FDB v Jone Tuvakasuka

advertisement

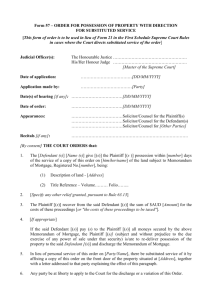

IN THE HIGH COURT OF FIJI AT LAUTOKA CIVIL JURISDICTION Civil Action No. 142 of 2011 BETWEEN: THE FIJI DEVELOPMENT BANK a corporate body having its Head Office at 360 Victoria Parade, Suva, Fiji. Plaintiff AND: JONE TUVAKASUKA of Nacocolevu, Nalawa, Ra, Farmer. Defendant Before : Master Anare Tuilevuka. Appearances : Mr. N. Nand & Mr. Sharma of Vijay Naidu & Associates. Defendant in Person. Date of Ruling : Friday 24 February 2012. RULING INTRODUCTION [1]. Before me is the Fiji Development Bank’s application pursuant to Order 88 of the High Court Rules 1988 against Jone Tuvakasuka, the defendant, to forthwith give vacant possession of the property described in Instrument of Tenancy No. 10151 NLTB No. 4/13/6641 known as Vunikavikaloa Lot 1 situated in the District of Nalawa in the Province of Ra. [2]. The land comprises an area of 8.868 hectares together with Sugar Cane Contract Registration No. 414/14059 Ellington 2 Sector. [3]. The FDB also seeks an injunction to restrain the defendant from dismantling any structure on the land which may cause damage to the property. [4]. The application is supported by the affidavit of Saimone Naikelekele Waqata, FDB’s Branch Manager in Rakiraki. The documentation in his affidavit also complies with the requirements of Order 88. FACTS [5]. Jone Tuvakasuka is the registered proprietor of the property in question. In May 2006, the Fiji Development Bank loaned the sum of $17,963.00 (seventeen thousand nine hundred and FDB v Jone Tuvakasuka HBC 142 of 2011 sixty three dollars) to Tuvakasuka. That loan was secured by a mortgage over the property. A copy of the mortgage is exhibited to the affidavit in support of the application. The original mortgage was produced at the hearing for my viewing. The loan was also secured by a crop lien over sugar cane Farm Registration No. 414/14059. [6]. The loan was repayable upon demand together with interest at the rate of 14.5%. Mr. Waqata also gave evidence in Court from FDB file records on the amount of the periodic payments required to be made under the mortgage. [7]. The FDB’s right to possession of the property arises out of Tuvakasuka’s default in paying the mortgage. On 29 July 2009, FDB issued a demand notice against Tuvakasuka. However, since then, Tuvakasuka has not settled the debt. On 05 December 2009, FDB advertised the property in the Fiji Times and the Daily Post. Tuvakasuka however has remained unresponsive. As of 31 July 2011, the total debt owing by Tuvakasuka stood at $46,922.69 including interest. [8]. Following the advertisement, FDB did receive some tenders. It has since responded to the tender of one Radha Krishna with an offer to sell the property for $18,000-00 (eighteen thousand dollars). FDB and Krishna have since executed a sale and purchase agreement which is dated 10 December 2010. [9]. Tuvakasuka has not filed any affidavit. However, I did allow him to give sworn evidence viva voce in Court. The gist of his evidence is that he acquired the farm with high hopes and did work hard on it planting sugar cane. [10]. However, the cane-tonnage produced from his farm dropped in 2007 because of the rains that fell that year. He never quite recovered from that because of rains in the following years. He says that he now realizes that if he switches to other crops such as cassava and vegetables, he will be able to repay the loan if given more time. ANALYSIS [11]. Tuvakasuka has neglected to perform his obligations under the mortgage. His default entitles the Fiji Development Bank as mortgagee to call up for the entire debt due and owing. However, Tuvakasuka still has not obliged. FDB is entitled to realize its security by way of a mortgagee sale. The Bank must be permitted to do so. However, for any sale to successfully take place, Tuvakasuka must first give up immediate vacant possession of the property. [12]. In Fiji Development Bank v Lal [2011] FJHC 787; HBC64.2010 (5 December 2011), Madam Justice Wati was asked to consider whether the political situation in Fiji in 2009 which allegedly led to a downfall in the mortgagor’s business and his inability to pay his mortgage debt amounted to a frustration of the loan contract. After examining various case authorities on the point1 1 Alanbert Pty Ltd. V. Butler Pty Ltd. [2000] NSWSC 261; Davis Contractors Ltd. V. Fareham UDC [1956] UKHL 3; [1956] AC 696; Denny Mott & Dickinson Ltd v James B. Fraser & Co Ltd [1944] AC at 275; Codelfa Constructions 2 FDB v Jone Tuvakasuka HBC 142 of 2011 10. The defendant's counsel's understanding on the law of frustration is misconceived. The defendant has to show that the loan contract that it entered into became fundamentally different from that originally contemplated for him to successfully rely on the doctrine of frustration. I do not find that the defendant's obligation had changed at all. He was obliged to pay the principal and the interest and in default to surrender the property that was mortgaged. That obligation remained throughout. The downturn in business could only be said to have made the defendant's obligation onerous. The doctrine of frustration therefore does not apply to his contract. 11. Even if the doctrine applied, there is no financial evidence provided to state that the defendant had suffered a downturn in business and so his allegation is as good as baseless. Secondly, downturn in business could have been contemplated by a good businessman. A good businessman knows that there is always a possibility of the business not doing well, either it be for worldwide recession or for any other reason, because this is an existing and known fact of business life. Having known that and having entered into a contract, relying on the business income to pay off the debt, the defendant cannot successfully rely on downturn in business, for whatever reason, to circumvent its obligation under the mortgage contract. 12. The facts of this case are related to that of the case of Westpac Banking Corporation v. Bickley [2001] NSWSC 756. In this case, a builder had a mortgage with the bank with his house as a security. The builder failed to make payments on the loan, due to downturn in his industry. The bank sought to enforce its charge over the property. The builder claimed that the contract of mortgage was unenforceable because of the introduction of GST which frustrated the contract. Master Harrison in that case held, and I also agree with his verdict that:"... The introduction of the GST did not make the mortgage contract fundamentally different from that originally contemplated. The contractual obligations for repayment did not alter because of the introduction of GST. Rather the defendant's ability to pay became more onerous. The doctrine of frustration is clear. It does not apply in theses circumstances..." [13]. It is hard to accept Tuvakasuka's plea in light of the above authorities. ORDERS [14]. Tuvakasuka is to give vacant possession of the property together with all improvements thereon within 28 days of the date of this Ruling. Costs in the sum of $500 (five hundred dollars) to the Fiji Development Bank. ………………………….. Anare Tuilevuka Master At Lautoka. Pty Limited v. State Rail Authority of NSW(1982) 149 CLR 337; National Carriers Ltd v. Panalpina (Northern) Ltd [1980] UKHL 8; [1981] AC 675. 3 FDB v Jone Tuvakasuka 24 February 2012. 4 HBC 142 of 2011