coffee summarized our market research best by saying, “Coffee is a drug. Drugs sell anywhere and everywhere.” All our secondary data confirmed this quote. Throughout all demographics and psychographics, coffee is a popular drink of choice with little variability in consumption. While coffee is more popular amongst older populations, almost 50% of the youngest age groups reported drinking coffee every day on a national survey. Another piece of data supporting Ozo was the fact that Westerners prefer independent shops, healthy items, and to support local artists which is a perfect alignment for Ozo. Ozo Coffee said they did not use much target research because of the fact that coffee is in such a high demand with such a diverse market. Throughout our focus group and survey one problem was how similar our sample was. All the students were with in 5 years of age and attend the same school. This allowed for us to gain very insightful knowledge on how Ozo could better target CU students as only 1 of 7 students in the focus group have ever tried it. Location was the biggest factor applying to why students hadn’t tried Ozo. Along with location we discovered that people are looking a different type of coffee shop in the morning than they are at night. People prefer to have quick and affordable coffee in the morning while they prefer more of an experience with elaborate coffee options in the afternoon and evening. Having a location closer to CU that offers quick affordable options for students on their way to class in the morning, and a comfortable environment with healthy and unique coffees in the evening would be the best way for Ozo to successfully reach our studied target market. 3 Introduction Secondary Research Ozo Coffee is a locally owned coffee shop with its roots and operating activities centered in the growing city of Boulder, CO. Ozo Coffee has three locations throughout Boulder to better serve the community. Two of these locations are actual coffee shops and one is a Roastery Café. The coffee industry is a very diverse category with much breadth that targets a majority of consumers despite their varying demographics and psychographics. Much like rapid expansion of McDonalds in the food industry, Starbucks Coffee was able to expand in a similar manner and it is no longer uncommon to see a Starbucks at every corner in every city in America. However, with the popularity of coffee shop atmospheres continuing to incline, more and more independent coffee shops, such as Ozo, are sprouting up and competing with established chains to win over customers. According to the article State of the Coffee Industry by Nicholas Upton, coffee shop revenue in the United States has increased about 5.5 billion dollars within the past 5 years. This revenue 4 has shown substantial growth of the coffee industry and, more importantly, data suggests this growth will continue through future years. The increase in revenue is attributed to the fact that more and more Americans are visiting their local coffee shop. According to State of the Coffee Industry, between the spring of 2011 and the spring of 2012, United States coffee shops experienced tremendous growth in customer traffic. Data shows that the amount of people who had visited a coffee shop within the last 30 days had increased by 3 million consumers, increasing from 29 million consumers to 32 million consumers in just one year. These numbers show industry growth of approximately 10.34% over the period. The data suggests that Americans are growing increasingly fond of coffee shops and seek the unique atmosphere and quality coffee offered by shops. This trend is likely related to “more spending cash in post-­‐recession America” (Upton, 2014). Demographic The target market for coffee is largely unconfined in terms of age and race, as almost every age and race are consumers of this product. Coffee is a natural drink that is simple, yet provides energy and comfort when we need it most. In 2010, only 44% of people age 25-­‐39 claimed to consume coffee every day. Research now shows that 63% of people age 25-­‐39 have a cup of coffee every day (Nation, 2013). This number is up form previous years by nearly 20%, once again exhibiting the strong consumer demand for this category. This growth gives us evidence that Ozo should be targeting over half the adult population. Coffee drinking amongst young adults (age 18-­‐24) has also risen from 31% in 2012 to 41% in 2013 (Nation, 2013). This is especially important because 76% of adults claimed to have started their 5 coffee drinking habits between the ages of 16-­‐24 (Kaakati, 2012). This suggests Ozo has a huge opportunity to target young adults that will turn into lifetime customers. If Ozo can target this generation and get them hooked on