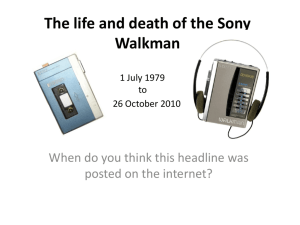

SONY LIFE PDF.p

advertisement