Ibraco Berhad - Affin Hwang Capital eInvest : Home

advertisement

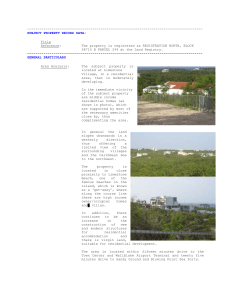

Company Focus Malaysia Equity Research PP 11272/8/2004 26 May 2004 Issue Price: RM1.20 Fair Value: RM2.20 Ibraco Berhad Closing on: 26 May Listing on: 16 Jun Sarawak property play At a Glance Main Board bound Ibraco is an established property developer in Kuching, Sarawak, focussing predominantly on building residential houses. The Group has ongoing projects totalling an estimated sales value of RM398.1m, and future development projects with combined sales projection of RM813.8m. Attaching a P/E multiple of 9x on the Group’s FY04 EPS of 24.5 sen, we have pegged a fair value of RM2.20 for Ibraco shares. LISTING DETAILS • A premier property developer. The Group’s flagship property development project is the Tabuan Jaya township, a prime residential area located 7km south east of Kuching city centre. Since 1975, the Group has launched and completed 4,920 property units with a combined sales value of RM668.9m in the Tabuan Jaya-Muara Tabuan area. More impressively, 99.9% of all the completed properties have been sold, thereby establishing itself as a reputable property developer in Kuching. Issue Manager: Funds Raised (RMm): Shares on offer (m): New Shares (m): Vendor Shares (m): Placement Shs (m): Public Offer (m): • Ongoing and future projects to contribute RM1.2bn in property sales. The Group currently owns a land bank of approximately 900 acres (of which 500 acres have been approved for development), located mainly in the Kuching area. Ongoing projects will see the development of 1,581 residential, commercial and industrial units with an estimated sales value of RM398.1m. And over the next 5 years, the Group plans are to develop a further 3,799 units of various property types with an estimated sales value of RM813.8m. POST LISTING Ord Share Cap (m): 90.0 Mkt Cap (RMm): 198.0 Est Free Float %: 27.4% * Based on our RM2.20 fair value Sector: Property Development Issue Statistics: Am Merc 19.1 15.9 15.9 12.9 3.0 USE OF PROCEEDS (RMm) 8.0 2.5 8.6 • Fair value at RM2.20/share. Using a basket of recently listed property peers for valuation Repayment of loans comparison, we have set a target P/E multiple of 9x for Ibraco shares. Based on the listing Est. listing expense prospectus FY04 EPS forecast of 24.5 sen, this translates to a fair value of RM2.20/share. Working capital At this price, Ibraco is valued at a market capitalisation of RM198m, which is comparable with property companies like Asas Dunia, Country View, FACB Resorts and Keladi Maju. Earnings & Valuations Historical Financial Summary Jan-02A Jan-03A Dec-03A@ Jan-02A Jan-03A Dec-03A@ Dec-04F 52.0 48.9 69.2 52.0 48.9 69.2 145.3 Turnover 16.9 17.7 16.9 16.9 17.7 16.9 n.a. EBITDA Pretax Profit 16.4 17.0 33.0 16.4 17.0 33.0 29.2 Net Profit 11.8 11.4 28.6 11.8 11.4 28.6 22.1 13.1 12.6 31.8 24.5 Margin Analysis (%) 32.5 36.1 24.4 469.6 (3.7) 152.3 (22.3) EBITDA Pretax Profit 31.5 34.8 47.7 16.8 17.5 6.9 9.0 Net Profit 22.7 23.2 41.3 n.m. n.m. n.m. 3.6 n.m. n.m. n.m. 1.6 @ - 11-mth period ended 31-Dec-03. Includes exceptional gain of RM16.9m n.m. n.m. n.m. n.m. FY (RMm) Turnover EBITDA Pre-Tax Profit Net Profit EPS (sen) * EPS Growth (%) P / E Ratio (x) ^ DPS (sen) Div Yield (%) ^ ROE (%) Book Value (RM) n.m. n.m. 1.33 n.m. P / Book Value (x)^ n.m. n.m. 1.7 n.m. MALAYSIA Stock Name Equine Capital Plenitude Yu Neh Huat E&O MK Land SP Setia PE (x) 8.9 8.1 10.7 11.0 13.7 12.9 Ownership: Deanna Ibrahim Wan Kamal Ibrahim Dr Sharifah Ibrahim Wan Aziz Ibrahim Ibraco Properties SB 16.4% 16.4% 16.4% 16.4% 6.8% Business Description: Customers: Housebuyers, mainly in the Kuching area in Sarawak. Sector Historical Valuation Mkt Cap (RMm) 135.0 249.8 352.7 724.4 3,084.8 2,142.6 Deanna Ibrahim @Sorayah bt Abdullah Group Chairman Wan Kamal Ibrahim MD/CEO Dr. Sharifah Deborah Sophia Ibrahim ED Key Activities & Products: Residential, commercial and industrial property development in Sarawak. * - Based on enlarged share capital of 90.0m ^ - Based on our fair value of RM2.20 F - Based on prospectus forecast @ - 11-mth period ended 31-Dec-03. Includes exceptional gain of RM16.9m Listed Peers Management: Not meaningful Malaysia Research Team· 603-2711 2222· general@hwangdbsvickers.com.my Refer to important disclosures at the end of this report Suppliers: Suppliers of building materials, civil and eletrical works, masonry and carpentry. Geographic Spread: East Malaysia 1 of 3 Company Focus New Listing Fact Sheet Background • A property developer focussing mainly on residential houses. The Ibraco Group has been involved in property development activities over the past 30 years, developing and selling residential, commercial and industrial properties. Its flagship project is the Tabuan Jaya township, a prime residential area located 7km south east of Kuching, Sarawak. Since 1974, the Group has completed 4,920 units consisting of residential (95.5%), commercial (2.5%) and industrial (2.0%) properties encompassing 850 acres of land. Of which, an impressive 99.9% of all completed units have been sold and handed over to buyers. • Quick review of the Sarawak property market. According to the Property Market Report 2003, the property market in Sarawak was sluggish for the first three quarters of 2003. The main component of the property market in Sarawak is the residential sub-sector, which accounted for 44.6% of total transactions from 1Q033Q03. Whilst the overall number and value of transactions decreased during the period, the prices of residential properties remained unchanged, with preferred locations such as Tabuan and Jalan Matang recording a price increase of between 5%-15%, and demand for units below RM200,000 remained encouraging. Prospects • Ample land bank for future property development activities. Ibraco’s existing land bank stands at approximately 900 acres, situated primarily in Kuching. Of which, 500 acres have been approved for development, which includes 184 acres that are currently being developed in on-going residential and industrial projects. In addition, Ibraco has an option to acquire approximately 255 acres of land (of which 96 acres have been approved for development) from Ibraco Properties Sdn Bhd (IPSB) at a market price to be determined by an independent registered valuer. IPSB is the investment holding company of the substantial shareholders who collectively own 72.6% of Ibraco post-listing. • Ongoing and future projects to contribute RM1.2bn in property sales. The Group currently has 7 ongoing projects with an estimated sales value of RM398.1m. This comprises 1,581 units of residential (including low cost housing) and commercial properties, to be completed between 4Q04 and 4Q06. As at 31 Mar 04, 396 residential units have been already sold, representing a take-up rate of 64.6% of the total units launched. Management will also be undertaking the development of a 430-acre township to be called Tabuan Jaya Baru. This project will be developed over 7 phases, with Phase 1 and 2 already underway. The remaining phases, which comprise 1,764 units of various development types with estimated sales value of RM492.6m, will be launched from 3Q05 onwards with completion between 3Q07 and 2Q10. Additional future property projects will be the developments of Tabuan Heights, Muara Tabuan and Stutong Low Cost Housing. The combined sales value of these projects, scheduled for completion between 1Q07 and 2Q10, is estimated at RM321.2m. • Proforma NTA of RM1.33. The Group’s financial position is expected to strengthen slightly after the flotation exercise. In particular, following the RM8.0m debt repayment using part of the IPO proceeds, total borrowings for the Group will be reduced from RM55.4m previously to RM47.4m. Accordingly, adjusting for a cash amount of RM15.7m, net gearing for the Group will drop from 33.2% before to 26.5%. After going public, on a proforma basis, the NTA per Ibraco share will stand at RM1.33. This has not factored in a revaluation surplus (net of deferred taxation) of RM44.2m arising from