coffee, they will likely be coffee drinkers, and in turn, customers, for life. It is a target market that has yet to develop any coffee shop loyalty, but has the potential to be a repeat customer for many years to come. Even America’s elderly (age 60+) showed growth in daily coffee consumption, up from 71% to 76%. The age range from 40-­‐59 showed small growth in daily consumption, increasing a mere 4%, from 65% to 69% (Nation, 2013). Different ages of consumers would like to see different things from a coffee shop, as each age segment has a particular set of desires and needs. Desired menu improvements included items such as healthier items, more food items, a drive-­‐thru, 6 live entertainment, and many others. This data can be seen below. Based off the compiled data above, it is apparent that different techniques will need to be employed based on the age segment that is being appealed to. While there are clearly items that are favored more so than others by all age groups, there are others that are more age specific. Addressing these specific age issues would allow you to attract the exact segment you want Race trends Asians have the highest usage of coffee chains and are more likely to visit coffee houses during all parts of the day. They are also more likely than any other group to have used a coffee house chain in the past month (Wall, 2013). Mintel’s Asian and Dining Out – US – May 2013 report shows that Asians are enthusiastic consumers of beverages. Some 65% of Asians say they order hot coffee, tea and chocolate drinks, while 57% say they order iced coffee and tea drinks (Wall, 2013). Asians are more likely to have purchased food or drinks from coffee houses or donut 7 shops during breakfast, so this is a good area to highlight for them. Income Trends Households with income less than $25K are the least like of any group to have purchased something at a coffee shop in the past month. Respondents with household income between $50K and $74.9K show a peak in coffee house and donut shop usage during the lunch hour during the past month. If upscale independent coffee houses want to attract this group, they should create loyalty programs like points programs or discount cards that will bring offerings within their budget (Wall 2013). Respondents with household incomes between $75K and $99.9K show a peak in usage of coffee houses and donut shops. They are also more likely than any other group to use donut chains and peak for usage of fast-­‐food coffee chains. This group also peaks in coffee house and donut shop usage during the dinner daypart during the past month. To attract this group, restaurants can extend hours into the evening daypart, offering small plates and live entertainment (Wall, 2013). 8 Regional Trends Northeasterners visit fast-­‐food coffee chains and desire more food menu items while Midwesterners have lower usage but prefer to use drive-­‐thrus. Southerners visit donut chains and desire live entertainment. Westerners prefer independent shops, healthy items, and to support local artists (Wall, 2013). 9 Consumer Preferences Market research reveals many trends as to when and how consumers prefer their coffee. Coffee drinkers are starting to trend away from the caffeine focused low-­‐end coffee and more towards a flavor focused experience. Of coffee consumed in past few years, 37%, a higher number than usual, was identified as gourmet showing a shift towards a more flavor focused coffee experience (Kaakati, 2012). Coffee shops such as Ozo are successfully catching on to this trend and shaping their shops to create a more home brew oriented atmosphere for their customer. Unique flavor with each individual cup of coffee is becoming more important for consumers in the coffee industry. It is no longer simply a choice between light, medium, and dark roasts of coffee but instead a customization of flavors and notes among many brewing variables. This includes the type of bean, the roasting method, the brewing method, serving method and much more. Consumers are paying extra attention to the subtle yet complex flavors in certain types of coffee and are demanding the opportunity to experience these flavors upon every visit to the local coffee shop. Tim Curry, owner of Wood-­‐fire Roasted Coffee, explains, “The goal is to maximize the flavor of each bean and emphasize the coffee’s point of origin. How I do that with roasting is establish a set of parameters to acquire those flavors that I feel best exemplify the coffee” (as cited in Porter-­‐Rockwell, 2014). Curry shares here that the flavor of each roast is most important and that consumers are beginning to notice these details. To obtain this wide variety of flavors and drinking styles that consumers demand the coffee industry is turning towards more technology