Airtel Africa Strategies: Enhancing Performance

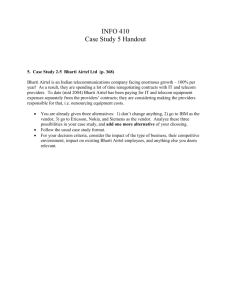

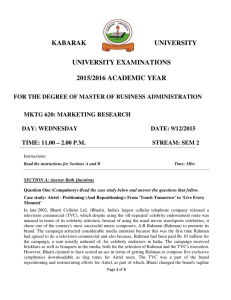

advertisement