a revaluation exercise that was carried out as part of the listing process. If the revaluation surplus were to be booked in, the adjusted NTA per share would rise to RM1.82. • Our fair value is set at RM2.20. In our valuation model, we have pencilled in a benchmark P/E ratio of 9x, derived from the average of our basket of recently-listed property peers, and at a 25% discount to the large-cap property counters under our coverage (see table overleaf for valuation comparisons). Based on the prospectus FY04 EPS projection of 24.5 sen, we have arrived at a fair value of RM2.20 for Ibraco shares. At a market capitalisation of RM198m, Ibraco will be ranked in the same league as other listed property counters like Asas Dunia, Country View, FACB Resorts and Keladi Maju. 2 of 3 Company Focus New Listing Fact Sheet Stock Comparison Listed on Ibraco ^ Equine Capital @ Plenitude # Yu Neh Huat * Average E&O Property @ MK Land @ SP Setia @ Average 16-Jun-04 28-Oct-03 18-Nov-03 9-Dec-03 Share price on 25-May (RM) 2.20 0.90 1.85 1.35 Calendarised EPS Dec-04 24.5 10.1 22.7^^ 12.6 - 0.65 2.57 3.78 5.9 18.8 29.4 PE (x) 9.0 8.9 8.1 10.7 9.3 11.0 13.7 12.9 12.5 NTA / sh (RM) 1.33 1.54 2.66 1.06 1.42 0.74 2.32 P/B (x) 1.7 0.6 0.7 1.3 0.9 0.5 3.5 1.6 1.9 Market Cap (RMm) 198.0 135.0 249.8 352.7 724.4 3,084.8 2,142.6 ^ - Based on our fair value of RM2.20 * - Based on consensus forecast # - Based on prospectus forecast @ - Based on HDBSV Research estimates ^^ - Not calendarised (June year-end) This document is published by Hwang-DBS Vickers Research Sdn Bhd (“HDBSVR), a subsidiary of Hwang-DBS Securities Berhad (“HDBS”) and an associate of DBS Vickers Securities Holdings Pte Ltd (“DBSVH”). The research is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty as to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. This document is prepared for general circulation. Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. HDBSVR accepts no liability whatsoever for any direct or consequential loss arising from any use of this document or further communication given in relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. DBS Vickers Securities Holdings Pte Ltd is a wholly-owned subsidiary of DBS Bank Ltd. DBS Bank Ltd along with its affiliates and/or persons associated with any of them may from time to time have interests in the securities mentioned in this document. HDBSVR, HDBS, DBSVH, DBS Bank Ltd, and their associates, their directors, and/or employees may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking/corporate advisory and other banking services for these companies. HDBSVR, HDBS, DBSVH, DBS Bank Ltd and/or other affiliates of DBS Vickers Securities (USA) Inc (“DBSVUSA”), a U.S.-registered broker-dealer, may beneficially own a total of 1% or more of any class of common equity securities of the subject company mentioned in this document. HDBSVR, HDBS, DBSVH, DBS Bank Ltd and/or other affiliates of DBSVUSA may, within the past 12 months, have received compensation and/or within the next 3 months seek to obtain compensation for investment banking services from the subject company. DBSVUSA does not have its own investment banking or research department, nor has it participated in any investment banking transaction as a manager or comanager in the past twelve months. Any US persons wishing to obtain further information, including any clarification on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document should contact DBSVUSA exclusively. DBS Vickers Securities (UK) Ltd is an authorised person in the meaning of the Financial Services and Markets Act and is regulated by The Financial Services Authority. Research distributed in the UK is intended only for institutional clients. Vincent Khoo, CFA, Director Hwang-DBS Vickers Research Sdn Bhd (128540 U) (formerly known as DBS Vickers Research (Malaysia) Sdn Bhd) Suite 13.01, Kompleks Antarabangsa, Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia. Tel.: +603 2711-2222 Fax: +603 2711-2333 email : general@hwangdbsvickers.com.my 3 of 3