in roasting and 10 brewing methods. Spears explains that coffee bars are a perfect example of the industry evolving and using more technology. A brew bar allows customers to customize exactly how they want their coffee brewed by experimenting with different coffee technologies in a comfortable atmosphere (Porter-­‐Rockwell, 2014). These technologies may include the traditional French Press, where the ground coffee beans are brewed straight in the water and then strained, or a newer Chemex a device that allows for a perfectly crafted cup of coffee using a manual pour over method. These brew bars allow customers to find out exactly how they like their coffee and also how to learn more about the flavors and characteristics found in each roast. With methods such as these, consumers are developing a more sophisticated and demanding pallet for local shop coffee. In addition coffee houses are now offering additional beverage options that expand outside the realm of the coffee bean. Tea is the second most ordered drink at coffee shops, accounting for roughly 15% of orders (Wall, 2013). While it is the second highest ordered beverage, tea has actually declined by 6% over the past three years. This is due to the introduction of fancier “tea” options such as tea lattes and herbal infused teas. Smoothies are the fasted growing beverages offered at coffee houses (Wall, 2013). This incline shows a growing trend for wanting healthier options at coffee houses. These types of 11 drinks are also good for afternoon refreshments, giving customers a reason to return to the coffee shop multiple times a day. There are several main methods for ordering coffee. The graph to the right illustrates both the national preferences and those specific to the Midwest region in terms of how they like to order. The Midwest population places more value, just below a 10% increase, on drive-­‐thru ordering. This suggests many Midwest consumers are driven my convenience and having a drive-­‐thru, or more convenient ordering system, could allow a shop to see an increase in customers. (Nation, 2013). In order to collect the best possible data, we employed a collection technique that was broad, yet very specific to coffee. Given the mass size of the coffee industry, we wanted to gather as much data as possible to ensure 12 Target Market Research Analysis Objective: Determine the appeal of coffee, local coffee houses, chain coffee houses, and Ozo. We decided to use Ozo Coffee as our target company to interview and conduct a focus group. We could not get an in person interview with anyone at Ozo Coffee, but we were able to get an email response to answer our questions. Greg Lefcourt, Director of Retail Operations, of Ozo Coffee, answered the following questions: Interview: 1) Who is the target market for your coffee products? (What age group, social demographics, etc.) “EVERYONE. We cater to the masses and do not have a specific target market, as that limits potential sales and growth of our product offerings. We keep an environment that can support everyone from teens to the elderly and do not discriminate”. 2) What demographic, psycho-­‐graphic, and other characteristics do the customers share? “They are coffee/tea lovers of all ages, walks of life, different professions. They appreciate good quality products and service with top notch customer service, speed, and attention to details”. 3) Have you used any sort of marketing research in the past? If so, what was it? What motivated you to use this research? “No, not necessary. Coffee is a drug. Drugs sell anywhere and everywhere. The research done was to determine the right location for each Ozo retail shop”. 4) What sort of marketing does Ozo Coffee currently use? “Advertising in local newspapers, different in store promotions, WORD OF MOUTH (huge in a small town like Boulder), different social media usage…” Target Market Research 13 According to our interview with Greg Lefcourt, no official market research was conducted when starting the Ozo coffee shops. Instead, Ozo obtained information on what their customers preferred based off their own previous knowledge and understandings about the coffee industry. Lefcourt claims that “coffee is a drug” and that “drugs sell anywhere and everywhere”. He eludes here that quite literally anyone could be included in their target market as long as they are looking for a caffeinated pick me up; particularly one that tastes excellent to go along with it. Findings About Target Market Ozo is a company of coffee experts. They know all of the technology, brewing methods, bean flavors and so on. This means that they don’t listen to what customers want; they tell customers what they want. This is what makes Ozo such a unique place to drink coffee. It is more than just a quick