Liz Claiborne Inc. - Corporate-ir

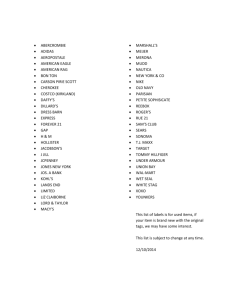

advertisement