unfinished business: ferc's evolving standard for capacity rights on

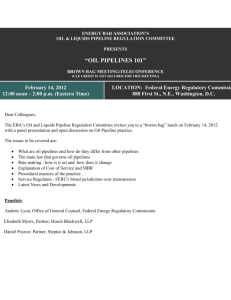

advertisement