fix for caffeine. It is a place for customers to learn, discover, and develop their palates. Ozo’s target market is largely made up of those who want to enjoy a finer cup of coffee. They come to Ozo to learn about what they want; not the other way around. Advantages of Market Research Techniques By choosing to do no official market research, Ozo saves time, money, and energy that would have otherwise been spent on the studies. Although some would argue that it is risky to build a company around only the owners’ understanding of what the customers want rather than actual data, Ozo proves their knowledge and 14 confidence in their craft by entering the market with this approach. By teaching the customers what they want rather than learning about what they want, Ozo builds an image of a confident company of leaders. This is an advantage to Ozo because customers see this leadership and desire to follow. As stated earlier, what makes this teaching atmosphere so successful is that consumers highly value the process of learning about coffee and developing their passion for it. This is precisely what makes the Ozo coffee experience meaningful. Disadvantages of Market Research Techniques Although this strategy of teaching the customers rather than learning from the customers is a key role in Ozo’s business model, it could face possible disadvantages as well. The issue is that although Ozo may be experts on coffee itself, they are lacking the market research on how to best deliver that coffee. In other words, Ozo has perfected the art of coffee, but do their customers have issues or unmet needs when it comes to atmosphere, customer service, or other possible variables? Ozo faces a disadvantage by not researching ways to improve their delivery methods. It is important that they realize that the package is almost as important as the product it contains. By conducting market research, Ozo might discover some areas of improvement where they can bring their delivery methods up to par with the coffee itself so that they can meet all of the customers’ needs Possible Market Research Opportunities 15 While Ozo does not conduct market research, that doesn’t mean that they can’t benefit from market research. Ozo could start by conducting very small, basic surveys that would cost very little, require very little time, and provide benefit to the company. For example, when someone orders a cup of coffee, they have to wait for it to be made. It would be very simple to direct customers to a stack of surveys that could be just one question. The survey could ask question such as “How enjoyable do you find the music on a scale of 1-­‐10?” or “Does free Wi-­‐Fi play a role in your cafe decision?” Questions along these lines would be easy and quick for the customers to answer while they wait for their coffee, the turnaround would be instant, and they can provide valuable knowledge on how Ozo should design their cafes. If Ozo had good results from the quick in store surveys, they can take it a step further to personal interviews. These interviews could again be taken while the person waits for the barista to make their coffee and perhaps be incentivized by a discount of their next visit. Using a personal interview would allow for Ozo to ask more in depth and detailed questions such as coffee preferences and detailed questions about the cafe atmosphere and the role that plays on their coffee decision. This would be more expensive and intrusive to the Ozo experience, but can provide detailed information on why people chose the coffee shops they do. Conducting a focus group on a diverse sample of coffee drinkers could provide Ozo with information that would be unobtainable any other way. It would provide a way to introduce new products to customers before taking them to market. They can receive feedback about what consumers like, when they would 16 like it, and how much they would pay for the new product. This can eliminate some of the risk in launching a new product. While a focus group would take time and money for Ozo to produce, the information that would come as a result form it could avoid costly failed product launches. Possible Market Research Opportunities MR Techniques Findings About Target Market Advantages of MR Technique Personal Survey ● Cafe environment preferences ● Coffee likes and dislikes In Store Survey ● Music preference ● Essentially free ● Location preference ● Low social desirability ● High speed ● Non-­‐intrusive. ● Short ● Low response rate Focus group ● Taste Tests ● Introducing new products ● Cost ● Analysis ● Complex questions ● Physical stimuli ● Lengthier interviews ● Rich feedback ● Group interaction 17 Disadvantages of MR Technique ● Social desirability ● Interviewer bias ● Expensive ● Intrusive Criteria Focus Group Design Respondents should be ages of 18 and 64 and reside in or near the Boulder Area. Researchers should seek a diverse group ranging from light to heavy coffee users, students and professionals, and health conscious individuals and individuals not concerned with healthy lifestyles. 