ANNUAL RepoRt

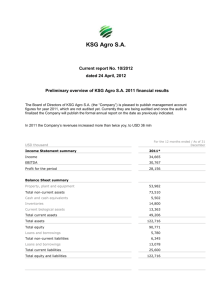

advertisement