International Trade, Econ 722, Spring 2015 Problem Set 2

advertisement

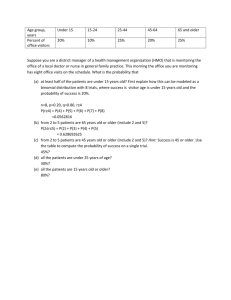

International Trade, Econ 722, Spring 2015 Problem Set 2 Arslan Razmi Feb. 10, 2015 (due Feb. 24 2015) 1. Using the Ricardian model with a continuum of goods for this question, explain the e¤ects of the following shocks on: (1) the relative Home wage, (2) the range of goods produced in Home, and (3) real wages in Home. . a An equiproportional technological advancement in the foreign country across the board (i.e., across all goods). Explain your conclusions mathematically, graphically, and intuitively. b. Next, suppose that the technological improvement occurs for the goods that the foreign country already produced and exported. A graphical and intuitive explanation would su¢ ce here. 2. In the DFS Ricardian model, suppose that an oil shock increases transportation costs, and suppose also that the wage ratio, !, remains unchanged. What are the e¤ects on: a. The pattern of trade and spending b. the domestic price of goods in both countries c. real wages in terms of an index of domestic prices. (hint: for the real wage, if the nominal wage either rises or falls relative to the prices of all goods then the exact speci…cation of the price index does not matter). Please be sure to explain the intuition in each case. 3. Consider a world with two regions, North, N, and South, S (see …gure). The two factors of production are capital (K) and labor (L) who receive factor prices r and w, respectively. Assume that Y is the relatively labor-intensive (L-intensive) good, while X is the relatively K-intensive good. Some of the questions below would require you to base your answers on Figures 1A and 1B. 1 a. Which is the relatively K-abundant region? Which is the relatively Labundant region? How can you tell? Which theorem helps you answer this question? b. Give a clear de…nition of what it means to say that North is more Kabundant. What exactly does it mean when we say that good Y is more L-intensive? c. Can you infer from the answer to part (a) that one region has absolutely more workers than the other country? d. Which region will have the lower wage in autarky? How can you tell? (Hint: Think of relative commodity prices and what that implies for autarky factor prices). e. Now suppose the two regions open up to trade with each other. How will they specialize? Which good will South export? Under what condition would they completely specialize? f. Under what conditions would factor price equalization (FPE) hold in these two regions? Explain with the help of a …gure. g. In the …gure, relative prices converge under international trade (the two dark lines are parallel to each other). What implications does that have for relative rental and wage rates in the two regions? (Hint: Think in terms of the FPE theorem.) Explain with the help of a …gure. What key assumption do we need to make in order to reach a clear conclusion? 2 h. Which factor will gain in the North from international trade? Which factor will gain in the South? Which factor will lose in each region? Hint: Use the Stolper Samuelson Theorem to answer this question. i. What happens in the South to: (1) the ratio of labor to capital used in the production of good Y? (2) the ratio of labor to capital used in the production of good X? j. Transnational corporations (TNCs) can now move their capital from one country to another relatively easily. Which way would you expect TNCs to move with their capital if the two regions allow factor mobility (think of autarky factor prices)? How realistic are the predictions of the H-O theory in this regard? k. How is the mobility of TNCs likely to a¤ect the validity of the H-O assumption that technologies are identical in the two trading regions? l. Suppose the North imposes tari¤s on the import of good Y. How would this a¤ect factor incomes in the North? m. From the perspective of long-run development, why do you think the South may not want to pursue the pattern of specialization found in part (e)? Discuss very brie‡y. (Hint: Is specializing in producing labor-intensive bananas the same as specializing in capital-intensive automobiles?) 4. (a) Derive the Rybczynski theorem (mathematically), and graphically depict the production path of a capital-abundant country as it attracts more and more foreign direct investment, i.e., its supply of capital increases (hint: you can do this with the help of a PPF graph). How do you intuitively explain this production path? (b) What happens to the capital-abundant country in part (a) if it invites “too much” capital? How does this relate to the complete specialization case when a country falls out of the cone of diversi…cation? Explain graphically (you could use …gures 1.8 - 1.10 of the Feenstra textbook or, alternatively, you could use Lerner curves). (c) China’s entry into the world trading system has increased the labor supply available for global production. Consider a world with two economic regions, the North and the South. Suppose that China is a part of the South. How will China’s entry a¤ect the shape and position of the South’s PPF (think in the context of the 2 2 2 model)? How will it a¤ect the pattern and volume of global trade between the North and the South? 5. Do problem 1.3 from the Feenstra textbook. 6. Do problems 4.1, 4.2, and 4.4 from the Bowen, et al. texttbook. 3