1. Do you or anyone in your family work for Ozo? 2. Select the age group that describes you. (Pick only age group 18-­‐64.) 3. Do you work full-­‐time or part-­‐time outside of the home? (Discard homemakers and retirees.) 4. What is the highest level of education you have completed? (Keep high school graduates and above.) 5. Select an annual income range. 6. On a scale of 1 to 5, 1 being strongly disagree and 5 being strongly agree, how health conscious are you? 7. Do you consume lunch outside of the home? 8. Have you participated in market research studies, like panel discussions, focus groups or surveys, in the last 12 months? 18 Attitude questions 1. How do you feel about the following? How do they compare? Coffee, local coffee houses, chain coffee houses and Ozo. 2. What words or images do you associate with cafes? 3. What are your experiences with Ozo? 4. What is some important brand attributes associated with Ozo? 5. What is the likelihood that you would seek an Ozo that served fresh and natural food and beverages? 6. Product characteristics? Taste, nutritional benefits, packaging preferences, pricing, promotion Usage questions 1. Have you been to a coffee shop in the last year? 2. What is your consumption habits regarding the following? Coffee, local coffee houses, chain coffee houses and O. Likes and dislikes? Brands preferred, why? 3. Where do you drink Coffee the majority of the time? 4. When do you drink coffee? 5. What is your favorite drink at a coffee shop? 6. What size drink do you order normally? 7. How much time do you think you spend at coffee shops each week? 8. How long on average do you think you spend at coffee shops each visit? 9. What coffee shop do you visit most in your town? 19 10. What coffee shop do you visit the least in your town? 11. What is the reason you go out to a coffee shop? 12. How much do you spend on coffee each week? 13. How much do you agree with the following statement: “I need coffee to get going in the morning.” 14. What is the ideal atmosphere of a coffee shop? 15. Do you go to coffee shops for any reasons other than the beverages? Rank the following ideas with an H (high), M (medium), L (low) if they would increase your coffee/beverage usage with Ozo Coffee. 1. A loyalty card that earns points for purchases. Once enough points have been accumulated, they can be redeemed for coffee, other drinks, and snacks. As well, they give a free beverage on your birthday and automatically enroll you in a mailing list with Ozo’s current offerings and savings. 2. By following Ozo on social media and promoting them, you can get an Ozo care package that contains branded hats, water bottles, coffee mugs, etc. 3. A recommendation system where the current user who makes a recommendation gets a $2 coupon and the new user also gets a $2 coupon off their purchase. 4. An online Ozo community where users can chat with one another and also with baristas working at Ozo. It would be a place where users can learn more about 20 the coffee industry and get answers to questions and share ideas and thoughts about their experiences at Ozo. 5. An Ozo mobile phone app that lets you order coffee before you get there. If you are on the go, you simply use the app to order and pay for a beverage. When you show up at your local Ozo, your hot coffee or other beverage is waiting for you. Focus Group Analysis How many times a week do you drink coffee? This question provided insight as to how much coffee the typical college coffee consumer has throughout the week. Responses varied from just one day a week to every day. However, this question revealed two key different segments, those who drink coffee just when they need a pick me up and those who are more habitual users. That is to say, they drink it as part of a morning routine. One participant stated, “I drink a cup of coffee everyday,” and another said “I have a cup, maybe two, a week.” Respondents were quite scattered with their consumption habits. Overall, three students claimed to drink coffee everyday while four said they drink it 2-­‐3 times a week. Where do you normally consume coffee? Again, this question provided two common themes. Respondents either said that they usually drink coffee at home or on campus, more specifically one of the libraries. Only one respondent indicated the occasional trip to a coffee house. Another respondent stated that, “I only drink coffee on campus, unless one of my roommates make it.” The responses to this question hinted that respondents 