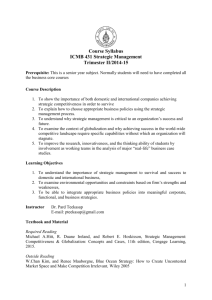

The Fundamental Rights of the Shareholder

advertisement