21 were very concerned with convenience and location. It seemed most respondents were unwilling to take the time to travel to a stand-­‐alone coffee shop. Three respondents claimed they consumed coffee mostly at home. Another three said they normally consumed it on campus and one at a coffee shop. When do you usually consume coffee? Respondents indicated two distinct time frames for consumption. They either drank coffee in the morning or in the afternoon. The timing of consumption seemed to isolate distinct perceived benefits and desires for the coffee. The morning consumer seemed to want their coffee quick. They indicated that they were not interested in spending very much time in the coffee shop. “I just want to get in and out when I’m getting coffee in the morning,” said one of the morning respondents. This group seemed to enjoy coffee in the morning as it gave them a jump-­‐start and got them going. The morning drinkers also seemed to drink coffee more routinely. The afternoon drinkers indicated that they usually drink coffee at this time if they need an afternoon pick me up. Usually, they said they needed to finish homework and other assignments and needed a boost. Specifically, one respondent said, “In the morning, I am trying to get my coffee as quickly as possible to get to class. In the afternoon, I spend more in the coffee shop to do work. Views on local coffee shops and Ozo? The response to this question was somewhat surprising. 5 out of 7 respondents indicated that they preferred smaller, more unique, local coffee 22 shops. A participant stated, “I like the feel of a smaller place. It just feels different and more personal.” This was a common theme amongst respondents. A couple of participants stated, “They usually have free trade coffee, which is really important to me.” Participants seemed very interested in local shops; however only one of the seven participants said they have been to OZO. This lack of patronage at OZO was not surprising though, as earlier consumers hinted that location was key and a majority of purchases were made right here on the CU Boulder Campus. What would you change about current coffee houses? This question provided the most variety of responses. Although, the group was able to hone in and agree on two features that would like to see in coffee houses. The first change was for bigger tables. As one respondent put it, “When I’m doing homework there I don’t have space for a laptop, notebook, and supplies.” This seemed especially popular in the subsection of respondents who spend more time in coffee shops for working purposes. The second change participants wanted to see was more social environment. A participant stated, “it would be cool if was like a daytime bar. More of a social experience where you could meet people and connect with friends.” While there were some changes the respondents hoped to see, they did seem largely content with the current structure of coffee houses. Summary All in all, this focus group provided much insight about the consumer. The biggest insight, and likely most useful for OZO, is that it seems there is demand for 23 their product amongst the focus group. However, as busy college students, many were unwilling to invest the extra time to travel to one of OZO’s locations when they can get their coffee right on campus. This gives OZO a big opportunity. If they want to establish more repertoire and do more business with college students, they need to open a location on campus. A surprising find from the focus group indicated only one respondent had been to OZO. Again, location could help this. However, advertising and specials could also help get more of the younger demographic into the store, especially during the afternoon when participants aren’t in as big of a hurry. Five out of seven respondents indicated that they prefer a smaller, more unique shop. Clearly, there is demand for OZO’s products amongst this demographic. OZO needs to work harder to connect with these customers and figure out an innovative way to deliver the products they desire without disrupting their routines or creating more work for the consumer. Convenience was the single largest motivator behind coffee purchases in the focus group and if OZO wants to attain more success within the college market it is essential that they provide a more convenient location to deliver their product. 24 Survey Design 1. Have you been to a coffee shop in the last year? This question is important because it screens survey takers. A no answer indicates that they are not in our target group. 2. When do you usually drink coffee? This is a question part of the introduction questions. It focuses the survey taker on coffee so they know what the following questions will be about. It also gives valuable information about consumer’s behaviors (when they are going in to coffee shops.) 3. How often do you drink coffee? This is another introduction question. It also gives us information on consumer behavior. 4. How often do you visit coffee shops? This is part of the main survey questions. It is important because it gives insight into the previous 2 questions. It can tell if people are drinking coffee more at stores or at home. 5. On average how much time do you spend per week at coffee shops? This is important because it shows if consumers want to spend time in the coffee shop or if the focus should be on grab and go coffee. 6. What makes a coffee shop’s atmosphere appealing to you? This can be used to show what customers like about visiting coffee shops. This will be used to improve the atmosphere of Ozo coffee. 7. How much do you spend on coffee each week? 25 This is important because it shows how much consumers are willing to spend on coffee per week. This can be used to help set price points. 8. How much do you agree with this statement? “I need coffee to get going in the morning.” This is part of more personal questions. It is important because it can show if the coffee shop will have repeat buyers. 9. What is your gender? Identification question. Will also show if more men or women are buying coffee. 10. What is your age? Identification question. Will show what age group buys the most coffee. Survey Analysis We surveyed 43 students from the University of Colorado in the 12:30PM Marketing Research and Analytics class. Of the 43 surveyed, 22 were female and 21 were male. 40 Students were under the age of 21, while three were older than 21. All 43 students had visited a coffee shop in the last year. The survey consisted of 10 questions and was designed to find coffee buying trends among a relatively untouched market for Ozo Coffee, college students. We asked “When do you normally drink coffee?” Respondents could check multiple boxes and we found that the majority of respondents (93%) drink coffee in the morning. 37% of respondents drink coffee in the afternoon and only 14% drink coffee at night or late at night. The graph below shows the distribution of answers. 26 # Answer 1 Morning 2 Afternoon 3 Night 4 Late at night Response % 40 93% 16 37% 4 9% 2 5% We then asked, “How often do you visit coffee shops?” This question showed almost even distribution with answers from “less than once a month” to “2 to 3 times weekly” all having similar number of respondents. Only one person said they visited coffee shops daily and none answered with they never visit coffee shops. Another key question was “How much time do you spend at coffee shops per visit?” This answer showed us that not many people from our sample want to sit down and enjoy their coffee in store. 34 respondents spend less than 10 minutes in coffee shops with 15 of those spending less than 5 minutes per visit. Only nine respondents (21%) spend more than 10 minutes in coffee shops each visit with even less (7%) spend an hour or more at coffee shops. We wanted to know what the atmosphere of the perfect coffee shop was. Below is a distribution of answers to the question “What makes the atmosphere of a coffee shop appealing to you? 27 # Answer 1 Quiet 2 Bright 3 Friendly 4 Good Service 5 Quick Service 6 Free Wi-­‐Fi 7 Large 8 Crowded 9 Small 10 Empty 11 Dark 12 Relaxing 13 Convenient 14 Good Prices 15 Other Response % 11 26% 8 19% 37 86% 32 74% 26 60% 29 67% 3 7% 1 2% 3 7% 2 5% 2 5% 26 60% 29 67% 17 40% 2 5% The final aspect that we wanted to know about was price points. We asked the respondents “How much do you spend off coffee each week?” Most respondents (51%) answered with less than five dollars. Only 5% of respondents answered with more than $20. This confirmed our finding from our focus group that people aren’t willing to pay for coffee they can make at home. With the help of survey analysis, we can show Ozo Coffee an untouched market and their trends. College students want coffee and Ozo can provide it; they just need a strategy on how to reach these students. 28 2014 Works Citied Kaakati. (2012, September 1). Coffee Shop 2012. Retrieved September 20, Nation of Coffee Drinkers, Across Every Demographic. (2013, November 26). Retrieved September 20, 2014 PORTER-­‐ROCKWELL, B. (2014). SIP SERVICE: ARTISAN COFFEE NOW TRENDING. Specialty Coffee Retailer, 21(4), 24-­‐31. UPTON, N. (2014). STATE OF THE COFFEE INDUSTRY. Specialty Coffee Retailer, 21(1), 10-­‐13. Wall, B. (2013, December). Coffee Houses and Donut Shops – US – December 2013. Mintel Group. Zegler, J. (2013, September 1). Coffee -­‐ US -­‐2013. Retrieved September 22, 2014. 29

![저기요[jeo-gi-yo] - WordPress.com](http://s2.studylib.net/store/data/005572742_1-676dcc06fe6d6aaa8f3ba5da35df9fe7-300x300.png)